Robocop vs. Terminator in Fintech; Comparing DeFi originations to Digital Lenders in the early years; plus 14 short takes on top developments

Hi Fintech futurists --

In the long take this week, I look at the difference between the digitization of existing models and emergence of digital-first models through the lens of consumer preferences. I was surprised to see just how popular the mobile channel has become for dealing with financial services products (40% of survey respondents prefer it), and that DeFi lending is outperforming Digital Lending in issuances on a normalized time scale. It's a good time to be re-inventing the industry!

The latest short takes on the Fintech bundles, Crypto and Blockchain, Artificial Intelligence, and Augmented and Virtual Reality are below. Thanks for reading and let me know your thoughts by email or in the comments!

Long Take

I've got a gentle, data-backed story this week inspired by a great distinction made in this Techonomy article by the Chief Digital Officer at Schneider Electric. The thesis tracks three key lessons from attempting to bring large companies into the 21st century: (1) transform the core of your business instead of fumbling around at the edges, (2) digitize your processes and separately figure out a distinct digital model, and (3) catalyze a digital ecosystem from the new model. You can think about the distinction as either taking the existing business and slowly swapping out parts from human to machine (e.g., like RoboCop), or building the robot from scratch utilizing the latest platforms, markets, and artificial intelligence (e.g., like Terminator).

This distinction is helpful in assessing how financial incumbents are performing, and why the Tech firm approach to Finance keeps is different from the traditional model. Goldman's credit card distributed through Apple looks a lot like RoboCop to me -- same old, but in a tech wrapping. But Goldman's approach into the market with Marcus, with digital lending and neobanking at the core, feels a lot more like Terminator. This is partly why Lloyds' announcement about launching a roboadvisor in 2020 is boring -- too little, too late, while Softbank plows hundreds of billions into neobanks, neoinsurers, digital lenders, and artificial intelligence.

Anyway, here's the data backed part. If you are focused on Fintech and building out digital, in whatever form, you are on the right track. A recent report from EY looking at the investment preferences of mass affluent and wealthy clients paints the picture clearly.

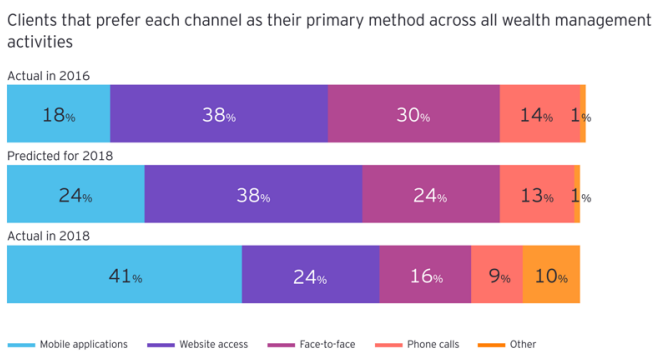

Just three years ago, only 18% of investors were using mobile apps to manage their money -- that number is now 40%. Face to face interactions have decreased rapidly, from 30% to 16%. But so is Web-app use! Phones have become the home for most of our attention, and financial activity is no exception.

They are our preferred method for dopamine delivery, and transactional activities like angry comments on Trump videos and free stock trading on Robinhood are a natural fit. More considered advice delivery -- things like setting up a trust, dealing with the financial implications of divorce, tax structuring across jurisdictions -- still benefits from at least 30% human interaction.

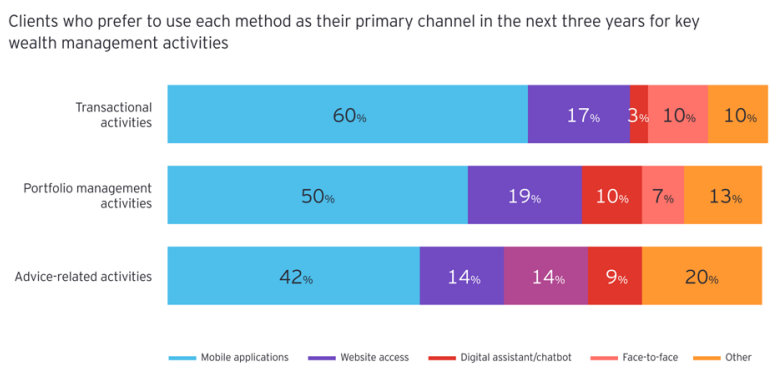

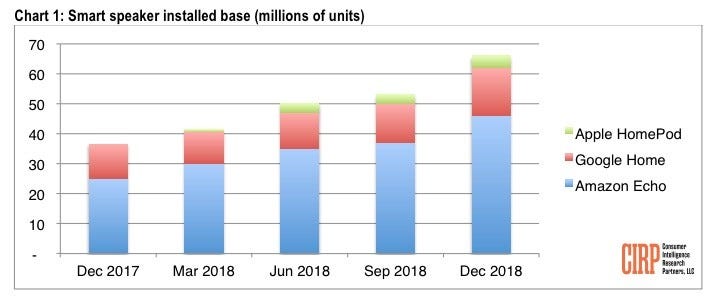

But mobile isn't the only growth platform for interaction. Check out the expected rise in chatbot and voice-first interactions below. People have now gotten enough smart assistants that there is an expectation of improvement in the quality of their applications and services. Today, less than 2% of respondents prefer machine assistants as a primary communication channel, but that preference rises to an expected 9% in the future. People want to talk to their machines, Star Trek style, about financial services.

There are many reasons why people may prefer to talk to a Terminator. There is of course pricing, transparency, structure, and easy of use. But perhaps there is another reason -- machines are way easier to fire. Instead of paying for human services, you pay a small subscription fee to software that figures the thing out. Or maybe it is even free, like a crypto protocol! And if you are dissatisfied with the result, then you just switch subscriptions to another provider, app, or crypto asset. Perhaps you switch from machine to human. But that awkwardness of a tech-first generation whose social arbiter is the Facebook Newsfeed or Tinder matching algorithm may lead people to prefer automation in difficult moments.

I have to take this depressing aside, also linked in the short takes below, on virtual reality software built to address this awkwardness. One example is a digital environment in which you can practice firing a 3D rendered employee using different conversational trees. I can't help but be reminded of Bioware's role playing games, and their branching dialogue. We are entering a world, Dear Reader, where reality mirrors the simulations we have created in our gaming worlds. People's careers hinge on how well you can navigate a Charisma check.

The outcome of both awkwardness and convenience are services like MaxMyInterest, which automatically shops for the top bank rate. Of course, all of API-first Fintech is trending in this direction as well. If your products are available through a software call, rather than a phone call, then optimization becomes part of the infrastructure. You see this in traditional banks as a Robocop layer on top. You see this in blockchain protocols as a foundational integrated layer at the core (e.g., InstaDApp).

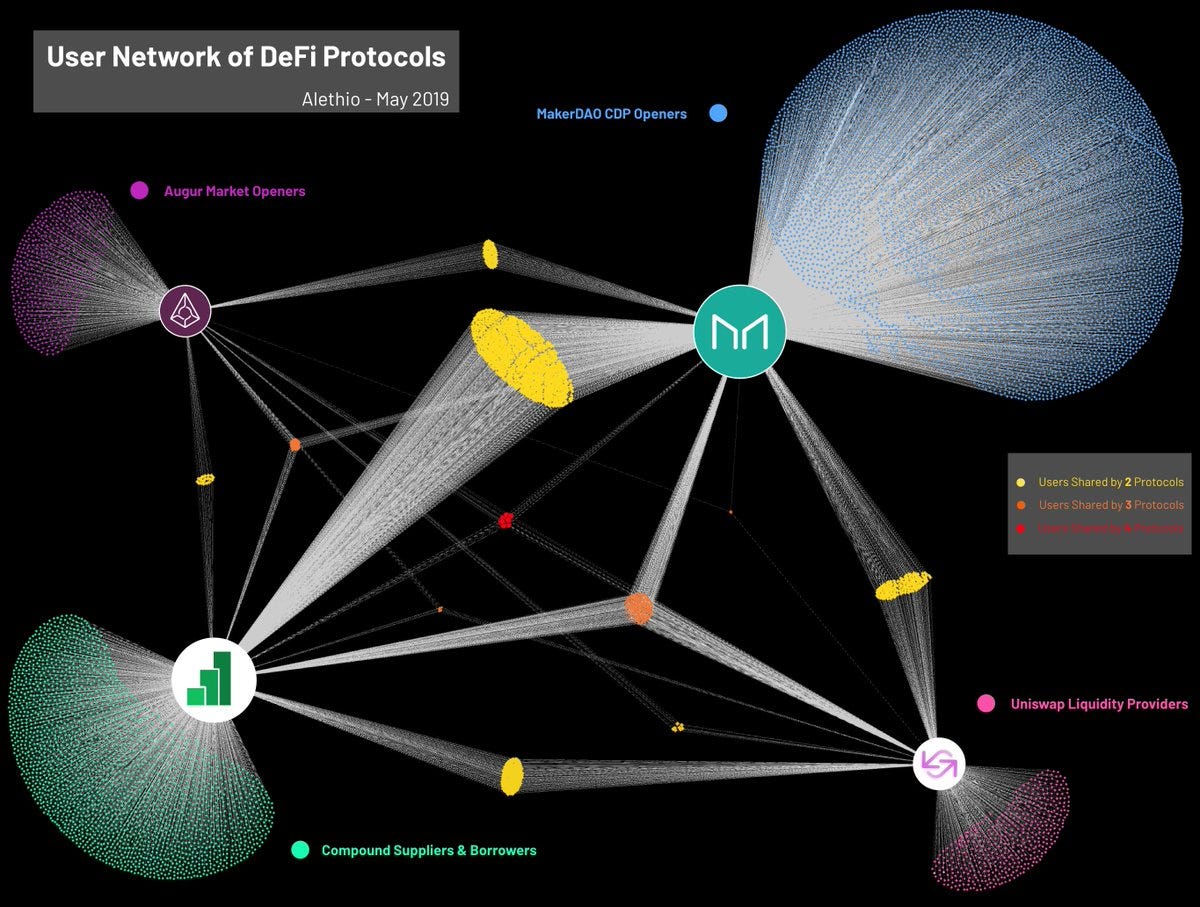

The final bit I want to showcase is just how good of a "Terminator" decentralized finance is becoming. Numbers differ of course depending on how you measure things, but charts below should be directionally correct. I took the annual growth of digital lending globally in the early years, and normalized against the growth in decentralized lending. The products are different -- all of DeFi today is collateralized, while digital lending involved actual underwriting risk (i.e., credit risk, not asset volatility). Yet still, it is helpful to see the two as comparisons, with the conclusion that DeFi is growing faster despite the alien nature of its underlying technology. The sources are Autonomous NEXT and Loanscan.

Similar things could be said of the Initial Coin Offering boom/bubble, comparing it to much slower but more sustainable growth in Fintech venture capital. Moderating growth against a correct regulatory approach is the right answer -- but innovation does often outpace the existing ruleset. It seems inevitable to me that DeFi lending will need to back into regulated banking and lending entities, or at least partner with them, to avoid being chased around or shut down by the authorities. Enabling tax arbitrage is not a long-term sustainable business model.

In conclusion, if you are working on digital, you are in the right place. Increasingly more people care about your work. Increasingly more people plan to use frontier technology for their financial services needs. Increasingly more people are experimenting with mobile, chat, and crypto asset solutions. As for those of us working against digital? There's always the awkward VR simulation.

Featured

Check out my latest discussion on the New Money Review podcast: The global fintech race

Last part of my interview on CIOs and Bowties is out! We talk crypto investing, Libra, and portfolio management and structuring.

Will I see you at the DeFi summit in September in London or the Ethereal summit in Tel Aviv?

Short Takes

Goldman Sachs may lose money on the Apple Card in the next recession, Nomura says. Assuming GS is spending $350 to acquire customers, it will take 4 years to break even and will lose money if losses run at 8%. But you know, nobody actually cares about economics these days. They care about human attention real estate, data, and cross-selling. GS merch, people.

Lloyds to roll out robo-advisory proposition in 2020. You know you're late when you're 12 years late. But better late than never! The ceiling for assets per customer in this solution is £100,000, which suggests still that the executives don't get it (i.e., robo is for everyone, not for "small accounts").

Ladder Now Available Through Radius Bank. API-first financial products will be integrated into all potential distribution points. Those companies have the chance for large network effects as a result. The downside is that everyone is doing this, and the market is still early.

Crypto Lenders Have Earned Just 2% on $4.7 Billion in Loans: Report. Interesting take on DeFi lending. The claim is that if you look at all the interest earned back in the space, only $86 million has been paid out on $4.7 billion (origination must be defined more broadly). Think about the short maturity of these high interest loans (for trading), and how some of the advertising is misleading in that investors are not getting a steady annualized rate. However, I see enough bundling happening between lending protocols, that we should get to a healthy aggregate view soon.

Ether May Have a Weak Hands Problem, New Interest-Gaining Token, Ethfinex is Now DiversiFi. Linking to Camila Russo's excellent DeFi newsletter, the Defiant. A research post from the Block finds that Ethereum token holders are 70% underwater relative to their purchase price, while for Bitcoin that number is 8%. It will take longer for Ethereum's more complex story to be understood by the market.

Samsung at Last Adds Bitcoin Support to Its Blockchain Phones. I still think that blockchain-native phones that can mix things like ApplePay, Visa, Stripe, Monzo and Crypto are the key to broader adoption. This phone will be able to sign crypto transactions and natively run dApps.

Other things that are kind of a big deal: Enterprise Ethereum Alliance’s New Mainnet Initiative Bridges Permissioned and Public Blockchains, StarkPay Offers an Improved Lightning Network Solution on Ethereum.

UPS Has Been Delivering Cargo in Self-Driving Trucks for Months And No One Knew. The pilot for this autonomous car delivery is on a 115 mile route between Phoenix and Tucson, and the cost of shipping has been reduced by 30 percent. TuSimple is the startup whose technology is being used, though an engineer and a driver are still sitting in these trucks. Watching this video from the driver's seat makes my skin crawl.

Munich Re launches claims automation suite. Taken at face value, this is a pretty cool implementation to deal with claims from hurricane damage. The insurance company pulls aerial image data, weather data, prior patterns, property intelligence information, and claims together -- and uses AI to make decisions for the simple cases faster. I found the aside to global warming causing the need to respond to move impacted people interesting.

Northern Trust Develops Machine Learning Based Forecasting. Cool stuff, and generalizable. The financial firm created an AI engine that imagines the most likely interest rate for lending out securities and uses that to catalyze markets. Outside of securities financing but for a similar concept, I'd point you to Elefant Markets, a fixed income broker/dealer that uses AI to fill in pricing gaps in the massive fixed income markets.

Deepmind's Losses And The Future Of Artificial Intelligence. Just how much does it cost Google to be best-in-class for AI? $572 million and counting.

VR lets you fire a virtual employee to practice doing it for real. Forget the dystopian spin. Instead focus on the fact that machines are teaching humans how to try and do emotional labor (e.g., fire people, sell things) by taking them through an automated adventure videogame. Are you telling me you haven't played something from Bioware in the last decade? Video games are our teachers now, apparently.

Snapchat’s Spectacles 3 Glasses Capture Images & Video In 3D. I am a weird early adopter of their products, but do think that there's something to be discovered in this vector.

Immersed Debuts Public VR Co-Working Space Designed For Remote Collaboration. Who needs WeWork and their billions of debt, when you can co-work in a virtual world and maximize your eye strain? Invest in eye drops.

Looking for more?

Find me on Twitter here for Fintech and here for Digital Art.

Want to send me a note? Reach out here anytime.