Slowing GDP growth by 1.5% is like another 10 million people getting infected with coronovirus, and other analysis on financial fragility

Hi Fintech futurists --

I hope that you and yours are OK, socially distanced and stocked on essentials. Whether you feel it yet or not in daily life, the world is bracing for coronovirus impact. In this week's analysis, I look at the difficult trade-offs between health and economy, and try to quantify the impact of the likely slow-down. We look at some grim but useful concepts, like (1) the value of a statistical life, (2) what happened to the Soviet economy and life expectancy after perestroika, and (3) how our financial machines (NYSE, Robinhood, Maker DAO) are cracking at the edges. If you can do one thing -- be kind and gracious with each other as some things inevitably break.

These opinions are personal and do not reflect any views of ConsenSys or other parties. Still, you should check out ConsenSys Codefi for software powering digital assets, financial enterprise blockchains, decentralized finance, and crypto payments here.

Thanks for reading and let me know your thoughts here!

Weekly Fintech & Crypto Developments

If you’ve found value over the years from my newsletter, now is the time to give back. I have added a premium subscription option.

A free "Futurist" tier will continue to include the weekly Long Take. Nothing lost!

A premium “Architect” tier will include an additional 12 key weekly updates with graphs and analysis on Fintech bundles, Crypto and Blockchain, Artificial Intelligence, and Augmented and Virtual Reality. You can see an example here: https://lex.substack.com/p/weekly-fintech-and-crypto-analysis

This is the last week when you can get a 25% discount for the next 12 months. Click below to subscribe.

Long Take

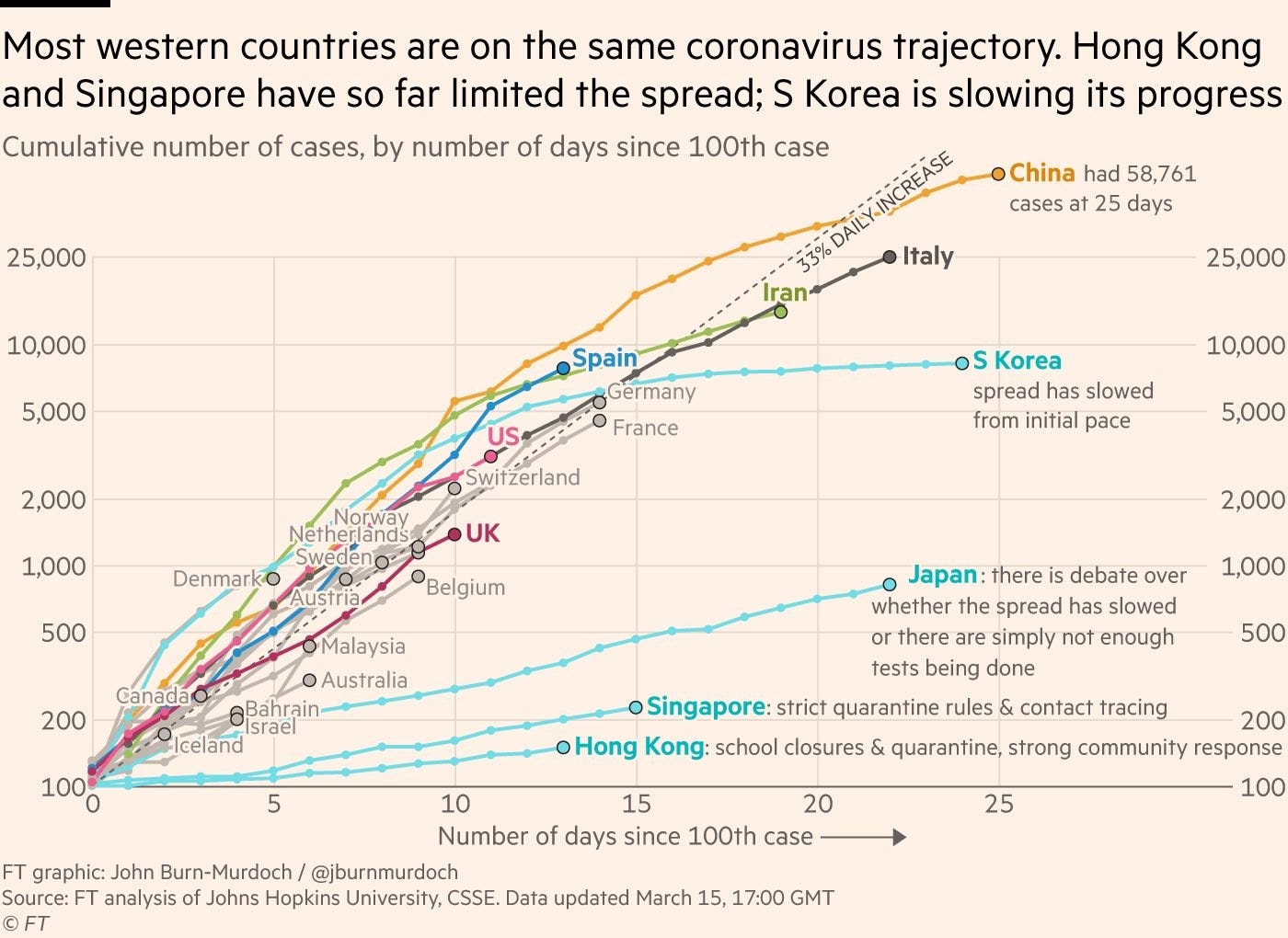

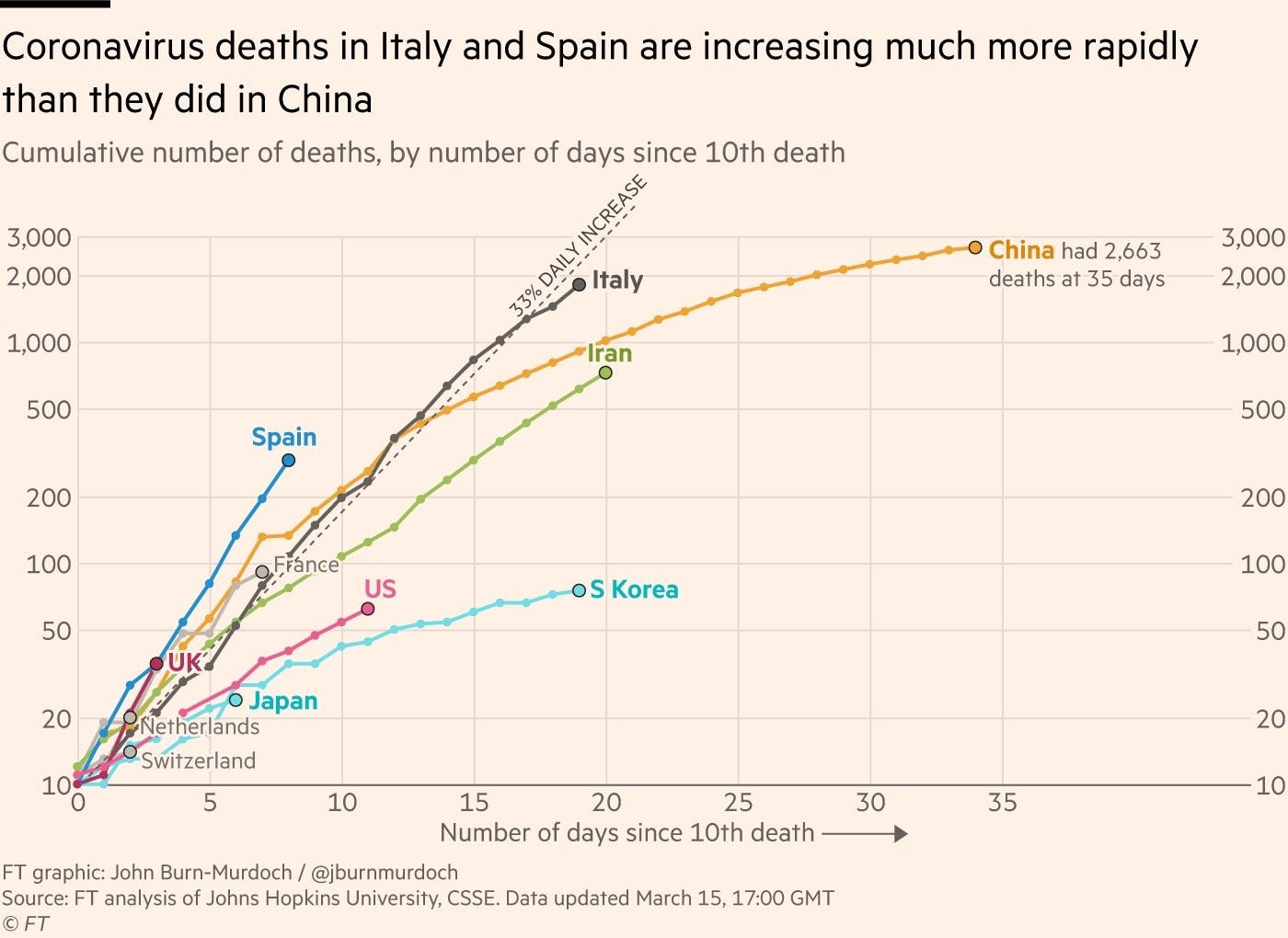

I don't know how anyone can get anything done anymore. All I can think about are these Coronovirus graphs from the FT, which show the awful power of exponential growth. Maybe people will stop saying something is "going viral" as a compliment. Below you can see infections rising on a log scale, by country. Only one type of action -- social isolation and distancing -- can get you off this dangerous ride up.

Response matters. In particular, early response and containment matters. You've heard this a lot by now. But slowing the growth rate and preventing the local medical capacity from being overwhelmed makes all the difference. This is the gap between a 0.5% mortality rate (Singapore) and a 7% mortality rate (Italy). For every 100 million infected people, that is the difference between 500,000 and 7,000,000 dead.

I won't repeat what you already know. What I want to stress instead, going back to my earlier post from 2 weeks ago, is that Coronovirus has lit our economic machine on fire in a way that is pretty much impossible to turn off. What we have on full display is called a complex system. The graphs of infections and deaths are awful -- but they are a one-dimensional slice of a multi-dimensional problem. They tell you a story about individuals and their state of health. They do not tell you the story of all the unintended, correlated consequences. They do not highlight how many hospitals are over capacity, how many families are out of work, how many businesses are shut down, how much stocks fall in value, how much credit contracts, and what happens to pensioners.

Why shold we care about economics and stocks? People are dying!

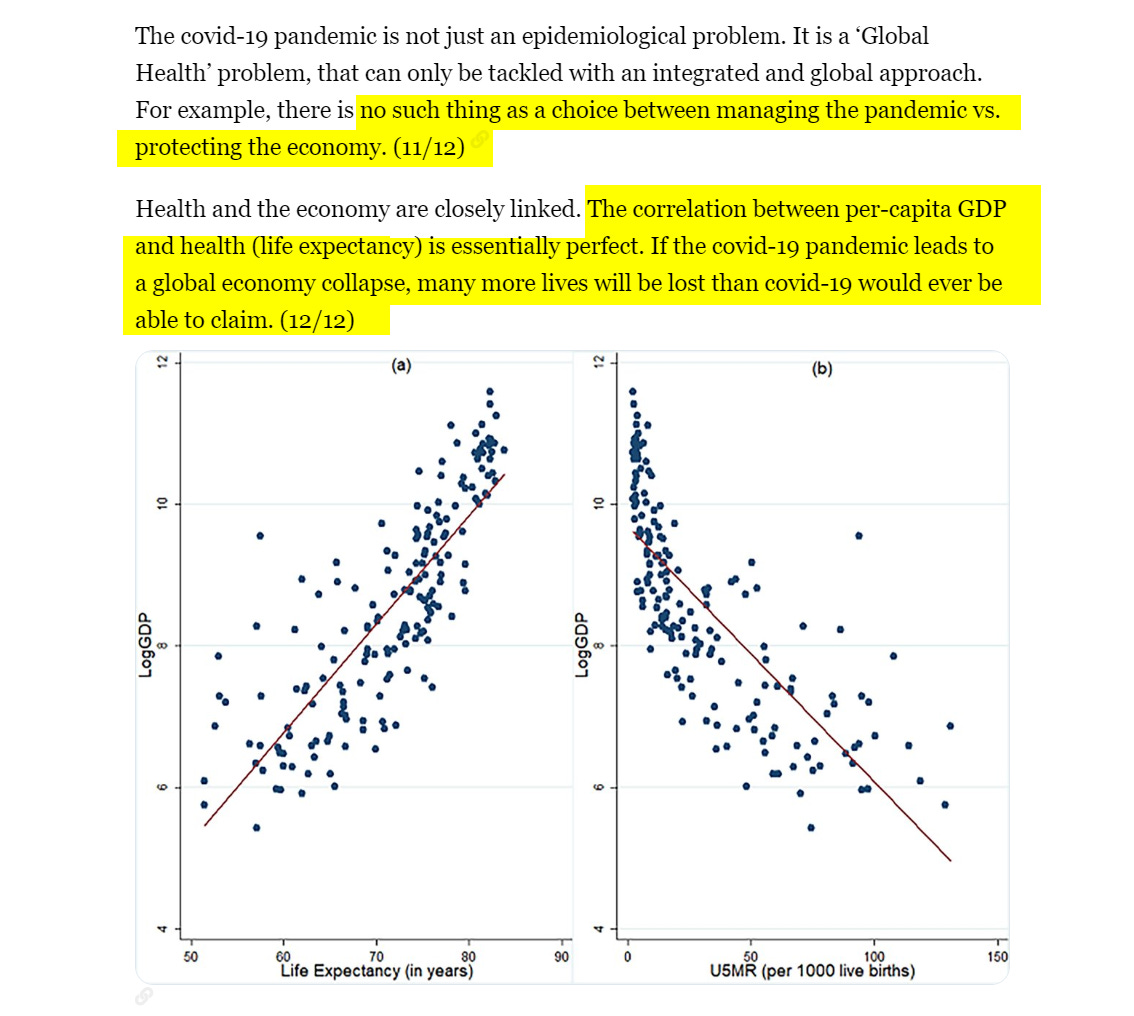

The reason we care is that complex systems, including economic ones, can multiply the deaths by an order of magnitude. In the chart above quoted from UCL computational biologist Francois Balloux, you can see the nearly perfect correlation between GDP-per-capita, and life expectancy. The more economically functional a society, generally speaking, the longer and better people live.

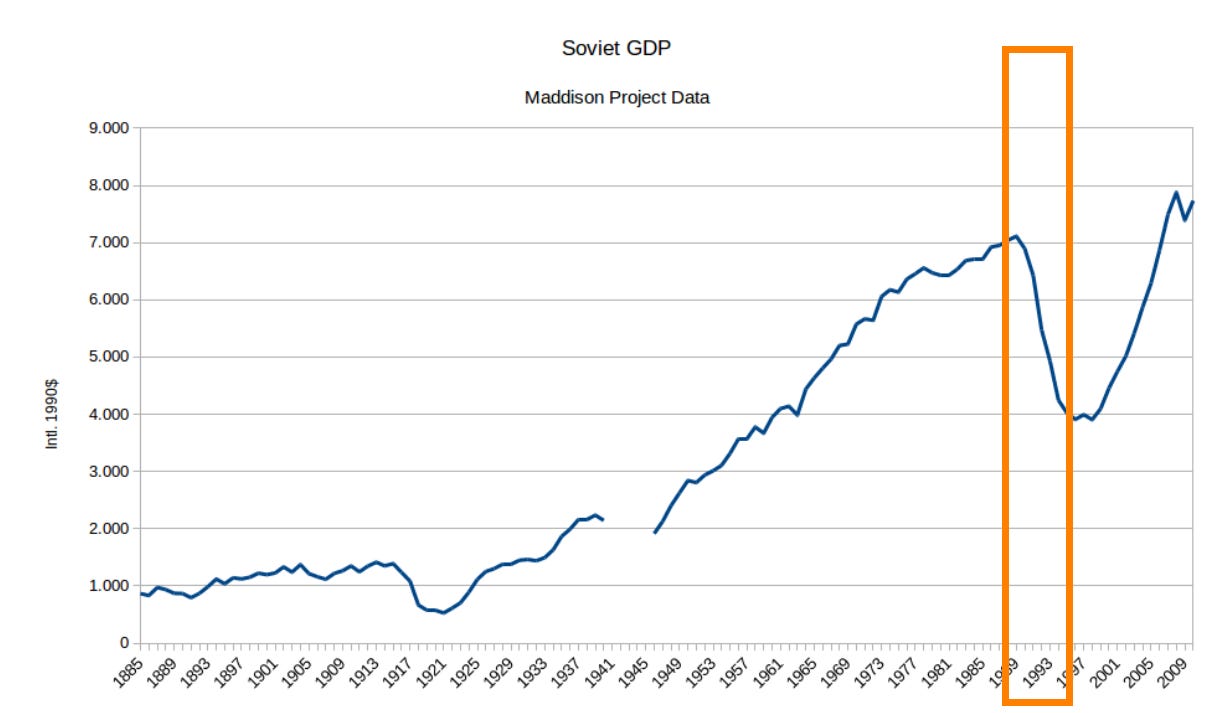

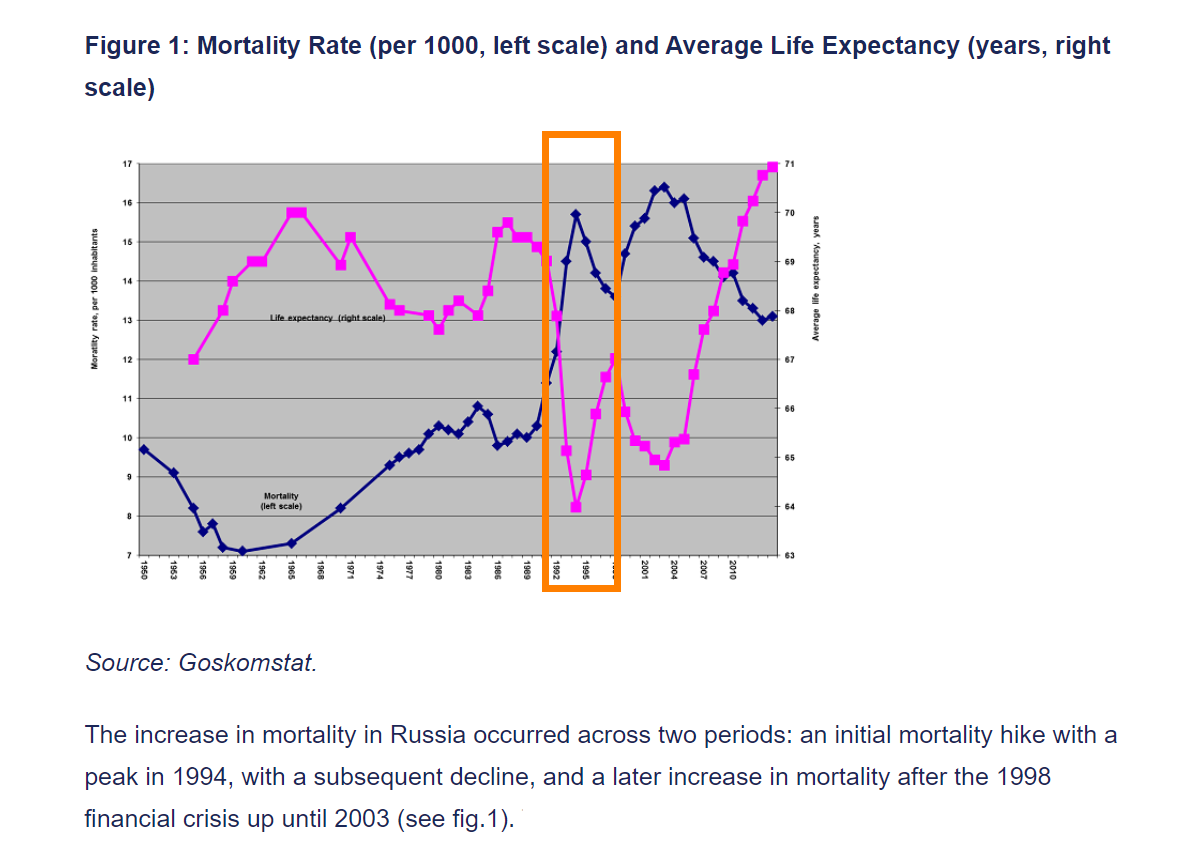

I will give you a vivid example. One has been kindly provided to us by history. In the early 1990s, the USSR experienced a sharp policy-caused GDP contraction of nearly 50%, as shown below. Introducing markets and capitalism as a shock, rather than as a controlled policy (see China) proved a mistake. It took Russia a decade before getting back onto a semblance of a growth curve. Associated with this drop in production also went social norms and the collective safety net.

Mortality rates increased from 10 to 16 per 1,000 people -- a 60% increase. Life expectancy fell from 74 to 71 for women, and from 64 to 57 for men. Unemployment and tumult led to alcoholism, sickness, and early death at national scale. Assuming a population of 140,000,000, normal mortality would be 1.4 million -- but became 2.3 million per year as a result. That's a million more people per year. Stretch the economic decline over half a decade, and you get a 5 million person impact.

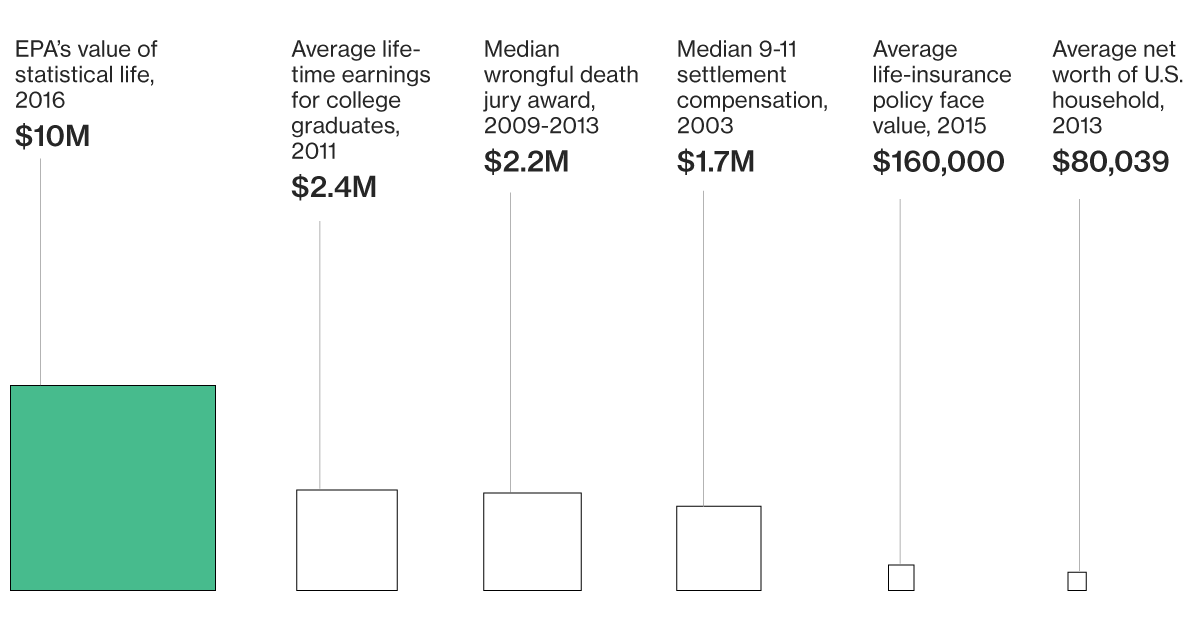

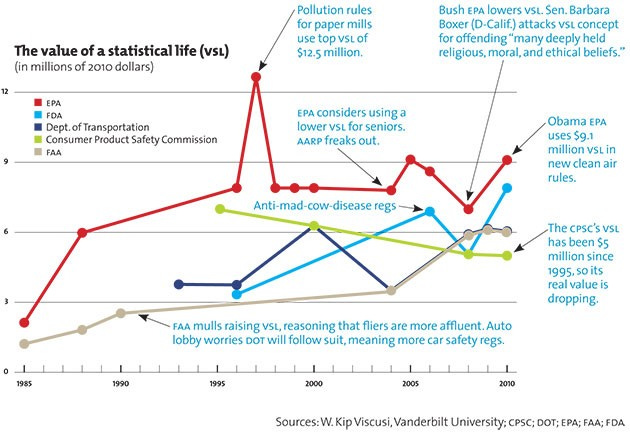

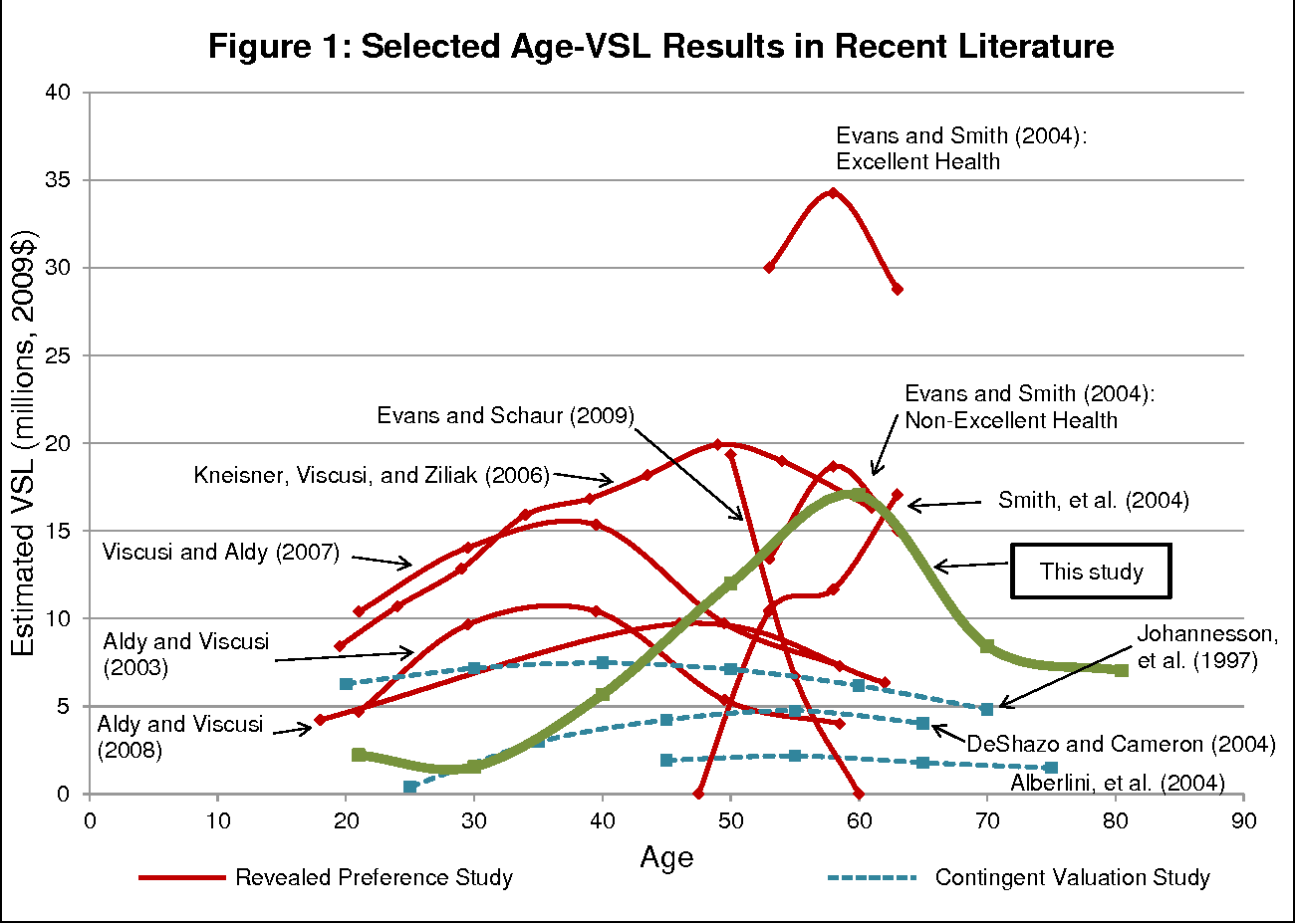

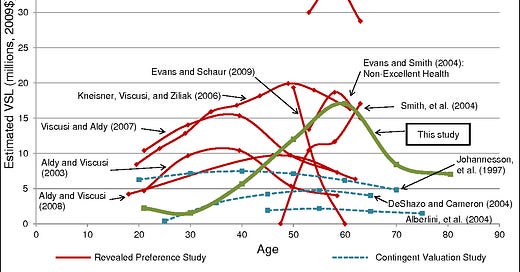

My point isn't to linger on horrors, but to highlight that leaders and policy makers have to think in a multi-dimensional manner all the time. They routinely trade off life and money, no matter how harsh this sounds. If you think that making these decisions is "icky", then you are just making the default decision for obvious life, no matter the cost. You might be protecting what you see, but destroying life inadvertantly on the other side. Such decisions have to be made in the case of medical regulation, automobile policies, and dozens other difficult trade-offs. See below for data on what the value of statistical life (VSL) looks life on average, and read an academic paper surveying the literature here. Sources also here, here, and here.

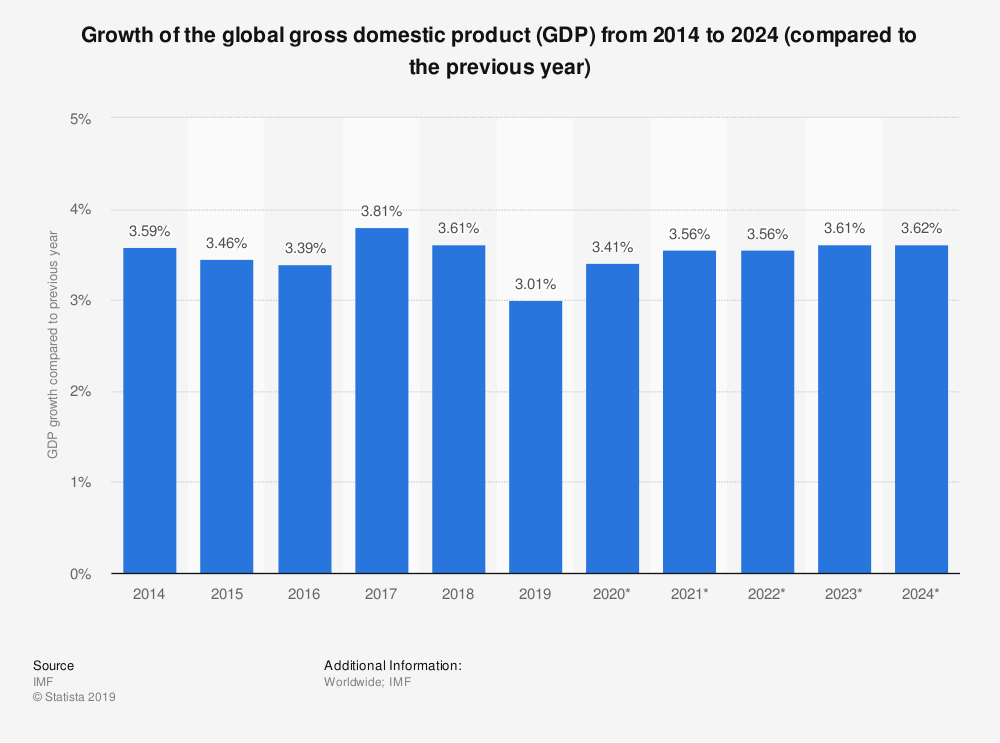

Statistically speaking, governments will no longer spend money on saving someone if it costs more than $5-20 million. Let's play out some rough, grim numbers. Current global GDP is $85 trillion, and grows annually at 3.5%. That generates $3 trillion of economic activity. If, like some investment firms currently project, global GDP growth settles in at 2.0% as a result of the contraction caused by the coronovirus, that will yield $1.7 trillion growth, or $1.3 trillion in economic loss. Taking our VSL math of $10 million per person to this contraction implies a statistical loss of 130,000 people. Under current Coronovirus mortality rates (1% to 4%), this is equivalent to an additional 5 to 15 million people infected.

Currently, there are 150,000 people infected. But credible scientists are projecting a worst case where hundreds of millions, if not billions, catch the virus within the next two months. The charts in the beginning of this write-up, showing the path of exponential growth cutting across the world, are proving the worst-case right so far. So I hope you don't think I am being blase about these awful circumstances. But rather, I want to call attention to the tangible impact we are not yet fully internalizing.

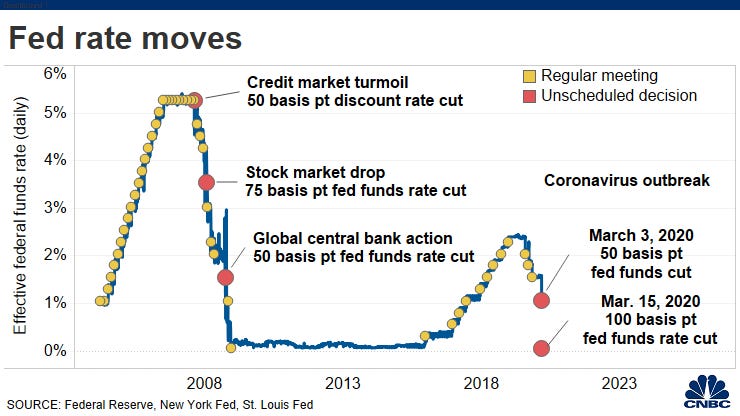

It is good to see sharp and decisive action by the world's central banks in cutting interest rates, and understanding the deep impact on our society (and associated statistical mortality) if the economy grinds to a halt. We've just received a shot of morphine -- a 150 basis point rate cut in the US and a $700 billion asset buy-back program. There are various fiscal measures being enacted across the world, from subsidizing employee leave, to propping up impacted industries like airlines, to extending loans to small businesses. Australia is spending $17 billion as stimulus. This is all a necessary, but limited step.

It's like taking a lot of Vitamin C after you know you already got the cold. This temporary positive shock will help -- but we are out of economic tools to deploy more broadly. Rates are now literally at 0%.I guess they could go negative, but have trouble imagining a world where that works for most retail deposits.

We must also consider second-order derivatives. Here's an absurd unintended consequence: in Thailand, as tourism slows to a crawl, wild monkeys are not being fed in public squares, and are now going into full tribal war for food! In the Finance and Fintech industries, we have already seen a number of unintended consequences going into motion.

Robinhood. The free trading app had a trading outage on March 2nd (SPY up 4.4%), 9th (down 8%), and 12th (down 9%). Comparable trading outages happened at firms like JPMorgan, but established players know how to make clients whole, and generally do not have millions of litigious retail users that are going through their first market cycle with a meaningful portion of their savings overexposed to volatility. If I understand what happened, it was too many orders and too many signups, which overwhelmed first the brokerage system, and then the DNS entirely. This is the challenge of building the whole stack bottoms up, rather than relying on commodity provider to do your trade order management, for example. If Robinhood burns up its brand, then that has impact on its employees, investors, asset allocators, and future risk tolerance towards consumer Fintech.

Circuit breakers. Trading keeps getting paused by circuit breakers (March 9th, 12th). When stock markets hit some particular loss amount per day -- 7%, 13%, and 20% -- trading on the entire NYSE is effected. In the first two cases, it is paused for 15 minutes. In the latter case, it is paused for the entire day. These rule sets came out of learning about panics from prior crashes, and current automation was built in response to a 2013 quant hedge-fund correlation event (same algos, different funds, flash crash). More granular rule sets exist for individual securities as well. Some analysts (like Matt Levine) think that we should just have a short trading window where robots clear the price once per day for the whole market, maximizing aggregated liquidity, rather than allowing our anxieties to continuously spin out.

MakerDAO. In the world of Ethereum and DeFi, Maker takes your collateral and issues out a stablecoin pegged to the dollar. If the price of your collateral falls below some limit, it is automatically sold -- auctioned to robots. When the price of the collateral (ETH) collapsed 40% last week, a whole bunch of accounts needed to sell that off and the mechanism for those sales became exposed. The auctions, which normally cleared at market-like prices, started to clear at near $0 prices, as demand dried up -- and created a $4 million hole in the Maker balance sheet. Additionally, all these liquidations, among other panic moves, made transactions 5-10x more expensive on the Ethereum system as a whole, leading to lots of processing failure. The whole thing reminds me of Auction Rate Securities in 2008, where everyone treated ARS paper as cash-equivalents with interest rates set during auctions; but when all the auctions dried up, your entire principal became trapped and illiquid.

The main takeaway above is that large blunt shocks have lots of specific, granular second-order effects that break the systems we have so carefully set up to protect our financial and economic machines. We live in one inter-connected, global house. And some things are now on fire, while we bicker about the color of the furniture.

Lets be thoughtful and kind to each by being good citizens and adhering to social distancing. But we also should be kind to each other when we witness that things break. It is not intentional, this fragility. Perhaps there was negligence in preparation. Perhaps we thought we were invincible, or that some risk don't matter. Perhaps we have had too much ambrosia. Now that things will be harder, let's not make it any harder for each other.

Looking for more?

Get the premium weekly summary and analysis by subscribing here.

Check out ConsenSys Codefi for software powering digital assets, financial enterprise blockchains, decentralized finance, and crypto payments.

Want to send me a note? Reach out here anytime.

Great article. The thing that is fascinating/scary about this is how it's seizing markets in every country. It's like the entire global economy pushed the pause button for the next 2-3 months. I personally think every bank account in the US should get $10,000 airdropped into the account, and perhaps more in the future. Right now deflation is the enemy.

Loved the article. The value of a statistical life is a useful Concept, but in my mind it has the same limitations of measurement like natural landscapes have. Valuation models have to rely on datasets where a clear market value can be assigned. Total value of life (let's assume stochastic) is ultimately value against the earning potential of that life. Just like for the Environment, total economic valuation covers all the earnings streams available to, say, a Woodland or parkland… without more directly visible correlations with other economic phenomena, it is difficult to assign any weights to other measures - say, destruction of parkland somewhere causes a minor crash in a stock market nearby because all those employed there tried to go into more liquid assets immediately.

In a way, Coronavirus is a great example of cascading effects - its dark, macabre productivity is not only in the People it kills, it is also that it has set many other balls rolling.

I particualrly like your choice of some proxies, including court Awards on wrongful deaths. But economic valuation of life is tricky.

I do agree with your general Message though. Great article!