The Blueprint: SEC allows Bitcoin futures ETF and Bitcoin lender Celsius gets $400MM @$3B; Coinbase & Sotheby's offering NFT platforms; Traditional paytech IPOs still doing great

Gm Fintech Futurists — our agenda for today is:

CRYPTO: Crypto Lender Celsius Network Raises $400M in Bid to Reassure Regulators (link here) and SEC Approves Bitcoin Futures ETF, Opening Crypto to Wider Investor Base (link here)

PAYMENTS: Mastercard-Backed AvidXchange Raises $660 Million As Trading Begins (link here)

NFTS: Sotheby’s Dives Deeper Into NFTs With Ethereum ‘Metaverse’ Marketplace (link here) and Bored Ape Yacht Club NFT Project to Launch Ethereum Token in Q1 2022 (link here) and and Coinbase Jumps After Sign-Up Numbers for NFT Marketplace Revealed (link here)

RESEARCH: The Law of Unintended Consequences via Wells Fargo, Divergence Ventures, DeFi designs, and the Federal Reserve (link here)

PODCAST: Scaling Web3 with the $10B+ Polygon protocol, with COO Sandeep Nailwal (link here)

If you want to go deeper in Fintech & DeFi, check out premium subscriptions below.

For crypto-native subscriptions, grab an NFT here and send us an email with the tx.

Visit our curated Partners:

M1 is the Finance Super App that puts you in control of your wealth. Invest, borrow, and spend your money how you want with sophisticated, automated tools to help you reach your financial goals more easily. Investing in securities involves risks, including the risk of loss. Borrowing on margin can add to these risks. M1 Finance LLC, Member FINRA/SIPC. Click here to get started.

Short Takes

CRYPTO: Crypto Lender Celsius Network Raises $400M in Bid to Reassure Regulators (link here) and SEC Approves Bitcoin Futures ETF, Opening Crypto to Wider Investor Base (link here)

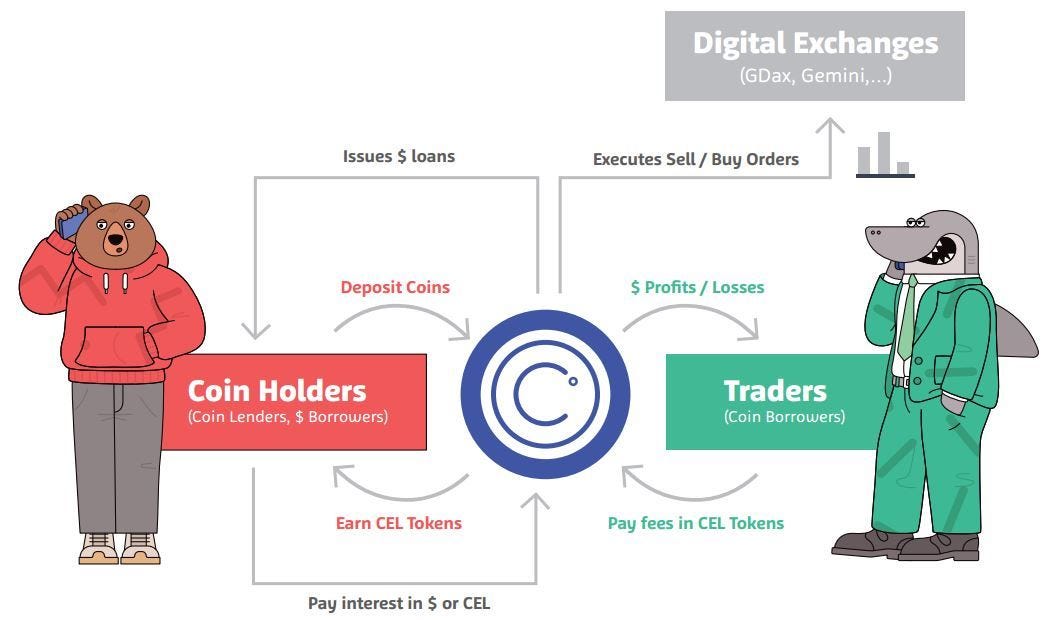

Celsius Network, a B2C digital lender in the Bitcoin space, has raised $400 million at a $3 billion valuation. This is a large jump up from the $30 million raised at a $120 million valuation last year, indicative of the commercial growth of crypto and the companies in the space. This move will also bring financial padding (i.e., being a good counterparty) to the organisation as Celsius and other crypto lenders (e.g., BlockFi) are under increasing scrutiny from regulators. Just last month the fintech received a cease-and-desist order from Kentucky’s security regulator regarding the interest earned on Celsius’ crypto accounts which cited violation of securities regulation.

A couple of details. Celsius is essentially a giant margin desk for Bitcoin, offering 17% rewards to lenders, with borrowering demand coming from trading — either leverage or going short. It’s got great exposure to the Bitcoin asset class, and is matching third party capital with increased trading interest. Now, it not only has a $3 billion equity valuation, but also a Celsius token with is worth about $1.5 billion on the market. That regulators have an issue with the lending but not the token is interesting homework for the reader.

We’re gonna shoehorn a key regulatory update in here by pointing out that the SEC dam on Bitcoin ETFs seems to have been broken. There’s a ProShares ETF instrument that has been greenlit, and Valkyrie is there as well. These are going to be useful instruments for sucking up asset allocation exposure. Strangely enough, these are composed not of the underlying Bitcoin commodity, but of *futures* on BTC. To say that market structure is better on a derivative than the thing itself is total nonsense. More likely, the futures market structure is under better control. And the regulators will attempt to gain broader control over what they can — including centralized companies like Celsius — until those decentralize into protocols and dissolve into the Internet like the rest of DeFi.

On a related topic, check out our podcast with Yield App. Also, think about how this effects the broader fintech bundle (Sofi, Robinhood, Revolut, Chime, Square, etc.)

PAYMENTS: Mastercard-Backed AvidXchange Raises $660 Million As Trading Begins (link here)

Here’s your moment on non-crypto traditional paytech zen.

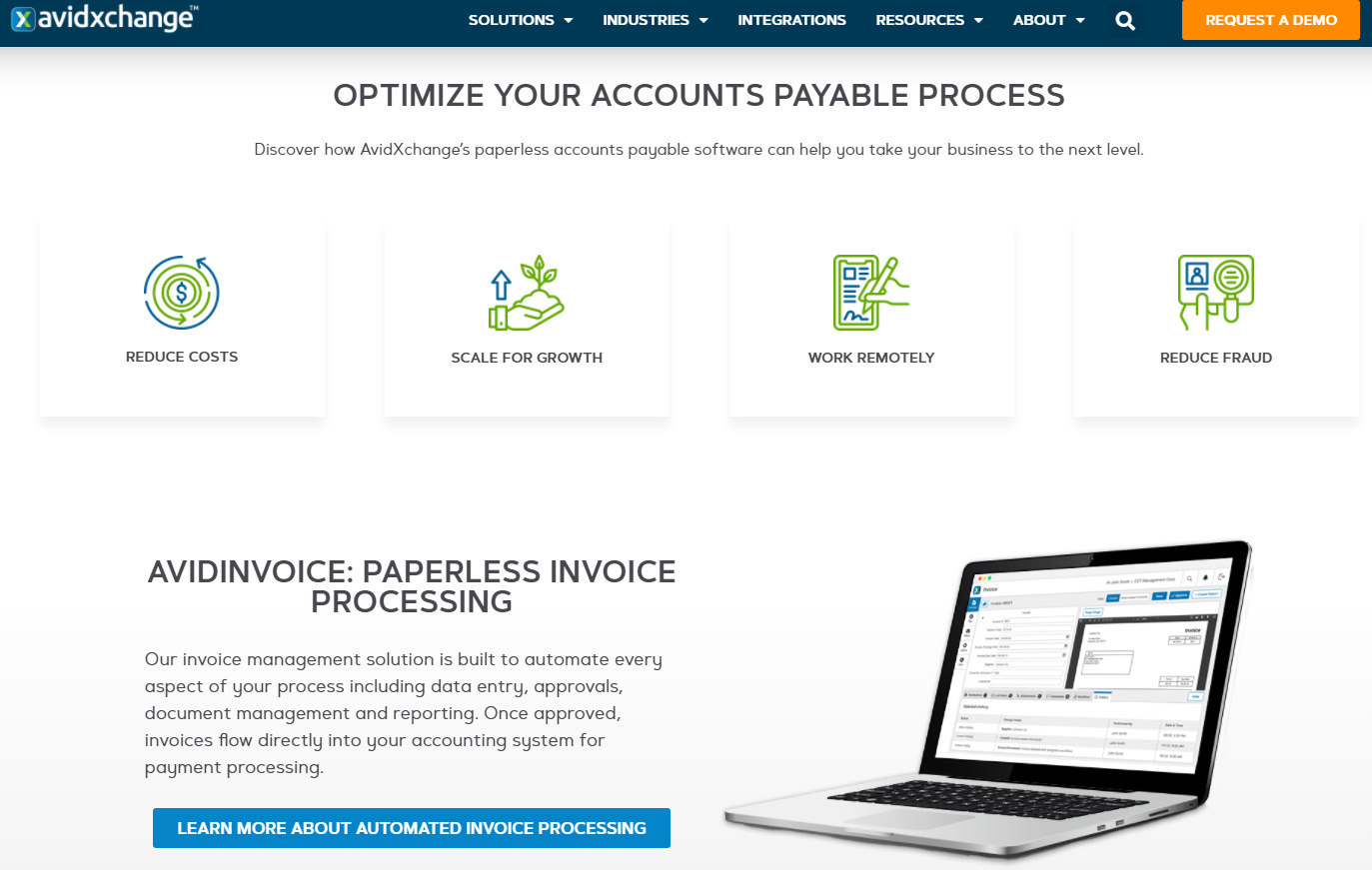

AvidXchange, a billing and payments software provider, completed a $660 million IPO fundraise at a $4.5 billion marketcap. The firm offers a software-as-a-service payable automation software, as well as payment solutions for middle-market companies and their suppliers (with middle market companies defined as those with between $5 million and $1 billion in annual revenue). The company’s traction is with this middle market segment, particularly with accounts payable workflows. From the prospectus:

7,000 buyers and have made payments to over 700,000 suppliers over the past five years. Our customers operate across a variety of verticals in which we have deep domain expertise, including real estate, homeowners associations, or HOA, construction, financial services, (including banks and credit unions), healthcare facilities, social services, education, and media. In 2020, we processed approximately 53 million transactions representing over $145 billion in spend under management across our platform and, of that, moved $38 billion in total payment volume from our buyers to their suppliers

In the first half of 2021, the company brought in $114 million in revenue, up 33% on the year before, with a net loss of $50+ million. A $250MM ARR is about 20x on the valuation, which is expensive but not insane.

We see two trends. The first is the continued interest in companies that focus on money movement through payment gateways, checkout, and other payment workflows (e.g., Checkout.com, Bill.com, Rapyd; yes we are conflating a bit). Automation up the stack from payment into workflows is the differentiator to capture different market segments.

The second is that the traditional finance function in companies is being turned into software, and joining the fintech theme. This explains things like Brex / Ramp (cards for employees) and Pipe (financing based on receivables), and also AvidXchange. The finance function is not the finance instrument, despite sounding the same. We are paying close attention to this theme, which is being wildly financed and broadly executed.

NFTS: Sotheby’s Dives Deeper Into NFTs With Ethereum ‘Metaverse’ Marketplace (link here) and Bored Ape Yacht Club NFT Project to Launch Ethereum Token in Q1 2022 (link here) and Coinbase Jumps After Sign-Up Numbers for NFT Marketplace Revealed (link here)

Everybody has or will have an NFT platform.

Coinbase announced an NFT platform, and got 1.4 million sign-ups on the waiting list. This led to a jump of about $10 billion in equity marketcap, to $60 billion. As comparison, OpenSea does $3B in volume per month according to DappRadar and has only 260,000 active users. Something like a 2% spread would imply about $50 million revenue per month. So you can see why Coinbase might want to cash in.

Sotheby’s also launched their version of the Sotheby’s Metaverse, where art collectors can go to buy and sell NFTs, for fiat or crypto through a natively digital marketplace. The first auction coming up is Natively Digital 1.2, which will feature 53 NFTs sold by 19 celebrities and/or notable NTF collectors. The auction will include CryptoPunks, Art Blocks generative art, and Bored Ape avatars.

We are also seeing the NFT projects themselves become increasingly sophisticated. the Bored Ape community is talking about fungible tokens for early 2022, which will see the project potentially using the instrument for governance purposes. There’s a lot more to say on this space - check out our podcast with Art Blocks CEO Erick Calderon here, financial myth-making in the world of NFTs here, and a podcast on Metaverse 101 here.

Rest of the Best

Here are the rest of the updates hitting our radar:

DIGITAL INVESTING: TradingView Bags Nearly $300M In Funding Round That Values Company At $3B (link here)

DIGITAL INVESTING: Fintech Firm Trumid, a Digital Credit Trading Platform, Secures $208M via Round led by Point Break Capital Mgmt (link here)

CRYPTO: SEC Approves Bitcoin Futures ETF, Opening Crypto to Wider Investor Base (link here)

CRYPTO: Tether’s Latest Black Eye Is CFTC Fine for Lying About Reserves (link here)

CRYPTO: SoftBank Joins $60M Investment in Crypto Analytics Firm Elliptic (link here)

CBDC: Binance to Delist Chinese Yuan, Block Crypto Traders in Mainland China (link here)

CBDC: Japan will prioritize simplicity in CBDC design, says central bank executive (link here)

NFTS: ViacomCBS gets into NFTs via a partnership with NFT startup Recur (link here)

NFTS: Ethereum NFT Game Sorare Investigated by UK Gambling Commission (link here)

METAVERSE: CEO Shares First Details on Magic Leap 2, Announces $500 Million in New Funding (link here)

ESG: NatWest allocates £100 billion for green lending (link here)

Blueprint Updates

Analysis: The Law of Unintended Consequences via Wells Fargo, Divergence Ventures, DeFi designs, and the Federal Reserve (link here)

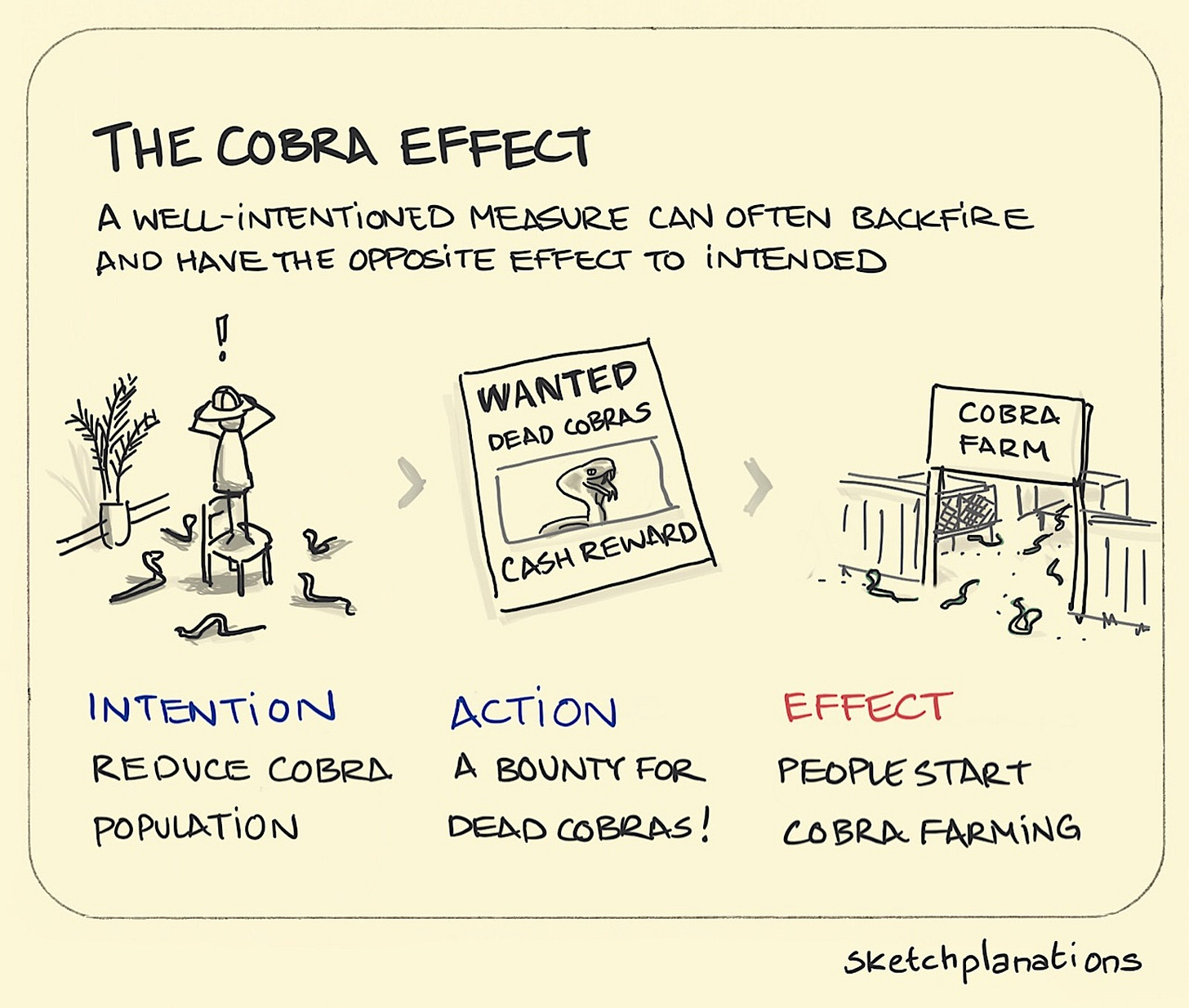

How can incentivises have unintentional consequences and what factors should we consider when creating incentive mechanisms?

We focus on the law of unintended consequences, and how making rules often creates the opposite outcome from the desired results. The analysis starts with the Cobra effect, and then extends to a discussion of the Wells Fargo account scandal, dYdX trading farming, Divergence Ventures executing Sybil attacks, and Federal Reserve insider trading. We touch on the concepts of credit underwriting and token economies, and leave the reader with a question about rules vs. principles.

Podcast Conversation: Scaling Web3 with the $10B+ Polygon protocol, with COO Sandeep Nailwal (link here)

In this conversation, we chat with Sandeep Nailwal – The Co-Founder & COO at Polygon (previously Matic Network). Sandeep is a long time developer who’s been dabbling in the space since way back in his college days. Originally known as the Matic Network, Polygon rebranded with the aim to reach a global audience and they’ve certainly done just that.

More specifically, we touch on Sandeep’s intriguing entrepreneurial journey, developing a blockchain startup in India, DApps, Scalability & Interoperability of Layer1 and Layer2 blockchain solutions, Zero-knowledge Rollups, NFTs & Gaming, and so much more!

“…the biggest non-technical reason why I don't see any layer one surpassing Ethereum is because of this community. I also remember that there is a very interesting page and I would kind of recommend all listeners to read it on Ethereum. It was ethereum.org. and the page was titled the 'Philosophy of Subtraction', right. And if you read that page you'll get goosebumps, right. I mean, the way they have narrated that we in spite of mattering more, we want to matter less. When we see opportunities…”

More? More!

If you want to go deeper in Fintech & DeFi, upgrade to a premium Blueprint subscription below. Our value prop is simple: experienced judgment, accurate vision. If you knew the shape of the tomorrow, what would you do today?

Want to chat? Stop by our (pretty empty right now until you join) Discord!

What did we miss? Reach out here anytime.