Web3: Coinbase asset management with One River Digital acquisition; Uniswap wallet blocked by Apple; ERC-4337 Smart Accounts

Also goodbye to Silvergate

Gm Fintech Futurists —

Welcome to our Web3 newsletter, covering DeFi, digital assets, NFTs, and the emergence of the financial metaverse. Today we highlight the following:

FINTECH & INSTITUTIONAL ADOPTION: Coinbase Purchases One River Digital In Move Into Asset Management Business

DEFI & DIGITAL ASSETS: Uniswap Labs Releases Self-Custody Crypto Wallet

CRYPTOECONOMICS & PROTOCOLS: Ethereum Users May Soon Be Able To Retrieve Lost Private Keys

CURATED NEWS

Based on your feedback, we know that many of you are interested in reviews of companies or projects highlighted by our community. Leave a comment below with a company of your interest and we’ll do a deeper take on it later!

Web3 Short Takes

⭐ Coinbase Purchases One River Digital In Move Into Asset Management Business - The Block

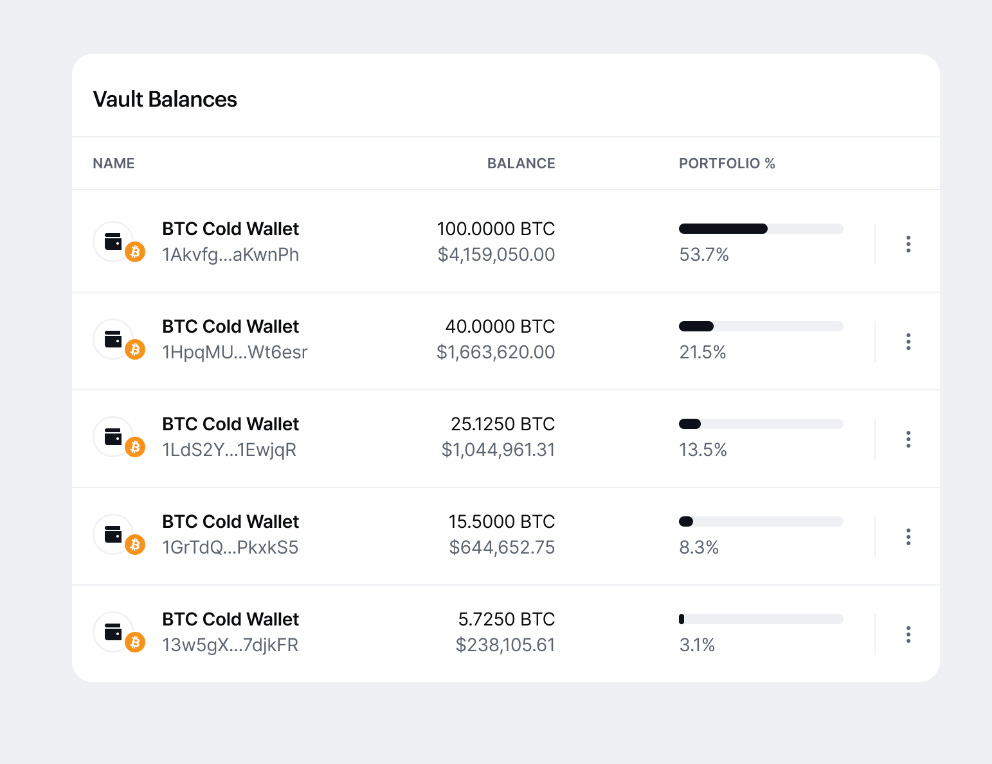

Coinbase, which has $50B of institutional assets on its platform, has acquired crypto asset manager One River Digital Asset Management (ORDAM) after a year of negotiation. Notably, Coinbase Ventures had backed ORDAM in its $41MM Series A fundraising round. After the acquisition, ORDAM will become Coinbase Asset Management (CBAM) and operate as an independent business and wholly-owned subsidiary of Coinbase.

In February last year, ORDAM collaborated with Coinbase to create a platform that provides wealth managers with direct access to ONE Digital SMA, a suite of investment strategies via a separately managed account (SMA) platform. ONE Digital SMA enables wealth managers to offer their clients cryptocurrencies and staking via Coinbase Prime, an execution engine, trading platform and custody solution used by hedge funds and wealth managers.

Coinbase's acquisition aligns with a diversification for an investment management business — from brokerage to fee based revenue. Other attempts at diversification include partnering with BlackRock and launching the Base testnet, Coinbase’s L2 protocol. Further, given the issues faced by Grayscale and Genesis, the crypto asset management space is becoming wide open for new institutional vehicles.

Regulations are also playing a part. In February, the SEC voted to expand asset custody rules for investment advisors to crypto, requiring financial institutions overseeing cryptocurrencies to obtain federal and state registrations. The proposed proposal mandates investment advisors maintain custody accounts for crypto assets similar to those for other assets (e.g., stocks and bonds) — an impractical and strange view given the nature of non-custodial assets.

👑Related Coverage👑

⭐ Uniswap Labs Releases Self-Custody Crypto Wallet - The Defiant

Decentralized exchange (DEX) Uniswap Labs has developed a self-custody crypto wallet. However, the platform is currently only available in early access, since Uniswap need Apple's approval to launch on its App Store, but the final build was rejected just before its December launch. This is both unsurprising and terrifying, given Apple's walled-green approach in Web3, requiring developers to pay 30% of NFT earnings to Apple for using their platform and prohibiting app stores within app stores (e.g., Fortnite ban).

In the wallet, users can trade tokens directly, switch between different blockchain networks, access market cap information, price charts, and volume data, use WalletConnect to connect to other apps, and back up their seed phrase on iCloud. ollowing the destruction of FTX, non-custodial wallets are more attractive than ever. As another example, MetaMask launched MetaMask Learn, a Grants DAO, and an SDK to integrate Web3 games into its platform.