AI: Collective Intelligence strikes gold mining for Alpha

A portfolio of crowd-sourced Monte Carlo simulations outperformed the cap-weighted index by 3%

Hi Fintech Futurists —

Today we highlight the following:

AI: The power of collective forecasting in discovering alpha

LONG TAKE: From Centralized AI to Personal Bots in the agentic economy

PODCAST: Building an 800,000 device DePIN blockchain, with Peaq Founder Till Wendler

CURATED UPDATES: Machine Models, AI Applications in Finance, Infrastructure & Middleware

To support this writing and access our full archive of newsletters, analyses, and guides to building in the Fintech & DeFi industries, see subscription options here.

AI: The power of collective forecasting in discovering alpha

For decades, individual investors have tried to outperform the market using a variety of strategies, ranging from charting to econometric models to machine learning (ML) techniques.

Traditional tools such as linear regression, time-series models (e.g., ARIMA), and factor-based investing (e.g., the Fama-French factor model) have long been used to forecast returns based on standard market data like historical prices, trading volumes, corporate earnings reports, and interest rates. However, over the last decades, investors have increasingly incorporated alternative data sources — such as social media sentiment, satellite imagery, and transaction data — spurred by advances in computing power that enable more complex and high-frequency trading strategies.

As a result, ML and deep learning models, such as decision trees, support vector machines (SVMs), and neural networks, are now widely used for price and returns forecasting. These models allow investors to apply techniques like sentiment analysis, powered by natural language processing (NLP), and algorithmic trading, which enables near-instantaneous, automated trade execution. One notable strategy is statistical arbitrage, which exploits pricing inefficiencies between correlated assets.

That said, the chances of consistently outperforming the market as an individual investor remain slim. Mutual funds have historically underperformed, which explains the rise in popularity of index investing. Even with advanced ML strategies, the odds are stacked against you due to the many complexities involved, including data curation, high-performance computing infrastructure, software development, feature engineering, and backtesting.

Peter Cotton, who holds a PhD in Mathematics from Stanford and is the Chief Scientific Officer at Crunch Lab, developed the Sector Monte Carlo Game, a project designed to challenge traditional index investing through collective forecasting. Participants submit Monte Carlo samples each weekend, predicting the returns of 11 financial sectors for the upcoming week using any models or techniques they choose. Scores and wealth rankings are updated weekly, rewarding participants based on the accuracy of their forecasts and their performance relative to competitors.

The game aggregates and evaluates probabilistic forecasts by collecting one million Monte Carlo simulations per sector from each participant. Instead of submitting point predictions — i.e., forecasting an exact percentage return for a sector — participants provide a range of potential outcomes for the 11 sectors.

To address the fact that actual outcomes may not perfectly match any single prediction, each Monte Carlo sample is smoothed using kernel density estimation. This smoothing process spreads out the influence of each prediction over nearby values, transforming the set of discrete simulations into a continuous probability distribution.

Wealth is updated weekly, with participants contributing a fraction of their total wealth. Participants whose predictions are both accurate and unique — those that closely match the actual outcome but are not widely predicted — receive a larger share of the rewards. This makes sense and mimics the first-mover advantage in financial markets (e.g., in arbitrage trading).

The combined weighted contributions from all participants (which is Q(z) in the image above) form the collective market forecast. This aggregate distribution serves as the benchmark for evaluating individual performance and allocating rewards, and in the past week, the portfolio of crowd-sourced Monte Carlo simulations outperformed the cap-weighted index by 3%.

We find the Sector Monte Carlo Game particularly interesting because it reflects the broader shift in investment strategies from macroscopic alpha to microscopic alpha. Here is a fun reference from Marcos López de Prado’s book, Advances in Financial Machine Learning:

“Mining gold or silver was a relatively straightforward endeavor during the 16th and 17th centuries. In less than a hundred years, the Spanish treasure fleet quadrupled the amount of precious metals in circulation throughout Europe. Those times are long gone, and today prospectors must deploy complex industrial methods to extract microscopic bullion particles out of tons of earth. That does not mean that gold production is at historical lows. On the contrary, nowadays miners extract 2,500 metric tons of microscopic gold every year, compared to the average annual 1.54 metric tons taken by the Spanish conquistadors throughout the entire 16th century! Visible gold is an infinitesimal portion of the overall amount of gold on Earth. El Dorado was always there . . . if only Pizarro could have exchanged the sword for a microscope.”

The search for profitable strategies has evolved much like gold mining. A decade ago, it was still possible for individuals to uncover macroscopic alpha using relatively simple tools like econometrics. However, the odds of discovering such alpha have steeply declined. Today, the search for macroscopic alpha faces immense challenges, and the opportunities that remain are microscopic. As noted by de Prado, this shift doesn’t imply smaller returns — there is actually more microscopic alpha available today than macroscopic alpha has ever produced.

The Sector Monte Carlo Game exemplifies this (or at least a part of this) evolution, showcasing that crowd-sourced wisdom — drawing from a much broader array of techniques and strategies — can reveal opportunities that remain hidden to those attempting to forecast alone. Companies and projects like CrunchDAO and Numerai, as well as the AI Kaggle competitions, have taken advantage of these dynamics to deliver breakthroughs for years.

👑 Related Coverage 👑

Blueprint Deep Dive

Long Take: From Centralized AI to Personal Bots in the agentic economy (link here)

We explore the emergence of the "agentic economy," driven by the convergence of blockchains, AI, and financial networks. The rise of AI agents, personalized digital entities performing tasks on behalf of individuals, poses significant questions about the future of technology ownership, privacy, and decentralization.

While current AI models, like those from OpenAI, operate as centralized entities, a shift towards individualized, localized AI could lead to a more decentralized landscape. We also examine the potential economic impact of AI companions, which could generate significant revenues and transform the entertainment industry.

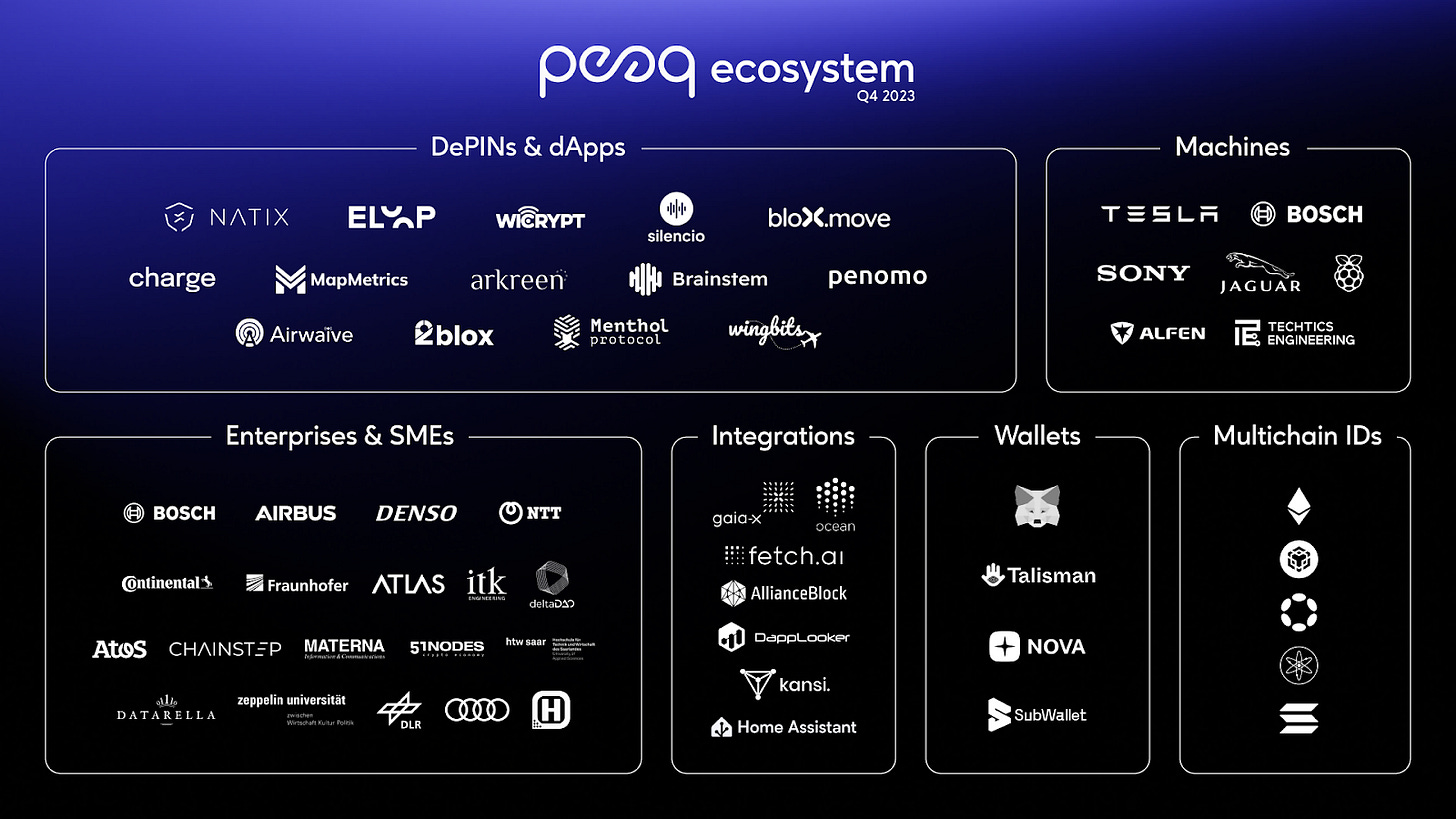

🎙️ Podcast Conversation: Building an 800,000 device DePIN blockchain, with Peaq Founder Till Wendler (link here)

In this conversation, we chat with Till Wendler — the Founder of Peaq, a Web3 network powering the Economy of Things (EoT), where decentralized applications for vehicles, robots, and devices can be built. Till is also the CEO & Co-Founder of EoT Labs, which focuses on developing and supporting open-source projects related to the Economy of Things.

Additionally, Till serves as an Advisor for penomo, a smart contract based monetization and battery asset management infrastructure for circular EV Battery businesses. Till previously held the position of Head of Operations at Advanced Blockchain AG and has experience as the CEO of Axiomity AG and blash-trading.com GmbH. Till holds a Bachelor of Arts in Business Administration from California State University - East Bay.

Curated Updates

Here are the rest of the updates hitting our radar.

Machine Models

⭐ Beyond Model Interpretability: Socio-Structural Explanations in Machine Learning - Google Research

⭐ A Deep Generative Learning Approach for Two-stage Adaptive Robust Optimization - MIT

Planning In Natural Language Improves LLM Search For Code Generation - Scale AI

Understanding Data Importance in Machine Learning Attacks: Does Valuable Data Pose Greater Harm? - Rui Wen, Michael Backes, Yang Zhang

A New First-Order Meta-Learning Algorithm with Convergence Guarantees - EPFL

A Physics-Informed Machine Learning Approach for Solving Distributed Order Fractional Differential Equations - Alireza Afzal Aghaei

AI Applications in Finance

⭐ Large Language Model Agent in Financial Trading: A Survey - Columbia University

Large Investment Model - Jian Guo, Heung-Yeung Shum

Machine Learning and the Yield Curve: Tree-Based Macroeconomic Regime Switching - Siyu Bie, Jingyu He, Francis X. Diebold, Junye Li

A Fused Large Language Model for Predicting Startup Success - Abdurahman Maarouf, Stefan Feuerriegel, Nicolas Pröllochs

Pricing American Options using Machine Learning Algorithms - Prudence Djagba, Callixte Ndizihiwe

Attention-Based Reading, Highlighting, and Forecasting of the Limit Order Book - Purdue University

Fundamental properties of linear factor models - Damir Filipovic, Paul Schneider

Infrastructure & Middleware

⭐ Altman Infrastructure Plan Aims to Spend Tens of Billions in US - Yahoo Finance

⭐ AMD to acquire infrastructure player ZT Systems for $4.9B to amp up its AI ecosystem play - TechCrunch

Tech industry taps old power stations to expand AI infrastructure - Financial Times

Applied Digital Announces $160MM Strategic Financing, Fueling Transformative Accelerated Compute and AI Infrastructure - GlobeNewswire

🚀 Postscript

Sponsor the Fintech Blueprint and reach over 200,000 professionals.

👉 Reach out here.Check out our new AI products newsletter, Future Blueprint. (Don’t tell anyone)

Read our Disclaimer here — this newsletter does not provide investment advice

For access to all our premium content and archives, consider supporting us with a subscription. In addition to receiving our free newsletters, you will get access to all Long Takes with a deep, comprehensive analysis of Fintech, Web3, and AI topics, and our archive of in-depth write-ups covering the hottest fintech and DeFi companies.