Hi Fintech Architects,

Welcome back to our podcast series! For those that want to subscribe in your app of choice, you can now find us at Apple, Spotify, or on RSS.

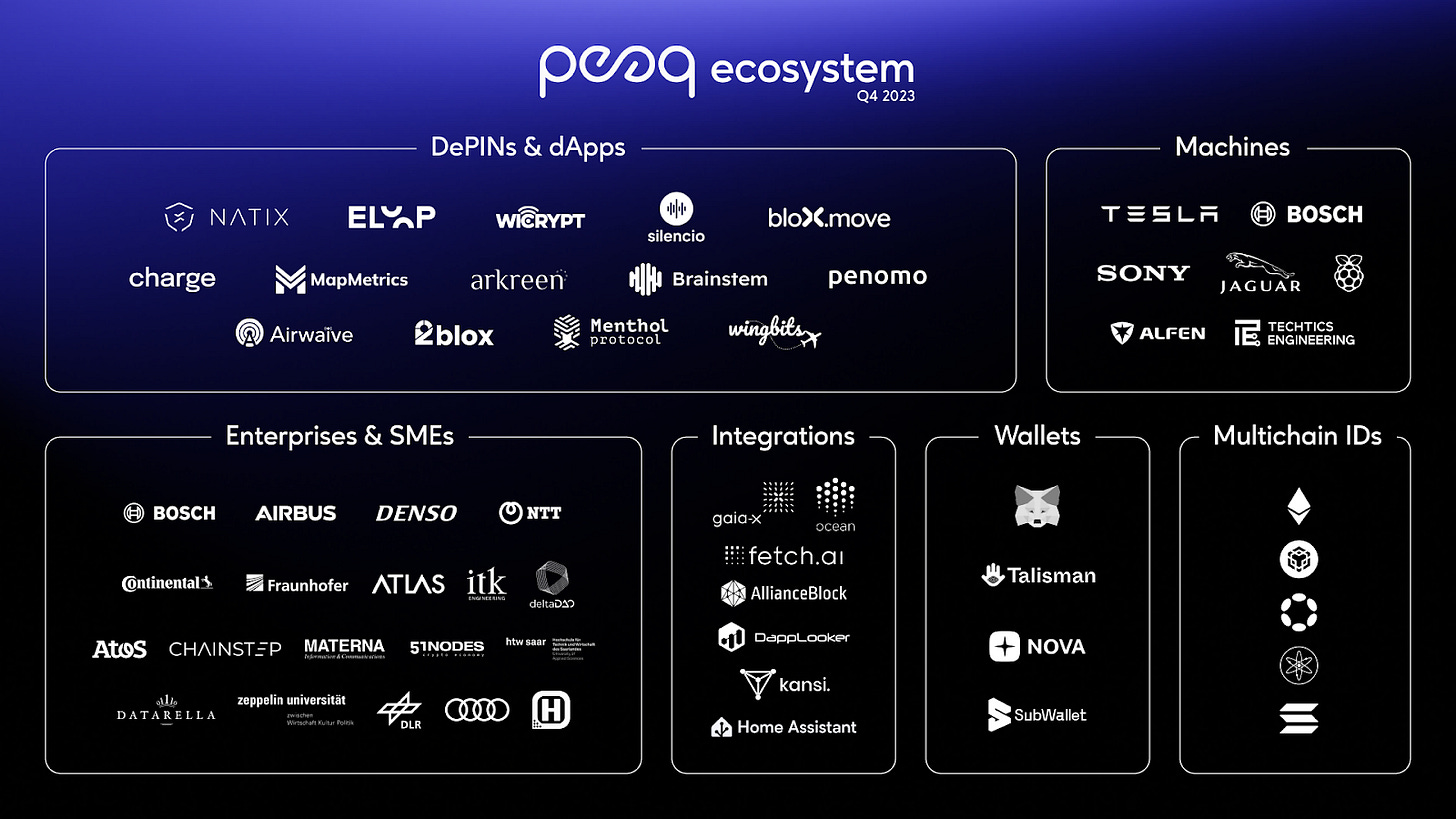

In this conversation, we chat with Till Wendler — the Founder of Peaq, a Web3 network powering the Economy of Things (EoT), where decentralized applications for vehicles, robots, and devices can be built. Till is also the CEO & Co-Founder of EoT Labs, which focuses on developing and supporting open-source projects related to the Economy of Things.

Additionally, Till serves as an Advisor for penomo, a smart contract based monetization and battery asset management infrastructure for circular EV Battery businesses. Till previously held the position of Head of Operations at Advanced Blockchain AG and has experience as the CEO of Axiomity AG and blash-trading.com GmbH. Till holds a Bachelor of Arts in Business Administration from California State University - East Bay.

Topics: Blockchain, web3, decentralized applications, dapps, economy of things, EOT, depin, iot, decentralized physical infrastructure networks

Tags: Peaq, IOTA, Exonum, DMG MORI, Silencio, MapMetrics, Helium

In Partnership

We are supporting an online conference with 1,000+ angels, VCs, family offices, and startup founders on August 28th, starting at 12 PM ET / 5 PM BST for 4 hours (join any time).

There will be speakers from Techstars, AngelList, Antler, HustleFund, Idealab, Everywhere Ventures, B Capital, PSL, The Council, SparkLabs Group, +50 other VCs. Registration stats so far: 433 Angels, 118 Syndicates, 114 LPs, 282 VCs, 792 Founders, 162 Accelerators, 116 Family Offices, 150 Exited Founders, 289 Venture Studios.

Some of the topics to be covered:

Best Practices for Angels

Family Offices: Investing in Funds as LPs vs Direct Startup Investments

How We Raised in 2024 – Where Should Startup Founders Start? Accelerator, Pre-seed Fund, or Venture Studio?

How to build a syndicate? Lessons from building a 1,300 angel network with $0 marketing

Register to join for free 👉 https://inniches.com/angel

Timestamps

1’09: From the Valley to Blockchain: Till’s Journey into Entrepreneurship and Crypto

4’59: Building Peaq: From Berlin's Blockchain Scene to IoT Innovation

8’26: Connecting Machines to Blockchain: The Use Case Discovery and Peaq's Evolution

13’31: From IoT to the Economy of Things: The Evolution of Connected Devices

17’53: Unlocking the Machine Economy: The Role of Web3 and DePINs in Decentralized Infrastructure

20’50: Scaling the Machine Economy: Successful Use Cases Built on Peaq's Decentralized Network

23’34: Driving Network Growth: How Peaq Reached 800,000 Connected Devices Through Strategic Go-to-Market and Product Market Fit

29’15: Streamlining DePIN Success: How Peaq Simplifies Tokenomics and Focuses on User Demand

32’56: Empowering Ecosystem Growth: Peaq's Role in Supporting Projects from Integration to Funding

34’45: The channels used to connect with Till & learn more about Peaq

Illustrated Transcript

Lex Sokolin:

Hi, everybody, and welcome to today's conversation. I'm super excited to have with us today Till Wendler, who is the founder of the Peaq Network. Peaq is one of the leading DePIN Layer 1s in the space, and we'll talk about what decentralized physical infrastructure networks are. I'm super excited for this conversation. Till, welcome.

Till Wendler:

Yeah. Hi, Lex. Pleasure to be here.

Lex Sokolin:

Fantastic. So let's start with how you got into entrepreneurship and what drove you into the blockchain space.

Till Wendler:

Yeah. That's a very interesting, unique history, I guess. I've been studying in the States. That was around 2015. Yeah, 2015, 2014, 2015, 2016, where I've been then also getting in touch with this entire topic of entrepreneurship because the university was more or less right in the middle of the Valley, Cal State, East Bay. So, I went to a lot of meetups, tech meetups, entrepreneur meetups, and that is what triggered something inside of me why I said, "Well, entrepreneurship, that's something that fascinates me. I want to move things. I want to create things." And then how I got into blockchain, into crypto, that was the very unique part.

So, I went back to Germany, and my ex-girlfriend at that point of time, her brother was a relatively successful Bitcoin miner who had an entire basement full of equipment, all the rigs and everything, and obviously that was very fascinating as a young person. Yeah, I started working with him, and he started offering me a side job where I was literally driving him around as a chauffeur. And he paid me in ETH, so a very well-paid profession looking back. At the same time, I started building up a business on the e-commerce payment side, at least it evolved into such, where you could literally pay in ETH, BTC, and I was helping e-commerce companies accepting those crypto payments and then I exchanged it for their goods that they've been offering.

Lex Sokolin:

That's a pretty fascinating start. What year were those rigs lying around in the basement you said?

Till Wendler:

I would need to look at it. That was around end of 2014, 2015, around that time.

Lex Sokolin:

Before the Ethereum launch?

Till Wendler:

Before the Ethereum launch, so there was a yellow paper that I've been also studying. He actually was already invested in Ethereum. That's how he was able to pay me in ETH. But yeah, so that was very, very early times still.

Lex Sokolin:

So off the bat you saw this and you said, "Okay. There's a potential for commercial activity here. It's possible that businesses would accept this as a currency." Of course, this is before the stablecoins became as big as they were. Was there any success that you saw in those early days and what happened then?

Till Wendler:

I guess I was also, to a certain degree, a little bit naive, so I thought, "Wow, that's revolutionary." I read the Bitcoin white paper, this ETH yellow paper. I said, "This is revolutionary. We can represent certain logics, execute it on chain verified decentralized systems." So, what fascinates a lot of people that hear about the space first time, I was really digging in it. And then the commercial aspect that was, I would say, more I felt like there is something going on. I couldn't identify what makes sense at that point of time, but I felt like an easy low-hanging fruit as everyone accepts those payments and well, I imagine it a little bit easier than it actually was because obviously German, Austrian e-commerce is not the most innovative ones, I would say. And it took quite a while to find some companies adopting it. Then later on, we sold the company more or less for almost the same value we invested. So, it was literally a really good lesson that I learned on the commercial side but not the most lucrative.

Lex Sokolin:

So the next step after that was you joining Advanced Blockchain AG. What did that company focus on, and how did it lead you towards Peaq?

Till Wendler:

It actually started with Peaq. Yeah, I then moved to Berlin. That was around 2016 just to be closer to the space. There was a lot of meetups, absolutely incomparable to if you look at ETH you see today with tens of thousands of people traveling to a different country, so this was literally a few people hanging out in a bar. It was called Room 77 in Berlin and them discussing the space basically, it was not more than that. But yeah, I felt very attracted to this community, to this maybe we could even call it some technological movement, moved to Berlin. That's when I met Leonard, my co-founder today. And then later also Max, the third founder. And we've been then attending a lot of meetups and somehow slipping into this entire IoT space as well and then started to connect the dots between IoT blockchain, so try to really get into it.

So that was how I slipped into Peaq. We had early ideas where we thought, "Okay, let's build some... today, you would probably call it, "some L2 to build something on ETH." We had the idea to build something on top of IOTA like a smart contract layer because IOTA was a rising star at that point of time, and that's when we had the first ideas about Peaq, actually. And then the problem was we've been really early, and there wasn't really a lot of people that believed in this being a really good idea, and there wasn't really a lot of investors that believed this would be a good idea. But there was our contact at Advanced Blockchain AG that offered to help us growing that and give us a little bit of some space and capital to make the first steps.

Lex Sokolin:

Yeah, what was that original idea? Because I think around that time, the perception of what a blockchain is for is for computation. Can you talk about what your idea was? How did you look at IOTA, and what did you think you wanted to do?

Till Wendler:

Well, yeah, IOTA was a lot about transactions. So, we looked at IOTA and we felt, okay, there's a lot of innovation in terms of the deck architecture they've been using. Even though we've seen quite some issues with it when we try to experiment with it, I don't know where they stand today. I hope a lot of them got fixed as of today. But what we realized also with deck concepts was that it was very difficult to represent actual smart contracts and logics being executed rather than just transactions. So, for transactions, that was a good architecture, but for any more complex logics that wouldn't really work, and that's why we experimented a lot on it. We experimented around ETH. We then built our own little system with Exonum, which is like a blockchain framework, which I would say is a little bit outdated today without stepping on someone's toes. But yeah, so we've seen some limitation in that system in terms of representing the logics we would need for machines executing actual exchanges.

Lex Sokolin:

Maybe zoom out a little bit and what are machines, why do they need a blockchain, and what were you thinking of connecting to what?

Till Wendler:

Yeah, we've been obviously also much younger at that point of time, so we've seen all ideas in our minds that can be represented also on chain. So, it wasn't really that granular that we would say, "Well, we need this and that use case that needs a chain," but there's a few cases. So, what we actually did then is we said, "Okay, let's maybe take a step back." There was this ICO wave and everyone was doing ICO, and for a while we thought, "Okay, let's raise some funds. Let's do an ICO, and let's conquer the world with whatever we are going to build." But we didn't know exactly how we would build it, and that's also why we said, "Well, let's maybe take a step back and go into the actual use case discovery. What is actually needed? What are the requirements on such a chain? What are the requirements from the machine and from the businesses so that we can actually solve problems and offer a solution? And then we went into enterprise development, so we started working with different kind of companies.

One of the first companies we worked with was DMG MORI, one of the largest machine manufacturers in Germany. We built a larger case with them. It was like the first DePIN we actually built without knowing that this would be a DePIN where they had big machines like CNC machines and so on that they were trying to lease also to different customer groups. In some countries, that would work well, but in some higher risk countries, they would experience also some frauds with those machines and the usage data, basically, similar to when you have a car odometer and you lease a car and then you will just reset it. Of course, a bit more complex in that case. But yeah, we involved different groups; a leasing company, a larger one, insurance company, a customer. DMG brought the machines on chain, so basically had them communicating with the chain, submitting certain states every minute or whatever that was in detail.

I don't remember, basically communicating their state, communicating the certain data, usage data and then having an automated pay-per-use model where the usage was basically being paid the minute it has been used. And that was a very interesting case for us to get a lot of ideas and insights. But there were also a few other cases, a few of those customers I'm not allowed to name. But one case that was probably the most impactful case for defining our requirements also for Peaq was a case with the VW Group, with the Volkswagen Group, where in a nutshell, they have a lot of different brands, SEAT, VW itself, Audi, Porsche and a few others. But they had the issue, or at least it was a concern that, for example, an Audi vehicle wasn't able to charge at a Porsche charging station and especially not a private charging station.

So, there was literally the VW, in this case, an Audi manager coming to us and saying, "My father-in-law, he has a Porsche, and he's charging with his private charging station at his garage. If I want to charge my Audi at his garage, at his charging station, the only way I can do it and I can actually pay him, and I don't know if I'm even paying the correct amount for the amount of energy being used is to give him a few Euros in cash, and nobody really knows what happens in the background." We then thought, "Okay, what if we have a complete..." And that was giving us a lot of insights on payments between the machines, also resource-dependent payments for energy being used, the need for machines having an identity to remove a lot of fragmentation, which is very obvious also in the charging industry. Whoever has an electric vehicle probably needs 10 apps or at least five apps minimum to charge a different charger. Sometimes it works, sometimes it doesn't authenticate and so on. Yeah, so that's how we also found a lot of requirements for Peaq.

Lex Sokolin:

What is a machine? How do you define that?

Till Wendler:

What is a machine? Yeah, essentially, I would say it's a computer in very simple terms.

Lex Sokolin:

So, any hardware physical device that has a need to be both in the physical and the digital world, and I guess that connects into the Internet of Things theme that was quite prevalent in the middle of the 2010s. Maybe I could ask you to define IoT and give your thoughts on the adoption of IoT and then talk about the term that you're championing around EOT and the Economy of Things. So, what's the Internet of Things and how do we get to the Economy of Things?

Till Wendler:

At least that's how we see it, the Internet of Things we would see as a more of interconnected physical devices that communicate and also to certain degree exchange data. But when it comes to the Economy of Things, so we like to call it the next evolutionary step of the Internet of Things. That is literally also the economic aspect in it. So actual value exchange between those different devices, sensors and machines so that they not only communicate and exchange data, but actually also can pay each other, execute transactions, pay each other for services and goods, so basically forming an own economy.

Lex Sokolin:

There was a lot of storytelling in the beginning of the IoT movement about just the number of devices and digital twins that would come online. There were the stories of drones working for Amazon to do deliveries, of course, Teslas and their charging stations, smart plugs and smart homes that you can control, and of course, the digital twins of cities and smart cities, so for large enterprises where you would have physical devices, whether it was airplanes and their engines or whether it was factories all running digital twins in parallel that would have life data from the sensors in the physical world.

So you're doing digital transformation on the physical world. You're uploading all of these things and then you're managing software versions of them in addition to the hardware versions. And I think a lot of that did come to fruition, but in a very enterprise way. On the consumer side, people aren't maybe even aware of IoT. Even if they have multiple smart speaker devices in their house, they don't know that they've got IoT devices. Do you think IoT has been successful to date? How much penetration is there in the market and are you satisfied with how far we've gotten?

Till Wendler:

I think I'm not satisfied at all. That's fine. I'm building Peaq. And we're trying to change the things as they're today because as they are today, the potential of these devices is very limited. The usage of those devices is very limited from an economical perspective, and it's very centralized. So, for example, even though, going back to that charging example, I might buy a charger, a home charger, and I have that on my wall and I paid $1,000 for that charger, it's still not really mine. So, it's not the case that anybody can basically stop by and charge their vehicle and I'm automatically getting paid. I can't really make that accessible to everyone out there, and that is the case for a lot of devices and a lot of machines that we use on a daily basis. That's why I think IoT Outworks today is, even though it might be connected to a certain degree, you spoke about the smart home.

So, you have things like IoT home assistant where you can connect different devices in the cloud system and so on. But outside that, they're not really able to identify each other and to also exchange value with one another, and I think that's why we're not satisfied. And especially also how the consumers, so the ones that are buying those machines, that are buying those devices, how they are essentially profiting from it, which in most cases, they don't do at all. At least from an economical point of view, they don't really own those devices. So, they're still behind centralized systems, clouds, gateways. That's why the potential is still not really used from our perspective.

Lex Sokolin:

So how do you see the Web3 tools of decentralized physical infrastructure networks attacking this problem, and what is the value add of having a Layer 1 protocol that's dedicated specifically for DePINs?

Till Wendler:

Generally, Web3 is obviously very well-designed for opening up certain systems and bringing different stakeholders together, and basically you have certain economies in itself that you can build. In this case, we believe that a machine economy, how we all imagine it, or at least we talk about it for a long time, all of us, that the best place to build a machine economy is in a Web3 environment so that all machines are able to identify each other, are able to transact with each other, and that you are able to build any kind of use case for all different kind of machines, so you can basically... Today it is almost impossible. Speaking of that, I'm going back to that charging use case because I think it's such a present case and also a big reason why this electric vehicle movement might have not been accelerating as fast as we were all hoping for. With Web3, and especially with Peaq, you are able to build multiple applications for one and the same machine. So, you can have five different applications including this charging station.

And that's why with Web3 and with our framework, we are able to open up the machine to give it its own identity, its own self-sovereign identity becomes a self-sovereign player in the economy. Being able to build this next generation of applications in an open, decentralized way so that you refer to them as DePINs, so that DePINs. So, applications that build use cases around those machines can build those use cases and those applications in a way that everyone can access those machines, that they can be part of also all other applications and can identify with all other potential applications and communicate and also in the interest of the people. So usually, they are incentivizing people to actually own that hardware, purchase that hardware, own that hardware and grow the infrastructure around that hardware to essentially profit also from the usage of that infrastructure. That's very contrary to how we use things today, where is usually always an intermediary, a company in between that is the gatekeeper for certain processes and always wants to have a cut when using those machines.

Lex Sokolin:

What are some examples of use cases that you think have been successful that have been built on Peaq? Just to clarify, Peaq is a network, so it's in a way an aggregator of multiple different DePINs. So, you're going to have applications that focus on different IoT verticals and have different dynamics. And one of the goals, of course, is to grow different parts of the network through getting more and more applications on. Can you talk about some of the ones that stick out to you as really good ideas or having a lot of traction?

Till Wendler:

Yeah. Yeah. By now, we actually have around almost 50 applications that are building on top by great teams, and honestly, it's really difficult to pick one or two favorite ones 'cause I think they're all really, really great and really advanced ideas, a few that might be very easy to grasp. One that comes to my mind is Silencio Network, which has an application that intends to fight noise pollution. It's very interesting to see because where the team originally intended to do the same thing, but in a more Web2 environment, and it became very difficult to scale because what it is all about in Silencio is to gather noise data and to fight the topic of noise pollution, which is actually a big topic as of today. And that noise data is only valuable for a lot of people, but it also has a commercial aspect.

It's very valuable for companies such as real estate evaluation platforms, even medical companies intending to build hospitals, but also booking platforms in the future where you can imagine going on a booking platform and seeing a very precise noise score of the area where you want to stay. If you're a very noise sensitive person, you might want to avoid a certain area, for example, when booking your next vacation. But in order to, if you think from a traditional world, to set up a lot of noise sensors around the world, it would take not only a lot of money, but then also a lot of manpower to go to every country, speak with different authorities where you could place these noise sensors, how to aggregate the data and so on and so on and so on.

But what they're able to do is to incentivize by leveraging Peaq in our infrastructure, as you described it, as a network, they can build an application or they're building an application where they're incentivizing average people like you and me and everyone out there to use their noise sensors, which can be a simple smartphone sensor to aggregate that noise data, contribute it and then actively earn from companies paying for that data. I think this is a really good example how you can leverage the Peaq infrastructure by making sure this is verified data coming through real sensors, but then also leveraging the communities and people out there, giving them a share in what they actually own and scaling that to hundreds of thousands of sensors by now within a few months.

Lex Sokolin:

I think the last metrics you've shared with me, there have been over 800,000 devices on Peaq. Is that right?

Till Wendler:

Around that number, yeah.

Lex Sokolin:

When did that growth come? Was it over the last year? Has that been gradual? How did you build that growth into the network? And part of it is also, especially in financial systems and in crypto, you have a lot of people coming in opportunistically or software bots like creating fake accounts. Whereas here, in the case of Peaq, like the devices are actual physical devices, so you're not going to be able to game these numbers because they're connected to people's phones or other hardware. Can you talk about your go-to-market and what you've seen in terms of getting more and more accounts and connections on the network?

Till Wendler:

I think the actual go-to-market started way back when we decided to, as I mentioned, not go for some ICO, a random platform, but when we decided to go into extra requirement findings and working with those companies and with different devices to actually experiment and figure things out on the ground level. And that set us in a really, really great position because we gathered so much insights, so many requirements, and of course, it was a very painful time, you can believe me. But we really identified all the puzzle pieces from a product perspective, the machine identities, data verification and how that needs to look like, payments, role-based access, autonomous agents, how they need to be leveraged in such systems to really set the product from a go-to-market perspective on a perfect spot, like it's a perfect market fit right now, product market fit right now.

Then what we focused on initially was to together focus on more early-stage projects that we believed had great founder’s teams and that were able to be a bit more flexible still on experimenting, where to build that product, how to build that product, and that really worked out well. Yeah, we got a few of those early-stage DePINs that we have growing, and then it was just, to be honest, and absolutely, we always believed in the product and our vision. But what then happened was beyond everything we could have imagined, like literally projects reaching out to us 'cause they've seen the success. They've seen how these projects were able to scale, those DePINS were able to scale because they didn't need to build all the blockchain parts themselves anymore.

They basically had a decentralized deck and that we built all along and that we perfectly designed in a way that they've been able to just adapt it and focus on their business as a 5G hotspot network that once incentivized people setting up 5G hotspots and provide connectivity and learn from it. You don't want to hire a 10-persons blockchain team that does nothing else than trying to figure out how to bring their devices on chain, how to make them pay, how to have reward mechanisms, how to make sure the data is verified. With Peaq, you have all of that. And I guess this mix out of product market fit and focusing on the right projects at the right time, that was key to the current success.

Lex Sokolin:

One thing that's useful to open up is also just the tokenomics of a DePIN project. Prior to Peaq, what many projects like Helium or Worldcoin had to do was they had to build their own network. And the reason they built their own network was because they could use the tokens of their network to compensate people who were bringing the supply of hardware into the project. So, you're not dealing with a large centralized company or a telecom that can spend 10 million or 50 million or 100 million laying down infrastructure, but you're dealing with essentially crowdfunding on the supply side. You need to create some incentive for people to want to join and contribute their hardware in their machines. And so, these networks would use the tokenomics that were pioneered by Bitcoin in order to get that supply in, and that could take years.

It could take three years to bootstrap enough of supply to say, "Okay, now we've got Filecoin and you can upload your images here," or, "With Helium, access to some network where you could get connectivity," and so you're playing multiple games. You're taking a bet on the substance of your project. Will people adopt decentralized Wi-Fi or decentralized Uber? Will they actually do it as a behavior? And you are also taking the risk of standing up the network and creating a set of validators and whether that works or not. But with Peaq, you're essentially taking out the requirement to set up your own network and instead, you're putting all the risk into will this activity have user demand? So, you can bootstrap the blockchain part just focusing on the financials of the token using the Peaq infrastructure and then focus the rest of your energy on the demand side. Do you agree with that story? Do you see that switch in the DePIN space? How do you think about it?

Till Wendler:

Yeah, I think it's perfectly summarized what Helium... I'm a big IoT blockchain enthusiast, but I never invested in Helium or never got a Helium miner, even though I think that it's amazing what these guys have been doing in terms of pioneering the space, I've seen it the same way. I've seen that they are trying to do three at the same time being an L1 building, basically an L1, then at the same time being also a DePIN. So, trying to merge those DePIN and economic mechanisms that are needed to incentivize certain behavior, trying to match that with the L1 economics that are needed to have a functioning L1 and then also being a hardware manufacturer on top of that, so like three startups in one. But yeah, that doesn't mean that I'm not admiring what they did and how they did things. I think it's still a big achievement and a lot of lessons learned, but yeah, that's why I would agree with the story.

Lex Sokolin:

Any other examples you've got of projects that are using Peaq on the blockchain side but have been able to figure out demand and figure out how to go to customers? Any other use cases that come to mind for you?

Till Wendler:

Yeah, I would generally distinguish between three different type of DePINs. The first category, if I may call it a category, is resource DePINs where there's a resource being offered such as energy from the charging station, such as 5G connectivity from 5G devices or antennas. And then there is also data DePINs where data is being generated by machines, by devices that's then been monetized. And the third one is tokenized or AWRA DePINs through real-world assets DePINs where it's more about crowdfunding certain devices or machines. And what we've seen is that especially the data DePINs, they are very fast to scale on the supply side, so for example, noise data, as I mentioned.

But then there's also, for example, street data, MapMetrics is a project that also builds on top of Peaq where you can map the streets and street data, congestion data and so on NATIX does something similar. Then, yeah, those projects, those data, I would call them. There, it can go relatively fast to build up a big supply side, but now that the heavy lifting is also on the demand side so that there's really a lot of demand and enough demand to serve that supply side and make sure that this is lucrative for everyone to provide that data, so we see that as a big challenge. We don't see that as a problem, but we see it as a challenge to overcome and helping those projects to get the right demand.

Lex Sokolin:

What do you think is the role of Peaq in catalyzing the sector? Is there anything that you're thinking about or doing to help projects that are joining this ecosystem? Whether it's in interoperability or whether it's bringing customers in, how do you think about growing the pie?

Till Wendler:

Yeah. As of today, we are helping the projects on several levels. Of course, on a technical integration level, getting familiar with Peaq technology, even though we removed a lot of entrance barriers, a lot of smart contracts they may have in place can be deployed easily on Peaq, so there's not huge migration efforts needed as well on a technical level. But then we're trying to help them on a product level 'cause if their product gets better, if their product grows users, it automatically grows more users, more devices, more machine identities on the Peaq network, adding more value to the network and the more machines, the more composability also in the network because they can all communicate with each other.

So, all these 800,000 devices you refer to, no matter if that's a vehicle charging station or a noise sensor or an air quality sensor or a 5G hotspot, whatever, they're all able to identify each other, communicate and transact with each other. So, we're trying to help them on the product side, optimizing their product on the go-to-market strategy as well. But then as a next step, we are trying to improve helping them also on the financial side, so helping them with funding, giving them access to investors, also forming investor alliances, working with different funds, trying to transport that topic also into investable products. On several levels, it's a very holistic approach, but if they get better, Peaq gets better, everyone profits from it.

Lex Sokolin:

Super. So if our listeners want to learn more about Peaq or try to work with the network, where should they go?

Till Wendler:

For sure. Our website is a good place to go to, peaq.network. But yeah, we have a Twitter or an X, so just look out for Peaq, try to find us there. And yeah, if you want to build a product on top of Peaq, we have a lot of CTAs on the website as well where you can get engaged with the team. Click on Start Building. We can help you to get started.

Lex Sokolin:

Fantastic. Till, thank you for joining me today.

Till Wendler:

Yeah, it was a pleasure. And yeah, thank you very much, Lex.

Postscript

Sponsor the Fintech Blueprint and reach over 200,000 professionals.

👉 Reach out here.Read our Disclaimer here — this newsletter does not provide investment advice

For access to all our premium content and archives, consider supporting us with a subscription.

Share this post