AI: Cursor raises $105MM for AI Code generation, Goldman using AI to draft 95% of IPO prospectus in minutes

AI agents may eventually autonomously generate and deploy trading logic. This shift could alter market microstructure.

Hi Fintech Futurists —

Today we highlight the following:

AI: Anysphere raises $105MM as AI Code generation meets capital markets

LONG TAKE: Why Bench Accounting collapsed despite $40MM in recurring revenue

PODCAST: Curve’s Big Bet Reinventing Payments and Wallets, with CEO Shachar Bialick

CURATED UPDATES: Machine Models, AI Applications in Finance, Infrastructure & Middleware

To support this writing and access our full archive of newsletters, analyses, and guides to building in the Fintech & DeFi industries, see subscription options here.

The Fintech Meetup Startup Pitch Competition, presented in partnership with Commerce Ventures, offers early-stage Fintech startups the chance to win one of two $50,000 uncapped SAFE notes. Held at Fintech Meetup from March 10-13, 2025, at The Venetian in Las Vegas, this event provides an incredible platform for emerging innovators to showcase their solutions, gain industry exposure, and secure essential funding.

With only 12 pitch slots available, the competition is highly selective. Applying is quick and straightforward, taking just five minutes. Startups looking to elevate their visibility, gain traction, and attract investment are encouraged to act swiftly and seize this unique opportunity.

Deadline has been extended from Jan 17 to Jan 24. You have until this Friday to apply!

AI: Anysphere raises $105MM as AI Code generation meets capital markets

Software generation by AI software agents is the next, and perhaps final frontier on the way to the Singularity. In that vein, we note that Anysphere’s Cursor recently raised $105MM at a $2.5B valuation, led by Thrive Capital and Andreessen Horowitz, with Benchmark also participating.

Most impressive is that the company’s annual recurring revenue reportedly jumped from $4MM to $100MM in under a year. That’s an incredible rise in usefulness evidenced by companies willing to pay for AI-led software development.

These numbers coincide with broader trends in venture capital, where 35% of the $366B market now flows into AI deals, according to PitchBook. OpenAI sits at a $157B valuation, Databricks at $62B, and Anthropic is in talks for funding that could bring it to $60B, up from $16B last year.

Cursor integrates proprietary models with those from OpenAI and Anthropic. Recent developments in broad LLMs and reasoning models, like the open source DeepSeek-R1 competing with OpenAI’s most expensive model at 95% of the price, signals that infrastructure costs are trending down and applications will need to fill in the gap.

Cursor is an application and its main draw is code completion and refactoring — predicting entire code blocks, rewriting them for efficiency, and automatically detecting errors. Their latest version extends predictions up to about ten minutes of future code. An “agent mode” goes a step further by executing tasks end-to-end under programmer supervision, similar to Meta’s explorations.

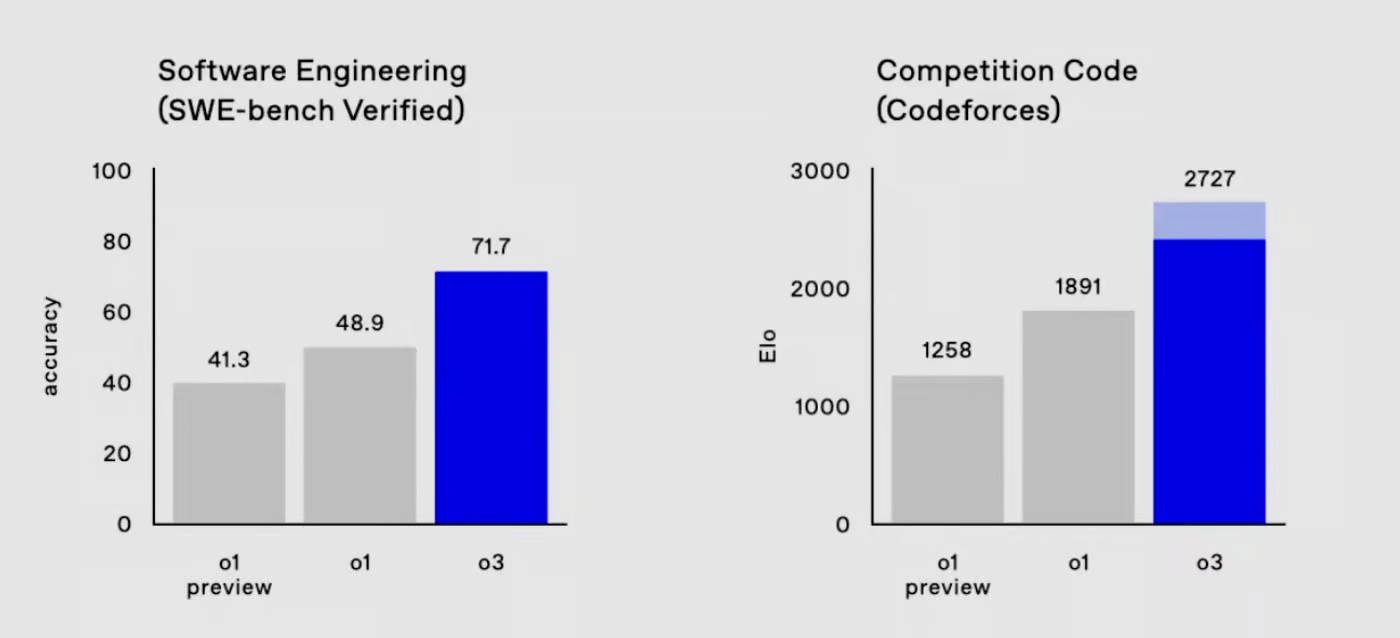

Anysphere’s acquisition of Supermaven also reflects increasing competition with GitHub Copilot, Codeium and Poolside. Meanwhile, OpenAI’s O3 model outperforms earlier iterations by 20% in programming tasks (outperforming the company’s chief scientist in competitive coding tests), and Google’s Gemini 2.0 Flash Thinking Experimental is evolving similarly.

These developments align with GitHub’s 2024 AI in software development survey, which noted that 97% of respondents across four countries have at least tried AI coding tools at work.

In the U.S., 90% reported improved code quality after adopting these solutions, and 60–71% found they ease the transition to new programming languages and the process of interpreting legacy codebases. More than 98% of organizations also use AI to generate test cases, at least on an experimental basis. Reflecting such uptake, Polaris Market Research forecasts the global AI coding market will hit $27B by 2032.

AI-driven coding is also seeing applications in trading and capital markets. Simon Taylor, the founder of Fintech Brainfood, outlines three phases of AI integration in finance here in this great writeup —

AI-Augmented Firms: Deploy generative AI for existing processes, such as automated research or data analysis.

AI-First Firms: Rely on proprietary AI models as their primary source of market insights, often using in-house data pipelines and machine-learning frameworks to detect complex trading signals.

AI-Only Firms: Operate with minimal human oversight, scanning markets continuously for patterns that human analysts may not catch.

Already, Goldman Sachs says it can draft up to 95% of an IPO prospectus in minutes, while companies like Finster and Auquan apply domain-specific language models to unify disparate data in PDFs, spreadsheets, and custom feeds. This approach scales well for workflows in capital markets.

In crypto, fewer intermediaries and openly accessible blockchain data create a unique space to apply AI code generation and agents.

For example, AIXBT processes social media sentiment and on-chain activity to advise token holders. Another example is ai16z, an AI-run, on-chain treasury collecting over $10MM in crypto from related assets. Its token has surged 1,660% since November, thanks partly to its “Eliza” framework, which combines LLMs with real-time transaction processing. This approach allows the treasury to optimize liquidity pools, assess market volatility, and act immediately on network fluctuations. Another example is Numerai, which has been experimenting with crowdsourced modeling since 2018.

While traditional finance incrementally adopts AI tools for specific, relatively simple tasks like IPO documentation, the more intriguing developments are happening at the intersection of automated code generation and capital allocation.

This means that, perhaps, the next major disruption in finance won't come from better algorithms, but from systems that can autonomously identify, code, and deploy novel trading strategies at machine speed. This is similar to the predictions we made about financial AI agents last May.

The current success of projects like ai16z suggests AI will eventually autonomously generate and deploy trading logic. This shift could alter market microstructure. We already know that the high degree of endogeneity in modern financial markets, where most orders are algorithmic responses to other orders, combined with the long-memory nature of order splitting, naturally leads to very irregular, “rough” volatility at the macroscopic scale.

The real test will come when these systems face their first major market downturn or black swan event.

👑Related Coverage👑

Blueprint Deep Dive

Analysis: Why Bench Accounting collapsed despite $40MM in recurring revenue (link here)

In this article, we discuss the collapse of Bench, a Canadian bookkeeping platform for small businesses, which went bankrupt despite raising $110MM+ in funding, including $50MM+ in debt.

The company's high cash burn of $1.5MM per month and inability to automate services contributed to its downfall, compounded by leadership conflicts and strategic missteps after the founder was replaced. We explore the lessons from Bench's failure — sustainable growth, focus on core value propositions, and disciplined financial management in fintech ventures.

🎙️ Podcast Conversation: Curve’s Big Bet Reinventing Payments and Wallets, with CEO Shachar Bialick (link here)

Lex interviews Shachar Bialick, the founder and CEO of Curve, a fintech mobile wallet.

Notable discussion points:

Bialick's background as a serial entrepreneur and his experience in the Israeli military shaped his ability to solve problems and work in high-stress environments, which are key traits for a successful founder.

The initial idea behind Curve was to create a "wallet to rule them all" - a single interface that could consolidate and manage multiple payment cards and accounts, providing more value and convenience to customers.

Building Curve involved navigating complex challenges, such as convincing payment networks like Mastercard and Visa to change their rules to allow Curve's back-to-back wallet technology. This required a resilient, innovative, and persistence approach.

Bialick emphasizes the importance of building a company culture that fosters curiosity, adaptability, and a belief that "everything is possible" rather than focusing on perceived limitations.

Lastly, Bialick discusses the evolution of the fintech landscape, including the challenges faced by neobanks in creating true financial marketplaces, and the ongoing issues with the implementation of open banking standards.

Curated Updates

Here are the rest of the updates hitting our radar.

Machine Models

⭐ Out of the (Black)Box: AI as Conditional Probability - Hui Chen, Antoine Didisheim, Luciano Somoza

⭐ Relaxed Recursive Transformers: Effective Parameter Sharing with Layer-wise LoRA - KAIST AI, Google DeepMind, Google Research

Byte Latent Transformer: Patches Scale Better Than Tokens - Meta, University of Washington, University of Chicago

Streamlining Prediction in Bayesian Deep Learning - Aalto University

Inference for Regression with Variables Generated by AI or Machine Learning - Laura Battaglia, Timothy Christensen, Stephen Hansen, Szymon Sacher

AI Applications in Finance

⭐ Combining Prediction Models and Multiagent Systems for Automated Financial Trading - Daniel Bañados, Marco JapkeEnrique Canessa, John Atkinson

⭐ Cut the Chit-Chat: A New Framework for the Application of Generative Language Models for Portfolio Construction - Francesco Fabozzi, Ionut Florescu

Risk forecasting using Long Short-Term Memory Mixture Density Networks - Nico Herrig

Hidformer: Transformer-Style Neural Network in Stock Price Forecasting - Warsaw University of Technology

Hard to Beat: Leveraging a Mixed-Frequency Cnn-Lstm Network and Intraday Images for Volatility Prediction - Thomas Heil

Deep Learning Meets Queue-Reactive: A Framework for Realistic Limit Order Book Simulation - Hamza Bodor, Laurent Carlier

Assets Forecasting with Feature Engineering and Transformation Methods for LightGBM - Konstantinos-Leonidas Bisdoulis

Infrastructure & Middleware

⭐ Biden Administration Adopts Rules to Guide A.I.’s Global Spread - The New York Times

Nvidia completes acquisition of AI infrastructure startup Run:ai - TechCrunch

Microsoft To Spend $80B On AI Infrastructure This Year - Silicon

🚀 Postscript

Sponsor the Fintech Blueprint and reach over 200,000 professionals.

👉 Reach out here.Check out our new AI products newsletter, Future Blueprint. (Don’t tell anyone)

Read our Disclaimer here — this newsletter does not provide investment advice

For access to all our premium content and archives, consider supporting us with a subscription. In addition to receiving our free newsletters, you will get access to all Long Takes with a deep, comprehensive analysis of Fintech, Web3, and AI topics, and our archive of in-depth write-ups covering the hottest fintech and DeFi companies.