Analysis: How to evaluate a Stablecoin deal, from Stripe to MoonPay

The Internet is a Universal Bank backed by the US dollar

Gm Fintech Architects —

Today we are diving into the following topics for premium subscribers:

Summary: Despite broader economic uncertainty and a pullback in risk assets, stablecoins have emerged as a core fintech infrastructure, driving acquisitions such as Stripe’s $1 billion purchase of Bridge and MoonPay’s $175 million acquisition of Helio. The market for stablecoin orchestration is competitive, with players focusing on transaction facilitation, fiat on/off ramps, and cross-border payments, especially in emerging markets. Success in this sector requires both scale — $5 billion+ in volume to be competitive — and eventual margin expansion, with monetization ranging from 10 to 100 basis points depending on geography. As stablecoin adoption continues, it is reshaping global financial services, effectively turning the internet into a universal bank backed by the U.S. dollar.

Topics: Visa, Mastercard, Stripe, Coinbase, MoonPay, Bridge, Helio, Mesh, Revolut, Metamask, Gnosis Pay, JP Morgan Onyx, Ripplenet, Canton Network, Deel, Rippling, Autonomous Research, BCG.

To support this writing and access our full archive of newsletters, analyses, and guides to building in the Fintech & DeFi industries, see subscription options below.

Long Take

Positioning

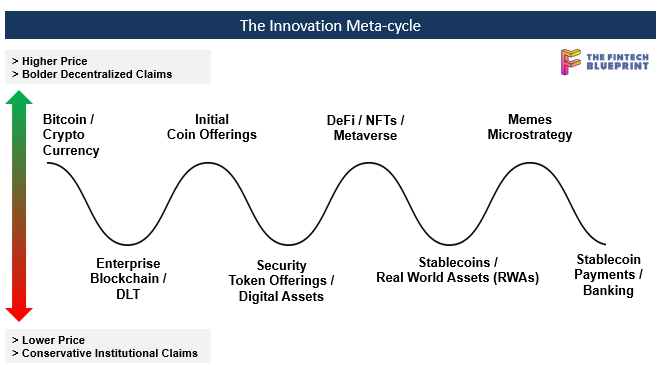

As we blow off across most risk assets and crater the economy, people become more conservative with their investments.

Instead of shifting into high-growth sectors, they flow into cash. The same psychological pressure is there for operators of companies and institutional asset managers. There is pressure to de-risk asset allocations, cut costs, and lower ambitions. The pendulum swings backward and forward.

We have, unfortunately, been here before.

The same pattern has different names. Today, after Kelsier and Saylor, much of the industry is looking for good news. Yes, deregulation across the OCC and SEC— and FDIC, CFPB, and all the XYZs — provides a catalyst. The GENIUS Act gives full permission to American banks and fintechs to rush into crypto. But those are not yet fundamentals, they are political feelings distributed by a tornado.

We can look at transactions, accounts, adoption curves and so on. But so much is hard to believe these days. How do we know that the numbers are not faked or robots?

We can look at the usage of AI, deployment of data centers, and investment dollars into frontier machine intelligence. And that is indeed encouraging, but it does not speak much about the relevance of financial services. Is there something here for innovation inside of banks? So far, most of the gains from AI have come for software development and the creative media industries, per data from Anthropic’s internal analysis below.

What do we want? A money chart that goes up and to the right, just as the market goes down. A money chart that will make us all rich just as everything else melts. A money chart that shows we were right all along.

Weren’t we? I’ll speak personally. After 15 years in fintech and crypto, I sure hope I was right all along. So here’s the chart.

Ah, there we are. I feel so much better.

Per month, according to this Visa-collated dashboard, we are seeing $700B of volume going through stablecoins. For comparison, Stripe recently announced $1.4 Trillion in total processed volume. Our crypto-primitives can do that in a bit less than two months. A deeper analysis can be seen here on the last fiscal year.

Even while our speculative bets on risk-on frontier fintech get cut in half, we can say that stablecoin transactions are the size of Visa and Mastercard annually. Stablecoin orchestration has arrived — a voodoo mix of payment gateways, payment processing, card networks and bank cores, merchant acquiring, FX on- and off-ramps, and the issuance of cards, coins, and various other alchemical money instruments.

Behold your market map, and tremble!