Analysis: Is Kelsier's $200MM insider trading scandal the next FTX?

The New SBF? How Two Brothers Rigged Solana’s Market

Gm Fintech Architects —

Summary: The crypto industry faces another black swan event as Hayden and Gideon Davis, founders of Kelsier, allegedly manipulated Solana-based token launches, siphoning $200M through insider trading and sniper bots. Using privileged access, they front-ran high-profile memecoin launches like $MELANIA and $LIBRA, profiting off unsuspecting traders while destabilizing the broader Solana ecosystem. This scandal implicates key platforms like Meteora and Jupiter, both integral to Solana’s liquidity infrastructure, raising concerns about deeper systemic fraud. The controversy echoes past collapses like Terra/Luna and FTX, highlighting persistent issues of unchecked speculation, financial engineering abuse, and the lack of effective regulation. As Solana’s price declines and trust erodes, the industry must confront whether it is doomed to endless cycles of grift or capable of evolving into a legitimate financial system.

Topics: Kelsier, Hayden Davis, Gideon Davis, $MELANIA, $LIBRA, Meteora, Jupiter, Solana, Raydium, Pump.fun, DeFi Tuna, Vitalik Buterin, Javier Milei, Terra/Luna, FTX, Three Arrows Capital.

This is a premium analysis open to everyone as the topic is of profound importance.

If you would like to support the newsletter, that is always appreciated and will give you access to all the linked content in the article.

Long Take

The New FTX / SBF is Here

The new crypto black swan event is here.

Buckle up, let’s look at it.

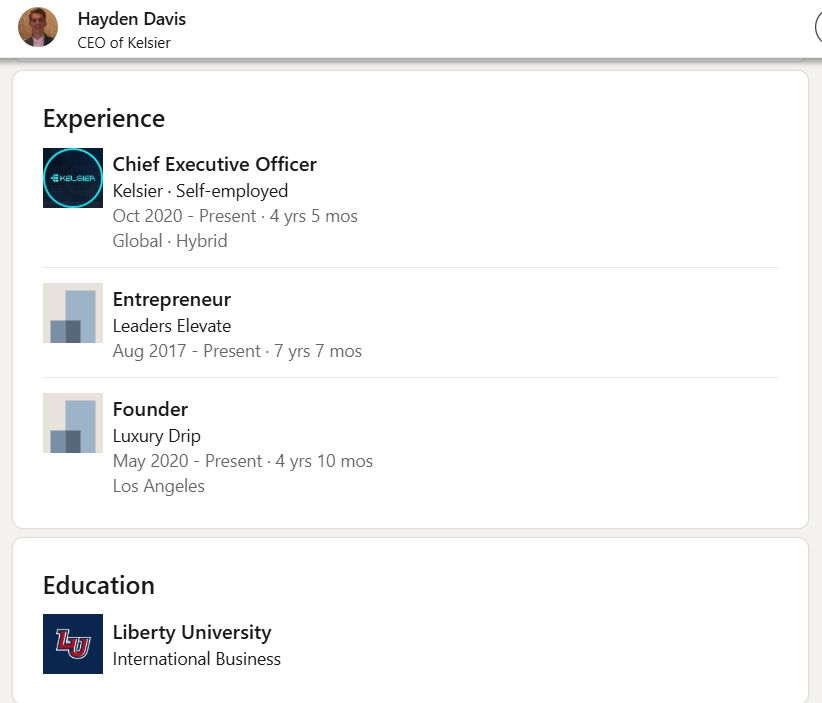

This guy’s name is Hayden Davis, and he is the CEO of Kelsier. This is his LinkedIn.

Pretty impressive background, with a degree from an online university in International Business.

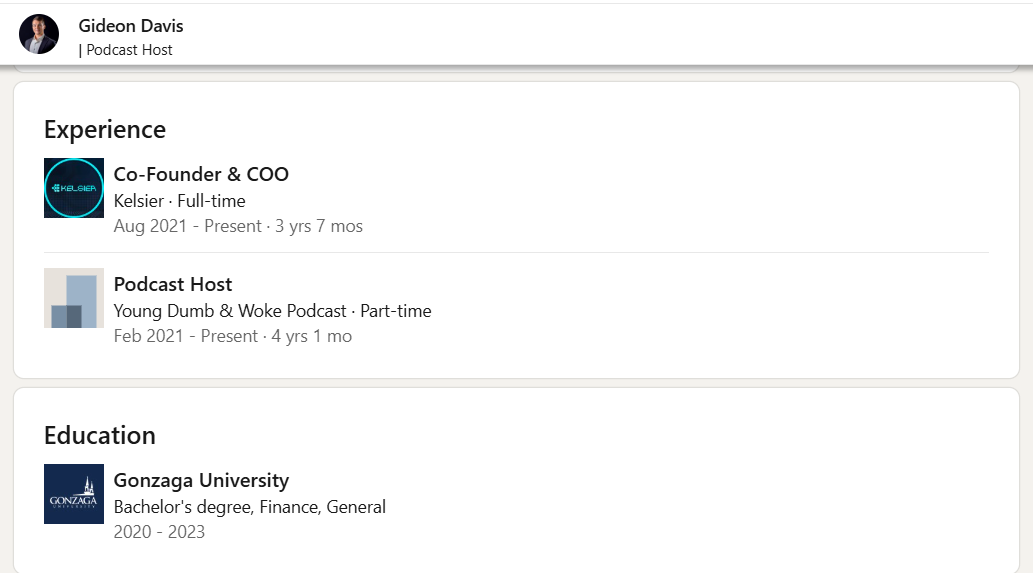

This is his brother, Gideon Davis. He is the host for the Young Dumb & Woke Podcast.

Gideon is also the co-founder of Kelsier, and this is his LinkedIn. Here is what the company website, which happens to still be up, says. Are you ready for synergy and expertise?

Incredible.

The brothers Davis had the dubious honor of stealing $200MM by market manipulation of Solana-based token launches. They ran the dumbest destructive playbook for likely dozens of projects, including for those at the presidential level — $MELANIA and $LIBRA.

Yes, these two guys, with their deep experience in the financial industry and blockchain production development — pardon the sarcasm — were able to get access to both the American and Argentinian Presidential teams and launch multi-billion dollar memecoins, only to steal the liquidity for themselves through sniping and market manipulation.

It wasn’t Vitalik Buterin that reached Trump or Javier Milei.

It was a young podcast bro who is about to get the President of Argentina to face impeachment proceedings.

Does any of that sound right to you?

If not, let us add a couple more exhibits before we start pulling things apart.

Here is the confession interview by Hayden where he admits to “sniping” the Melania coin and using insider information to profit.

He is sitting on $100MM of siphoned off assets, and freaking out while people are threatening his life. This interview is meant to shine a full light on all the industry activities. There is brazen market manipulation and awareness of the significance of this activity.

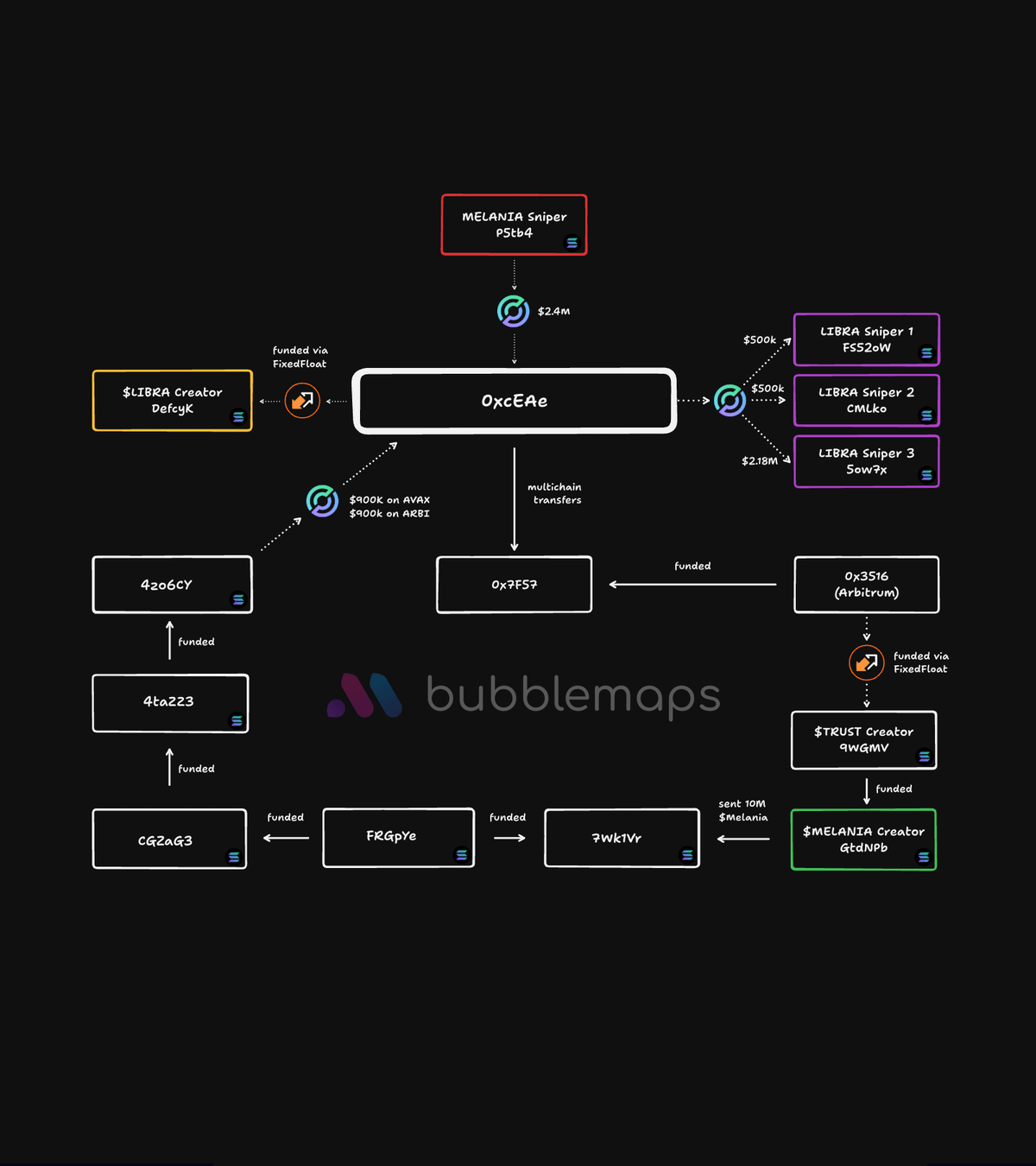

Hayden admits he coordinated a token launch, told people who were his "clients" that he will market make the launch smoothly, then got his own sniper bots ready, got a group of other people ready to benefit from the launch, and on $Melania and $Libra sniped enough of the token at launch to sell $200MM into the market rugging the price on both. He is implicating himself, the inner circle, and the launch platforms.

Of course those are just the big names. There are lots of smaller ones.

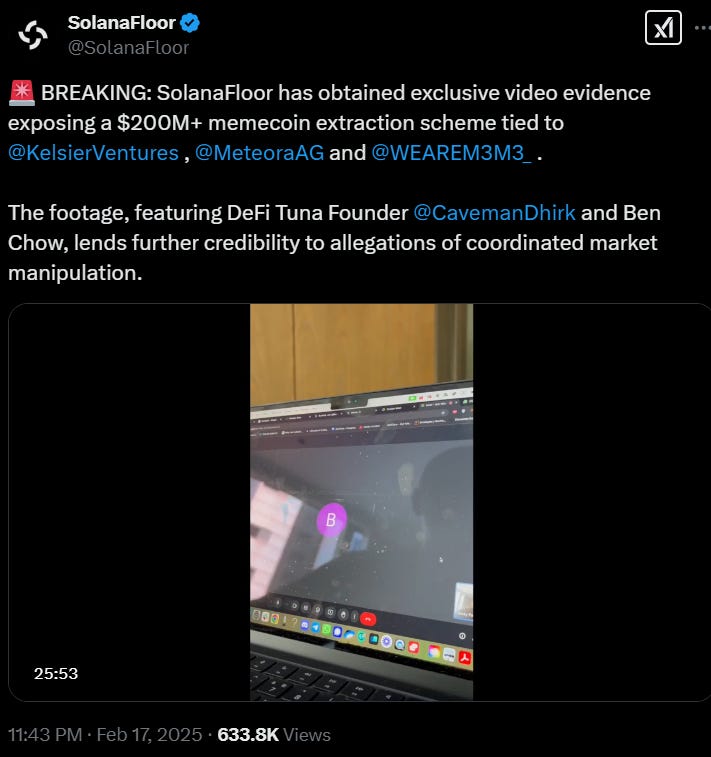

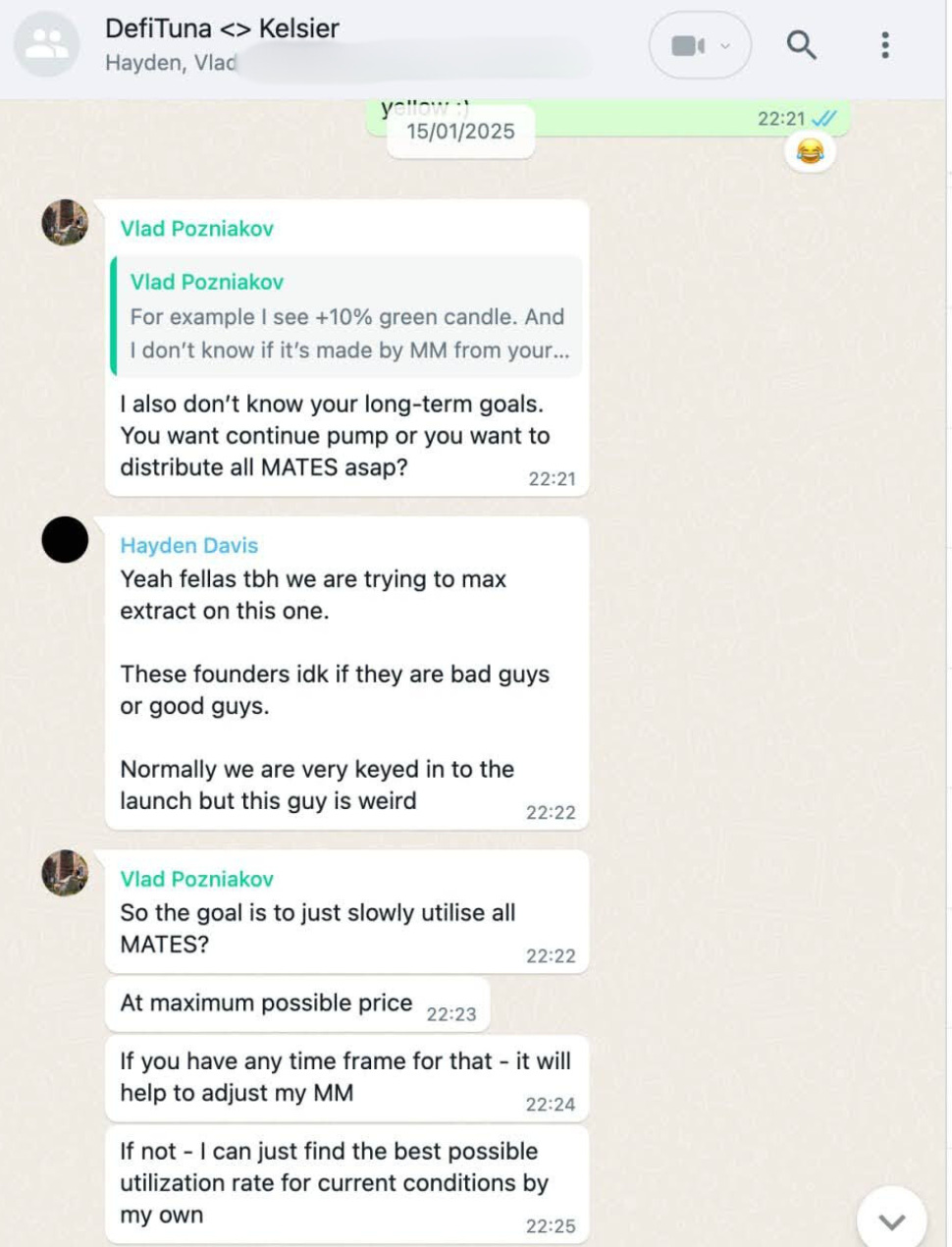

Here is another video following the breadcrumbs of those involved. A founder of market making platform DeFi Tuna, whose developer implemented the launches coordinated by Kelsier, records a conversation with the manager of Meteora, which is a token launch platform that creates liquidity provision pools that power trading.

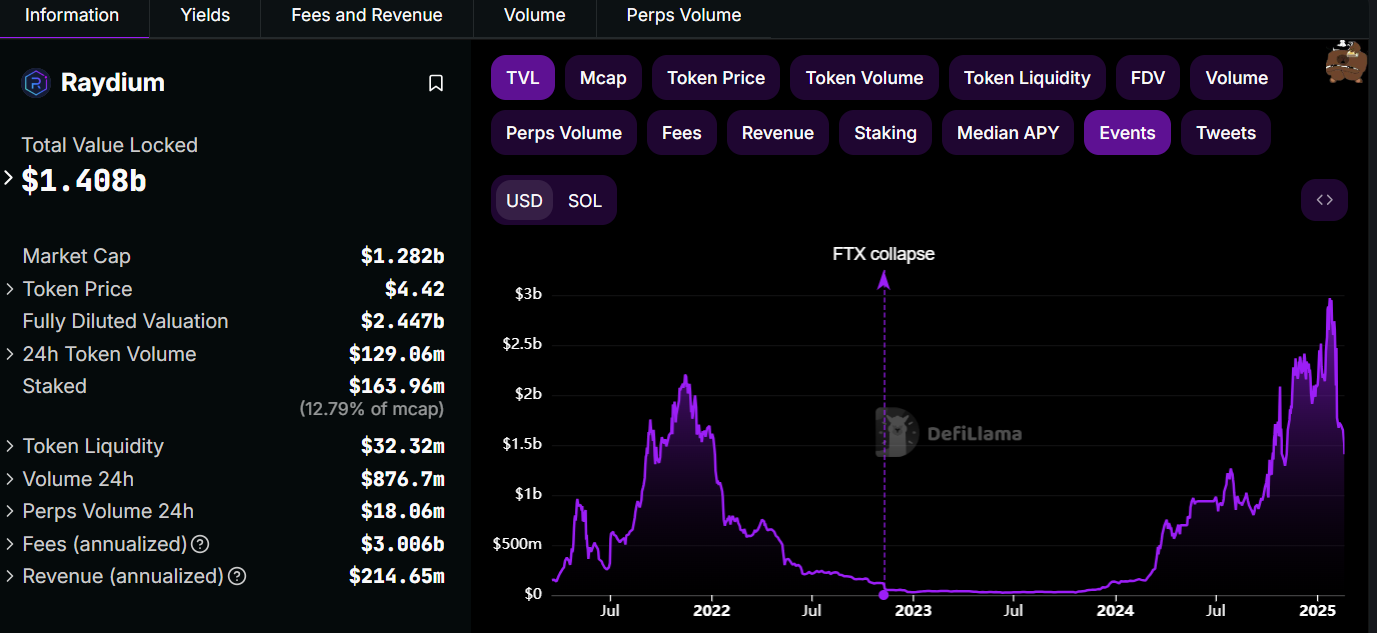

Meteora was founded by the team from Jupiter, a decentralized exchange with $2.4B in TVL according to DeFi Llama.

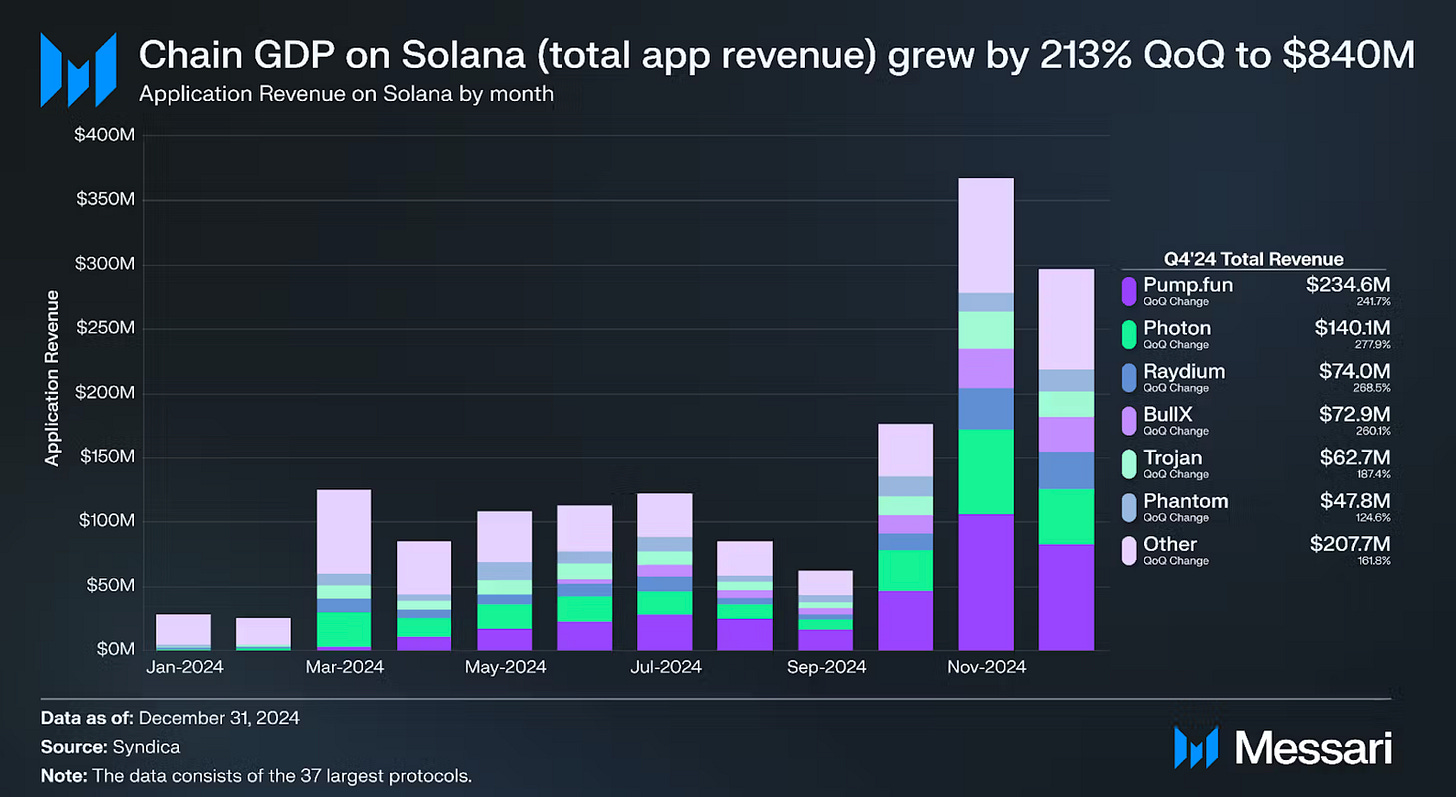

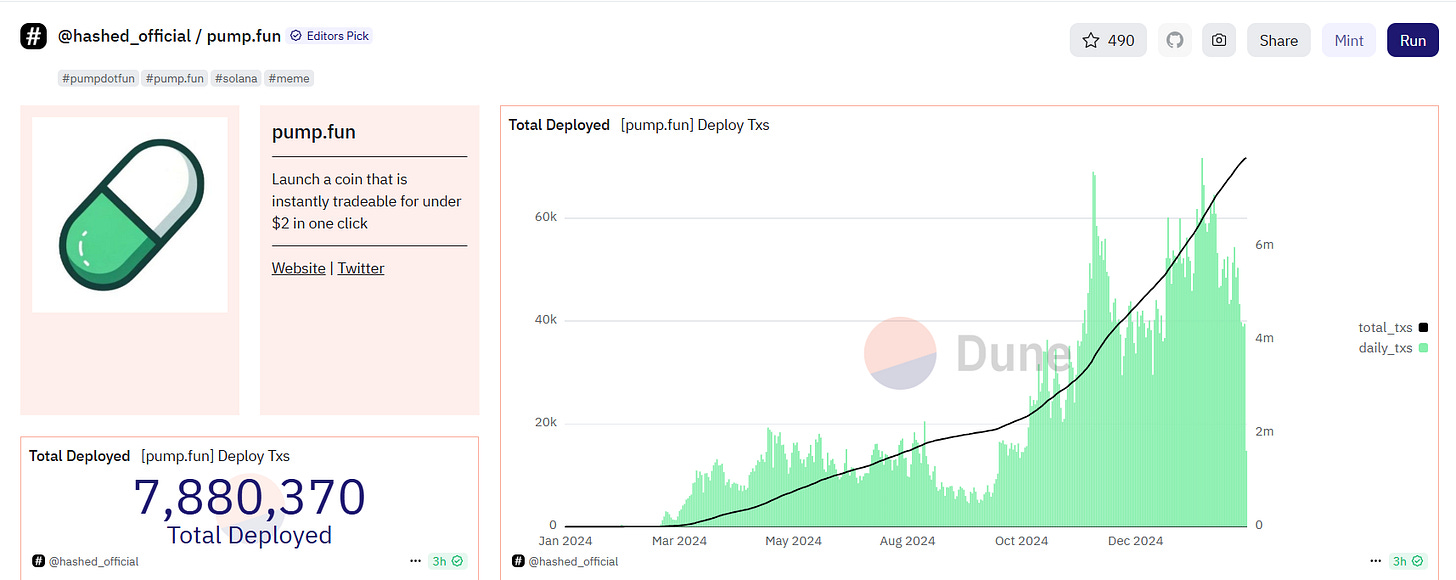

The purpose of Meteora was to compete with Pump.Fun, the retail memecoin launcher that has taken Solana by storm in 2024, and single-handedly revived the chain’s relevance. Solana’s massive trading volumes and various exchange fees are largely built on these meme token volumes.

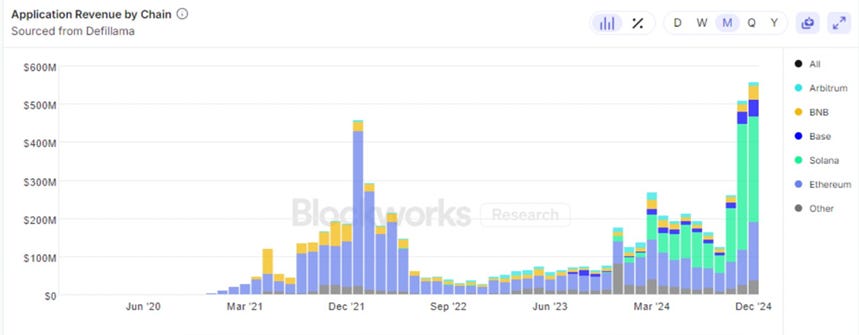

We remind everyone of these charts about onchain revenues, and Solana’s relative outperformance compared to Ethereum and Base recently shown below. The crypto ecosystem generated $500MM of revenue per month, and most of that from Solana.

Within Solana, we can see that Pump.fun accounted for nearly 30% of the entire chain, with $234MM in revenue last quarter. Welcome to your clown world.

It’s the memeplex Nasdanq and we all lose.

Mechanism Design for Memecoin Launches

Let’s spend the time to unpack some terms.

First, how do these token launches work?

You have to understand the core ideas underneath onchain markets. As with FTX before this, the fault doesn’t necessarily lie with the system, but the human behavior around the system. It is the custody of funds and the decision to manipulate markets that is at issue, not decentralized finance on its own.

Blockchains have little processing power and they have to sync all their nodes. So the compressed version of a giant exchange and settlement house has to be clever. At a high level, decentralized exchanges have (1) pools of capital provided by liquidity providers that are used as a trading slush-fund, (2) a formula that creates a relationship between a pair of assets, (3) bands of liquidity, meaning price ranges, to which the assets apply, and (4) an algorithm that automatically moves price.

There is no offer and bid as you would have it in an order book.

See more on this below.

So, we know that supplying liquidity is necessary to stand up trading in a token pair.

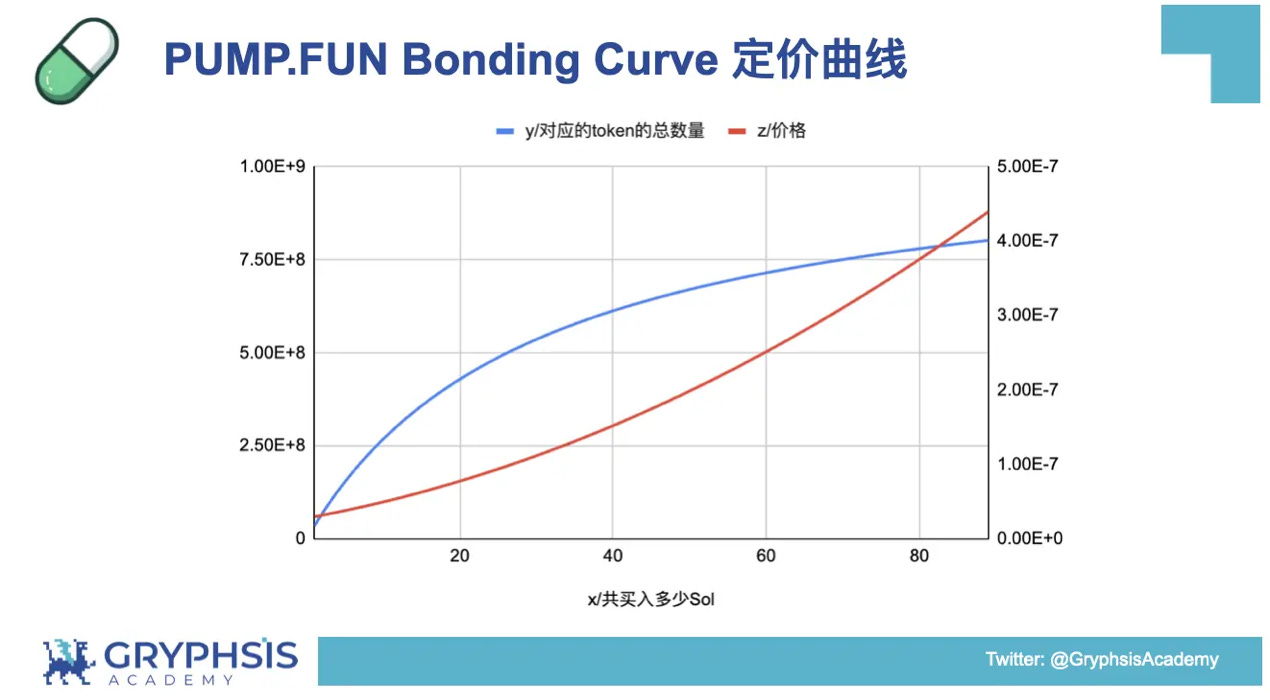

There is another mechanism called the bonding curve. This is what is behind projects like Friend.tech, BitClout, or any other large set of assets that need a programmatic way to change the token price depending on demand automatically. We discuss this here in detail. You can think of this as a reverse utility function, or as a measure of willingness to pay.

The thing about bonding curves is that you do not need prior liquidity from LP providers. The market cap of the token generates the value that can be sold off for marketable assets. This is “one sided liquidity”.

Pump.fun recombined these ideas on Solana in a way that created a huge speculative boom. First, it adopted a bonding curve, so that anyone can create tokens for no fees other than paying for the smart contract.

Once the token reached a marketcap price of $69,000, a liquidity pool was created on Raydium, an automated market maker and exchange. The total value in Raydium peaked around $3B and has already fallen $1.5B in the last month.

As a reminder, Solana has a habit of fraud associated with its DeFi protocols. In 2022, its main DeFi protocols rehypothecated their own assets to create a fake $4B of value.

At the time, this was one of the events that led to the sell-off in Solana and the negative reputation it accrued. How time flies.

Meteora was not associated with Raydium, but with Jupiter. It does not have the same mechanisms involving bonding curves, and therefore likely requires more “hands-on” involvement on market makers in creating liveness. Projects would pay market makers some portion of the token supply along with cash to act as the “bonding curve” up to a higher enterprise value, where the project was no longer as fragile in its reaction to supply and demand.

This is the part that Kelsier pocketed, instead of using to manage the market. As a side note, traditional investment bankers sometimes also contractually act as a buyer of last resort in IPOs they offer as a standard practice.

Where we are currently with the story is that the CEO of Meteora has resigned, while the CEO of Jupiter exchange is hiring a law firm to investigate. Who, how, and where was involved is unclear. Jupiter is the much bigger fish to fry, of course. And after that, Solana.

High Frequency Sniping

So high frequency trading firms, can’t live with them, can’t live without them.

Our equity markets are made by HFT firms, not by brokers yelling at each other on the stock exchange.

All of this above is now code.

And to be the fastest to execute trades, you end up arbitraging location and data centers and so on. These are now large quant shops. They arbitrage enormous trading venues for tiny differences and eat up most of the supply and demand in the market. This is their job and it is why Robinhood is free.

In crypto, you also have market makers and high frequency bots. But not all are created equal.

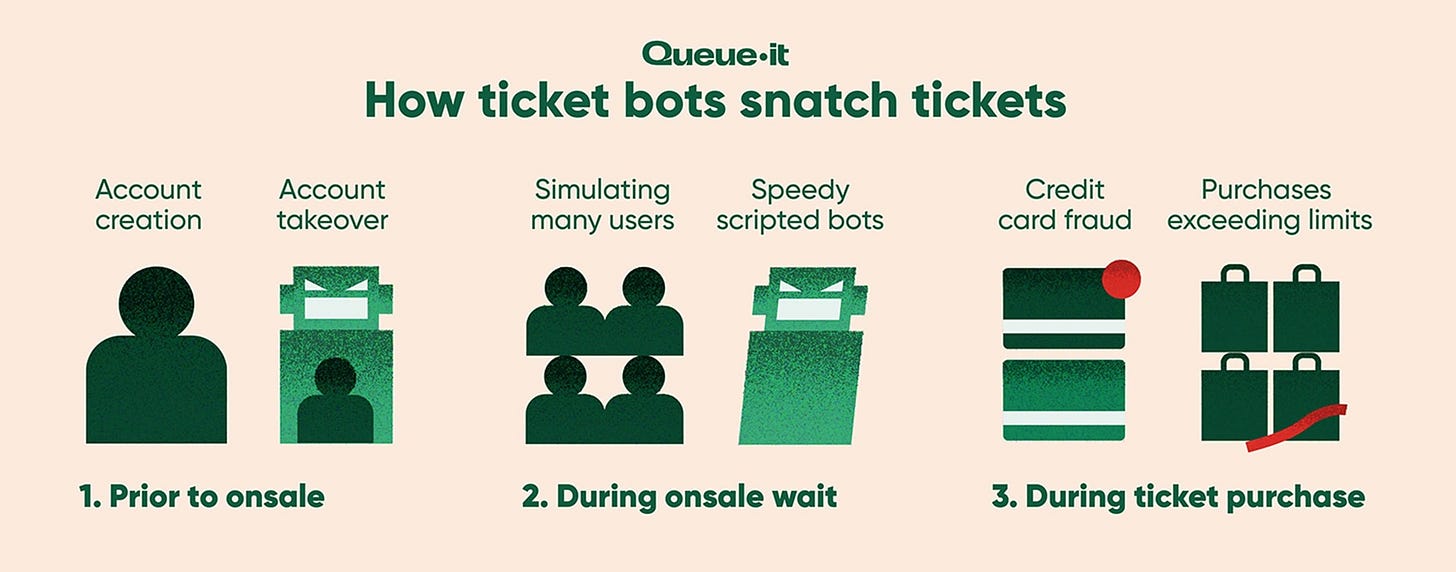

What is being alleged here is “sniping”, which is the equivalent of a ticket scalper for token launches.

If you ever tried to buy a ticket for a concert only to have it sell out in 15 seconds, you never had a chance. A bunch of robots bought up all the ticket and will re-sell them at a mark-up. No Taylor Swift for you!

Token snipers do this for new token launches, scanning blockchain code to find new tokens about to hit the market. If they like it, the bot will immediately buy things using the equivalent of APIs, and humans waiting to click on a button on a website will never have a chance.

In the case of $MELANIA and $LIBRA and the rest, Kelsier also had inside information about the token launches that nobody else knew. They controlled when the launches would happen and where. And they got their bots out just as the coin launched.

Here’s Hayden admitting and rationalizing the act — remember, he is sitting on $100MM of these funds.

"A lot of the discussion has turned to wallets that have been linked back to me—wallets that sniped the coins I launched. In the case of Libra, the wallet that refunded Dave, which he said was my personal funds, was linked to an Avalanche wallet that was used to snipe Libra.

But if I launched the coin, is it unfair for me to snipe it? I would say no, and I have a couple of reasons for that. Most of the time when we're sniping, it's not about insiders making money. It's about preventing other snipers from getting in.

Most of the time when we snipe, we're doing it to avoid getting overrun by expert snipers—guys who are throwing in millions right at launch and crushing the market. If we don’t take action, they get in first, dump their positions, and tank the project.

The money we use for sniping isn't personal profit; it’s project money. That’s how we do it every time. If there’s enough volume, we use the sniped funds to stabilize the project and make sure it has a chance to continue."

Hayden’s excuse for using insider information to grab the money is to get to it before others do. Sometimes he would use it to “manage liquidity”, and then sometimes he would just sell it onto unsuspecting market participants if the projects were not his close friends.

“Yeah fellas tbh we are trying to max extract on this one.” Pretty clear implication of their role in the industry.

Unlike these human market makers, bonding curves do not automatically take your assets before you can invest, and then sell them back to you at a higher price. This is human judgment and behavior. Maybe they taught it wrong in International Business at online university.

Broader Implications

I am sure more will come out here as various parties deepen their investigations of the situation.

It feels a lot like the first days of the Terra/Luna collapse, before FTX, Silvergate, and Three Arrows Capital unwound on their bad leverage, fake tokens, and the stealing of customer funds.

We are looking at industry mechanisms and questioning how they work and where they fail. We are hoping that this can be fixed with better math. We have not faced the 60% drawdowns in the major coins like BTC and ETH. But this may come.

In reality, it is probably the tip of the iceberg.

There have been 8 million tokens deployed to date. I wrote last week that they are like YouTube videos, not like big blockbuster movies. There are only more YouTube videos.

It is hard to imagine regulation coming to address this in the Trump era, with the President being at the heart of memecoin culture today, and financially incentivized to keep it going.

It is hard to imaging that this will slow down. Only more tokens will be launched.

But something must change in the market structure. This financial nihilism is poison — it restricts crypto from being a real financial infrastructure for the world. It turns away customers, founders, and investors as they lose faith and interest in the space. And it attracts low quality grift over and over again.

The questions are coming about Meteora. Did they incentivize or direct this behavior? Certainly the DeFi Tuna video suggests that they did.

And if so, how is Jupiter involved? Already, assets are leaving and Solana’s price is falling.

And if so, what was Solana’s role? It was founded in the shadow of FTX and was famous for its market-manipulation, hyper fake growth culture. Did it grow out of those roots into a clean ecosystem with real developers? Or are we just now going to uncover the same grift and opportunism as before?

And if so, what can Crypto do as a whole? Is the industry doomed to repeat speculation manias until there is nobody left in the world that hasn’t been rugged, phished, and hurt by the market participants? Is the opening up of financial infrastructure, is the democratization of financial engineering the great evil itself? Should only the ivory tower wizards of Goldman Sachs touch this forbidden art?

And if so, what of human nature? Why is it that when we choose between Vanguard and Schwab, people choose Schwab. And between Betterment and Robinhood, Robinhood and options trading win? And between Ethereum and Solana, the casino thrives and celebrates?

How much more is there to take? How not to despair from exhaustion.

If you made it down here, thanks as always for your time and attention.

We kept this free as it is important. To support the Blueprint, upgrade here.

Appendix

For your reading pleasure, the juiciest part of the Kelsier interview:

1. Admitting to Insider Knowledge and Industry-Wide Manipulation

“Every meme coin I've ever known or invested in or been a part of, like, the people that benefit the most are the people that structure the deal, similar to any other business in the world. People that are closest normally make the most money or lose the most money. So I don’t—I think that’s a bit of bullshit, and that’s just like crypto people that are angry that they’re like—there’s always an unfair—there’s an unfair advantage.”

“If you’re calling out that, you have to call out everything else.”

“I mean, every KOL, every single one globally, that’s how their main money gets made. They know about a deal, they agree to a deal, and then they make money on the deal.”

2. Admitting to Sniping His Own Project

"In the case of Libra, there's the—the wallet which Dave got refunded by, which is, according to him, your personal funds, was linked to an Avalanche wallet which was funded like a sniper of Libra."

"I wouldn't say linked to me. I would say linked to the project."

"We snipe our own projects to keep the market from getting crushed. If you let these other guys in, they’ll dump millions on you and wreck everything. So we snipe the launch, hold the tokens, and use them to manage liquidity. That’s just how it works."

"Retail never gets in at the beginning anyway. By the time they see it, it’s already 10-20x up. So what difference does it make?"

3. Admitting to Refunding an Insider After He Lost Money

“So couple things. One, that was probably a mistake, to be honest with you. At the moment, at whatever that was—I don’t know when that was—whatever it was, middle of the night, whatever, I’m going back and forth with him, I’m thinking, ‘Well, Malay is going to publicly support this. This is no big deal. I don’t want Dave to lose money.’ I’m not—not thinking from the perspective of, like, ‘Holy shit, uh, everybody’s going to get fucked on this.’ That’s not the perspective.”

4. Admitting to Being Involved in Other Sniped Launches

“Were you part of the Melania launch, and was that sniped as well?”

"I mean, look, I think that—I mean, I told you like beforehand, this before this started, I mean, I'm—I'm happy to share the truth, but, uh, I mean, you're—you're—you’re asking a question that’s um—it’s just—I mean, I'll answer, but it’s uh—just factually going to put me in into a lot of danger, um, which was fine. I'll answer. I was part of it."

"I think the—the team did want to snipe it because of how big the snipe was on Trump’s, um, and we weren’t the—we—we definitely weren’t the big sniper, um—we—we were not the—that was what we were trying to avoid. Um, and, uh, we didn’t make any—there was no money made from the Melania team on any—we didn’t take any liquidity out. Zero.”

5. Acknowledging Price Manipulation and Market Rigging

"People are saying this is a rug pull, like that’s not objectively true. There’s still like—there’s what, 60 million on the bonding curve of liquidity that’s locked, right? It’s at 300 million market cap. Like, it’s not a rug. It’s—it’s—it’s—it’s a plan gone miserably wrong with a hundred million dollars sitting in an account that I’m the custodian of."

"If we injected all that back into a chart, it would get up to about two and a half, three billion, right? Which is about where the all-time high was, and at least gives it a chance. And I’m—I’m completely clean of that, right? Then, like, you guys can say whatever you want—the money is back in the chart, and then people can say like, you know, ‘Oh, well, he bought the token before, blah blah blah.’ There’s no world in which I’m buying this token. I want to get the fuck away from it. This has been a colossal nightmare for me.”

6. Acknowledging Insider Deals on the Trump Token

"People were able to buy in at 500 million, yeah. Yeah, yeah, yeah, yeah. Like—like, people sniped that coin too?"

"No, no, no, no, no, no. Like, at the—when—before it launched at some private dinner, uh, that—they gave people special access to buying it at."

"Yeah, yeah, yeah, yeah."

"This is all a game. Every launch is structured to benefit insiders first. If you’re a retail trader thinking you’re going to make millions off meme coins, you better study your ass off—because the game is rigged."

7. Admitting That He’s Holding the $100 Million for Leverage

"The fact that I have control over this money is making me a target—but it’s also protecting me. This isn’t just some random scam. This is an international incident involving a sitting president."

"If I custody the funds with a third party, I lose my leverage. And right now, that’s the only thing keeping me safe."

🚀 Postscript

Sponsor the Fintech Blueprint and reach over 200,000 professionals.

👉 Reach out here.Check out our AI newsletter, the Future Blueprint, 👉 here.

Read our Disclaimer here — this newsletter does not provide investment advice

Great piece Lex. I caught a few of your sessions here in HK at Consensus too, and the sentiment on focusing on builders doing hard things really resonated. Keep up the awesome work!