Analysis: How Trump's memecoin made and lost $40B for the new Crypto King

How TRUMP and MELANIA Coins Redefined Memecoin Economics

Gm Fintech Architects —

Today we are diving into the following topics:

Summary: We discuss the implications of Trump’s return to power and his administration’s alignment with tech leaders, including Musk, Zuckerberg, and Bezos. The launch of two memecoins, TRUMP and MELANIA, amassed $10 billion in market cap and $40 billion in fully diluted value, with TRUMP reaching an $80 billion FDV at its peak. This event highlighted the intersection of political power and crypto, demonstrating how memecoins, despite their nihilistic economics, can drive significant market attention and activity, with Solana emerging as the blockchain of choice. The mechanics behind the memecoins involved strategic liquidity provision and market-making, which led to speculative trading and large financial losses for many participants. We analyze the financial and long term outlook in detail.

Topics: MELANIA, TRUMP, Elon Musk, Mark Zuckerberg, Jeff Bezos, Solana, Moonshot, Phantom, Sequoia, Paradigm, Robinhood, Coinbase, Silk Road, Ross Ulbricht, Raydium, Orca, Meteora, Ethereum, BlackRock, World Liberty Financial, Bitcoin, DOGE, Bonk.

To support this writing and access our full archive of newsletters, analyses, and guides to building in the Fintech & DeFi industries, see subscription options below.

Long Take

Mark to Market

One of the things that sets people apart is how fast they can process information.

And the most important thing is to process information that is uncomfortable and contrary to the beliefs you hold. Call it “updating your priors”, “Bayesian Reasoning”, or in Wall Street terms, “marking to market”.

Here is where we stand.

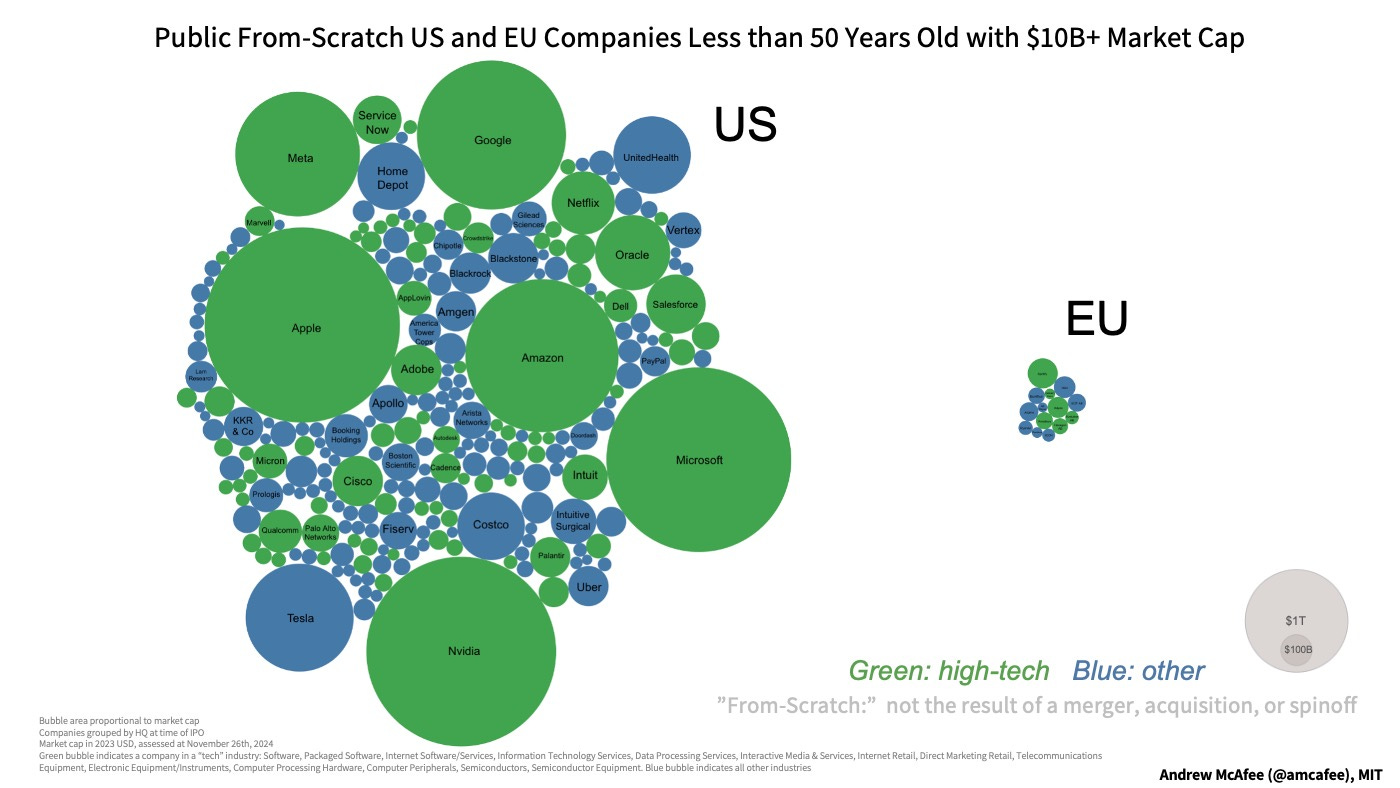

Trump is again the President of the United States. He is allied with the Silicon Valley class, giving Musk, Zuckerberg, and Bezos a seat at the table previously unavailable. The tech royalty comes into power during a moment when AI and Fintech and Crypto are accelerating and becoming the main competitive geopolitical sword, in addition to the production of energy and the conquest of space. Their goal — and well motivated in our view — is to disassemble the belligerent regulatory apparatus that, in part, has cost the Democrats the election.

As a result, China will step up its game even more, while Europe and the UK face the irrelevance accorded to Luddites unless the Markets in Crypto-Assets Regulation (MiCA) and The European Union's (EU) Artificial Intelligence (AI) Act are reversed. Revolut and Klarna are going public in New York, not London, and wealth is running away from Europe to settle in the more permissive Middle East.

The population replacement rate is plummeting and gender relations are worsening. There is no backup for any Social Security or Medicare spending because there are fewer young people and the old are living longer. Therefore young generations are revolting by gambling away on options and crypto. Interest rates are rising despite the best efforts of central banks to lower them, and national debt payments are ballooning to painful levels. Policy makers have few levers to pull to reverse this, but the US at least has reserve currency status for a few more decades.

Betterment lost to Robinhood. Robinhood lost to Coinbase. Coinbase lost to Solana. The degen cycle will only increase as humans are reformatted into vassals of the super-financialized AI organism into which we are all assimilating. The Singularity is coming, and we are lost in the fog.

Now that we know the market, let’s identify the catalyst.

Before the inauguration, the Trump team — which is being rumored to be Barron and company — launched two memecoins called TRUMP and MELANIA.

We’ll discuss the mechanics in more detail below.

Suffice to say, this has generated about $10B of marketcap and $40B of fully diluted value. Note that FDV is the current token price times all the tokens issued, which excludes those that are locked or unvested. At one point, TRUMP alone was trading at $80B of FDV.

This makes sense from a cynical perspective. As the administration comes to power, the Trump family wants to position itself to benefit from the loosening of the regulatory apparatus and the inevitable capital gains that will flow into the space. With their position secured, it makes it easier — from a transactional point of view — for them to care about supporting the tech industry.

From a more positive perspective, this is a break-through crypto event, assembling more capital in the course of 2 days than any investment bank can hope to gather over months of work. If the US President can do this, anyone can do this, which supports a strongly pro-crypto government and “entrepreneurial” climate in the US. The pardoning of Silk Road founder Ross Ulbricht confirms this. And the fact that Web3 infrastructure could withstand, to some extent, the enormous demand an $80B new asset placed on market structure demonstrates that DeFi is ready for “prime time”.

We vacillate between these positions.

Memecoins and financial nihilism are not productive, in an economic sense, and generally represent the worst parts of the industry. Most people have lost money on memes, and they signal highly manipulated, unfair markets. In terms of industry reaction, the idealists, open-source artists, and collectivist technologists are frustrated with TRUMP, and I’ve heard enough private feedback to know that many are upset about the credibility issues in what looks like a money grab.

But the more practical libertarians and anarchist speculators are ecstatic — it is their turn to drive the casino.

The Mechanics

On January 18th, Donald posted the tweet above. It reached over 100 million views, and any compliance officer will tell you, qualifies as a financial promotion.

The TRUMP token launched on Solana, in the tradition of the other 2.4 million memecoins on Pump-dot-Fun. There have already been a lot of tokens related to Trump on Solana, and none of them were deemed “official”. This is because it is permissionless to launch a token — a new one comes out every day.

So how could you tell if this was real or not?

The first hint is the Bubblemap above, which shows you that the tokenomics described on Trump’s website matches the actual setup of the underlying wallets. By looking onchain, you can see which wallets hold how much of the supply.

The second way to validate these things is to look at Dexscreener, the primary destination for memecoin trading, and notice the liquidity provision related to the coin.

If you are not familiar with this website, look at the box to which we point the arrows.

Liquidity amounts to $20MM at the time of writing, but was much higher at launch. This capital was committed in order to “make the market”, which implies that a sophisticated financial participant is putting money on the line to enable trading. In traditional finance, compare this to an investment banker that agrees to underwrite an IPO.

However, market makers in crypto walk in a grey zone. They washtrade the token back and forth to create the impression that a lot of people are interested in an asset. This leads others to invest their money and watch the overall value go up. Individual contributions are hidden in the activities of the market maker’s much larger trades, which in the end are net zero as the position eventually is unwound. This is why memecoins are a zero-sum, nihilistic game. They go up, and then they go down.

Above you can see the most critical take. This is exactly what most of Solana is about, and has been the playbook since the FTX days to “growth hack” financial assets. We have written about this for years — the Trump team just used the platform for its intended purpose.

And as Trump’s coin reached $80B, we know that his team retained 80% of the entire supply. This means he made $60B+ on paper during this run-up.

You cannot exit such a position reasonably, since we only have $20MM in liquidity here. But you can use the position to borrow other capital. Unfortunately, this is also when the rookie mistake happened — MELANIA’s token was launched on January 19th, cutting TRUMP in half and costing the Donald about $40B. MELANIA ran up only to about $15B FDV before collapsing down to $4B.

People understood the game as the completely opportunistic nature of the launches became apparent. This was something to trade in and out.

It was to show everyone who is the biggest meme in the world.

Fintech Chops

Let’s talk about infrastructure.

The primary launch partner for TRUMP was the Moonshot app, pictured above. It processed $400MM in volume, brought in over 200,000 users to Solana in 12 hours, and earned a few million in revenue.

How about the rest of the industry? Did they take a principled view to protect consumers?