Analysis: Hyperliquid prints $550MM revenue and $40B valuation with no VCs

With $300B in monthly volume, this small team may have created the next Binance onchain.

Gm Fintech Architects —

Today we are diving into the following topics:

Summary: We discuss the meteoric rise of Hyperliquid, a decentralized perpetuals exchange that has reached a $40B valuation within two years and generates $550M in annualized revenue. Built on its own high-speed Layer 1 chain (HyperCore), the exchange dominates decentralized derivatives with over 60% market share, processing $300B in volume per month and offering leveraged trading across 100+ assets. Its HYPE token is reinforced by strong tokenomics, including daily buybacks and a 31% user airdrop, without any VC funding or private sales. Compared to Uniswap and public fintechs like Coinbase and Robinhood, Hyperliquid trades at a lofty 72x revenue multiple, supported by rapid user growth and product-market fit. With public companies like Eyenovia and Lion Group now allocating treasury funds into HYPE, Hyperliquid may be the first decentralized exchange to fully bridge DeFi and public capital markets—unless it crashes under the weight of its ambition.

Topics: Hyperliquid, Uniswap, GMX, Coinbase, Robinhood, Binance, FTX, BitMEX, CME, Intercontinental Exchange, Eyenovia, Lion Group, Solana, Sei, Arbitrum.

To support this writing and access our full archive of newsletters, analyses, and guides to building in the Fintech & DeFi industries, see subscription options below.

Long Take

The Decentralized Exchange Decacorn

There’s a $40B exchange that has reached its market cap in less than 12 months.

While most non-Bitcoin non-meme crypto is bleeding out, Hyperliquid has managed to build an enormous business with real revenues, while floating a uniquely productive token. The company has cash flow, token buybacks, and currently a strong reputation in the industry. This is a good example of a team that shipped a product to a core group of users that wanted it, then rewarded them $45,000 for loyalty, and built a financial moat as a result.

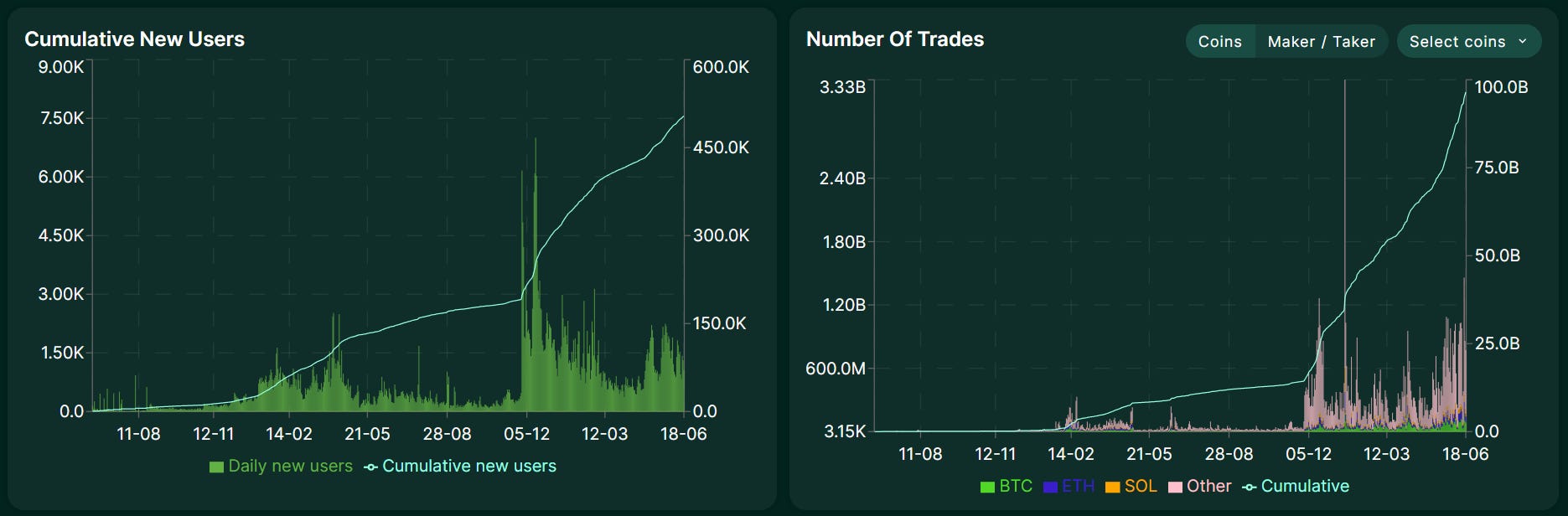

As students of Fintech and DeFi, we have multiple profound questions about the meteoric rise of this exchange. How can a small team of a dozen or so quant trading engineers so thoroughly dominate a market, especially when the market already *looks* so saturated? At no point in Fintech history, that I can think of, has someone been able to speed-run $40B of value in 2 years. Notice that the token has $500MM of daily volume and $12B of float, which means that this is not a shallow market manipulation scheme with a high FDV and low float, but something far more organic.

But before we get into financials, let’s talk about the product.

Hyperliquid Labs was founded in 2023, soon after the FTX collapse. Sam Bankman-Fried, the FTX Founder, went from being perceived as a market-making genius to a white collar criminal and fraudster, leaving behind a black-hole of market demand for crypto perpetual trading.

At the time, FTX was the king of the perpetual asset class — an invention unique to crypto markets that resembles other derivatives, like options (the lifeblood of Robinhood) or contracts for difference (the lifeblood of eToro).

Of course, FTX wasn’t the first to do perpetuals. In fact, they followed BitMEX founded by its CEO Arthur Hayes, who invented the instrument and eventually was captured by US authorities, who fined him $10MM and gave him a two-year probation sentence for various AML breaches. BitMEX itself was fined $100MM for these violations at a time when the United States prioritized enforcement.

Perpetuals allow you to bet on the direction of a financial asset’s price using only a bit of margin, while giving you access of up to 100x leverage. This business model is far more profitable than taking commissions on trading spot, because people are wrong more often than not, and as a result, lose their margin deposit. Similarly, when one buys an option and it expires out of the money, the cost is higher than if you have merely paid a transaction fee.

Dealing in this dopamine-inducing high-risk asset class is the difference between selling coffee and cocaine.

Here below is Robinhood’s revenue over time.

The high octane stuff — options and crypto — is a way more profitable thing to do than selling equities.

Anyway, back to Hyperliquid.

Rather than building on an existing blockchain, founder Jeff Yan undertook the alternate path of trying to create a bespoke Layer-1 blockchain optimized for trading. While there were many existing spot and perpetual products already in the market, they were clunky and limited by the processing capacity of Ethereum. Uniswap, the runaway success using automated market maker logic, did not have an order book because you could not fit so much logic into smart contracts. Perpetuals platforms were siloed off on layer 2 networks and required deep crypto-native expertise for access, which limited their liquidity.

However, the market was signaling that live order books were the next step for decentralized finance.

Solana had seen the rise of several projects trying to build CLOB (central limit order book) on their faster chain, and projects like Sei had positioned on this idea specifically. Hyperliquid did more than position. They decided to build the thing out, while also targeting the most profitable part of the crypto trading market, with the least onboarding consumer friction possible.

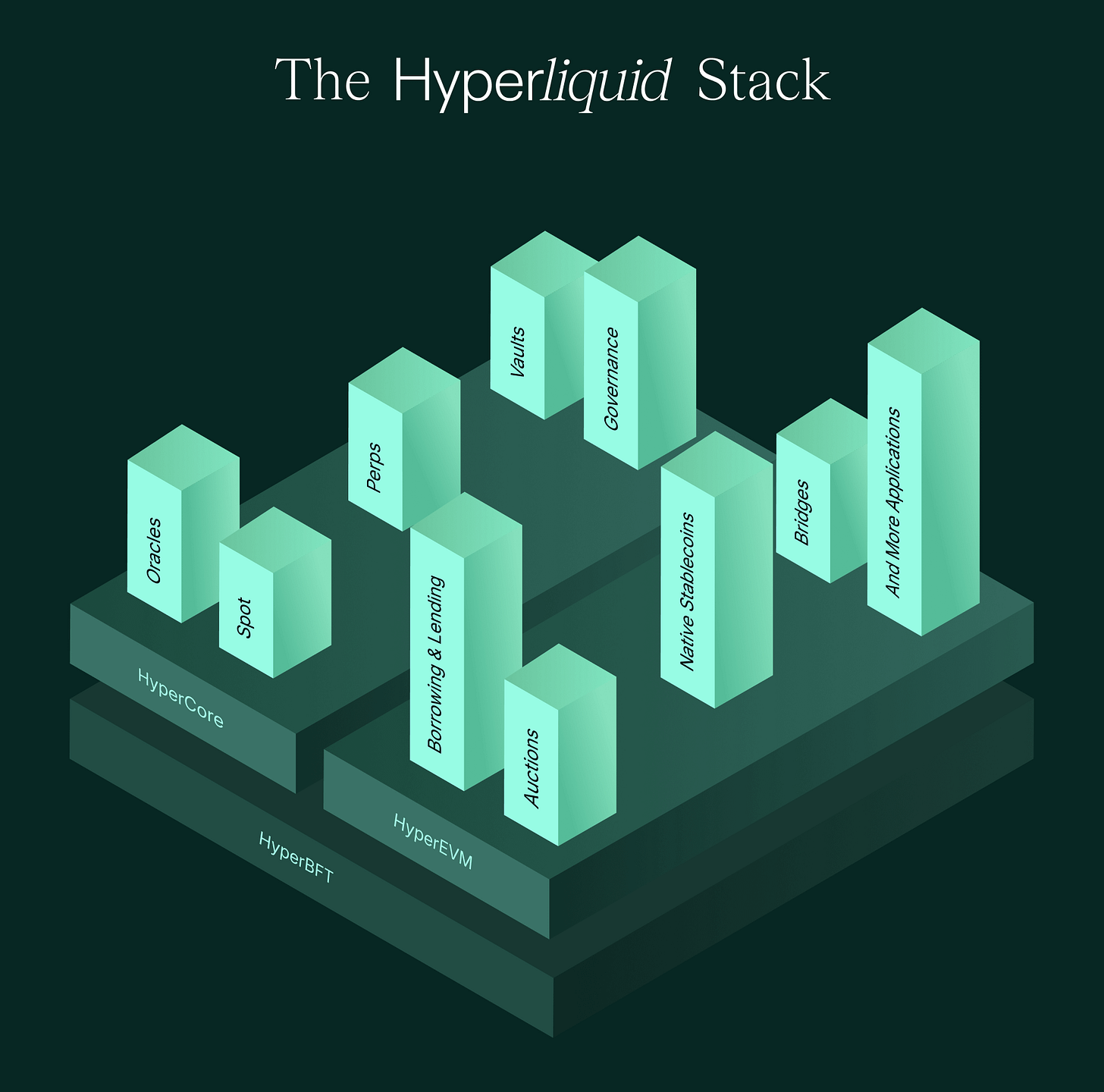

The backbone of Hyperliquid is its proprietary Layer-1 network built from scratch for high-performance finance. The chain uses a consensus mechanism called HyperBFT, a variant of Byzantine Fault Tolerance optimized for speed. Blocks are confirmed in under one second, and the network can theoretically handle up to 200,000+ transactions per second. The trade-off is that Hyperliquid’s validator set is relatively small, with only 16 validators at launch, and the chain is more centralized than other large L1s. All trade matching, clearing, and settlement occur within Hyperliquid’s chain called HyperCore, ensuring transparency since every order and fill is onchain.

To clarify, when we say DeFi, we mean that the software is not built on traditional financial rails (e.g., portfolio management systems and stock exchanges) but blockchains, and that users are leveraging self-custody to hold assets and automated logic to perform transactions. Hyperliquid lacks Ethereum’s decentralization, and takes only an incremental step away from running an internal database — but it is a step nevertheless.

By mid-2023, Hyperliquid launched its flagship product: a decentralized perpetual futures exchange running on the new chain. The platform’s early version was live by mid-2023, with the first perpetual markets launching around September 2023. An innovative Vault system (called HLP or Hyper Liquidity Pool), inspired in part by the success of the perpetuals exchange GMX on Arbitrum, was introduced alongside the exchange to bootstrap liquidity.

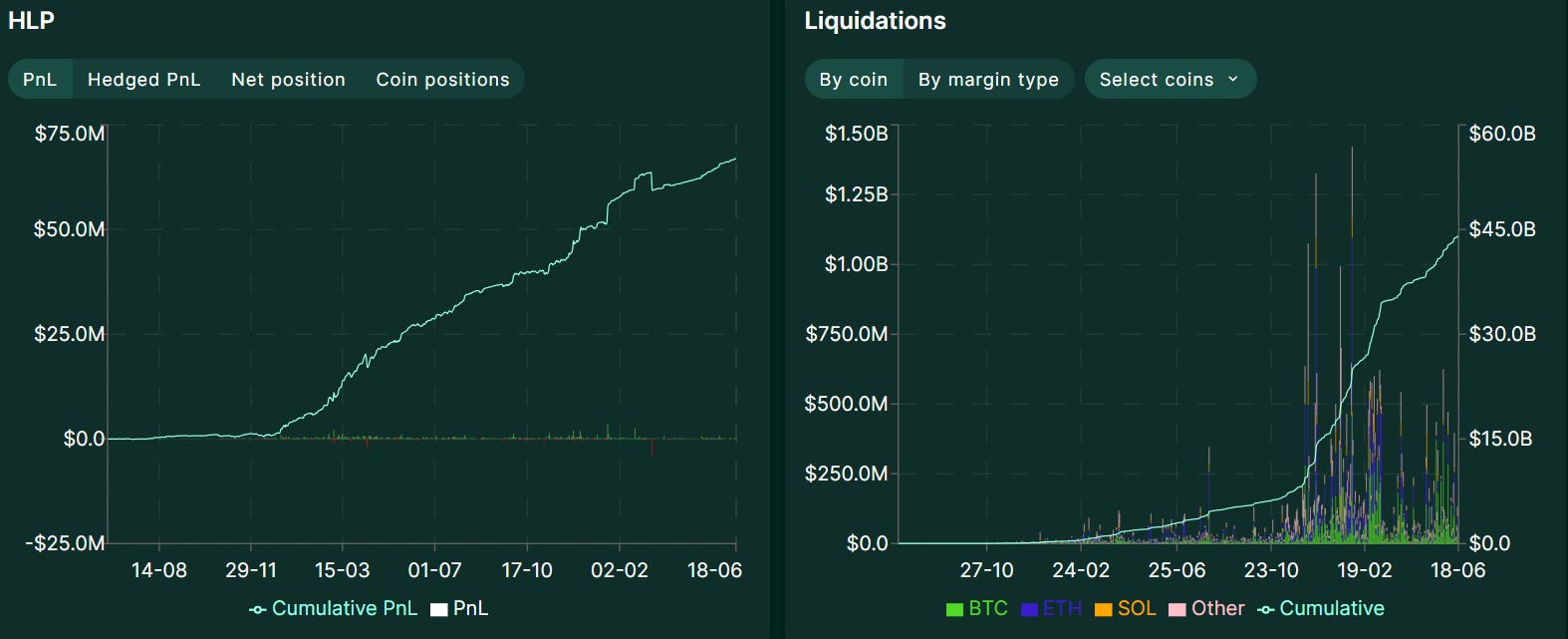

HLP acts as the counterparty for a share of trades on the platform. Users can deposit funds into HLP, which then provides liquidity — taking the opposite side of traders’ positions or filling in when there’s order book imbalance. In return, HLP earns a portion of all platform fees and the PnL from traders’ losses. The fact that HLP is profitable means that, on average, traders are losing money.

The exchange now supports perp markets on 100+ assets, including major cryptocurrencies (BTC, ETH, SOL, etc.) and trending altcoins. In late 2024, Hyperliquid expanded into spot trading on its chain, using an order book and the same interface as the perp exchange. Spot listing works differently — listing participants have to bid with USDC for the right to create a new token ticker on Hyperliquid., and the cost to win a token auction can exceed $100,000, comparable to listing fees on mid-tier centralized exchanges.

Hundreds of thousands of traders use Hyperliquid, and they have made over 100 billion trades since inception.

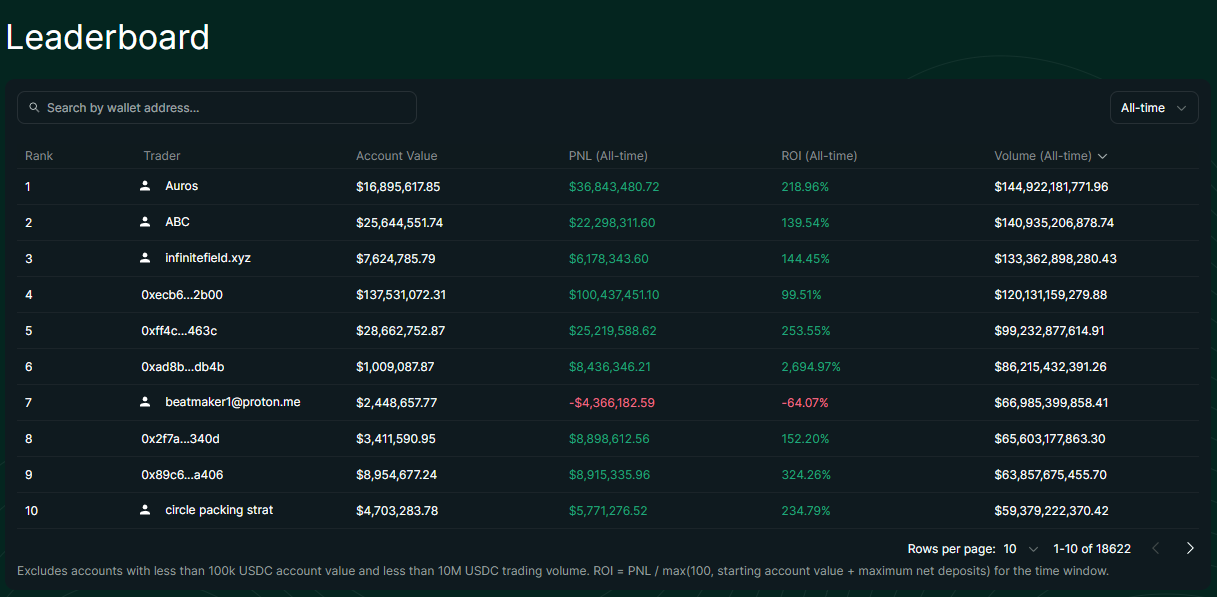

For some users, that means they have made over $100MM in profit, while pushing an enormous amount of quantitatively-driven volume.

For others, the losses can be just as large.