Analysis: Will Fintech Deregulation make up for a $1.5T Hit to the Economy?

Is the current market chaos is a necessary short-term reset or a reckless dismantling of stability that will set the U.S. back

Gm Fintech Architects —

Today we are diving into the following topics:

Summary: We ask whether the current market chaos is a necessary short-term reset (creative destruction) or a reckless dismantling of stability that will set the U.S. back (unsustainable contraction). The U.S. economy faces a projected $1.5T contraction due to tariffs and government downsizing, triggering a broad market sell-off across stocks, AI, fintech, and crypto. While concerns over AI overinvestment and U.S.-China competition fuel economic uncertainty, deregulation in fintech and crypto is accelerating, with the SEC dropping cases against major industry players and the White House dismantling regulatory bodies like the CFPB. The GENIUS stablecoin bill signals a pro-innovation stance, opening the door for fintechs to integrate digital assets into global financial infrastructure. However, this policy shift is time-limited, as isolationist economic strategies are historically unsustainable.

Topics: Trump Administration, David Sacks, SEC, CFPB, OCC, FED, NVIDIA, DeepSeek, Coinbase, Binance, OpenAI, Solana, Kraken, Robinhood, SoFi, Uniswap, Yuga Labs, Consensys, Tesla, Jack Henry, FIS.

To support this writing and access our full archive of newsletters, analyses, and guides to building in the Fintech & DeFi industries, see subscription options below.

🚩Shoutouts

Our friend Jason Mikula’s company Taktile has raised $54MM. Taktile’s platform helps Fintech risk and engineering teams manage workflows for automated decision-making. Learn more here. Jason also writes the excellent Fintech Business Weekly.

Long Take

The US economy is being torn down and rebuilt in real time.

A $1.5T contraction looms as tariffs and job cuts reshape the market, sending stocks, AI, fintech, and crypto into freefall. At the same time, a wave of deregulation is tearing down financial and technological barriers, unleashing unprecedented opportunities for builders. This moment is either the necessary destruction before a stronger, more self-sufficient future — or the beginning of another reckless boom-and-bust cycle that will leave the U.S. weaker in the long run.

Is this creative destruction or just destruction? The administration is betting that cutting government jobs, reshoring high-tech manufacturing, and gutting financial oversight will force the economy onto a more sustainable path. But history suggests that isolationist policies rarely outperform open collaboration, and unchecked speculation has a habit of ending in disaster. If the next four years are a free-for-all, where will it take us?

Macro circus

How is the economy doing? It’s clown town.

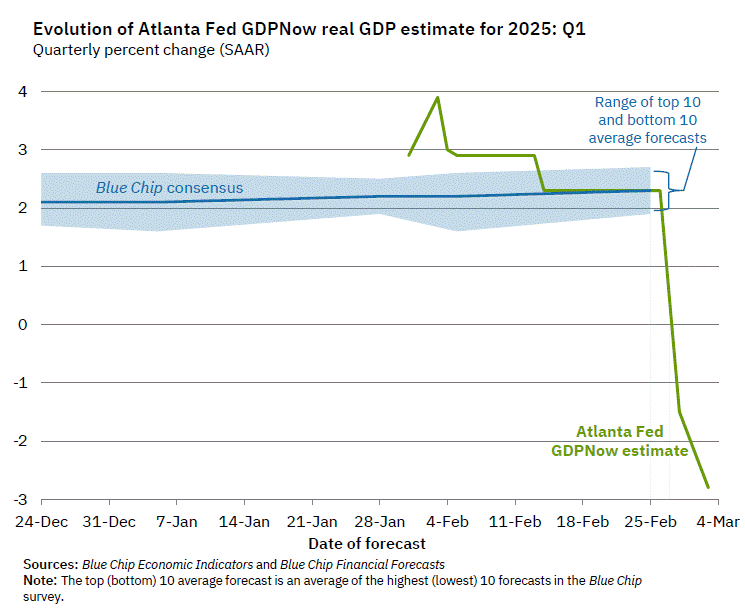

As a result of the last month of policy implementation, US GDP is forecasted to fall 3% rather than rise 2%. That’s a difference of 5%, or about a loss of $1.5 trillion in economic activity — about the size of Indonesia, Turkey, or most of Mexico. Already, the most recent job report is surprising to the downside.

The two main drivers of this are (1) the uncertainty around tariffs and free trade — note that most economist oppose tariffs in the same they oppose minimum wage — and (2) the cutting of government employment by Musk, who has tanked Twitter’s revenue from $5B to $2.5B, while tripling profitability.

In response to these projections, the Trump administration is suggesting to re-categorize how GDP is measured to exclude government spending, which to be fair, would nullify the entire 90-year old field of Keynesian economics, but move numbers around to make things look better on paper. The Austrians are having their day in the sun.

The markets have reacted predictably.

There has been a sharp contraction across stocks (5% down above), AI (7% in NVIDIA above), crypto (BTC down 9%), and Fintech (both neobank SoFi and neobroker Robinhood down 15%). Everything we watch is on fire.

Yes, we were selective with the time horizon for this chart. But this performance captures (a) the “mark to market” of expectations from actual policy actions as compared to (b) the trade on Trump’s campaign promises and implied insinuations. Last year, people expected a pro-growth de-regulation agenda coming from the new White House. The implementation, however, has been more rough and isolationist.

Let’s quickly look at the fundamentals in our core sectors.

AI has seen pretty bearish sentiment since the release of DeepSeek, and prior to that, Goldman’s report that there is an overinvestment in AI infrastructure, comparing the current boom to that of the Telecom sector in 2001.

Maybe things are getting overbuilt.

And yet, below is the growth in NVIDIA quarterly revenue.

Does that deserve a $70B marketcap decline?

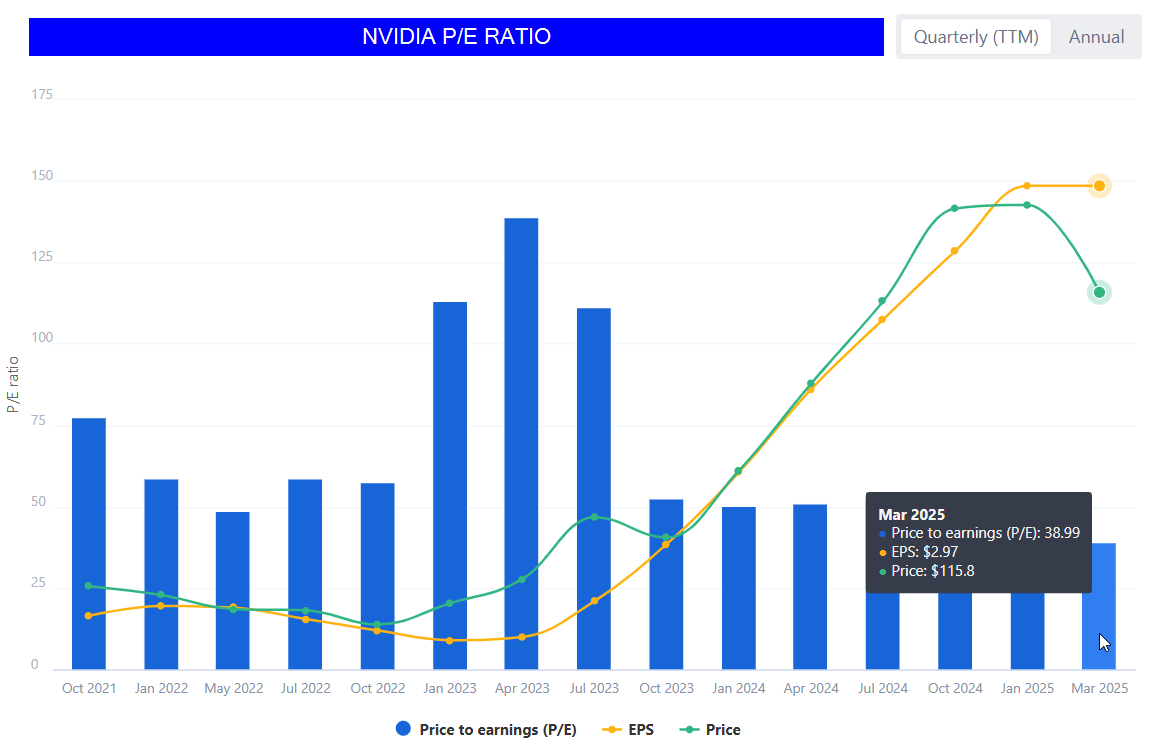

Now you can say stocks don’t get priced on revenue. They get priced on earnings and future expectations. So let’s look at the NVIDIA price-to-earnings ratio, which tells us how many years of holding the stock would pay for its current market capitalization — the payback period.

Surprisingly, NVIDIA is trading a 38 P/E, lower than pretty much any time during the last 5 years. It has grown into its valuation. The uncertainty is all about whether future performance will continue to scale at the same rate.

If we zoom out, is it appropriate for the entire S&P500 to fall 5% based on earnings expectations? Below we show the monthly P/E ratio as well as the 10-year trailing numbers of the Shiller P/E ratio on a much longer time horizon.

There is no question that we are at historic highs often seen before large market crashes.

Some catalyst usually kicks off those market crashes. We finally discover that the Emperor has no clothes, like Dot Com companies failing to monetize their visitors, or lines waiting outside of bank runs during the Great Depression. Today’s discovery may be the fear of international competition with China and the hole in Western manufacturing for high tech products.

Maybe this is the signal and America should be afraid after all?