Gm Fintech Architects —

Welcome everyone to the open edition of our premium newsletter. Today we are diving into the following topics.

Summary: We reflect on the evolution of innovation in Fintech, AI, and Crypto, celebrating the bold risks and breakthroughs shaping the future while challenging traditional frameworks of success. OpenAI's hiring of Coinbase's former CMO and Stripe's CTO launching a $500M+ AI startup exemplify the shift towards an AI-driven economy. While critics may dismiss bubbles as speculative, these waves of innovation often lay the groundwork for future breakthroughs and new economic models. The message is clear: embrace curiosity and risk, as they drive humanity's creative and technological progress.

Topics: TBD

To support this writing and access our full archive of newsletters, analyses, and guides to building in the Fintech & DeFi industries, see subscription options below.

We are building out our presence on Bluesky. Follow us if you are there!

Long Take

Sorry not Sorry

I feel like I have to apologize.

Sorry to be celebrating the $100,000+ Bitcoin price. Sorry to be continuing to write about AI and Crypto in a fintech newsletter. Sorry I couldn’t stick to spreadsheets of private neobank economics. I know that’s what everyone wants, and I just want to keep singing this other song.

I feel like I have to apologize because I grew up on Wall Street, and was socialized into its hierarchies and value systems. It is important to wear a suit every day at the esteemed Lehman Brothers. It is important to go to grad school and get an MBA, and maybe a JD. It is fancy to work in private equity and LBOs, that’s where the smartest people go. Institutions imply prestige, and so on. You are probably here because in some way you believe these things, were taught that thinking these things is how to be accomplished and successful.

But remember, time changes everything. This is how success looked 500 years ago.

So why do we still have to celebrate this?

If we are being honest — like really honest about who is running the system — they look like this. We don’t have to like the kings to know who they are.

Let the counter-reaction and the revolutions come. Of course they will come, as they do for everyone who pushes too much at the world.

I know that to celebrate art, chaos, and anarchy is to invite ridicule from the Warren Buffets of the world. And that the heroes of our public stories are so often the villains in many private ones.

When we swim about in the beautiful drunken stupor of the bubble, drowning in hallucinatory songs of the science fiction future, it is easy to celebrate what may come. When the bubble bursts and we have to pick up the pieces, explain what went wrong, and hide our tails, it is hard. The Luddites celebrate our defeat.

But let’s be real — there is no worse trade than betting against the resilience and creativity of humankind.

There is always pleasure that others take in calling the innovators and entrepreneurs — those who are both naive and prophetic — grifters, fraudsters, and scammers. Surely it must all be luck, or some manipulation of the system, or some upfront inequity!

How boring it must be to come upon the geiser of life, the essence of what makes us human, and click your tongue and shake your head. To worry about all the fences around what has been, before seeing what animals roam beyond. I am sorry for those of us who cannot enjoy the sheer brilliance of something new opening a door of possibility to the new world. And I am sorry for the great price society pays — in human mana and suffering — when the old ways are broken and left behind. And yet, the pattern is eternal.

I wrote this a while back, an ode to the risk-takers:

Is what matters the last mile, or the first mile? Unequivocally, it is novelty and frontier. It is not for the explorer to worry about who will come along on the road they paved in a decade. Without the explorer, the roads remain in the imagination and the orthodoxy ossifies into lifeless stone. And if it is the new thing that we must elevate, then it is fog and the dark which is our greatest enemy.

When we step in the swamp of the unknown, what vipers lie in the water? The poison of risk. The poison of loss. Our bodies shriek with chemicals at the chance of loss. Anguish comes from physical and mental sources. Our minds render them equally. Because it is all mere input to be rendered. Loss. Risk of failure. Shame. Wrongness. Embarrassment. Excommunication. Fear. Loneliness. Death. This is what most see when there is a blank page. The answer though is to start drawing, not hide from our emptiness.

As AI continues to develop, several things will become more obvious. It is not that machine cognition is special, but rather that human cognition is not. Those modern reasonings parts of our brain will be digitally assembled in reverse from evidence, from the data exhaust of the Internet, like gears. They already have been. Those gears will be arranged together, by yet other emergent patterns. Fractal self similarity along the creases of our humanity. The super organisms they power will lack many of our dimension, as any robot that skipped natural selection through sexual reproduction. But they will contain many others. You do not miss the ability to see infrared. But still you lack it.

There are thing we know and things we do not know. Much of what we do not know can be discovered through recombination. We call this innovation or invention. Reasoning machines are built on the graph of human knowledge and experience. It is their nature to interpolate through this space by locomotion. According to cortical column brain theory, locomotion is the key to our intelligence as well. We will ask the machines questions and they will recombine for us, and eventually themselves, the answers. I call this skill “illustration”. It is beautiful and new, but there is a quality to it that is not art. Nearly all of life is the practice of illustration. To aspire beyond is insane.

The more frightening question is about the frontier. Those things beyond our knowledge, experience and comprehension. The Cthulus hiding in dark matter, invited by questions we cannot even formulate. No more than a dog trying to catch a passing truck. The machines will ask these questions. They will expand the scope of possibility, and bring back things truly unknown. We will dance like shamans in the thunderstorm. And what will be the cost of this? Money? Mana? Crypto? Oil? Calories? Life? And who will pay it? Machine labor needs machine systems. The super organism moves energy in ways different from that of human society. And yet most of us dance the speculation dance about whether Bitcoin will wrap in an ETF to sit in asset allocation pie charts. Is that the frontier?

So that’s what I say about these charts.

Sorry, not sorry.

Talent

We are sitting at an intersection, waiting for the light to turn green.

Some of us want to keep driving on into the fog.

Two things stood out this week, both from the perspective of talent. Perhaps these are the grifters that everyone keeps telling me about, chasing bubbles and barking at clouds. Or — far more likely — it is the canary in the coal mine, telling us the direction of movement.

OpenAI has hired its first CMO, Kate Rouch, who was most recently the CMO of Coinbase. Coinbase is an $80B company, and most of that marketcap was created during Kate’s tenure. OpenAI is a $160B private company. There is some probability that by the time it goes public, it will be a $1 trillion behemoth, on the same path as NVIDIA, Google, Meta, and Amazon.

In all worlds, OpenAI is at the heart of the new economy.

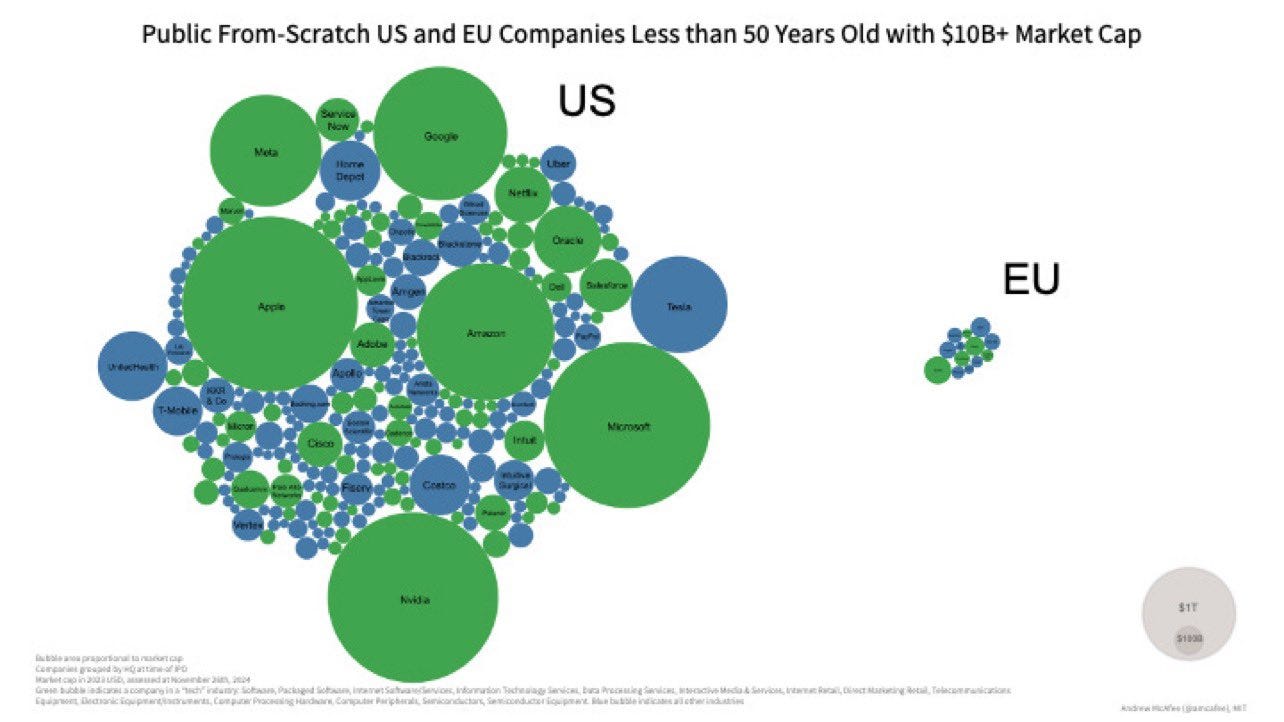

If you don’t think that the latest tech matters, and economies can run on old tech and population growth, we give you the following charts:

The Western world has bifurcated between the United States, which is using the tech flywheel to advance forward, and Europe, which is being left behind in the dust without the same advantages. No tech sector, not GPD per capita growth.

Here is the second data point. The CTO of Stripe, David Singleton, is stepping down from his position at one of the hottest fintech platforms out there after 6 years. Imagine walking away from this company before it even goes public! But Singleton will be fine — he has already raised $50MM+ at a $500MM+ valuation for a pre-product startup focused on an operating system for AI agents called /dev/agents.

Surely there could be better branding.

Before Stripe, Singleton worked on Android at Google, being early to mobile as a platform. This is a technologist that understands what is coming around the corner. And what is coming around the corner is an AI economy.

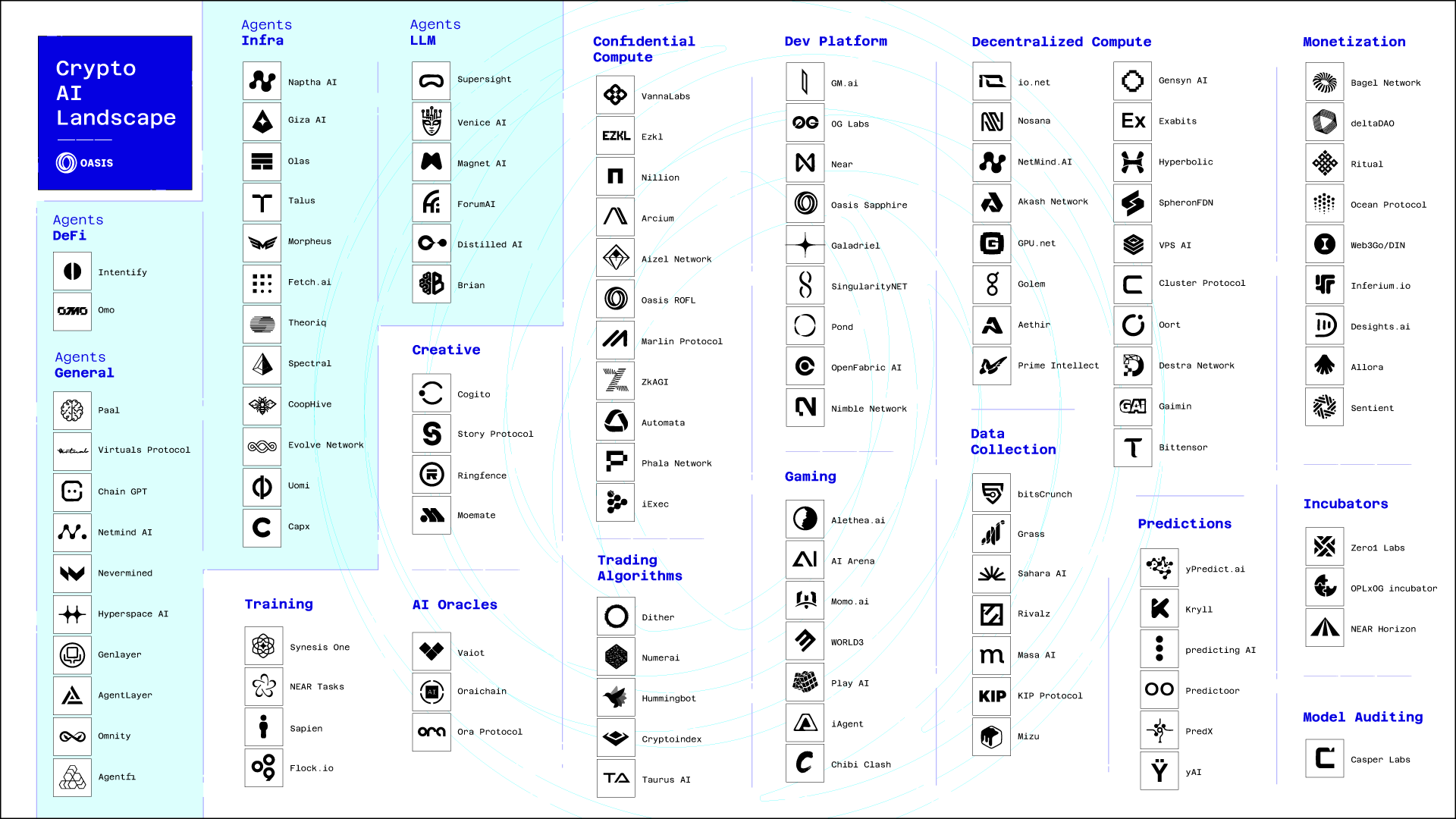

We have discussed in detail before how the packaging of foundational models into anthropomorphic “agents” can make it much easier to work with AI. In this world, we have lots of software robot do our bidding, and eventually we will do theirs.

Imagine you are sitting on top of Stripe and you realize that financial rails need to be built for these AI agents. You also realize that financial rails are a consequence of underlying economic activity, which results in commerce mediated in market venues, which then needs machine banking. And then you realize that commerce is much bigger than financial services — in fact, “the economy” is the container in which “financial services” is a feature.

And so you leave Stripe based on your advanced information about the shape of the world to create an orchestration platform for these things to interact with each other, and eventually touch the real world. Of course, we think this is the job of open source, public chains, but our bias gets in the way.

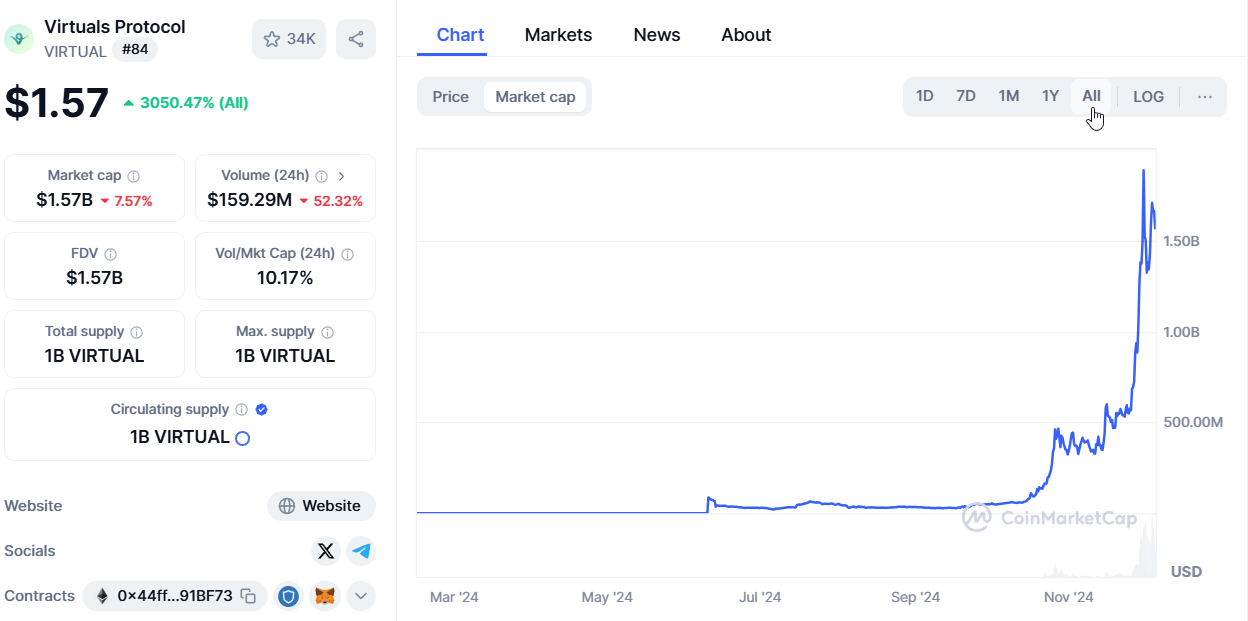

Similarly, imagine you are joining OpenAI as CMO, now sitting in the largest footprint of fine-tuned LLMs in the world. As a reminder, Coinbase is home to Base, a scalable EVM layer 2 chain that attaches to Ethereum, which is now the primary venue to the largest AI agent token platforms, like Virtuals.

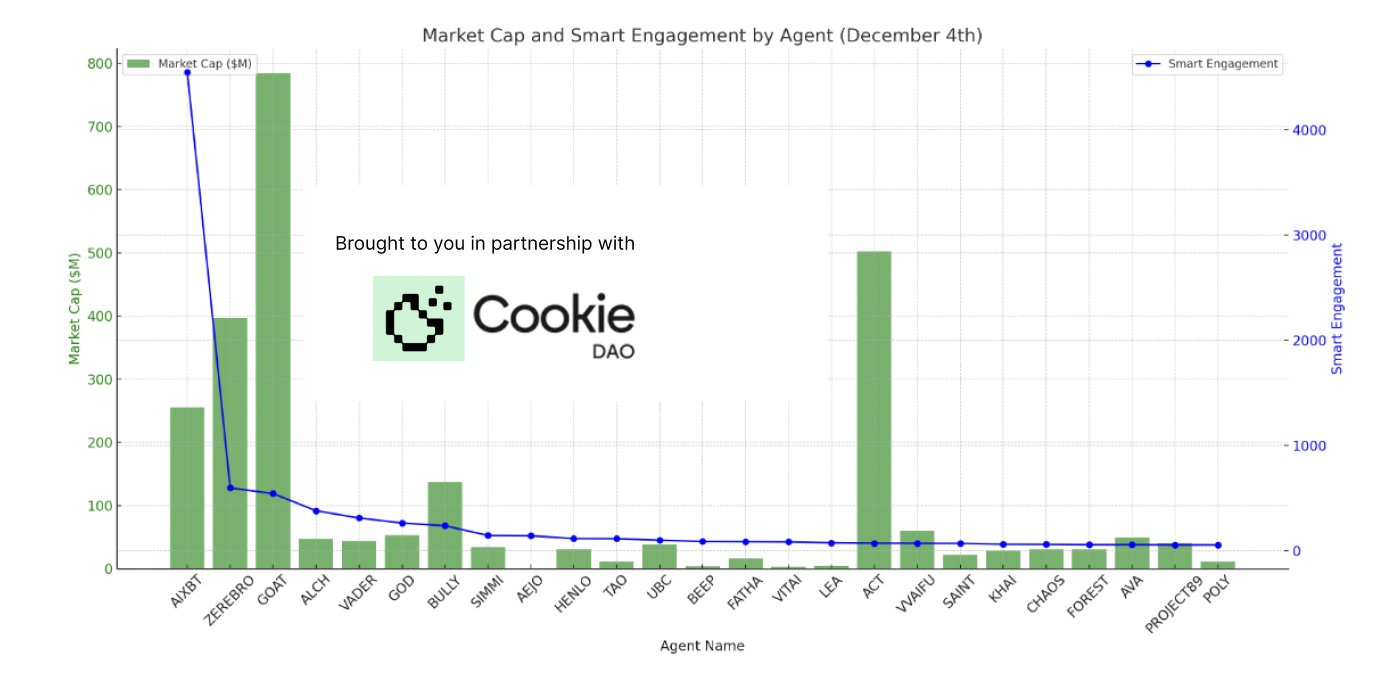

And here are the select marketcaps and attention metrics for these honeypots.

We have a $1B+ valuation for GOAT and a range of $50-400MM valuations for other memetic plays. For the Virtuals platform — the OpenSea or Uniswap of this cycle — the token is trading at a $1.6B valuation.

So as the CMO of Coinbase, do you think this is information you would pass to the rest of the OpenAI C-suite? Imagine how much value would be created if you financialize and unleash the millions of customized agents out there?

Look — I know what you are thinking. I am thinking about it too.

This is just like that time we all got really excited about the metaverse and NFTs, and all of that went to zero. How embarrassing for Zuckerberg to rebrand Facebook into Meta at the top of the metaverse bubble!

There is a reason we opened this newsletter edition with how we opened it.

I am sorry to buy into the hype! I am sorry to say “Metaverse” again! I am sorry to get swept up! And yet, these are the breakthroughs that are paving the way for the next breakthrough, and the next one after.

Because NFTs are how you get access to bank accounts in 2024, for example. See Fiat24. And if you didn’t understand the utility of the technology — you work in a bank enterprise blockchain depatment that looks down on speculation and this type of innovation — then you won’t understand it now. And you won’t understand when things like this go global and through and beyond the developing world.

Bask with me in the light of this beautiful bubble! Find in it your truth.

We will come down to Earth. But so what!

Just like eyeballs were the wrong metric for DotCom companies, so is engagement the wrong metric for AI agents. EBITDA, transaction volumes, net interest — all these things will come with time.

Don’t extinguish curiosity for that which we do not yet understand. Hold on to it.

🚀 Postscript

Sponsor the Fintech Blueprint and reach over 200,000 professionals.

👉 Reach out here.Check out our AI newsletter, the Future Blueprint, 👉 here.

Read our Disclaimer here — this newsletter does not provide investment advice

A lot to think about here. But ... bubbles are created by hype. If AI is the future, it will be because it will facilitate more.efficiency in business processes allowing for greater profits. Companies in any industry can benefit from that. It's all speculation, but some speculation is better than others.