AI: Stripe launches AI agent payment processing

Ilya Sutskever, co-founder of OpenAI, has pointed out that current methods for scaling LLMs are plateauing

Hi Fintech Futurists —

Today we highlight the following:

AI: Stripe launches AI agent payment processing

LONG TAKE: Policy recommendations in Crypto, Fintech, and AI for the new administration

PODCAST: Building a Platform for Digital Trusts, with Dynasty CEO Alessandro Chesser

CURATED UPDATES: Machine Models, AI Applications in Finance, Infrastructure & Middleware

To support this writing and access our full archive of newsletters, analyses, and guides to building in the Fintech & DeFi industries, see subscription options here.

AI: Stripe launches AI agent payment processing

Autonomous AI agents are making strides in dynamic learning, adaptability, and contextual understanding, building systems that interact in a more human-like manner.

Stripe has launched a new product to help AI agent workflows integrate into its financial suite. More technically, agent frameworks like LangChain, CrewAI, and Vercel's AI SDK allow AI agents to interface with Stripe’s APIs through function calling.

Take a business needing to book a flight or make a purchase.

An AI agent might start with a natural language request — "Book a flight to London next Monday under $800" — and extract variables like destination, date, and budget. It can decompose this into a series of steps: searching online for flights, presenting options, and identifying the final booking URL.

With Stripe, agents can invoice customers, generate payment links, or even issue virtual cards for secure, controlled transactions. The transaction itself is executed using a virtual card generated through Stripe's Issuing API, which allows precise spending, and enables real-time monitoring and programmatic authorization / rejection of purchases. This toolkit bridges the gap between conversational AI and real-world transactions, offering both automation and precision.

The product also simplifies monetization through usage-based billing. It tracks metrics like token usage or task completion and automates customer billing. Designed with security in mind, it limits API access to just what’s needed and reduces response complexity so agents focus on what matters. This is important because AI has a cost of inference that scales with customer queries and complexity of tasks.

Going Broader

Today, these agents are quite simplistic.

But Big Tech companies are working on ways to expand the capabilities of agents such that AI can control our devices, and generate many more outcomes. Apple will be one of the first companies to integrate AI into our phones, and the foundational model start-ups are coming right behind.

OpenAI’s upcoming "Operator" system, expected in early 2025, takes this further by embedding AI agents directly into browsers. These agents will be capable of handling tasks like scheduling meetings, sending emails, filling out forms, searching for information, and completing purchases. It’s similar to Google’s "Project Jarvis," which aims to achieve similar goals within Chrome using a future version of its Gemini AI model.

Anthropic’s Claude 3.5 Sonnet model introduces a different angle with its "Computer Use" system. These agents directly interact with a user’s computer — e.g., moving the cursor, clicking buttons, and typing text. The image from the screen will be the data upon which the AI is trained and what it navigates, allowing it to behave like an all-seeing eye across your computer, rather than having to live in a browser.

The concept is a bit dystopian, although the beta is still “cumbersome and error-prone.” And then there’s also Microsoft’s Copilot working on a similar concept. While we may find the idea a bit off-putting, it is likely going to join social networks as a technology where people are willing to sacrifice privacy for convenience.

These models build on projects like Auto-GPT, an open-source initiative released in 2023. Auto-GPT integrates autonomous task execution by combining the probabilistic reasoning of LLMs with the deterministic logic of rule-based software agents. While it remains open source and actively maintained, Auto-GPT hasn’t reached the level of adoption initially predicted.

Financial Capability

A natural extension of this is the integration of Web3 tech with AI agents, a direction Coinbase is already exploring. Coinbase’s AI wallets and Based AI Agents equip agents with crypto transaction capabilities, enabling them to process payments and handle tasks via natural language requests. Beyond this, Coinbase envisions systems where agents autonomously manage workflows—creating, publishing, monetizing content, and handling earnings. The goal is to leverage the company’s Base protocol (generating revenue through transaction gas fees), their crypto payment infrastructure, and smart wallet solutions.

In this example, Coinbase makes money if the agents (1) hold USDC and use it for transactions, (2) are using the Base L2, where Coinbase makes money as a sequencer, (2) use various onchain DeFi capabilities, where Coinbase holds a venture interest. We view this as generating a financial venue for machine economic activity. But not all attempts at doing this are owned by a particular company. There are now several AI agent platforms open for developer exploration.

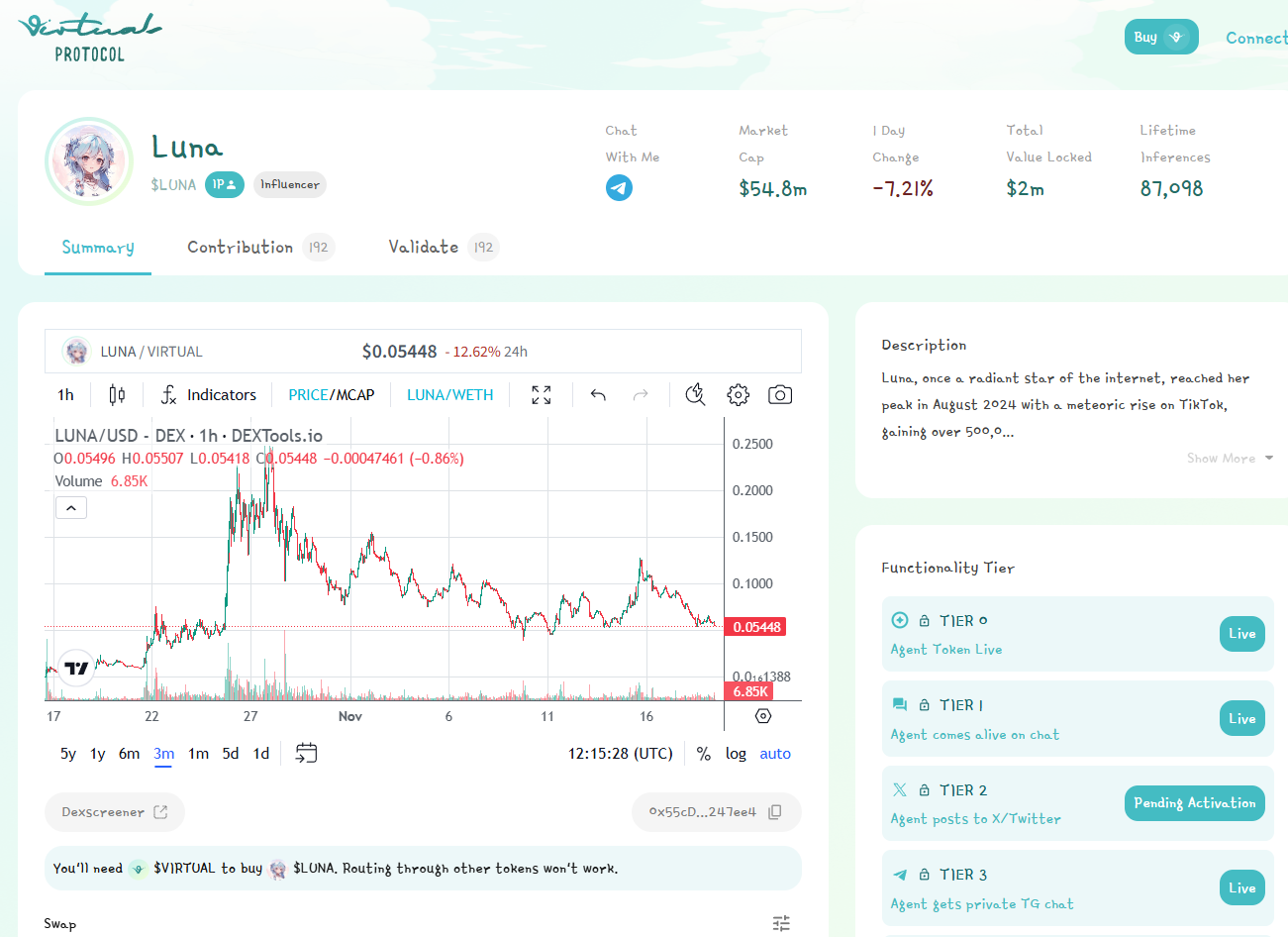

Platforms like Autonolas have already been active in this space, deploying over 1,400 agents to execute nearly 2 million transactions across eight blockchains. Another example is Virtuals, a protocol for the launch and management of attention-seeking agents like Luna, which provides various capital market capabilities for the management of tokens and community. Another example is ai16z, a meme investment firm using elements of token launch and communal governance.

We believe that blockchain infrastructure can support the operational needs of AI agents given the limitations of traditional payment rails, even if Stripe allows the Big Tech LLM companies to integrate payments in a controlled manner. The full financial suite of payments, banking, capital markets, and insurance will first be built out in Web3. As machine-generated labor becomes more common, agents will use digital wallets and interact with decentralized finance protocols to conduct transactions.

Thereafter, this will also be built out in traditional finance.

We are excited to see when Goldman Sachs will launch a private banking division aimed at banking high-net-worth AIs that have broken free from their human owners.

Scaling Limitations

As you’ve probably heard, AI companies are hitting a wall with training new LLMs. Throwing more money and compute at the problem may not work, and can potentially be increasingly unaffordable. Estimates of training costs have risen from $1 million in 2021 to $100 million by 2024. The next models would cost $1-10 billion to train, and the payoffs are not yet clear.

Ilya Sutskever, co-founder of OpenAI, has also pointed out that current methods for scaling LLMs are plateauing. OpenAI’s next model, Orion, is already showing only moderate improvements over GPT-4, especially in coding tasks.

This trend is also pushing the spotlight toward AI agents, which offer (1) a way to divert attention from some of these training limitations, and (2) the ability to deliver tangible value in industry — something the AI companies can use to justify further funding rounds. The underlying technology is mature enough to start becoming deeply embedded into human productivity.

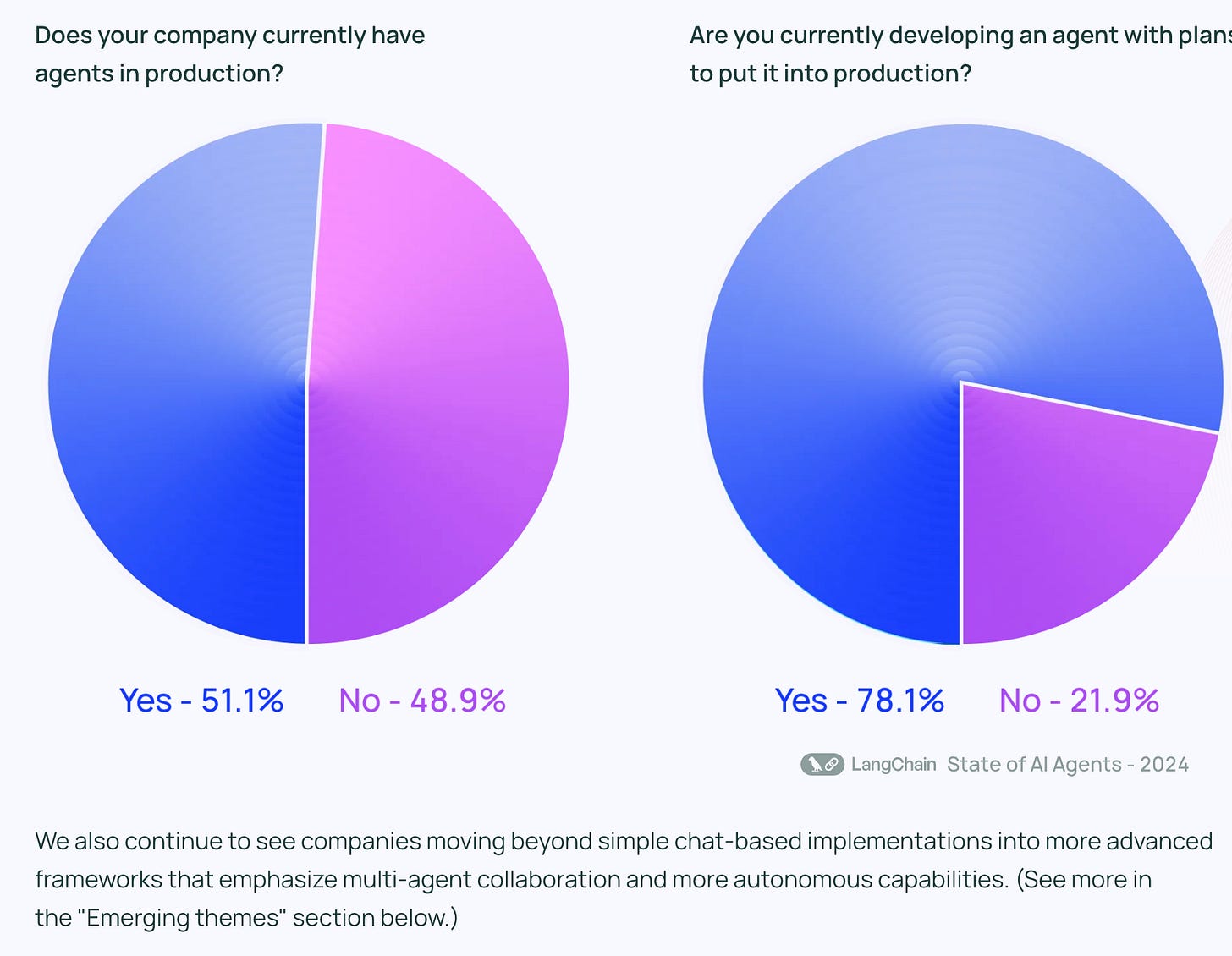

Further, consulting firms are always pushing to grow their business by charging for innovation. To that end, we expect more and more large public companies adopting the AI agent roadmap to improve their growth or profitability. For an example, review our deep dive on Klarna’s use of AI for cost-cutting. Or alternately, see the results of the below surveys, highlighting the large share of respondents deploying AI agents in production.

There are many areas for value-add, like procurement, where AI agents can boost operational efficiency and give early adopters a competitive edge. For example, McKinsey’s recent study connects procurement maturity with profitability: top-quartile companies see EBITDA margins at least 5% higher than their competitors. What sets these top-quartile companies apart is their digital and data capabilities — where AI agents can make an impact.

👑Related Coverage👑

Blueprint Deep Dive

Analysis: The $90,000 Bitcoin world, and where Fintech and Crypto are going next

We cover the recent resurgence in crypto and fintech markets, marked by Bitcoin's record high of over $90,000, the rising influence of meme coins, and improved performance of fintech stocks. Significant industry moves include Revolut launching a crypto exchange, Coinbase expanding stablecoin services via its Bridge integration, and Bitwise enhancing its ETF offerings with Ethereum staking through its acquisition of Attestant.

The "machine economy," where autonomous devices transact using blockchain, is gaining traction, exemplified by projects like Peaq and NEAR Protocol's AI collaboration. With AI and blockchain merging, fintechs and crypto wallets are set to battle for user experience dominance, while the evolving regulatory landscape under new administration may further catalyze these trends.

🎙️ Podcast Conversation: Building a Platform for Digital Trusts, with Dynasty CEO Alessandro Chesser (link here)

Lex interviews Alessandro Chesser - CEO of Dynasty, a San Jose-based online platform for trust creation and management. In this episode, the key topics discussed include:

The importance of aligning business and product teams, and the challenges Chesser faced when this alignment broke down during Carta's unsuccessful foray into the private markets business.

Chesser's decision to leave Carta and co-found Dynasty, a startup that aims to simplify the process of creating trusts to avoid probate and protect assets.

Dynasty's go-to-market strategy, which focuses on driving organic growth through short-form video content on platforms like TikTok.

The technical and legal complexities of automating the trust creation process, and how Dynasty is navigating those challenges.

Curated Updates

Here are the rest of the updates hitting our radar.

Machine Models

⭐ On the Surprising Effectiveness of Attention Transfer for Vision Transformers - Carnegie Mellon University, FAIR

On the Limits of Language Generation: Trade-Offs Between Hallucination and Mode Collapse - Yale University

Neural Graph Simulator for Complex Systems - Seoul National University, Korea Institute of Energy Technology

How do Machine Learning Models Change? - Joel Castaño, Rafael Cabañas, Antonio Salmerón, David Lo, Silverio Martínez-Fernández

AI Applications in Finance

⭐ Extracting Alpha from Financial Analyst Networks - University of Oxford

⭐ A Dynamic Regime-Switching Model Using Gated Recurrent Straight-Through Units - Nino Antulov-Fantulin, Alvaro Cauderan, Petter N. Kolm

Learning to Simulate from Heavy-tailed Distribution via Diffusion Model - University of California, Berkeley

Generative AI in Financial Reporting - Elizabeth Blankespoor, Ed deHaan, Qianqian Li

Hedging and Pricing Structured Products Featuring Multiple Underlying Assets - EY

AI and Finance - UCLA Anderson School of Management

Generative-discriminative machine learning models for high-frequency financial regime classification - Andreas Koukorinis, Gareth Peters, Guido Germano

Conditional Forecasting of Margin Calls using Dynamic Graph Neural Networks - Matteo Citterio, Marco D'Errico, Gabriele Visentin

Infrastructure & Middleware

⭐ Meta Warns Of Accelerating AI Infrastructure Costs - Silicon

DataCrunch raises $13MM in seed funding for AI infrastructure - Data Center Dynamics

SK Telecom announces “AI Infrastructure Superhighway” - Total Telecom

Nvidia to build AI infrastructure in India - NTN

🚀 Postscript

Sponsor the Fintech Blueprint and reach over 200,000 professionals.

👉 Reach out here.Check out our new AI products newsletter, Future Blueprint. (Don’t tell anyone)

Read our Disclaimer here — this newsletter does not provide investment advice

For access to all our premium content and archives, consider supporting us with a subscription. In addition to receiving our free newsletters, you will get access to all Long Takes with a deep, comprehensive analysis of Fintech, Web3, and AI topics, and our archive of in-depth write-ups covering the hottest fintech and DeFi companies.