Analysis: The $90,000 Bitcoin world, and where Fintech and Crypto are going next

New Crypto Highs, Fintech Resurgence: What’s Driving Growth?

Gm Fintech Architects —

Today we are diving into the following topics:

Summary: We cover the recent resurgence in crypto and fintech markets, marked by Bitcoin's record high of over $90,000, the rising influence of meme coins, and improved performance of fintech stocks. Significant industry moves include Revolut launching a crypto exchange, Coinbase expanding stablecoin services via its Bridge integration, and Bitwise enhancing its ETF offerings with Ethereum staking through its acquisition of Attestant. The "machine economy," where autonomous devices transact using blockchain, is gaining traction, exemplified by projects like Peaq and NEAR Protocol's AI collaboration. With AI and blockchain merging, fintechs and crypto wallets are set to battle for user experience dominance, while the evolving regulatory landscape under new administration may further catalyze these trends.

Topics: Bitcoin, Ethereum, Solana, DOGE, Elon Musk, Vivek Ramaswamy, Revolut, Coinbase, Utopia, Bridge, Stripe, Bitwise, Attestant, BlackRock, Peaq, NEAR Protocol, 0G / Zero Gravity, Grass Network, Dfinity.

To support this writing and access our full archive of newsletters, analyses, and guides to building in the Fintech & DeFi industries, see subscription options below.

In Partnership with Generative Ventures

We support visionary founders building at the intersection of financial technology, decentralized networks, and machine intelligence. 👉 Tell us about your project.

Analysis

A better mood

The market is showing clear signs of recovery.

Let’s take a short celebration lap.

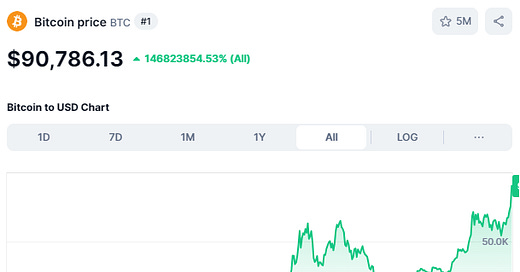

Bitcoin has reached over $90,000, setting a new all-time high. It’s a remarkable shift, especially considering how long we stayed below previous highs. That period was a challenging time for many investors. Many Luddites were very happy to say that crypto is dead. They were wrong — instead, the cycle repeats in a logarithmic pattern.

There is something uncanny about it. Unlike a start-up, which has a single hype period followed by the trough of disillusionment, BTC just keeps going and finding new places in which to expand.

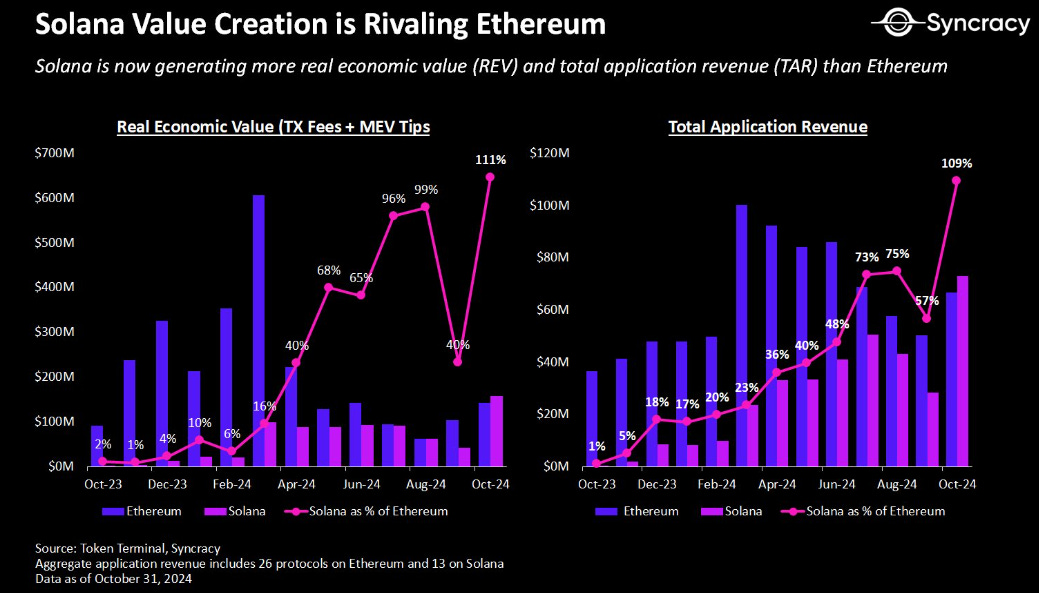

Ethereum, however, is still lagging behind relative to its all-time high. Solana, the darling of the current season, has been making substantial progress in catching up to ETH. Ethereum is still the far bigger asset with a $400B marketcap, and has a broader ecosystem of scaling solutions and applications. But it has fared worse as an investment this year.

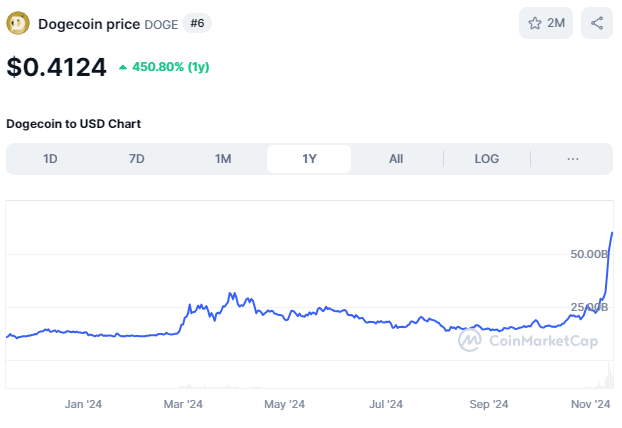

Part of Solana’s success can be credited to the rise of meme coins, which continue to attract interest. DOGE, the original meme coin, remains popular, especially with figures like Elon Musk and Vivek Ramaswamy, now involved in overseeing its impact through their new roles at the Department of Government Efficiency.

Truly, we live in the most ridiculous of times, where memes can be worth $70B and keep ramping up with cultural significance. Why is this happening?