Artificial Intelligence: Neobank Dave launches GPT chatbot for scalable customer service

Cost savings or revenue generation?

The Fintech Blueprint team will be taking a break for the holidays from December 23 — January 7th. We will return in the new year with fresh insights. Happy Holidays!

Gm Fintech Futurists —

Welcome to AI in Finance, focused on the application of artificial intelligence — LLMs, generative AI, machine learning, deep learning, and neural networks — to financial services.

Today we highlight the following:

Fintech’s Future is AI: Neobank Dave’s Chatbot - An Example of AI Efficiency (link here)

CURATED UPDATES: LLMs and other Machine Models; AI Applications in Finance; Infrastructure & Middleware

For weekly deep dives on the frontier of fintech, check out our premium offering.

Fintech’s Future is AI: Neobank Dave’s Chatbot - An Example of AI Efficiency (link here)

Neobank Dave recently launched DaveGPT, an AI-powered chatbot that responds to customer inquiries in real-time. The tool generates an 89% resolution rate, a major improvement over Dave's previous bot, DaveBot.

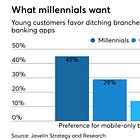

Dave CEO Jason Wilk says DaveGPT's large language model approach provides a superior and more human service while saving staffing, training and infrastructure costs. The GenAI chatbot enables Dave to serve its 9 million customers with only 300 employees, a whopping 30,000 customers per employee. Compare this level of scalability, essential to the success of startups like Dave, to the customer density of traditional banks, which in the European Union has reached up to 225 customers per employee.

Dave collaborates with Aisera to interact with OpenAI’s LLM capabilities, fine-tuned by Dave, to create DaveGPT’s ultra-relevant responses that resolve nearly 9 out of 10 customer inquiries. Over time, Wilk envisions personalizing advice by factoring in users' financial data – a level of personalization other financial institutions such as Commerz Bank are striving for using GenAI avatars.

This level of success with AI in financial services is not limited to fintech startups. Ken Moore, CIO at Mastercard, notes that institutions are just scratching the surface of what generative AI can do for banks. He expects that within the next 12 months, GenAI will be integral to all processes, ranging from customer service to financial advising, security, and marketing.

In fact, established financial leaders such as JP Morgan have already started to adopt AI chatbots as financial advisors.

If institutions throughout the industry do indeed adopt AI, we can expect cost reductions of up to 22% across front office, middle office, and back office by 2030, saving institutions nearly $1T across the board. Per McKinsey, GenAI could further add $200-$340B in annual profit for banks, equivalent to 9-15% of current operating profits. McKinsey projects the greatest profit gains in corporate and retail banking, at $56 billion and $54 billion respectively.

Specific opportunities include using AI to automate manual processes like testing, assess regulatory impacts, and extract insights from unstructured customer data to improve service quality. Additional areas of value include fraud detection, personalized financial planning and advice, operational efficiency, risk management model development,

These projections, combined with DaveGPT's demonstrated performance, are an optimistic view on how AI could deliver efficiency gains, cost savings, and customer satisfaction for modern fintech platforms that deploy the technology. That said, it is also fair to have reservations about how far conversational interfaces can go in transforming the customer experience. Early fintech chatbot platforms like Kasisto, large contact center software providers, like Twilio, as well as neobanks like Dave, have struggled to maintain value in the current market environment.

We are optimistic that GPT front-ends will indeed support millions of customers and be both useful and empathetic in discussing financial products. However, we are skeptical that embedding the technology into an existing footprint will bring about a platform shift. More likely, a destination of AI conversation traffic will have multiple financial products embedded therein.

👑 Related Coverage 👑

Reach 200,000 Fintech Professionals

With a 35% open rate and 1 million post views per month, we have an engaged audience of Fintech, DeFi, and AI enthusiasts receptive to your messaging.

Contact us to learn more about our custom opportunities.

Curated Updates

Here are the rest of the updates hitting our radar.

Machine Models

⭐ Google Gemini Pro helping devs and organisations build AI - Technology.

Regulatory compliance with AI in Fintech - Medium

Artificial intelligence now capable of creating new AI without human intervention, scientists say - NY Post

AI Applications in Finance

⭐ E-commerce fintech SellersFi secures $3M credit facility from Citi - Fintech Nexus

Square's departing CEO on Gen AI: You don't need an MBA to run a startup - eFinancial Careers

Infrastructure & Middleware

⭐ Equinix enables private AI infrastructure for businesses - Venture Beat

🎁 Give the Gift of AI, Fintech and DeFi Insight

The holidays are fast approaching and you still have a chance to gift something special to those interested in AI, Fintech and DeFi.

If you're searching for a thoughtful and impactful gift this season, consider gifting the Fintech Blueprint Premium Subscription. 🎁

Premium members receive:

Wednesday’s Long Takes with a deep, comprehensive analysis.

Office Hours, quarterly digital roundtable discussions with industry insiders.

‘Building Company Playbook’ series, offering insider tips and advice on constructing successful fintech ventures.

Enhanced Podcasts with industry leaders, accompanied with annotated transcripts.

Archive Access to an array of in-depth write-ups covering the hottest fintech and DeFi companies.

🌟 Offer something unique and valuable this holiday season. Gift your loved ones an opportunity to stay ahead in the financial technology space.