Hi Fintech Futurists,

Welcome back to our podcast series! For those that want to subscribe in your app of choice, you can find us at Apple, Spotify, or on RSS.

In this conversation, we chat with Jason Wilk, Co-Founder and CEO of Dave (NASDAQ:DAVE), a US challenger bank that has prevented $1 billion in overdraft fees, and has reached 10 million users in just four years. Founded in 2017, Dave went public in January 2022 via SPAC that had a market cap of close to $4 billion. As a private company, Dave raised almost $200 million and attracted top investors and personalities like Mark Cuban, Norwest Venture Partners, Financial Solutions Lab, and even Diplo.

But entrepreneurship runs in Jason’s blood, as he is a 4X founder, as well as, an active angel investor in MetroMile, Eatsa, Air Media, SnapChat and more. He formerly was co-founder and CEO of AllScreen.TV, a technology platform that enabled large media outlets to syndicate their digital content to over 500 publishers. Clients included Vice, Time, CondeNast, AOL, Yahoo and many more and investors included Mark Cuban, Jonathan Kraft, Skip Paul and Y-Combinator.

In Partnership:

Get Ready to Be Blown Away! There’s a New Fintech Event in Town!

Created by the founders of Money20/20 and Shoptalk, Fintech Meetup is bringing an amazing speaker lineup, 200+ sponsors, and 3,000 attendees to the Aria in Las Vegas on March 19-22, 2023. And, our proprietary tech will facilitate 30,000+ in-person meetings!

👉 This is a great event! — learn more at Fintech Meetup or download the brochure.

Timestamp

1’28”: Expansion of Jason’s foundational entrepreneurial experiences to date

4’20”: Jason’s entrepreneurial journey and development of his approaches to various businesses

10’41”: The idea behind Dave and the motivation behind its creation

16’05”: The value of Dave in a customer’s banking journey and the marketing behind it

18’17”: The predictive technology behind Dave

20’07”: The economics of Dave & its product ecosystem

23’14”: The thinking behind taking Dave public via a SPAC

25’07”: The state of public markets & the feasibility of SPACs today

28’46”: The bundling & unbundling of financial services & Dave’s positioning for customer success

30’44”: Channels to learn more about Dave

Sneak Peek:

Jason Wilk:

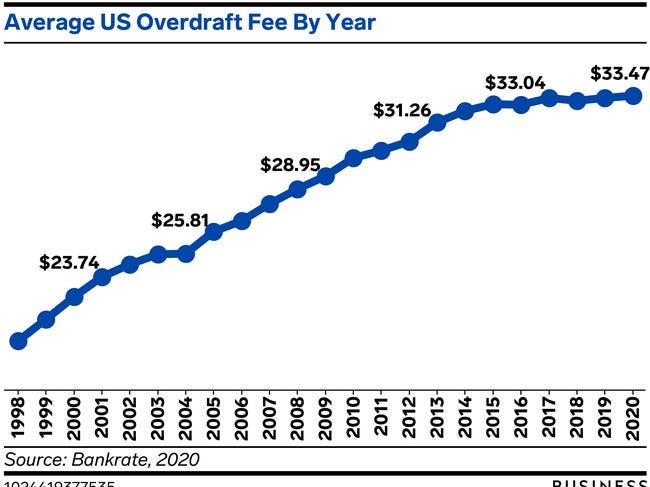

…I had a lot of personal pain, which is overdrafting going through college. Certainly, overdrafting while we were building our business with such a limited salary that we had from our first set of investors, and just the agony of a $34 overdraft fee when you're just going negative by $5 or $10 to buy gas or groceries or whatever you need was starting to rack up into the tune of a couple hundred bucks a year, if not more. Recognized that if I had this pain, I can only imagine what the rest of America was sort of going through. If you just look at the number of people in this country who are living paycheck to paycheck, it's the overwhelming majority.My co-founder and I, we knew that for our next venture we wanted to go for something that was big. So many of these industries that are large such as healthcare and telecommunications all seem very big things to disrupt, but banking seemed like it was ripe for disruption. We had seen a very early entrant in FinTech called Acorns, which you probably are familiar with, and they were leveraging this new company called Plaid, which was giving people access to checking account data.

I thought, "Wow, I mean, if my bank only used any of the data it had on hand about my transactions, my payment history, they should know that I have money coming in at some point. They should know about my upcoming bills and there's no need to charge a $34 overdraft fee on something that is such a short-term amount of money that is highly likely that I'm going to be able to pay back."

So that was the idea, that it would be very tough for us to go launch a straight up bank of our own, but if…

Postscript.

Subscribe to our podcast on Apple Podcasts or Spotify

What did we miss? Reach out here anytime.

Stop by our Discord!

Like it? Share it!

Share this post