Blueprint: Barclays investing in crypto-custodian Copper; Jack Ma loses fintech crown, steps down from Ant; Zillow bought too many houses

Hi Fintech Futurists —

You are the best, today’s agenda below.

CRYPTO: Barclays to back digital asset custody firm Copper (link here)

FINTECH: Jack Ma to give up control of fintech giant Ant Group: WSJ (link here)

REAL ESTATE: Seattle-based Zillow faces another shareholder suit over failed house-flipping business (link here)

Long Take: Sizing up Roblox, Minecraft, and Fortnite as places for financial economies (link here)

Podcast Conversation: What is GameFi and the $1B+ fractal DAO building it, with BitDAO Head of Product Strategy Jacobc.eth (link here)

Greatest Hits Report on DAOs

We hope your week is off to a good start. We start our week participating in several DAOs. If you want to know more, take a look at our latest Greatest Hits Report on DAOs.

In this Greatest Hits report on DAOs we covered:

Lessons from Elon Musk, Warren Buffett, Galaxy Digital, and the emerging DAOs for building a Fintech empire

Sheila Warren of the World Economic Forum on the 4th Industrial Revolution, the role of Law, Government, and DAOs, and the Creator Economy

Metaverse 101 with Lex Sokolin and Cris Sheridan, Sr. Editor of Financial Sense

Building the foundational money DAO (Decentralized Autonomous Organization) in DeFi, with Rune Christensen of Maker Foundation

MakerDAO valuation

And so much more…

We encourage you to dive into the material, see the progression over time, identify how we came to our conclusions, and find ways to build your own mental blueprint.

This report is exclusive to premium subscribers. Become a premium member of Fintech Blueprint and get full access to the report.

Short Takes

CRYPTO: Barclays to back digital asset custody firm Copper (link here)

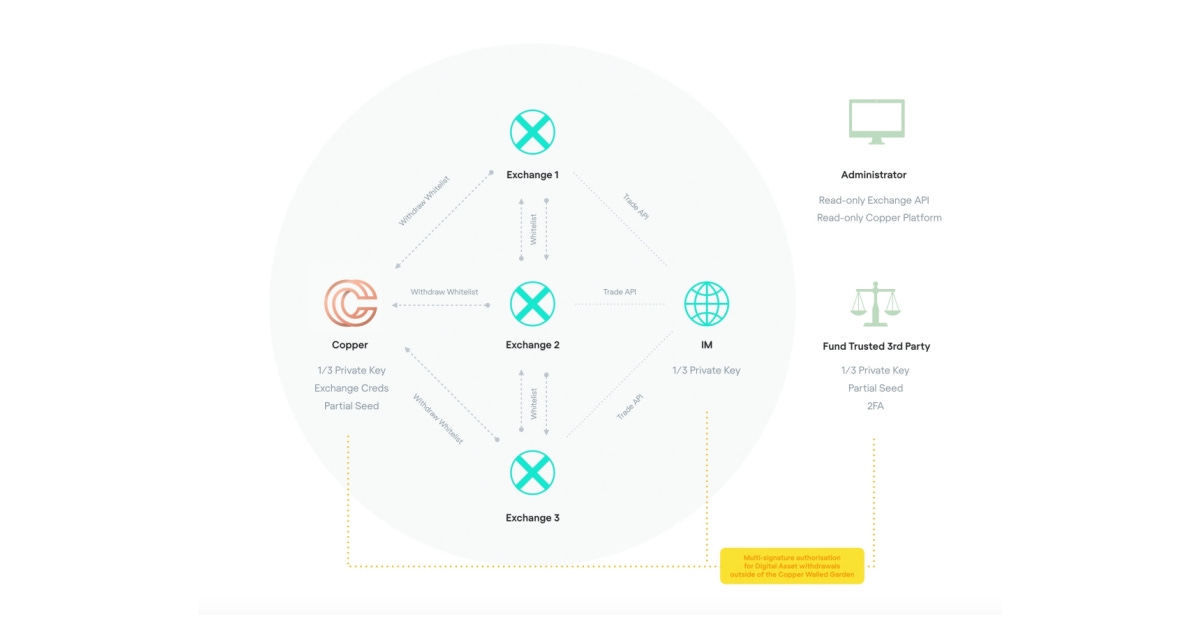

Crypto-custody provider Copper is closing an investment round at a valuation of $2B, with Barclays participating after a $75MM Series B in 2021. The valuation is lower than the $500MM funding round at a $3B valuation that Copper was aiming for in November 2021, which had garnered interest from Tiger Global, SoftBank Group and Accel. But you know, Tiger and SoftBank hit a bit of a wall.

While Copper failed to get regulatory approval from the FCA, an issue given their UK based origins, the firm has received acceptance instead from the Swiss Financial Services Standard Association (VQF), allowing the firm to offer its services in Switzerland. We continue to appreciate the global leadership role Switzerland has played in normalizing digital asset custody.

A lot is going on in the custody space. Metaco was chosen by Citi, SocGen FORGE and BNPP SS. BNPP SS is also a user of the leader in the space, Firelocks. Given the uptake by financial incumbents of relationships with digital asset custodians, we expect more downstream usage and distribution as well. While the current market is still down, and retail experience has been negative through capital loss, the next wave offered through these platforms is likely a better experience.

CONSUMER: Jack Ma to give up control of fintech giant Ant Group (link here)

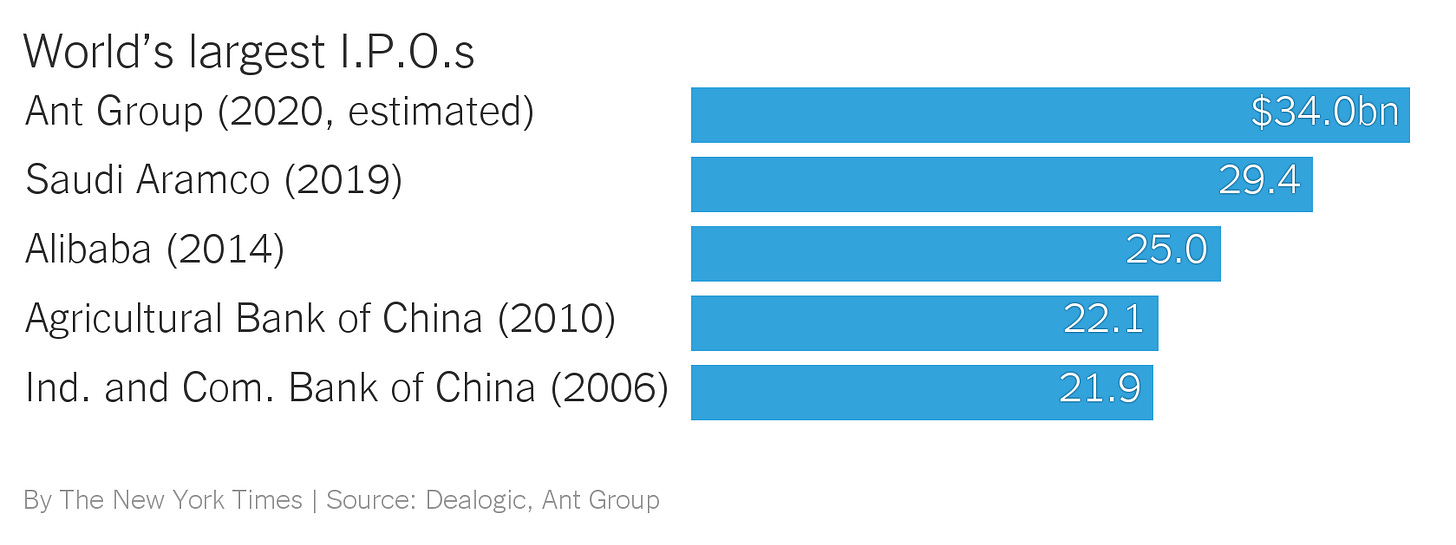

Alibaba Group founder Jack Ma is relinquishing control of its fintech unit, Ant Group. The move comes almost two years since Chinese regulators prevented Ant Group from going through with their $35B IPO, which would have been world’s largest IPO at the time. The rationale for preventing the IPO was due to demands for Ant Group to be subject to the same financial regulation as traditional banks. Rumors also swirled about Jack being in political trouble.

Ant Group is a fintech powerhouse with Alipay (one of two providers with a duopoly of the Chinese mobile payment market, alongside WeChat Pay), a money market fund (previously the world’s largest) and a microlending business under its umbrella. Per TechCrunch, following its blocked IPO, there have been calls from China to go through a series of rectification measures: (1) to bring more transparency to its transactions, (2) gain the required licenses for its credit businesses, (3) protect user data privacy, (4) establish a financial holding company with sufficient capital, (5) to improve compliance of its securities business, and (6) to revamps its financial businesses generally to accommodate the law.

Jack Ma has already taken a step back from the Alibaba Group, the eCommerce giant that uses Ant’s payment processing — he stepped down as CEO in 2013, retired as chairman in 2019, and now owns less than 5% of shares. Yet Ma in 2020 still owned 50%+ of Ant. Ant’s transition to a financial holding company requires it to look much more like the state-owned banks of the country. That likely also means distribution of the Chinese CBDC.

There’a lot to say about power and project our myths of Elon Musk and Steve Jobs on Jack Ma. Surely you would want to have the founder capitalist driving profound social and infrastructural innovation? Well, depends on the “you” in question.

REAL ESTATE: Seattle-based Zillow faces another shareholder suit over failed house-flipping business (link here)

Zillow, a real estate marketplace, is being sued by another shareholder for alleged misleading of investors regarding their house-flipping business, Zillow Offers. The suit reports that executives at Zillow provided incorrect statements regarding the success of Zillow Offers, despite the business model performing poorly.

Zillow Offers worked by buying homes in cash, removing the need for sellers to stage and show their homes. It did this using a price-finding algorithm, which was supposed to derive a premium on houses that Zillow could then sell on for a profit, while also providing sellers with a near-instant offer. However, a myriad of issues, along with negative profitability, saw Zillow Offers close down in November 2021. These issues range from the algorithm incorrectly predicting future prices to underpaying contractors, leading to houses sitting in inventory for longer.

Investors have claimed that Zillow did not disclose the problems occurring within the unit, including poor governance and overbuying, with five lawsuits now consolidated into two cases against the firm. Zillow executives argue that they adequately notified investors that they were testing an “unproven business model”. There’s likely a lot of legal work before the underlying reality is exposed, but to paint the picture here is a core number: Zillow lost $528MM last year, up from $162MM in 2020.

Sometimes, if you are not in the risk capital business maybe don’t go into the risk capital business.

Long Take: Sizing up Roblox, Minecraft, and Fortnite as places for financial economies (link here)

We look at the key digital environments that can support a new virtual economy, and parse their economics and adoption.

In particular, we review the scale of Roblox, Minecraft, and Fortnite, as well as their industrial logic. We also higlight the longer tail of relevant projects — Second Life, World of Warcraft, Eve Online, The Sandbox, Decentraland, and Otherside. This isn’t mean to be an exhaustive list, but a highlight of some key properties that might become a foundation for Web3 commerce and their posture towards NFTs. The logic connects to our prior explorations of DAOs as business organizations, and DAO tooling as the CFO tech stack equivalent in Fintech.

What is GameFi and the $1B+ fractal DAO building it, with BitDAO Head of Product Strategy Jacobc.eth (link here)

In this conversation, we chat with Jacobc.eth, the now Head of Product Strategy for BitDAO’s Windranger Labs, and Head of Product for the Game7 DAO.

Previously, Jacob worked as Lead of Operations at MetaMask, and before that he led product for the Panvala grant funding DAO, one of the earliest grant DAOs in the Web3 ecosystem.

Rest of the Best

Here are the rest of the updates hitting radar.

NEOBANK: US-based fintech Umba buys majority stake in Kenya’s Daraja microfinance bank

INVESTING: China-Switzerland Stock Connect Launches

INVESTING: Shares raises $40 million

INSURTECH: Integrity Marketing Group acquires Annexus

INSURTECH: Mulberri raises $4 million

INSURTECH: Lemonade completes acquisition of Metromile

INSURTECH: Grape raises CHF 1.7 million

VR: Zuckerberg Wants Meta’s AR/VR Business To Be As Big As Ads By 2030

AI: Kompliant secures $14M to help companies tackle financial compliance challenges

Shape your Future

Wondering what’s shaping the future of Fintech and DeFi?

At the Fintech Blueprint, we go down the rabbit hole in the DeFi and Fintech industries to help you make better investment decisions, innovate, and compete in the industry.

Sign up to the Premium Fintech Blueprint newsletter and get access to:

Blueprint Short Takes

Web3 Short Takes

Long Takes on Fintech and Web3

Digital Wealth

Access to the Podcasts with annotated transcripts

Full Access to the Fintech Blueprint Archive

Read our Disclaimer here — this newsletter does not provide investment advice and represents solely the views and opinons of FINTECH BLUEPRINT LTD.

Want to discuss? Stop by our Discord and reach out here with questions