Blueprint: Ethereum energy use ⬇️99%+ after Merge; Finance automation platform Mesh raises $60MM; JPM buys Renovite to compete with Stripe

Hi Fintech Futurists —

You are the best, today’s agenda below.

CRYPTO: Ethereum Merge alleviates ESG concerns (link here)

PAYTECH: Mesh raises $60m for finance automation platform (link here)

PAYTECH: JPMorgan Chase acquires payments fintech Renovite to help it battle Stripe and Block (link here)

LONG TAKE: Lessons from the Application / Infrastructure cycle for future bets (link here)

PODCAST: Building Dave, the neobank saving users $1B in overdraft fees, with Dave Founder and CEO, Jason Wilk (link here)

Here’s that handy upgrade button to access the Long Takes — a rigorous view on the future of our industry. Level up your Fintech and DeFi knowledge. 👇👇👇

In Partnership:

Get your Early Bird ticket to Fintech’s Big New Q1 Event. Join Fintech Meetup on March 19-22, 2023 at Aria, Las Vegas for amazing speakers, exhibit hall, receptions, and more… plus we’ll facilitate 30,000+ onsite meetings with proprietary tech.

👉 Get yout ticket now! Early Bird rate ends soon.

Short Takes

CRYPTO: Ethereum Merge alleviates ESG concerns (link here)

If you haven’t already, Google The Merge to see a countdown to our 2022 most anticipated event. Check out a special podcast of The Scoop featuring Lex and host Tim Copeland discussing the implications of the Merge on Ethereum and ESG.

The Merge is the transition of Ethereum from Proof-of-Work (PoW) to Proof-of-Stake (PoS). As Ethereum moves to PoS, it will be use 99.95% less energy compared to PoW. Removing such concerns around sustainability, an argument often used against Bitcoin and Web3, opens up Ethereum to a new wave of entrants, from builders to artists, who were previously deterred by environmental issues. To go deeper, check out this coverage from ConsenSys.

PAYTECH: Mesh raises $60m for finance automation platform (link here)

Mesh Payments has landed $60MM in Series C funding, shortly after raising $50MM in their Series B. Mesh helps companies automate spending, and provides real-time insights into budgets across various expenses and SaaS subscriptions. More recently, they released a physical numberless corporate card, which can be tied to different virtual cards, and then swapped via the software. The company claims to make finance teams 5x more efficient, saving 3 days per month with their tools.

The fintech is in competition with companies like Brex, Ramp and Airbase. In the first half of 2022, Mesh reportedly hit $1B in annualized payment volume from 1,000+ customers, and tripled their ARR (2.5% interchange * $1B = $25MM). For context, Ramp has around $5B in annual payments volume and has raised over $1B, vs. Mesh’s $123MM in total.

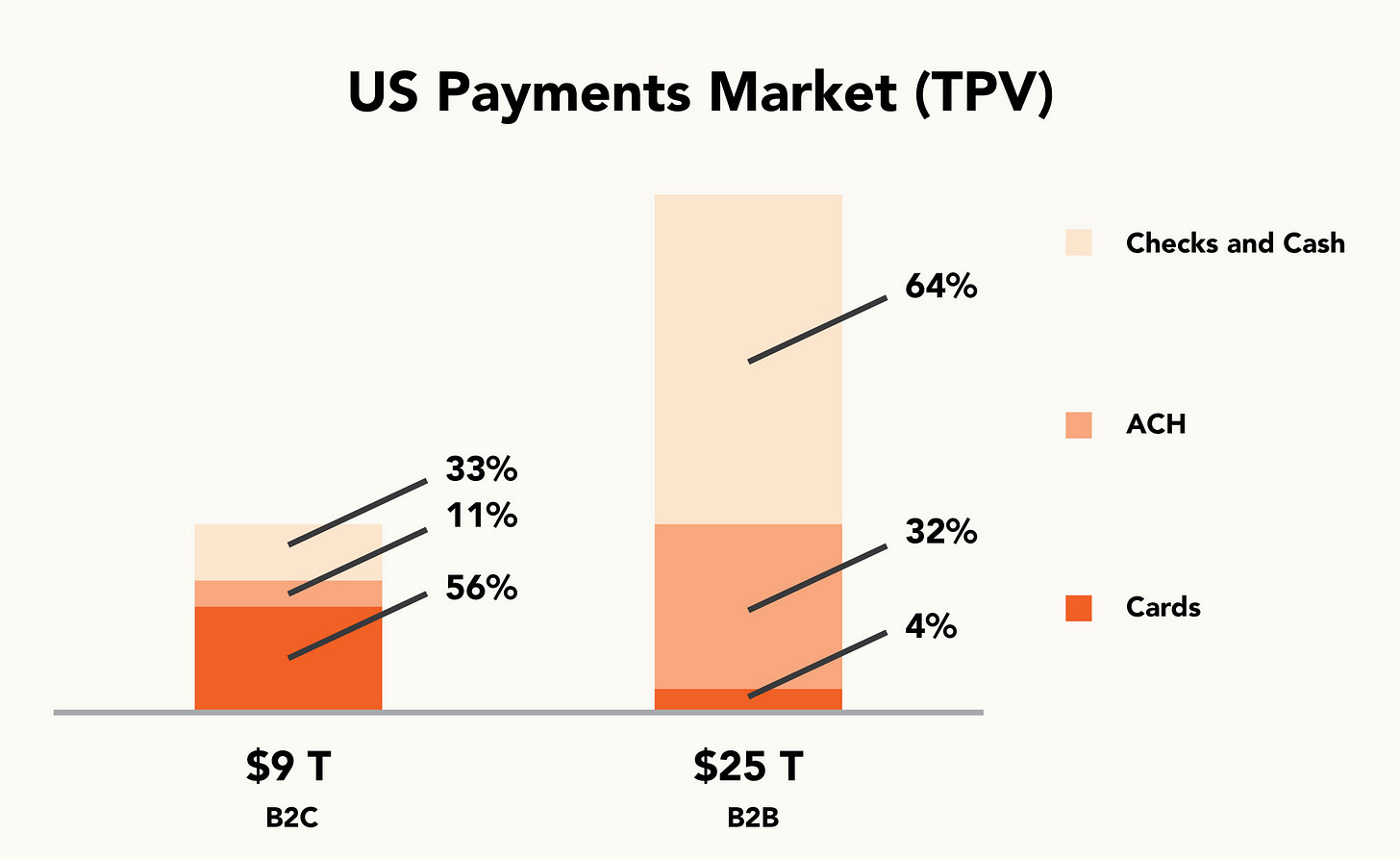

It seems unusual to us to see so many similar value propositions around automating the CFO stack, funded to such large amounts. However, the market likely affords a lot of growth before competition starts to become an issue. The above charts from the Brex pitch are instructive. B2B payments volumes are very large, but cards are not widely used relative to consumer preferences. And if we know anything, it’s that consumer preferences are what real people prefer — not enterprise or financial software. The play is to flip payment processing from checks and cash to industrial card usage. See more on this topic here.

PAYTECH: JPMorgan Chase acquires payments fintech Renovite to help it battle Stripe and Block (link here)

Payments fintech Renovite will be acquired by JP Morgan for an undisclosed sum. Renovite works with merchants and financial incumbents to provide cloud-based payment solutions that help companies across areas ranging from fraud prevention to clearing and settlement services. The key here is “cloud native” — check out below for the value proposition.

JPM, the world’s largest payments provider processing over $9T daily, doesn’t want to lose market share to fintech rivals, like Stripe and Block, due to an outdated payments offering — one that can’t scale quickly enough, or can’t adapt to multiple channels and new builds. Acquiring the technology is the fastest way for JPM to catch-up in the eCommerce segment and we think this acquisition is about bolt-on capability and the software’s flexibility across geographies, not revenue.

Zooming out, JPM has been acquiring multiple fintechs recently, including an ESG platform, a roboadvisor, and now a paytech provider. Dimon has been vocal about the threat posed by technology, and this is reflected in operating expenses of the company — the incumbent’s investments in technology led to operating expenses rising 19.7% in the twelve months ending June 30 2022 up to $80.6B, with the 2022 tech budget spend targeted at $22B. That could be a nice venture check too.

Long Take: Lessons from the Application / Infrastructure cycle for future bets (link here)

There are cycles to it all — in market prices, in economic performance and personal debt, and in the innovation dialectic between applications and infrastructure.

We look at the Union Square Ventures thesis from 2018 and apply it to current fintech valuations, Klarna’s results, and the upcoming Ethereum Merge. What’s the strategy for those of us in the fog?

Podcast conversation: Building Dave, the neobank saving users $1B in overdraft fees, with Dave Founder and CEO, Jason Wilk (link here)

In this conversation, we chat with Jason Wilk, Co-Founder and CEO of Dave (NASDAQ:DAVE), a US challenger bank that has prevented $1 billion in overdraft fees, and has reached 10 million users in just four years.

Founded in 2017, Dave went public in January 2022 via SPAC that had a market cap of close to $4 billion. As a private company, Dave raised almost $200 million and attracted top investors and personalities like Mark Cuban, Norwest Venture Partners, Financial Solutions Lab, and even Diplo.

Rest of the Best

Here are the rest of the updates hitting radar.

BANKING: Northwestern Mutual unveils “The Great Realization” brand campaign, announces new CMO

INVESTING: GMO Launches Portfolio Construction, Management Platform for RIAs

INVESTING: Liberty Mutual extends brand to E&S delivered via retail brokers

INSTITUTIONAL: Credit Suisse Establishes Qatar Technology & Engineering Hub

INSURTECH: State Farm invests $1.2 billion in ADT

INSURTECH: Ottonova raises €34 million

Shape your Future

Wondering what’s shaping the future of Fintech and DeFi? At the Fintech Blueprint, we go down the rabbit hole in the DeFi and Fintech industries to help you make better investment decisions, innovate, and compete in the industry.

Sign up to the Premium Fintech Blueprint newsletter and get access to:

Blueprint Short Takes

Web3 Short Takes

Long Takes on Fintech and Web3

Digital Wealth

Access to the Podcasts with annotated transcripts

Full Access to the Fintech Blueprint Archive

Read our Disclaimer here — this newsletter does not provide investment advice and represents solely the views and opinions of FINTECH BLUEPRINT LTD.

Want to discuss? Stop by our Discord and reach out here with questions