Blueprint: FTX launches spread trading, catching up to Coinbase; Nigerian fintech TeamApt $50MM; Truework $50MM for income verification

Hi Fintech Futurists —

You are the best, today’s agenda below.

DEFI: Paradigm and FTX Team Up To Launch Crypto Futures Spread Trading (link here)

PAYTECH: QED makes its first African investment, backing Nigerian fintech TeamApt in $50M+ deal (link here)

LENDING: Truework raises $50 million (link here)

Long Take: The creative remains of Facebook Libra -- US CBDC, Silvergate's stables, Mysten, Aptos, 0L Network, and Meta's wallet (link here)

Podcast conversation: Eliminating payday loans and overdraft fees for 2.5MM employees, with Matt Kopko of DailyPay (link here)

Here’s that handy upgrade button to access the Long Takes.

It’s a lucky day to level up your Fintech and DeFi knowledge. Super lucky 🍀 🍀👇

In Partnership:

Applications are open for leading global Web3 accelerator, Outlier Ventures' Polkadot and DeFi Base Camp programs. Base Camp is a 12-week accelerator program where they support early stage startups with the major challenges they face.

The Outlier vision is to empower innovators in web3, and Over 100 startups have leveraged their expertise to grow… Will you be next?

Outlier Ventures offers:

$100,000 cash stipend to cover running costs during the program

Access to Outlier Ventures and their global industry leading network of builders, investors and mentors

Tailored sessions with technical specialists to support design, building, scaling to enable you to succeed in Web3

Short Takes

DEFI: Paradigm and FTX Team Up To Launch Crypto Futures Spread Trading (link here)

Crypto exchange FTX and institutional liquidity platform Paradigm (1,000 clients, $10B+ volume per month) are launching spread trading on FTX — simultaneous purchasing and selling of two related investments to create a net trade with a positive value. Take for example cash-and-carry trading, an arbitrage strategy that exploits mispricing between assets and their corresponding derivatives, such going long while simultaneously shorting a futures or options contract.

Paradigm had previously already integrated with Bybit and Deribet, offering futures spreads since February. Adding more venues like FTX benefits Paradigm, which effectively powers arbitrage activity across exchanges. It is, however, the first instance of Paradigm offering spot trading in the spread. Another benefit for users is that spreads executed on Paradigm and cleared on FTX will be subject to half the fees that a user would typically incur for executing two trades, creating an attractive bundle for arbitrageurs.

FTX has continued growing through the downturn, while Coinbase has been printing $1.1B losses. Of interest is the relative collapse in institutional trading revenue for Coinbase, down 60%, while retail revenues are down 66%. We wonder if Paradigm is seeing any particular pressure to find retail venues for its liquidity products.

We’re also seeing FTX nearing on Coinbase in daily volume — $1.9B for FTX vs $2.2B for Coinbase. This is combination of its operating performance, smart acquisitions and industry level bailouts, and new features (more here).

PAYTECH: QED makes its first African investment, backing Nigerian fintech TeamApt in $50M+ deal (link here)

VC firm QED Investors led a $50MM investment into TeamApt, a Nigerian paytech and banking platform provider. The round was joined by existing investors Novastar Ventures, Lightwrock and BII, who invested in the $30MM+ Series B last year.

TeamApt is one the biggest payments and banking platforms in Nigeria, processing $100B in annualised run-rate transaction value across their two key products: (1) Moniepoint and (2) Monnify. Moniepoint provides 400,000 Nigerian SMBs with business expansion loans, business management tools (i.e accounting and expense management) and working capital. Monnify is the payments tooling layer, providing the infrastructure for users to manage and make payments. TeamApt bootstrapped over the past 4 years and became profitable — last year, the firm generated $100MM+ in annualised revenue.

With the cash injection TeampApt is looking to go deeper into lending, which currently comes from its microfinance bank subsidiary balance sheet. Going forward, the company will develop a set of lending partnerships to have more debt facilities for its customers.

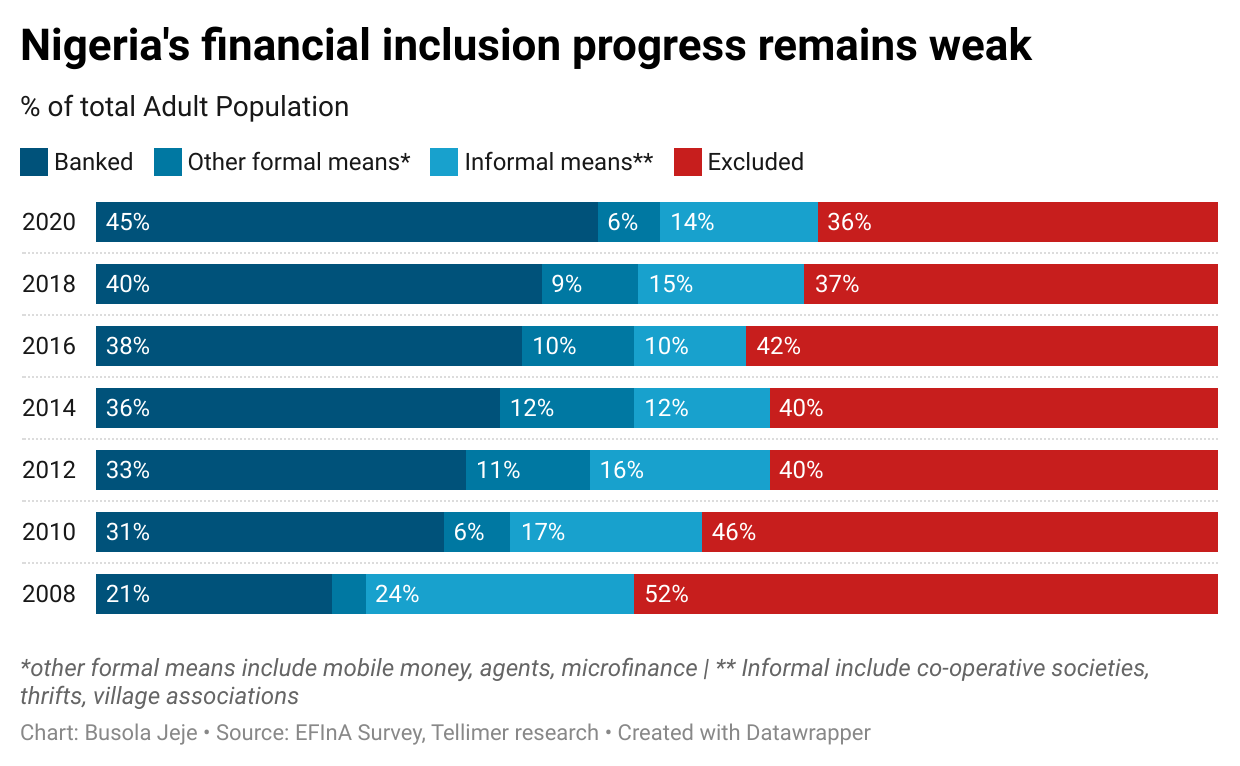

The Nigerian fintech space is quickly maturing as adoption of digital payments becomes more commonplace, with nearly $800B in annualised digital transactions in the first third of the year. We’ve also previously covered Flutterwave, Africa’s biggest fintech, leading paytech infrastructure across the continent. These are fantastic developments. That said, there’s still enormous progress yet to be made in financial inclusion, with 36% of the adult population still excluded from financial services.

LENDING: Truework raises $50 million (link here)

Credit scoring firm Truework, which helps lenders instantly verify income and employment of borrowers, has brought in $50MM in Series C funding. The round was led by G Squared and joined by Sequoia Capital, Indeed, and others. Truework integrates with a range of payroll providers, like Gusto and Zenefits, to provide mortgage providers and lenders a means of verifying and approving borrowers quickly using Truework’s APIs.

Consumer borrowing in the US is on the rise with borrowing jumping by over $40B in June. Maybe the unusually high inflation and lack of savings for most Americans has something to do with it. With increased borrowing comes increased demand for quick income and employment verification, highlighting the growing need for Truework’s product in the market.

However, the income verification space is becoming increasingly saturated. Pinwheel raised $50MM in January (listen to our podcast with Pinwheel here), and Argyle brought in $55MM in March. Lenders are likely interested in optimising their approval process as credit starts flowing again. That said, we wonder whether this is a winner-take-all market, or whether multiple providers can survive.

Long Take: The creative remains of Facebook Libra -- US CBDC, Silvergate's stables, Mysten, Aptos, 0L Network, and Meta's wallet (link here)

Facebook’s Libra had big goals, but flamed out after pressure from regulators and the dissolution of its consortium. What is the impact of that experiment today? What remains?

We look at several outcomes, including the CBDC efforts in the US, and Silvergate’s acquisition of the technology and its stablecoin goals to compete with Circle. We also review the three major blockchain efforts in the Move ecosystem, Move being the proprietary programming language for the Diem chain. Last, we points to Meta’s continued interest in Web3 worlds and crypto wallets. Perhaps not a failure after all.

Podcast conversation: Combining AI and DeFi to underwrite Web3 risks, with RociFi Co-Founder Chris Brookins (link here)

In this conversation, we chat with Chris Brookins — co-founder of RociFi, a new DeFi primitive for under-collateralized lending.

Chris is a crypto veteran, having entered the space in 2014, and prior to RociFi, founded Valiendero Digital Assets, a quantitative cryptocurrency investment fund, founded out of Carnegie Mellon University. Valiendero utilized machine learning and data-driven investment strategies over a variety of liquid digital assets.

Rest of the Best

Here are the rest of the updates hitting radar.

PAYTECH: Finix raises $30 million as fintech’s spotlight picks its sides

NEOBANK: SoftBank sells 12 million SoFi shares to ‘dramatically’ cut costs

NEOBANK: Grasshopper raises $30.4 million

WEALTHTECH: Farther, a wealth tech firm, banks $15M Series A as valuation hits $50M

INVESTING: Syfe Officially Launches in Australia, Offers Digital Brokerage Services

DIGITAL LENDING: ‘Selling Sunset’ star Christine Quinn’s brokerage debuts new crypto credit scoring platform

EMBEDDED FINANCE: UK fintech Griffin lands £12.5m in latest funding round

Shape your Future

Wondering what’s shaping the future of Fintech and DeFi?

At the Fintech Blueprint, we go down the rabbit hole in the DeFi and Fintech industries to help you make better investment decisions, innovate, and compete in the industry.

Sign up to the Premium Fintech Blueprint newsletter and get access to:

Blueprint Short Takes

Web3 Short Takes

Long Takes on Fintech and Web3

Digital Wealth

Access to the Podcasts with annotated transcripts

Full Access to the Fintech Blueprint Archive

Read our Disclaimer here — this newsletter does not provide investment advice and represents solely the views and opinions of FINTECH BLUEPRINT LTD.

Want to discuss? Stop by our Discord and reach out here with questions