Blueprint: Sardine's $52MM a16z round to fight payments fraud; Messari gets $35MM for honest crypto data; $50MM for values-based investment platform Ethic

Hi Fintech Futurists —

You are the best, today’s agenda below.

SECURITY: Sardine raises $51.5M led by a16z to sniff out fishy fintech transactions (link here)

CRYPTO: Messari raises $35M to expand ‘Bloomberg of crypto’ ambitions (link here)

INVESTING: Advisor-Focused Investment Platform Ethic Raises $50 Million (link here)

LONG TAKE: The evolution of embedded finance to $7T in flows, and the OCC's mandate to derisk it (link here)

PODCAST: Transforming art, private equity, and securities into tokenized assets on chain, with Securitize's CEO Carlos Domingo (link here)

Here’s that handy upgrade button to access the Long Takes — a rigorous view on the future of our industry. Level up your Fintech and DeFi knowledge. 👇👇👇

In Partnership:

Only 4 days left to get an Early Bird ticket to Fintech’s only tech-enabled event. Join Fintech Meetup on March 19-22, 2023 at Aria, Las Vegas for amazing speakers (see partial list here), exhibit hall, receptions, and more… They facilitate over 30,000 onsite meetings with technology that works.

Short Takes

SECURITY: Sardine raises $51.5M led by a16z to sniff out fishy fintech transactions (link here)

Fintech-focused anti-fraud platform Sardine has closed a $51.5MM Series B round, a meaningful increase after February’s $19.5MM Series A. The round saw participation from leading Web3 players like a16z, ConsenSys, Uniswap Labs, as well as Visa, Google Ventures and other VCs. The startup uses a range of behavioral, financial, and device-specific user data to help fintech and crypto clients identify fraudulent activity and remove it from payments flows.

Sardine stands-out for a couple of reasons. First, a meaningful amount of the fraud that the platform detects are people who had previously passed KYC. It is able to do this by combining fraud detection functionality with identity detection capabilities by looking at behavioural biometric data and device intelligence, e.g., how you move your mouse. The metrics assessed range from whether a user is using a prepaid phone, how many transactions they have made, to whether they are using a throwaway email domain.

Second, Web3 companies in particular like the instant ACH and credit card onramp for purchasing crypto assets, as compared to waiting several days to access funds. Sardine also offers direct fiat to NFT checkout within NFT platform Autograph, reducing friction for retail investors, with a conversion rate of 98%, up from around 50%. This works because Sardine takes on the fraud risk, thereby putting capital to work behind its algorithms, which shows the amount of conviction behind the software. Socure is the biggest competitor in the space, and was valued at $4.5B in their Series D last November. You can check out our podcast with Sardine’s Simon Taylor here, and more to come!

CRYPTO: Messari raises $35M to expand ‘Bloomberg of crypto’ ambitions (link here)

Crypto data firm Messari has raised a $35MM Series B, a bump from its $21MM Series A last year. The new round will fund new products that will allow investors to compare tokens across multiple networks, as well as to create custom data sets. This sets up the foundations for a GAAP equivalent of standardised reporting in crypto, which has been one of Messari’s key ambitions since its founding around the ICO era.

Messari is positioned as the Bloomberg of crypto assets, providing investors with reports and data insights into the ecosystem, and trying to uncover metrics that are often gamed by industry participants (e.g., diluted market caps, real exchange volume). And whereas a regulator like the SEC requires public companies to file financial data, Messari is able to pull much of it onchain.

Currently Messari makes revenue through two streams: (1) subscription services for investors using research and data and (2) by compiling and packaging protocol data and charging the underlying blockchains for it. For context, Bloomberg last reported revenue of $11B in 2021, although it is of course playing in a much larger market. Publicly traded company Thomson Reuters has a $70B marketcap, whereas ICE bought Interactive Data for about $5B, which gives us a target range if the crypto asset class glows up.

Referral Program Reminder

Let’s make everyone’s Monday better by sharing the Fintech Blueprint newsletter with colleagues, friends and relatives. If you drive sign-ups , we will return the favor by giving you the following:

Refer 2 people - Get your social media profile, a company, a startup, a job posting (or any other link) featured in an edition of the newsletter with a link

Refer 10 people - get a 30-day FREE Fintech Blueprint trial + lifetime exclusive access to Lex’s fintech research library for an email of your choice, composed of high quality in-depth research reports from top-tier institutions

Refer 35 people - get a 90-day FREE Fintech Blueprint trial + if you are among the top 3 referral sources, a 30-min “Business Vision Call” with Lex.

Beware that your invites need to accept the invitation and subscribe to the free version of the Fintech Blueprint newsletter by 30 September. Make sure that you’re logged in and click the ‘Share’ button below! Happy sharing ✌️

INVESTING: Advisor-Focused Investment Platform Ethic Raises $50 Million (link here)

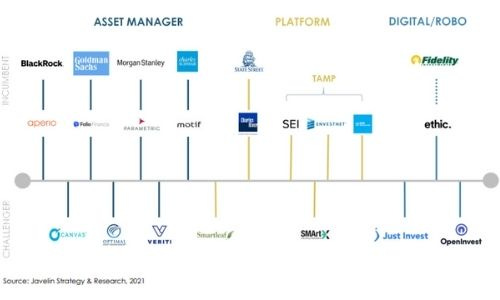

Ethic, a direct indexing platform, has raised $50MM in Series C funding. The platform helps investors to set up custom, values-based portfolios with a focus on ESG data and socially responsible investments. It currently helps financial advisors manage over $2B in AUM, up from $1B in April when it raised a $29MM Series B. And if the name seems familiar, it might be because the platform touts Prince Harry and Meghan, Duchess of Sussex, as investors and “impact partners”.

Ethic remains one of the last independent firms in the space, with competitors like Veriti Management being snapped up this summer. These companies have been particularly popular due to their bespoke investing experience and focus on ESG, whose funds have grown at twice the rate as funds without ESG over the past year. All in spite of Texas’ and other states recent clampdown on ESG.

Ethic also operates as a subavisor to RIA firms, enabling their users to access Ethic’s services via their custodial platforms. As an example, advisors can access Ethic through the Fidelity Separate Account Network. This allows RIA firms to boost their offering without detracting from their brand name, whilst Ethic get to grow their share of users. It also helps that the platform integrates a digital interface with drop-down menus and sliders to make it easy for investment firms and their clients to use the service as well.

That said, we are still somewhat surprised that B2B digital investing firms are raising large checks on small-ish AUM given the challenges roboadvisors had in exiting (e.g., valued at 10%+ of AUM).

Long Take: The evolution of embedded finance to $7T in flows, and the OCC's mandate to derisk it (link here)

We look at the Bain Capital report about embedded finance growing to $7T in flows by 2026, and the recent OCC moves to regulate the evolution of fintech and crypto banking.

This jumping off point helps us understand the process by which new things become popular, gain a mandate, and then cause an opposite reaction from their counter forces. We also touch on the SEC looking to gain jurisdiction over ETH post Merge, the White House working on a digital asset framework, and the OCC’s blocking of stablecoin based banking.

Podcast conversation: Transforming art, private equity, and securities into tokenized assets on chain, with Securitize's CEO Carlos Domingo (link here)

In this conversation, we chat with Carlos Domingo, is a senior executive, entrepreneur, investor, and currently the CEO and Co-Founder of Securitize, Inc. Carlos has 25+ years of experience in innovation and digital transformation.

Before becoming the CEO of Securitize, Carlos co-founded and launched SPiCE VC, a fully tokenized VC fund. In order to ensure global compliance for SPiCE VC, Carlos and his team created the security token issuance and lifecycle management platform that would later become Securitize, Inc.

Rest of the Best

Here are the rest of the updates hitting radar.

BANKING: Finastra and Visa introduce global BaaS offering integrating Visa Direct

BANKING: For Brazilian shareholders, Nubank’s IPO has a bitter aftertaste

WEALTHTECH: Wealth-tech platform Centricity raises $4 million in pre-seed round

INSURANCE: AIG’s Corebridge raises $1.68 billion in IPO

INSURTECH: Bamboo completes $16 million raise

INSURTECH: Acrisure acquires B2Z Insurance

AI: Brightflow AI aims to spotlight small business cash flow

Shape your Future

Wondering what’s shaping the future of Fintech and DeFi? At the Fintech Blueprint, we go down the rabbit hole in the DeFi and Fintech industries to help you make better investment decisions, innovate, and compete in the industry.

Sign up to the Premium Fintech Blueprint newsletter and get access to:

Blueprint Short Takes

Web3 Short Takes

Long Takes on Fintech and Web3

Digital Wealth

Access to the Podcasts with annotated transcripts

Full Access to the Fintech Blueprint Archive

Read our Disclaimer here — this newsletter does not provide investment advice and represents solely the views and opinions of FINTECH BLUEPRINT LTD.

Want to discuss? Stop by our Discord and reach out here with questions

I am intrested to,know !

Assaf,Rosenkrantz!