Blueprint: Web3 infra QuickNode raises $60MM @ $800MM; Stripe needs to go public; Moody’s rates 20 stablecoins

Everyone is launching a token, maybe never

Hi Fintech Futurists —

You are the best, today’s agenda below.

WEB3: QuickNode Raises $60MM in Series B at $800MM Valuation (link here)

PAYTECH: Stripe eyes an exit over next 12 months (link here)

CRYPTO: Moody’s Is Working on Scoring System for Crypto Stablecoins (link here)

LONG TAKE: What do Jamie Dimon and Yifan He (Red Date Tech) accuse of being a Ponzi, and Why? (link here)

PODCAST CONVERSATION: Powering the AI revolution from DeepDream to Dall-E, with Lambda Labs CEO Stephen Balaban (link here)

Here’s that handy upgrade button to access the Long Takes — a rigorous view on the future of our industry. Level up your Fintech and DeFi knowledge. 👇👇👇

PS. We are working on a survey to send out this week, which will give free subscribers a chance to win premium access. Stay tuned!

In Partnership

Fintech Meetup Ticket Prices Increase Friday at Midnight. Don’t miss these savings for Q1’s big new Fintech event. Join 3,000+ Attendees from 750+ Companies from across the fintech and payments ecosystem for 30,000+ double opt-in Meetings. Learn from 250+ speakers (full list here), and have fun at receptions and at the Industry Night event.

Short Takes

WEB3: QuickNode Raises $60MM in Series B at $800MM Valuation (link here)

QuickNode, a Web3 end-to-end development platform, has raised $60MM at an $800MM valuation from 10T Holdings, Tiger Capital, and others. The platform provides Web3 developers tools, like API kits and analytics, for over 16 blockchains and 33 networks — (1) the core API can be used to manage blockchain forks and upgrades, (2) the NFT API provides developers with visibility into NFTs and their underlying metadata, (3) the Token API supports finding token data. The positioning is to create a toolset to make onboarding to Web3 easy for Web2 developers.

The firm last raised a $35MM Series A a year ago, and has since grown the user base by over 400% and making 90 new hires. Notably, this a significant up-round, despite crypto-related investment volume and valuations dropping considerably over the last 6 months. In Q4 2022, firms in the space raised $2.7B in 366 deals, declining over 50% compared to Q3 2022.

The roadmap includes plans to “decentralise” the platform by end of year, hinting at the tokenisation of its product. This may have acted as an incentive for investors in QuickNode, given tokens would be a new source of capital and liquidity. However, it is hard to do this without sacrificing security or uptime for the platform itself. Other competitors, like Infura, have also been discussing decentralization, and Pokt Network is already decentralized. Alchemy is yet to announce a plan.

Tokenisation can be a method of adding significant value to the balance sheet, particularly if designed with real utility and community ownership. But if done incorrectly, it makes the product more costly, less efficient, and higher friction. We have also seen companies hinting at token launches for years without actually going live, perhaps attract activity from airdrop farmers but waiting out the legal uncertainty.

👑 Related Coverage 👑

PAYTECH: Stripe eyes an exit over next 12 months (link here)

Payments fintech Stripe is looking to go public within the next 12 months. The fintech plans to go public via a direct listing or a private market transaction, such as a fundraising event or tender offer. From a financial perspective, Stripe had gross revenues of $12B in 2021 and is EBITDA profitable. Also, like, it’s Stripe.

The company provides payments services for both physical and online retailers, helping to power subscription services, software platforms, and marketplaces. Last valued at $95B after raising $600MM in March 2021, Stripe is now attempting to raise $2B at a valuation of between $55-60B, with its internal valuation having been cut to $63B in the market downturn. This is a further drop on its last valuation six months ago of $74B. As evidence of this contraction, the fintech also recently laid off 14% of its staff (1,120 people) in November.

While the significantly lower valuation is far from positive, it is in line with the rest of the industry. BNPL provider Klarna’s valuation dropped by 85% last year when raising at a $6.7B valuation, down from $45.6B in June 2021. Partner and competitor Plaid also laid off 20% of its workforce in December. Supply of fintech fundraising has slowed down, but demand from fintechs is still sky-high given cost structure and growth ambition. The correction is likely a long term improvement for the industry, aligning valuations to profits and better unit economics.

👑 Related Coverage 👑

Interested in Sponsorship?

To support the Fintech Blueprint and reach our 150,000+ Substack and LinkedIn audience of builders and investors, learn more below or contact us here.

CRYPTO: Moody’s Is Working on Scoring System for Crypto Stablecoins (link here)

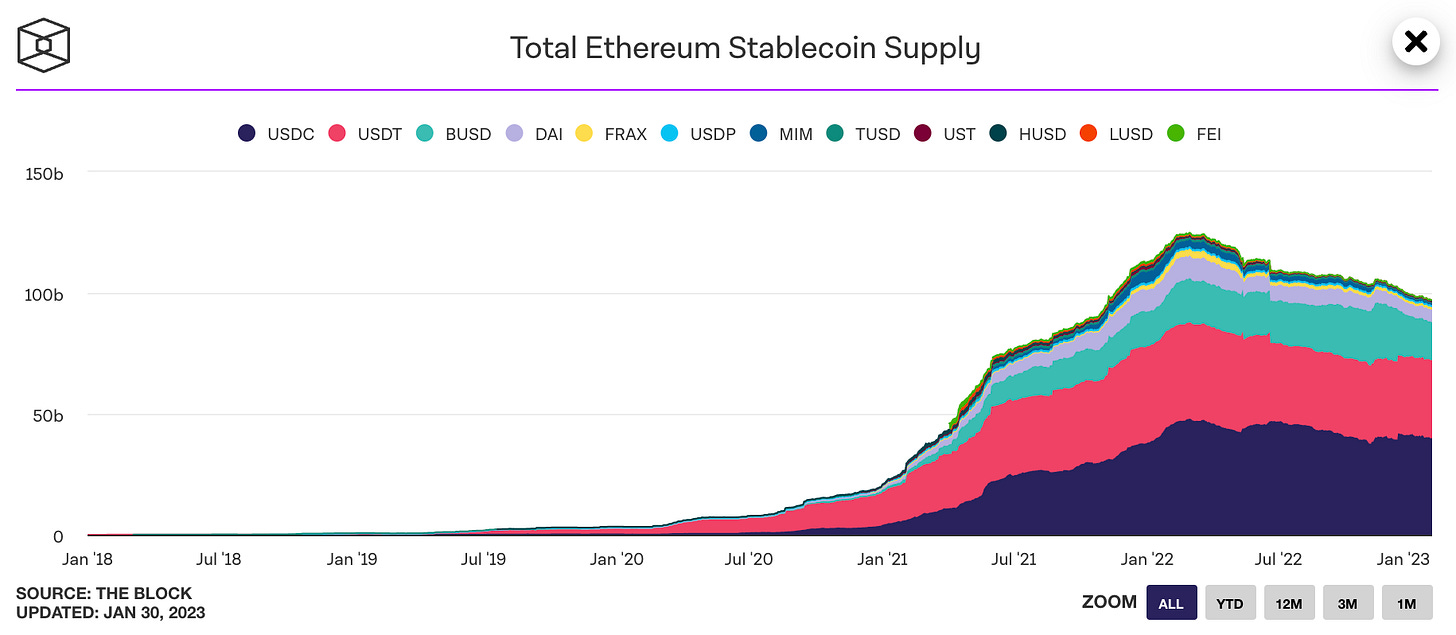

Moody’s, a credit rating provider for bonds in financial markets, is working on a scoring system for Stablecoins, or tokenized cash equivalents pegged to fiat currency. An initial 20 stablecoins will be analysed, assessing the quality of attestations of their underlying reserves. For context, the marketcap of stablecoins is about $100B, down from a $125B peak.

Moody’s already provides credit ratings for publicly traded crypto companies, such as Coinbase, and has a research arm analysing the sector at large. The main benefit is to provide users with a clear understanding of the risks associated with stablecoins, which can be designed in myriad ways.

For example, stablecoins are most popularly collateralized by the fiat currency they represent (typically USD in the form of short-dated US Treasury Bills). However, they can also be backed by cryptocurrencies, as is the case with MakerDAO’s DAI, or commodities, such as gold in the case of Paxos’ PAXG. For more information on the varying mechanisms, we highly recommend this article from ConsenSys. Reserve attestations tend to be published on a monthly or quarterly basis, as confirmed by a third-party audit firm.

Stablecoins have been under fire from regulators for a while now, since they are representing the sovereign currency in another form. Tether was fined in 2021 in regards to its reserves for stablecoin USDT, with $67B in circulation. Luna’s algorithmic stablecoin UST depegging led to its collapse and the loss of millions in user funds. Even so, the concept for financial institutions and investors remains appealing as a way to reduce volatility of token holdings and as a means of interacting with blockchain technologies. JPMC even released its JPM Coin for internal payments in 2019. We think ratings could help establish deeper legitimacy for crypto’s most traded tokens, with stablecoin volume at $7.4T in 2022.

👑 Related Coverage 👑

Long Take: What do Jamie Dimon and Yifan He (Red Date Tech) accuse of being a Ponzi, and Why? (link here)

The top banker in the US and the person managing the build out of China’s Blockchain Services Network are both in the news calling Bitcoin a Ponzi scheme.

We don’t like it. So we spend some time addressing the rhetorical point — answering the Marxian criticism about the lack of labor, and the Capitalist criticism about the lack of value. We also highlight the launch of the Universal Digital Payments Network from Red Date, and the work of JP Morgan Onyx — both of whom rely on variations of the Ethereum codebase.

Podcast Conversation: Powering the AI revolution from DeepDream to Dall-E, with Lambda Labs CEO Stephen Balaban (link here)

In this conversation, we chat with Stephen Balaban, the co-founder and CEO of Lambda. Lambda provides GPU servers, workstations and cloud services for training neural networks. Lambda customers include Apple, Tencent, Intel, Microsoft, Harvard, Princeton, Stanford, and the U.S. Federal Government.

Prior to Lambda, Stephen was the first engineering hire at Perceptio, a machine learning company acquired by Apple that created facial recognition networks that ran locally on mobile phone GPUs.

Rest of the Best

Here are the rest of the updates hitting radar.

PAYTECH - PhonePe will invest more in insurance after raising $350 million

WEALTHTECH - J.P. Morgan Asset Management Expands in China

PAYTECH - Caura raises £4 million

ROBOADVISOR - FinTech Company Sidepocket To Launch in February 2023

INSTITUTIONAL - Nav acquires Nuula

REGTECH - Corlytics Buys ING Regulatory Technology Platform SparQ

INSURTECH - CLARK acquires Anorak

INSTITUTIONAL - Nasdaq Ventures Leads Financing in Due Diligence Platform

AI - European banks struggle with AI, while US banks lead the field, according to a new index

Shape your Future

Wondering what’s shaping the future of Fintech and DeFi? At the Fintech Blueprint, we go down the rabbit hole in the DeFi and Fintech industries to help you make better investment decisions, innovate, and compete in the industry.

Read our Disclaimer here — this newsletter does not provide investment advice and represents solely the views and opinions of FINTECH BLUEPRINT LTD.

Want to discuss? Stop by our Discord and reach out here with questions