DeFi: $225MM raise for Monad, Ethereum competitor with parallel execution

And $100MM for Berachain. What's going on?

Today we highlight the following:

PROTOCOLS: Alternative Layer-1 Monad raises $225MM before launching its testnet

CURATED UPDATES: Financial Institutions and Adoption; DeFi and Digital Assets; Blockchain Protocols; NFTs, DAOs and the Metaverse

To support this writing and access our full archive of newsletters, analyses, and guides to building in Fintech & DeFi, subscribe below (if you haven’t yet). We just adjusted the price to $12/mo.

PROTOCOLS: Alternative Layer-1 Monad raises $225MM before launching its testnet

There continues to be a gold rush for performant computational blockchains. And why not — the payoff could be hundreds of billions of dollars.

What makes them performant? Speed, scalability, and the ability to process complicated computations. If we are in the Nintendo version of the world today, Super Nintendo and Playstation are just around the corner. To that end, Monad has raised $225 million and Berachain has raised $100 million in capital. These are ridiculously large fund-raises for what are essentially pre-product market fit infrastructures. But we leave the venture capital dynamics discussion creating these valuations to another time.

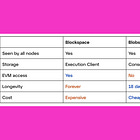

Monad is a Layer 1 blockchain claiming the ability to process 10,000 transactions per second (TPS). This is a material increase on Ethereum’s 15 TPS, or 55 TPS when considering L2 transactions, and even Solana’s 4,000 TPS — all while maintaining a technical design similar to Ethereum. It features a decentralized validator set and is EMV-compatible, supporting and executing smart contracts and applications developed for the Ethereum Virtual Machine. This means that users can use the same wallets, like MetaMask, and block explorers, like Etherscan, to sign or view transactions. Applications can be ported over to Monad without any code changes and the address space is the same as on Ethereum, enabling users to reuse their existing keys.

At the crux of Monad’s performance are (1) parallel execution and (2) superscalar pipelining. Parallel execution is the ability to process multiple transactions simultaneously, rather than sequentially. This is significant because traditional blockchain operations process transactions one at a time, which can lead to bottlenecks and slow confirmation times during periods of network load. Parallel execution ensures that transactions that do not depend on each other's outcomes can be processed in parallel.

Superscalar pipelining is where work is staged so that it can be executed in parallel. Take for instance the four stages of doing laundry: (1) wash, (2) dry, (3) fold and (4) store. The basic logic here is that once you have washed the first load of laundry and put it in the drier, you can start washing the following batch, rather than waiting for all four stages to complete. This makes pipelining more efficient as it uses multiple resources simultaneously. For Monad, this concept is applied across four main areas: MonadBFT (consensus), Deferred Execution (consensus), Parallel Execution (execution) and MonadDb (execution).

But why do we need to scale TPS? Currently, 96% of all DeFi capital is in EVM dapps, yet Ethereum roll-ups are only capable of doing around 55 TPS. A single app with 1 million daily active users, each performing 10 transactions a day, would require a TPS of 100 for that app alone. If blockchain-based applications continue towards mainstream success, the user experience will suffer profoundly. Unlike L2s, which primarily create new venues for transactions, Monad claims to use the EVM without inheriting Ethereum’s throughput bottlenecks.

Beyond the tech, Monad’s community and memetic energy have contributed to the hype. One marketing tactic is an exclusive Telegram group, capped at 1,000 of the most active community contributors — culled and replenished daily. Those in the group are first to receive updates, early testing access, exclusive airdrops from Monad partners, and, perhaps, eligibility for the Monad airdrop itself. The result is an army of , ambitious, hardworking contributors working for free, many of which will be Web3 key opinion leaders (KOLs), marketing the chain. Anyone can also use Monad’s meme generator to have some fun while promoting the brand.

Once Monad is live, the challenge will be attracting top dApps, particularly now that L2 transactions are cheap enough for most users following EIP-4844’s implementation. Ethereum is also working towards its roadmap goal of achieving 100,000 TPS on L2s through sharding, although this milestone is still years out. The question is whether we will see demand for such TPS before Etherum is able to effectively scale. Clearly, some VCs think we will.

We mentioned Berachain, another novel L1 built using CosmosSDK, also raised $100MM this past week. Its core feature is exactly the incentivization for builders to switch ecosystems with the concept of Proof-of-Liquidity. First, users stake a selection of tokens (e.g., BTC, ETH, stablecoins) to a validator. Then, validators can direct a portion of block rewards to applications building on the chain, including them in the financial upside. This innovative ecosystem growth model has already attracted over 200 apps to commit to building on the chain. Whether such financial games can outpace Ethereum’s network effects we leave as food for thought for the reader.

👑 Related Coverage 👑

Long Take: Can the SEC take down Uniswap, and all of DeFi with it?

In this article, we discuss the recent regulatory actions faced by Uniswap from the SEC. Despite these challenges, the DeFi ecosystem continues to grow, with over 1.3 billion addresses and daily active users increasing from 5 million to nearly 8 million. Financial activity in DeFi has also seen a resurgence, with cash equivalents growing to $150 billion and DeFi assets topping $100 billion, partly due to significant staking activities.

Uniswap, a cornerstone of the DeFi infrastructure facilitating over $2 trillion in cumulative volume and generating $500-$1B in annual fees for users, exemplifies the sector's potential for innovation and disruption. The article also touches on legal arguments surrounding the SEC's attempts to regulate DeFi, as well as providing comparisons to the performance of Coinbase and Virtu.

Curated Updates

Here are the rest of the updates hitting our radar.

Financial Institutions and Adoption

⭐ BlackRock Creates Tokenized Asset Fund, SEC Filing Shows - Decrypt

Galaxy Digital to launch $100 million fund for early-stage crypto companies - The Block

Auradine Raises $80 Million in Oversubscribed Series B Financing and Achieves $80 Million in Bookings - Globe Newswire

XION RAISES $25M TO MAKE CRYPTO DISAPPEAR - Burnt

TradFi firms now prefer public blockchains: Ex-Grayscale exec - CoinTelegraph

Game-changing Telegram trading bot, Bitbot reaches $2M mark in presale - CoinTelegraph

DeFi and Digital Assets

⭐ Ethena Just Launched to a $1.2 Billion Market Cap—Here’s What You Need to Know - Decrypt

⭐ Ethereum Giant Uniswap Is Getting Hit With an SEC Lawsuit, Company Warns - Decrypt

MakerDAO raises debt ceiling to $1 billion for Dai allocations in Ethena's stablecoin markets on Morpho - The Block

Ethena Labs adds bitcoin as USDe backing asset - The Block

Blockchain Protocols

⭐ Wormhole Debuts at $3B Valuation in 617M Token Airdrop - CoinDesk

a16z Crypto releases Jolt 'zkVM' to help scale chains with ZK proofs - The Block

peaq raises $15 million in pre-launch funding - Peaq

0G Labs launches with whopping $35M pre-seed to build a modular AI blockchain - TechCrunch

Succinct Labs Raises $55M to Propel Zero-Knowledge Proofs Into Mainstream Development - Bitcoin.com

Espresso Systems Raises $32M to Bring Scaling and Privacy to Web 3 - Coindesk

Merlin Chain sets new standard for blockchain security and innovation with State-of-the-Art chain architecture - CoinTelegraph

How Solana developers are tackling network congestion challenges - CoinTelegraph

NFTs, DAOs and the Metaverse

⭐ Binance ends support for Bitcoin Ordinals - CoinTelegraph

Pharrell, Lil Wayne to Headline Doodles NFT Animated Film - R\Scene

Wu-Tang Rapper Ghostface Killah Reveals Free Bitcoin Ordinals Mint - R\Scene

Bitcoin Layer-2 Social Network Offers Rewards for 'Touching Grass' in NFT Game - Decrypt

🚀 Level Up

Sign up to the Premium Fintech Blueprint and in addition to receiving our free newsletters, get access to:

Long Takes with a deep, comprehensive analysis.

‘Building Company Playbook’ series, offering insider tips and advice on constructing successful fintech ventures.

Special Reports

Archive Access to an array of in-depth write-ups covering the hottest fintech and DeFi companies.

Join our Premium community and receive all the Fintech and Web3 intelligence you need to level up your career.