DeFi: Ethereum L2 fees fall 90%+ as Dencun upgrade hits Optimism, Base & Zora

It's time for "The Surge"

Today we highlight the following:

PROTOCOLS: Dencun Goes Live and L2 Fees Plummet

CURATED UPDATES: Financial Institutions and Adoption; DeFi and Digital Assets; Blockchain Protocols; NFTs, DAOs and the Metaverse

To support this writing and access our full archive of newsletters, analyses, and guides to building in the Fintech & DeFi industries, subscribe below.

PROTOCOLS: Dencun Goes Live and L2 Fees Plummet

Ethereum upgrade “Dencun” has gone live after successful trials on Goerli and Sepolia testnets since January.

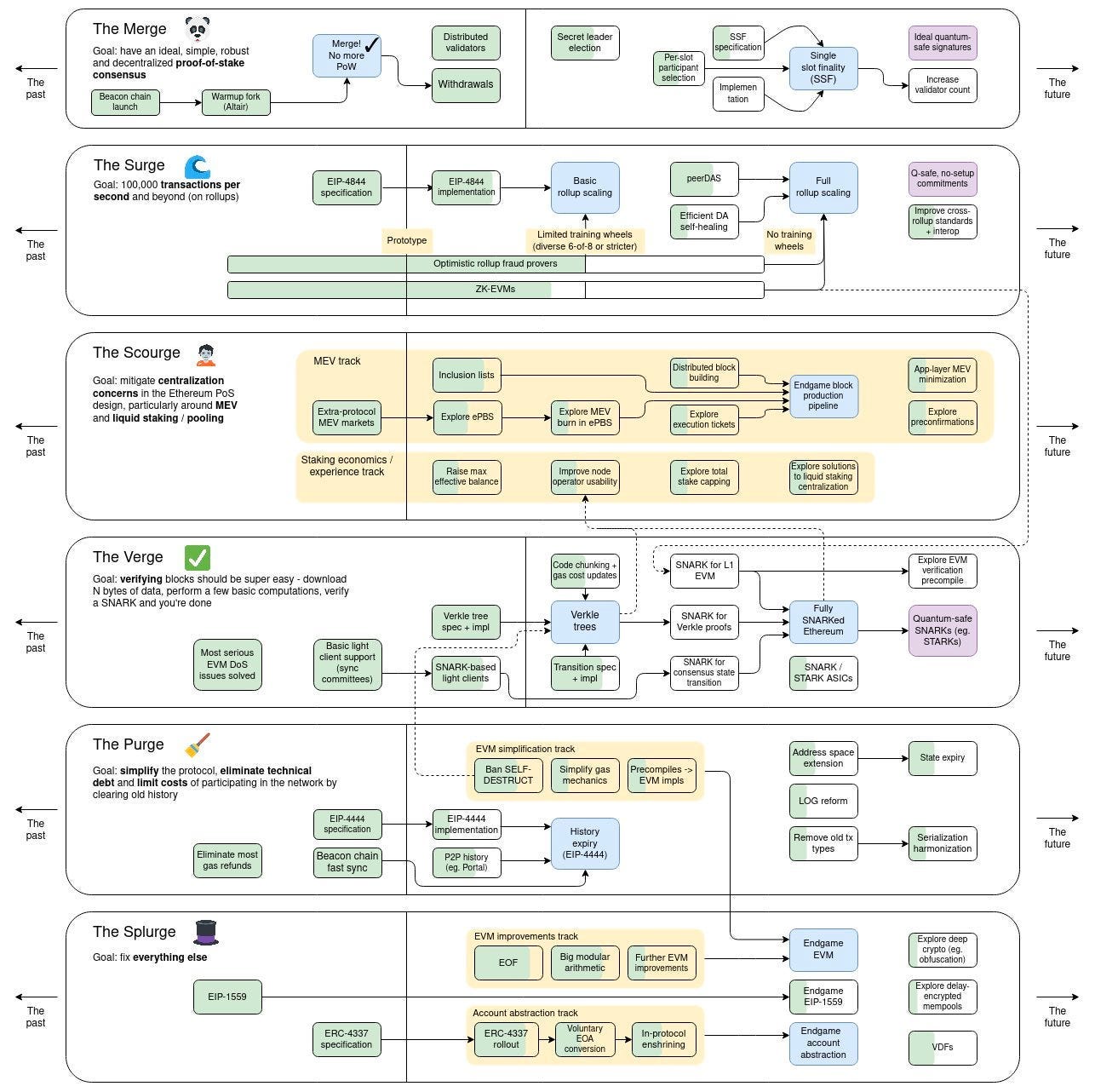

Dencun is a significant Ethereum upgrade composed of several Ethereum Improvement Proposals (EIPs) - EIP-4844, EIP-1153, EIP-4788, EIP-7044, EIP-7045, EIP-5656, and EIP-6780. Its purpose is to reduce the cost of transaction fees on Layer 2 (L2) blockchains operating on top of Ethereum, in line with Vitalik’s rollup-centric roadmap that the Ethereum community has been working towards over the past few years. The ultimate goal is to achieve an Ethereum powered by L2s, where transactions are cheap, fast and capable of hosting applications that can be used at scale by billions of people. Dencun marks the beginning of “The Surge” era in Ethereum’s roadmap, with the goal of achieving 100K transactions per second on rollups.

The most important among these proposals are proto-danksharding, EIP-4844, and transient storage, EIP-1153. Proto-danksharding introduces a “blob-carrying” transaction type. It reduces data transmission costs on Ethereum mainnet by imposing a limit on the size and quantity of “blobs” of transactions per block. This prevents excessive computational and storage demands for Ethereum nodes, as blobs only reference the underlying data. Combined with transient storage, which only allows data storage for the duration of the transaction, the data demands on Ethereum are significantly reduced along with the associated costs.

While significant, Dencun is only one big step in a lengthy Ethereum roadmap. After The Surge, there remains four stages: The Scourge, The Verge, The Purge and The Splurge. The Scourge looks to mitigate issues around Ethereum’s proof-of-stake design, particularly regarding centralisation risks in the form of liquidity staking and MEV extraction. The Verge looks to eliminate the requirement for network validating nodes to have a copy of Ethereum’s entire history of transactions. The Purge looks to remove technical debt and simplify the network, significantly lowering the hard disk requirements for node operators. And finally, The Splurge, will look to address any other issues that could not be fitted into the previous upgrades, if required. At the end of it, Ethereum should be a cheap, highly scalable network with minimal centralisation risks.

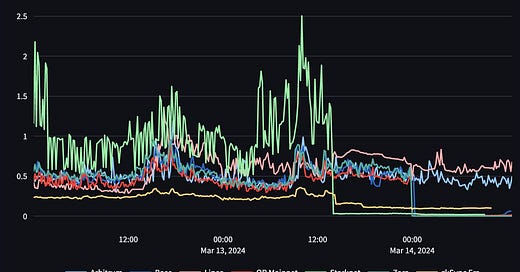

The Dencun upgrade is already reducing fees between 50-99% for the L2s that have adopted it — Arbitrum costs are down 71.5%, Optimism costs are down 96.6% and Zora costs are down 99.6%. Now, transactions are $0.01 on Optimism — a significant leap forward in accelerating the potential for consumer crypto payments. New users have came flocking to L2s, with a record high 4.6MM weekly active users on Ethereum L2s.

The ripple effect of the Dencun upgrade across the ecosystem will be profound. DeFi trading volume has previously been dominated by high value transactions, highlighting how high gas costs have impeded frequent, low-value transactions. Lending and other DeFi protocols may see an influx in adoption as users are able to access financial applications without a significant participatory cost.

However, there are many other burgeoning Web3 applications that will benefit from the upgrade. Gaming is a sector that relies on fast and affordable transactions. With this upgrade, users can participate in game economies without substantial costs for in-game actions like buying items or interacting with the environment. Blockchain supply chain management solutions will be able cheaply track goods while benefiting from the immutability and transparency of Ethereum. Identity management solutions will also become more scalable, enabling widespread decentralised and customisable identity solutions. NFT marketplaces and services will also become more accessible, with NFTs mint costs plummeting ($0.0009 to mint on Zora), ushering in their ubiquity for creative and operational use cases.

Rollups play a crucial role in supporting Ethereum’s transition from a monolithic to a modular blockchain. Monolithic blockchains, like Bitcoin and Solana, offer a tightly integrated set of components designed to work seamlessly within the same framework. Modular blockchains instead look to separate consensus, execution and data storage, enabling these components to be optimised individually. This enables greater customizability of chains, accommodating a broader range of applications whilst maintaining decentralisation and security.

While monolithic blockchains like Solana benefit from its simplicity and security, modular blockchains pave the way for greater scalability, flexibility and upgradeability, and specialisation. Solana’s low fees and speed may have secured it a significant portion of the marketplace in the short-term, but whether it will be able to compete with equally low fees on rollups coupled with increased functionality will be the next test. Ethereum’s roadmap still has a long way to go before all of these benefits are realised at scale. For now, the building must go on.

👑 Related Coverage 👑

Curated Updates

Here are the rest of the updates hitting our radar.

Financial Institutions and Adoption

⭐ Binance quietly spun off $10 billion venture arm Binance Labs - The Block

Is CeDeFiAi the missing link for seamless DeFi and CeFi interaction? Read AMA recap - Coin Telegraph

DeFi and Digital Assets

⭐ EigenLayer teases mainnet's final roadmap before launch - The Block

Maker moves to meet demand for DAI - Blockworks

Defi protocol Mozaic Finance suffers $2.4m heist - crypto.news

Blockchain Protocols

⭐ Metis launches alpha version of its decentralized sequencer - The Block

Eclipse Labs raises $50 million in Series A funding ahead of expected Q2 mainnet - Businesswire

Crypto’s Berachain Becomes Unicorn in $69 Million Funding Round - Bloomberg

Aptos GameStack Eases Crypto Game Development—With Google Cloud's Help - Decrypt

Ethereum Layer-2 Blast Suffers Outage as Dencun Upgrade Goes Live - Decrypt

NFTs, DAOs and the Metaverse

⭐ Starbucks is shutting down its NFT rewards program - Mashable

Arbitrum eyes $400 million crypto gaming fund with proposal to DAO - The Block

Runestone NFTs Lead the Charge in Multi-Chain Marketplace Sales - Bitcoin.com

🚀 Level Up

Sign up to the Premium Fintech Blueprint and in addition to receiving our free newsletters, get access to:

Wednesday’s Long Takes with a deep, comprehensive analysis.

‘Building Company Playbook’ series, offering insider tips and advice on constructing successful fintech ventures.

Enhanced Podcasts with industry leaders, accompanied with annotated transcripts for deeper learning.

Special Reports

Archive Access to an array of in-depth write-ups covering the hottest fintech and DeFi companies.

Join our Premium community and receive all the Fintech and Web3 intelligence you need to level up your career.