DeFi: Account abstraction wallet UniPass gets $7MM; Liquid staking from Ether.Fi using EigenLayer

Account abstraction and Google logins are coming to non-custodial wallets.

The Fintech Blueprint is a newsletter authored by me, Lex Sokolin, and a small group of brilliant researchers who focus on frontier technologies impacting the future of financial services. I am glad you are here. Was this email forwarded to you? You deserve your own:

👉subscribe here.

Gm Fintech Futurists —

Today we highlight the following:

ADOPTION: Account Labs Raises $7.7 Million for New Google-Enabled Crypto Wallet (link here)

DIGITAL ASSETS: Ether.Fi Rolls Out Liquid Staking Token eETH, That Can be Restaked On EigenLayer (link here)

CURATED UPDATES

If you got value from this post, let us know your thoughts! And to recommend new topics and companies for coverage, leave a note below.

ADOPTION: Account Labs Raises $7.7 Million for New Google-Enabled Crypto Wallet (link here)

Account Labs has raised $7.7MM for its non-custodial stablecoin crypto wallet, UniPass, in a round led by Amber Group, MixMarvelDAO Ventures and Qiming Ventures. The wallet offering stands out from competitors with two features. Firstly, it leverages account abstraction to reduce the complexity for end-users and to enable more advanced features, akin to those in online banking. Secondly, it offers one of the easiest onboarding experiences for new users with Google login and balance top-ups with Apple Pay, Mastercard or Visa cards.

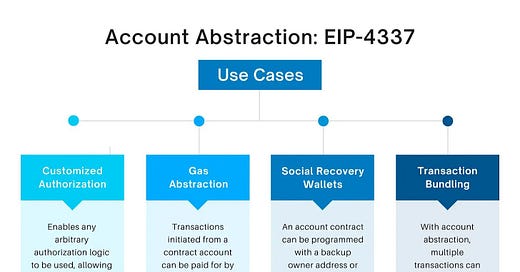

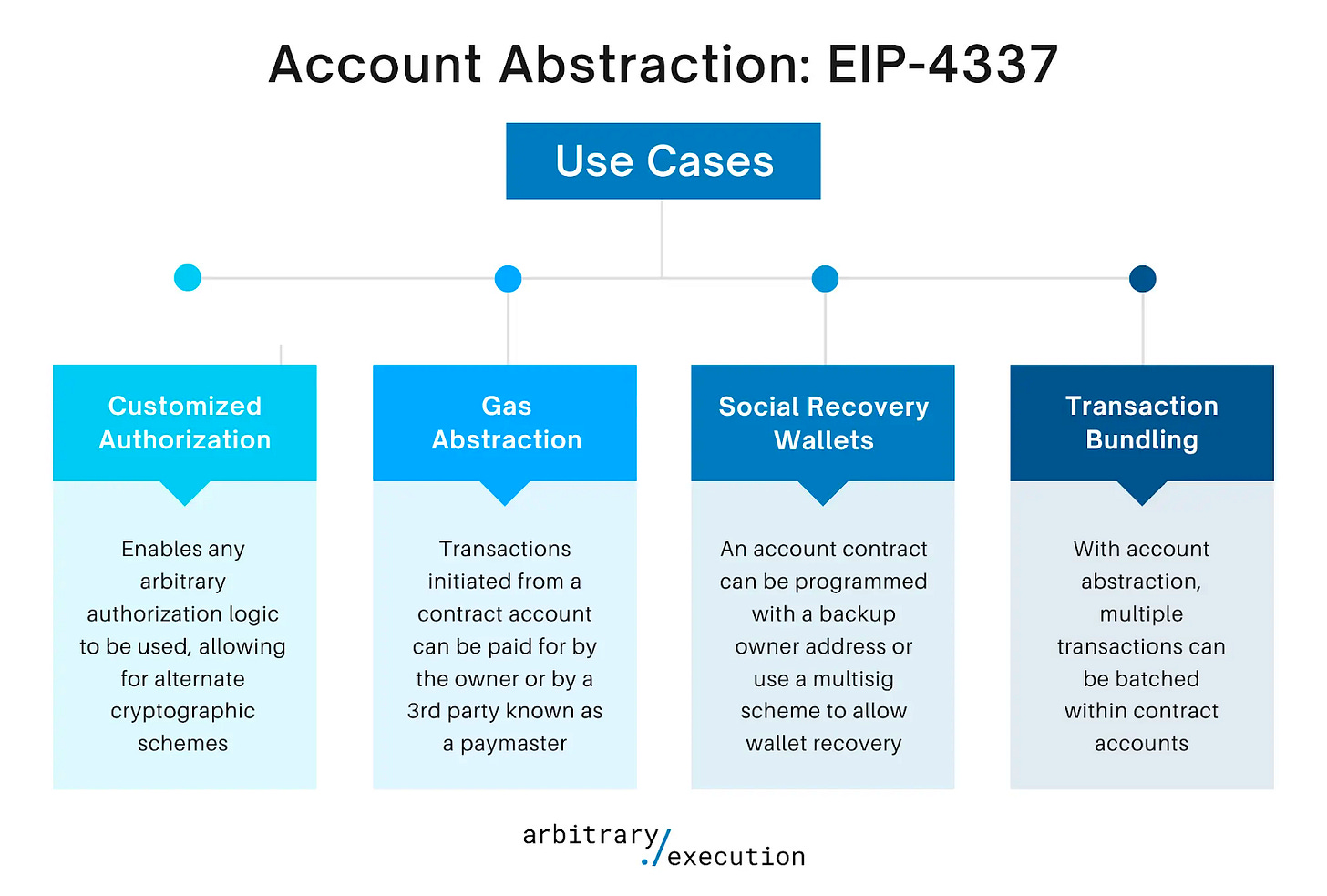

Account abstraction is at the cutting edge of advancements in the non-custodial wallet space. Traditionally, users interact with Ethereum using externally owned accounts (EOAs). EOAs are controlled by private keys and typically involve the generation of a seed phrase. They are limited in how they can interact with Ethereum, requiring each transaction to be performed individually. This poses difficulty when performing batch transactions and requires users to have a balance of ETH to cover gas costs. Account abstraction allows users to flexibly program the security and user experience associated with the account, effectively upgrading EOAs to enable them to initiate a set of EOA transactions before they are processed on Ethereum. The logic is coded into the wallet itself, which is then executed on Ethereum.

By implementing account abstraction, UniPass offers a wallet where users do not need to hold ETH to cover gas costs, nor do they have to safeguard a complex 12-word seed phrase. The wallet abstracts the complexity of making multiple manual transactions when swapping tokens, combining token swap transactions into a single click and allowing stablecoin holdings to be utilized to cover gas. Users can use their stablecoin balances to pay for goods in any token without having to take the risk of holding the associated token. It also enables other social accounts, like Google logins, to be used to set up the wallet. Users leverage Web3 without having to understand or care about the underlying technology.

We are fans of Account Labs' approach as it knocks attracts non-crypto native users, who benefit from a streamlined experience and a familiar login process with Google. Apple ID and other social media logins are soon to be supported as well. Crypto payment acceptance is also on the rise, with Ferrari being the latest blue-chip company to accept tokens and 75% of retailers planning to accept crypto payments within the next year.

Despite the benefits, challenges remain. While there are no KYC measures, accessing a wallet with a social account will be off-putting for some users who are more protective of connecting their identity with their digital wallet. Additionally, if you think there is a risk that your Google account might be compromised, there is the added threat that the perpetrator will now have access to your digital assets as well as your emails, photos, and the many other services connected to your Google account. Despite these risks, we think Google logins are relatively secure and this user-friendly approach is helpful to bring crypto payments to the masses.

👑 Related Coverage 👑

The AFC Policy Summit serves as a pivotal gathering for industry leaders, regulators, academics, and policymakers.

Confirmed speakers include Congressman French Hill, Chairman of the Subcommittee on Digital Assets, Financial Technology & Inclusion, Mark Gould, Chief Payments Executive, Federal Reserve Financial Systems, among many more.

👉Register before 11:59pm October 20 and SAVE 20%!

DIGITAL ASSETS: Ether.Fi Rolls Out Liquid Staking Token eETH, That Can be Restaked On EigenLayer (link here)

Ether.Fi, a non-custodial liquid staking protocol, has launched its liquid staking token, eETH, on Ethereum's Goerli testnet in preparation for its mainnet launch on November 6. The launch coincides with ongoing scrutiny surrounding Lido Finance, the largest liquid staking protocol in terms of TVL, over its refusal to self-limit its staking.

Ether.Fi offers liquid staking, which allows users to earn rewards by validating a network while maintaining the flexibility to invest their locked funds elsewhere. Custodial and centralized exchanges, like Coinbase, offer staking services that consolidate large pools of ETH for multiple validators. Such centralization poses a risk to the network's security, as it creates a concentrated target. Ether.Fi enables users to retain control over Ethereum validator operations, whereby users maintain custody over their assets and interact with other protocols, effectively mitigating counterparty risk.

eETH, the liquid staking derivative offered by Ether.Fi, is an ERC-20 token representing a claim on staked ETH or ETH held in the platform's liquidity pool. Through a rebase mechanism, eETH holders receive an automatic distribution of staking rewards based on their share of the total staked ETH. What sets eETH apart from competitors is its integration with EigenLayer, as staking with eETH on EtherFi automatically restakes on EigenLayer. Think of it as native restaked ETH.

However, in our previous analysis of EigenLayer, we highlighted the potential risks of a rush to farm new tokens using staked ETH, which could expose black swan risks due to inherent rehypothecation. Another concern is Lido's validators controlling 31.54% of the staked Ether's supply. This can lead to cartelization and poses risks to Ethereum and pooled capital, especially when critical consensus thresholds are exceeded.

To address these concerns, Ether.Fi is implementing safeguards in its smart contracts to limit its staking to a maximum of 25% of both the staked Ether's supply and Ethereum's validator headcount. Lido will hold a dominant position for the foreseeable future. However, we anticipate that capital allocators will become increasingly aware of the risks and seek out alternative protocols, leading to a wider distribution of TVL across liquid staking protocols.

That said, there is also risk in the nesting dolls of staking assets, no matter how much we use the word “decentralized”. Sometimes, it is alright to just put money in a bank.

👑 Related Coverage 👑

How to Reach 195,000 Fintech Professionals

With a 35% open rate and 1 million post views per month, we have an engaged audience of Fintech, DeFi, and AI enthusiasts receptive to your messaging.

👉 Contact us to learn more about our custom opportunities.

In Partnership

Mule in the middle: Where all new account fraud, ATO & scam money lands

👉 TODAY at 2pm ET

Financial Institutions of all stripes are grappling with the uptick of money laundering accounts in their portfolio today. All of this bad money often lands into a web of interconnected accounts that are used to launder it.

Join experts from BioCatch and Varo as they discuss:

The common fraud schemes that are in use today

The new-age technology that is effective in protection

The biggest pain points for all banks and fintechs

Curated Updates

Here are the rest of the updates hitting our radar.

Financial Institutions and Adoption

⭐ BitGo Buys Crypto Wealth Management Platform HeightZero - CoinDesk

⭐ EU Formally Agrees On New Crypto Tax Data Sharing Rules - CoinDesk

Trezor Launches Two New Devices To Help Onboard Crypto Newbies - TechCrunch

Ferrari Will Now Accept Crypto Payments For Its Cars in the U.S. - nft now

DeFi and Digital Assets

⭐ Account Labs Raises $7.7MM As FTX’s Demise Leads To Crypto Self-custody Growth - TechCrunch

⭐ Elixir Protocol Secures $7.5MM Series A Funding At $100MM Valuation - The Block

⭐ AI Creator Bot Platform MyShell Raises $5.6MM At $57MM Valuation - InvestingCube

Uniswap To Charge 0.15% Swap Fee On Website And Wallet - The Defiant

Lido Exits Solana Following Community Vote & Lido Faces 20 ETH Slashing Penalty - The Defiant

Coinbase Advanced Offers Perpetual Futures To Non-US Customers - Blockworks

Blockchain Protocols

Scroll Suffers From Weak Adoption One Week After Mainnet Launch - The Defiant

Stellar, Early Blockchain Built For Payments, Adds Smart Contracts To Take On Ethereum - CoinDesk

Ethereum Restaking: Blockchain Innovation Or Dangerous House Of Cards? - Cointelegraph

Manta's Layer-2 Blockchain Already Plans To Ditch OP Stack For Polygon - CoinDesk

NFTs, DAOs and the Metaverse

Yuga Labs CEO Addresses Community Criticism - The Defiant

Open Metaverse Alliance Seeks Universal Standard For Creator Royalties - nft now

Bitcoin Metaverse Token Pre-Sale From ‘Life Beyond’ Team Raises $3.5MM - Decrypt

⭐ Shape your Future

Curious about what is shaping the future of Fintech and DeFi?

At the Fintech Blueprint, we go down the rabbit hole to help you innovate and compete.

Sign up to the Premium Fintech Blueprint newsletter and get access to:

Wednesday’s Long Takes on Fintech and Web3 topics with a deep, comprehensive analysis

Office Hours, monthly digital roundtable discussions with industry insiders

‘Building Company Playbook’ series, offering insider tips and advice on constructing successful fintech ventures

Enhanced Podcasts with industry leaders, accompanied with annotated transcripts

Archive Access to an array of in-depth write-ups, spanning across 15+ topics and encompassing over 50 Fintech and DeFi brands

Read our Disclaimer here — this newsletter does not provide investment advice and represents solely the views and opinions of FINTECH BLUEPRINT LTD.

Contributors: Lex, Laurence, Matt, Farhad, Daniel, Michiel, Bo

Hi

good