DeFi: BlackRock files for Bitcoin ETF testing the SEC; Ethereum restaking goes live with EigenLayer

The layering of the staking rewards cake has begun

Gm Fintech Futurists —

Today we highlight the following:

PROTOCOLS: Ethereum ‘Restaking’ Protocol EigenLayer Launches On Mainnet (link here)

INSTITUTIONAL ADOPTION: BlackRock Joins Ranks Of US Bitcoin ETF Hopefuls (link here)

CURATED UPDATES

To support this writing and access our full archive of newsletters, analyses, and guides to building in the Fintech & DeFi industries, subscribe below.

DeFi Short Takes

INSTITUTIONAL ADOPTION: BlackRock Joins Ranks Of US Bitcoin ETF Hopefuls (link here)

Despite the ongoing persecution of the crypto industry by the SEC, financial incumbents are doubling down on the asset class. Blackrock, the world's largest asset manager with $9.1T in AUM, has filed their plans with the SEC for its iShares Bitcoin Trust. This is not the first time we have seen a Bitcoin ETF application. Many have applied and many have failed — including Bitwise, Invesco, and Grayscale Investments, the latter of which sued the SEC for blocking its bid to convert its Bitcoin Trust into a spot ETF. But none of them have the financial and political power of Blackrock.

Coinbase, which is currently being sued by the SEC for allegedly running an unregistered exchange, is the proposed custodian for the trust. Last August, the two firms worked on connecting Aladdin, Blackrock's investment platform, with Coinbase Prime, Coinbase's full-service prime brokerage platform for executing trades and custodying assets. The partnership gave BlackRock clients access to crypto trading, prime brokerage, reporting capabilities and custody capabilities.

The Bitcoin Trust looks to draw on a bitcoin reference rate from CF Benchmarks, which is owned by another crypto exchange, Kraken. CF Benchmarks collects price data from exchanges to provide accurate spot price tracking. A reminder that Kraken was also a target of the SEC, paying $30MM to settle charges against its staking-as-a-service program, which is a charge also against Coinbase.

The SEC has previously justified blocking the issuance of spot Bitcoin ETFs due to the lack of adequate surveillance compared to trading on registered exchanges, although ironically they have permitted ETFs that invest in Bitcoin futures contracts to come to market. Notably, other countries' regulators have allowed the issuance of ETFs, including Canada, Germany, Brazil, and Dubai. If you would like to revisit our take on the implications of the SEC's position on cryptocurrencies, you can find it here.

Notably, BlackRock CEO Larry Fink has claimed that tokens are "the next generation for markets." Spot Bitcoin ETFs in particular have been consistently seen as an entry point for crypto in ETF markets, which represent ~13% of equity assets in the US. The move from Blackrock also motivated WisdomTree and Invesco to follow up with their own spot Bitcoin ETF applications. ETFs are required for packaging the asset class for traditional distribution — the trillions in asset allocations managed by financial advisors, private banks, and 401(k) providers.

While spot Bitcoin ETFs are not new, having incumbents finally starting to move their weight might be enough to legitimize the instrument. On the exchange side, we see traditional market makers and brokers getting into the space with EDX Markets launching with the backing of Citadel, Fidelity and Charles Schwab. A conspiracy theorist might even argue that the SEC has been clearing the way.

👑Related Coverage👑

PROTOCOLS: Ethereum ‘Restaking’ Protocol EigenLayer Launches On Mainnet (link here)

EigenLayer, a restaking protocol built on Ethereum, has completed the initial stage of its Ethereum mainnet launch. Notably, EigenLayer has secured a $50MM funding round in March led by Blockchain Capital, bringing total funding to $63.5MM.

Ethereum holders can stake their assets for a reward, provided for participating in the proof-of-stake consensus mechanism securing the chain. Other chains, like Polygon, also utilize proof-of-stake, but must build a new community of validators that hold their assets with sufficient decentralization. It is difficult to boostrap interest and financial capital.

EigenLayer has built a protocol around the mechanism of restaking, which allows the usage of staked ETH as staking collateral in other systems. This allows a single user to use the same capital to “secure” two or more networks simultaneously. This generates faster security generation, by using existing market participants, at the cost of leverage and cross-protocol risk. A new network does not have to create demand for its own token to spin up its network (e.g., below an AVS is an actively validated service).

Ethereum validators can opt into additional yield by restaking their ETH to secure additional networks that use EigenLayer through an open marketplace on the platform.Validators are incentivized to restake, but take on increased risks — for example slashing penalties that could cascade across networks — in attempting to secure yet another blockchain. Presently, EigenLayer supports Lido's version of staked ETH (stETH), Rocket Pool's version (rETH), and Coinbase's version (cbETH) as well.

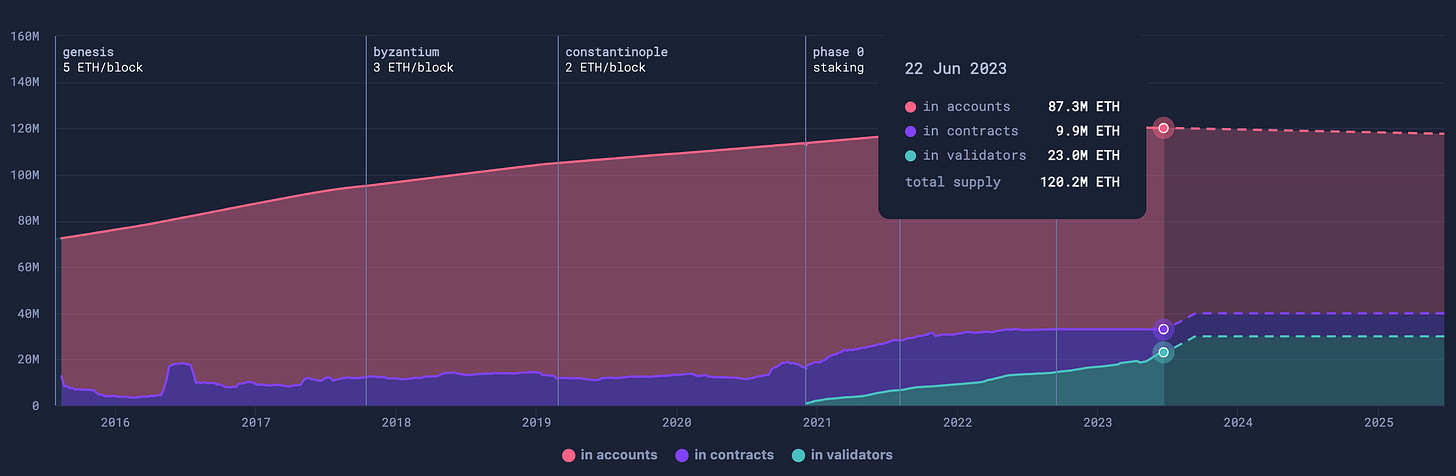

This year has witnessed significant growth in staked ETH, rising from 14% to nearly 20% of total supply, amounting to 23MM ETH ($42B), alongside an increase in the market capitalization of Liquid Staking Tokens (LSTs) to $15.5B. We expect restaking to take off as more protocols look to leverage the staked capital supporting Ethereum. At the same time, we are reminded of the recursive yield farming of DeFi summer, where collateralized value increased recursively through rehypothecation and the yield rewards of app tokens. There will be a rush to farm new tokens using staked ETH, and black swan risks will reveal themselves given the inherent leverage.

👑Related Coverage👑

Curated Updates

Here are the rest of the updates hitting our radar.

Financial Institutions and Adoption

⭐ Wall Street Giants Back EDX Markets, A New Cryptocurrency Exchange - Cointelegraph

Wall Street-Backed Bitcoin ETFs Pile Up After BlackRock’s Filing - The Defiant

Investment Firm Republic Buys Stake In Crypto Broker-Dealer INX At $50MM Valuation - CoinDesk

Binance Deregisters In UK Amid Regulatory Woes - The Block

DeFi and Digital Assets

⭐ DeFi Credit Protocol Concordia Raises $4MM In Round Led by Tribe, Kraken Ventures - CoinDesk

Stablecoins: Week In Review In Charts - 6/16 - Galaxy Digital

Frax Finance Plans To Launch Its Own L2 By End Of Year - Blockworks

Curve Opens Vote To Add WETH Collateral For crvUSD Stablecoin With $200MM Debt Ceiling - The Block

Blockchain Protocols

⭐ Polygon Proposes Zero-Knowledge Overhaul For PoS Chain - The Defiant

⭐ BNB Chain Launches Testnet For Layer 2 Network - The Defiant

⭐ A Look into Arbitrum After the Airdrop - Nansen

Watch Out, Ordinals — 30,000 ‘Ethscriptions’ Land On Ethereum - Cointelegraph

Ethereum Developers Consider Raising Max Validator Limit From 32 To 2,048 ETH - The Block

Uniswap Taps Wormhole and Axelar For Cross-Chain Bridging After Lengthy Analysis - The Defiant

BNB Chain Releases Layer 2 Testnet Based on Optimism's OP Stack - CoinDesk

Blockchain Security Firm CertiK Found an Infinite Loop Bug in Sui Network - CoinDesk

NFTs, DAOs and the Metaverse

⭐ Sotheby's Second 3AC NFT Sale Nets $10.9MM, With 'The Goose' Alone Netting $6.2MM - CoinDesk

Sued By CFTC And SEC, Binance Partners With The Weeknd For Metaverse Experience - Blockworks

Ethereum CryptoPunks NFT Burned And Reborn On Bitcoin Network - The Block

Shape your Future

Wondering what’s shaping the future of Fintech, Digital Wealth and Web3?

At the Fintech Blueprint, we go down the rabbit hole to help you innovate and compete in Fintech.

Sign up to the Premium Fintech Blueprint newsletter and get access to:

Monday Fintech Short Takes, with weekly coverage of the latest fintech, digital investing, banking, and payments news via expert curation and in-depth analysis

Wednesday Long Takes on Fintech and Web3 topics with a deep, comprehensive, and insightful analysis without shilling or marketing narratives

Thursday DeFi Short Takes, weekly analysis of developments in the crypto space, including digital assets, DAOs, NFTs, and institutional adoption

Access to the Podcasts with industry leaders on building leading companies in Fintech and DeFi along with value-added data-driven, annotated transcripts

Full library of the weekly in-depth write-ups on 15+ topics and 50+ Fintech and DeFi brands, offering deep, comprehensive, and insightful analysis without shilling or marketing narratives

Exclusive Deep Dive reports into Fintech business models and brands that transform the Fintech and DeFi space

Access to our CEO & Founder focused 'Building Company Playbook' series, offering insider tips and advice on constructing successful fintech ventures.

Making The World a Safer Place