DeFi: Binance launces L2 opBNB to rival Coinbase's Base; BitGo is a unicorn 🦄

The Layer 2 showdown just got more exciting and BitGo's fundraise lands despite recent crypto custody troubles

The Fintech Blueprint is a newsletter authored by me, Lex Sokolin, and a small group of brilliant researchers who focus on frontier technologies impacting the future of financial services. I am glad you are here. Was this email forwarded to you? You deserve your own:

👉subscribe here.

Gm Fintech Futurists —

Today we highlight the following:

PROTOCOLS: Binance To Launch opBNB Layer 2 Network Later This Month (link here)

FINANCIAL INSTITUTIONS: BitGo secures $100 million in Series C round at $1.75 billion valuation (link here)

CURATED UPDATES

To support this writing and access our full archive of newsletters, analyses, and guides to building in the Fintech & DeFi industries, subscribe below.

BLOCKCHAIN PROTOCOLS: Binance To Launch opBNB Layer 2 Network Later This Month (link here)

Binance is launching opBNB, a Layer 2 scaling solution for its BNB Smart Chain. The announcement comes shortly after Polygon unveiled Polygon 2.0 — an architecture aimed at achieving scalability and unified liquidity across chains built on top of Polygon. Coinbase and ConsenSys have launched their own L2s, Base and Linea respectively, on mainnet.

The news mark a period of rampant activity from Binance — it shut down its buy-and-sell service, Binance Connect (formerly Bifinity), Binance.US requested a protective order limiting the information the SEC can access in their legal case, and invested $10MM into Helio Protocol.

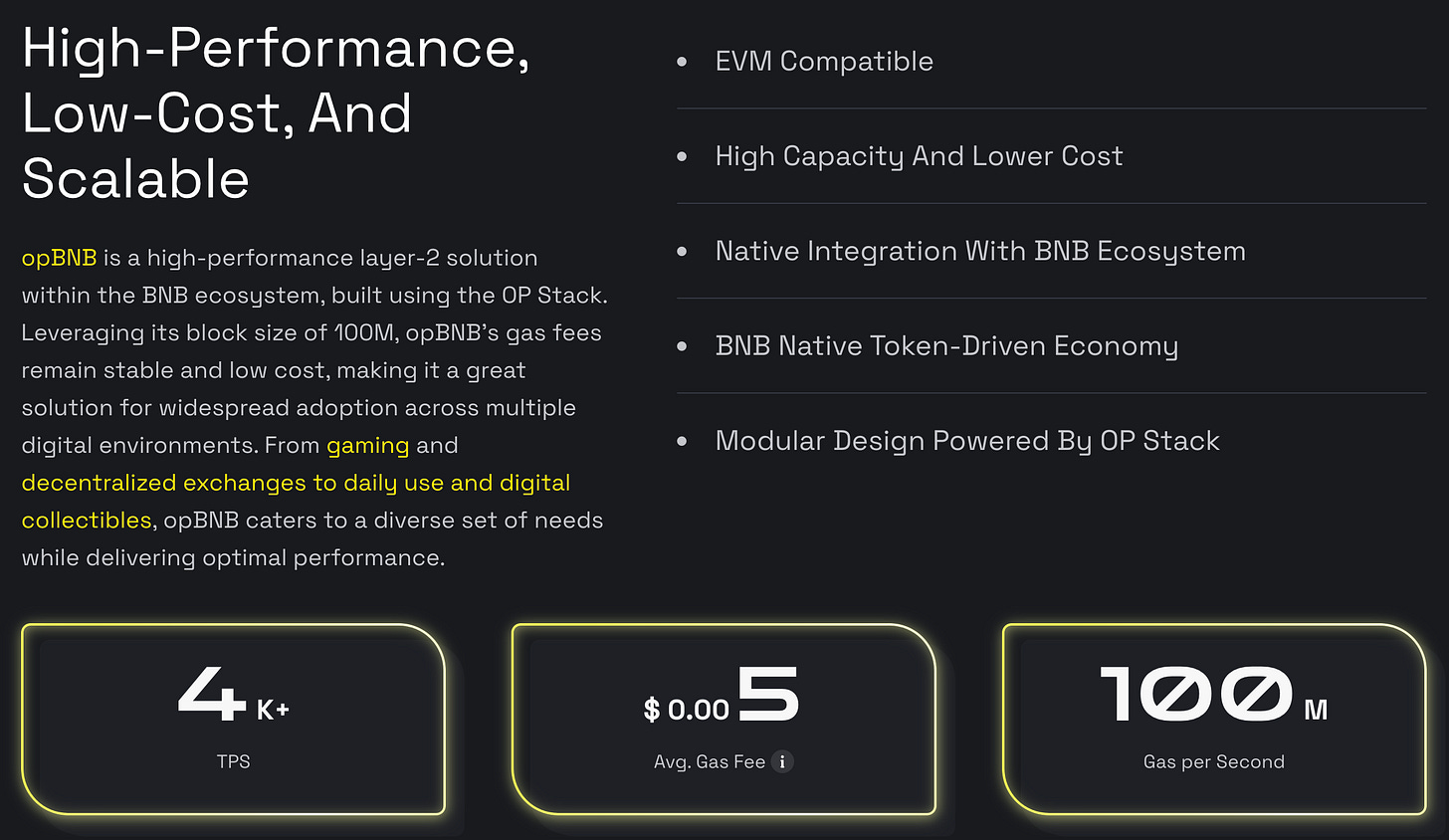

opBNB, an optimistic rollup, improves BNB Smart Chain's scalability by processing transactions off-chain and validating them with fraud proofs, resulting in significantly higher throughput than the underlying chain. Last May, Binance integrated Optimism's technology, deploying Optimism's OP Stack, to reduce costs and improve scalability for transactions on the chain.

Driven by the OP Stack, opBNB has average transaction gas fees of $0.005 and achieves a throughput of 4,500+ TPS - making the chain feasible for managing transaction-intensive use cases like machine learning (ML) data, Web3 gaming, and NFT trading. opBNB also functions within the EVM (Ethereum Virtual Machine), the framework employed by Ethereum, enabling it to facilitate the movement of dApps across all EVM-compatible networks with minimal code changes.

From a more technical standpoint, individuals engage with opBNB by initiating fund deposits from BSC and engaging with dApps and smart contracts on opBNB. Subsequently, sequencers compile transactions, calculate state transitions, and forward them to the rollup contract on BSC. Then, Provers produce cryptographic evidence (i.e., proofs) validating the legitimacy of these state transitions, while Verifiers (or Challengers) examine these proofs to confirm the accuracy of the opBNB state. A state transition involves updating the data stored in the blockchain's state (e.g., account balances, contract storage) to reflect the effects of a transaction. This state change becomes a part of the blockchain's immutable history.

Blockchains deal with a well-known trade-off trilemma: scalability, security, and decentralization. L1 networks typically tick the security and decentralization boxes, while sacrificing scalability. So, we end up with slow performance and high fees. Remember the exorbitant gas fees during the Otherdeed NFT mint? It’s not obvious to us that the BNB chain was expensive to use prior to this upgrade, but the investment meta has moved on from alternate L1s to L2s, so Binance must chase the dragon.

We are seeing various scaling solutions in development — Optimism, Arbitrum, Matter Labs' zkSync, Starknet, ImmutableX, Polygon zkEVM, Polygon 2.0, ConsenSys's Linea, Taiko, Coinbase's Base, and many more. Focusing on the most recent ones, Polygon 2.0 and Base, both opBNB and Polygon 2.0 share technical similarities. In Polygon 2.0, the Execution Layer arranges batches of transactions and aids validators in reaching consensus on the committed chain data. Meanwhile, the Proving Layer generates cryptographic ZK-proofs to establish the inclusion of these transactions within the Ethereum base layer.

But the primary competition lies between Binance and Coinbase. As the SEC targets both exchanges, it is becoming evident that Coinbase will likely retain its dominant position in the US, reinforced by Coinbase gaining approval to introduce federally regulated crypto futures trading. Meanwhile, Binance is on the defensive, filing for protection from the SEC.

Base, also built on the OP Stack, already houses 100+ dApps, including DEXes like Uniswap and Sushiswap, wallet providers Exodus and Brave, and infrastructure players Nansen and Etherscan. Only a month after launching it is already the fifth biggest L2 network, with $234MM in TVL and up 50% in the past week alone. Binance has its competition cut out on the L2 front, although we expect Optimism to be gleefully watching on the sidelines as it rakes in sequencer fees from both networks.

👑 Related Coverage 👑

Insights Report

Before we move onto our second topic, we would like to highlight an Insights Report from Fintech Nexus and Brighterion, a Mastercard company. In their survey of 100 financial institutions, they explore how financial institutions are using artificial intelligence for transaction fraud monitoring in the dynamic digital landscape.

FINANCIAL INSTITUTIONS: BitGo secures $100 million in Series C round at $1.75 billion valuation (link here)

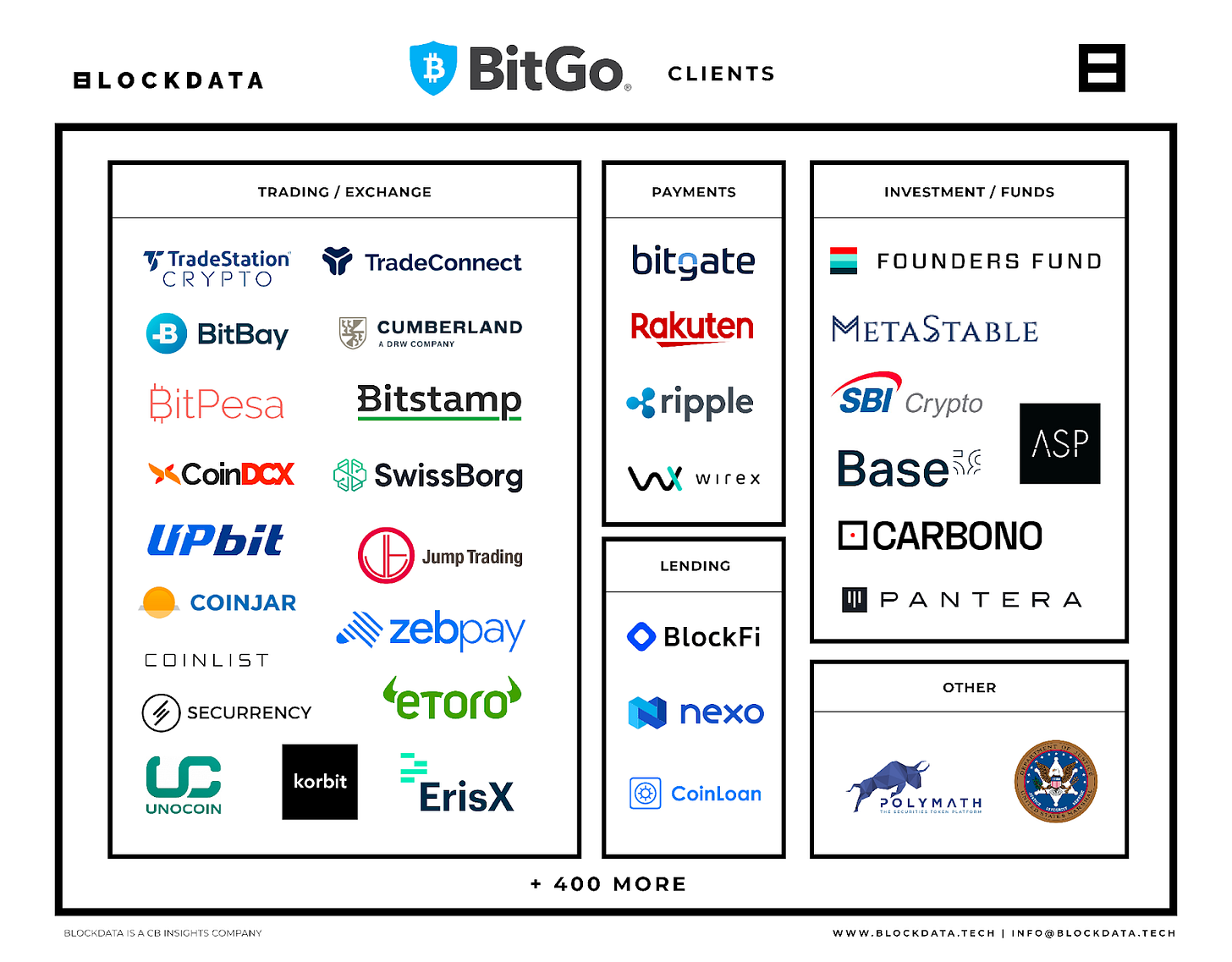

Crypto custodian BitGo has raised $100MM in Series C funding at a $1.75B valuation, a notable round given the difficult crypto fundraising environment of late. The round builds on the $42.5MM Series B back in 2017, which included Goldman Sachs, Pantera Capital, and Craft Ventures as investors.

BitGo had previously tried to fundraise at a $1.2B valuation in November last year, after a potential acquisition by Galaxy fell through for the same amount in August that year. The failed acquisition, reportedly due to BitGo not providing audited financial statements for 2021, ended in the firm suing Galaxy for $100MM for breaching the merger agreement, which has since been dismissed.

BitGo’s primary offering is crypto custody solutions for financial institutions, helping them to manage their digital assets in a compliant and secure manner with up to $250MM in insurance. It also helps them make the most of these assets through a range DeFi offerings from lending to staking, depending on the client’s risk tolerance. Lastly, it provides an infrastructure offering for exchanges, retail aggregators, and software companies, providing wallet-as-a-service for user onboarding and a range of APIs to power back-end systems. And this round comes off the back of an impressive year to date, with a 60% increase in new client onboarding, a 200% increase in fiat custody, a 20% increase in assets under custody and a 40-fold increase in staked assets on the platform.

The new funds are expected to be used to fund strategic acquisitions. The custodian had previously reached a preliminary agreement to acquire Prime Trust, another crypto custody firm in June, but the deal fell through with Prime Trust since filing for Chapter 11 bankruptcy. Because they literally lost the keys.

We find this news interesting for two main reasons. First, it bucks the trend of a down period in crypto funding, at its lowest level since 2020. The latest quarter of fundraising totalled $2.5B, a major drop-off since 2022Q1 peaks of $13.5B. Recently, it seems to be picking back up with Flashbots raising $60MM at a $1B valuation last month, EigenLayer raising $50MM in March, and Worldcoin raising $115MM in May.

Second, it further demonstrates the attention that institutional-grade crypto custody solutions continue to receive. Competitors like FireBlocks raised $550MM last year at an $8B valuation and Anchorage raised $350MM at a $3B valuation, both during the peak of crypto fundraising in late 2021 / early 2022. These raises by custody solutions are indicative of institutional demand, highlighting the increase in openness towards the asset class, and the demand for DeFi solutions onchain.

👑 Related Coverage 👑

Curated Updates

Here are the rest of the updates hitting our radar.

Financial Institutions and Adoption

⭐ The Machine Economy And The Convergence Of Web3, AI And Fintech - CoinDesk

⭐ Singapore Finalizes Regulatory Framework For Stablecoins - The Defiant

Ripple Labs Opposes ‘Gambit’ Appeal Request By The SEC - Blockworks

DeFi and Digital Assets

⭐ MakerDAO Attracts $700M In Deposits After Hiking DAI Savings Rate - The Defiant

⭐ PayPal Teams Up With Ledger On Fiat Onramp For US Users - The Defiant

Binance Labs Invests $10MM To Accelerate Helio Protocol's Liquid Staking Pivot - Decrypt

MEV On The dYdX V4 Chain - Chorus One

Bittrex Global Not ‘Paying A Penny’ As Its US Affiliate Set To Pay SEC - Blockworks

New Social Trading App Attracts 12,000 Users In Less Than Two Days - The Defiant

Binance Connect Is Shutting Down On Aug. 16 - Blockworks

Blockchain Protocols

⭐ Linea Completes Public Mainnet Rollout - The Defiant

ZetaChain Announces $27MM Raise In Latest Funding Round - Blockworks

Shibarium Botches Launch With Bridged ETH Unrecoverable - The Defiant

Sei Network Launches Token And Mainnet Beta - The Defiant

NFTs, DAOs and the Metaverse

Coca-Cola Turns Its Attention To Base With New NFT Collection - Bitcoinist

Grimace Forever: McDonald's Is Giving Away Free NFTs That You Can't Trade - Decrypt

Neal Stephenson's Metaverse Vision Is One Step Closer As Lamina1 Blockchain Launches Betanet - CoinDesk

'Krapopolis' To Premiere In September with NFTs And Fan Voting - The Defiant

⭐ Shape your Future

Wondering what’s shaping the future of Fintech, Digital Wealth and Web3?

At the Fintech Blueprint, we go down the rabbit hole to help you innovate and compete in Fintech.

Sign up to the Premium Fintech Blueprint newsletter and get access to:

Monday Fintech Short Takes, with weekly, in-depth coverage of the latest fintech, digital investing, banking, and payments news

Wednesday Long Takes on Fintech and Web3 topics with a deep and insightful analysis

Thursday DeFi Short Takes, weekly analysis of developments in the crypto space, including digital assets, DAOs, NFTs, and institutional adoption

Deep Dive reports into Fintech business models and brands that transform the Fintech and DeFi space

‘Building Company Playbook’ series, offering insider tips and advice on constructing successful fintech ventures.

Enhanced Podcasts with industry leaders, accompanied with detailed annotated transcripts

Archive Access to an array of in-depth write-ups, spanning across 15+ topics and encompassing over 50 Fintech and DeFi brands