DeFi: Polygon 2.0 looks a lot like the "Internet of Blockchains" again; Mastercard's smart contract app store

Android dreams of financial infrastructure

Gm Fintech Futurists —

Today we highlight the following:

PROTOCOLS: Polygon Unveils Plan To Build Network Of ZK-based Layer 2 Chains (link here)

FINANCIAL INSTITUTIONS: Mastercard plans beta for a blockchain ‘app store’ for ‘regulated’ financial apps (link here)

CURATED UPDATES

To support this writing and access our full archive of newsletters, analyses, and guides to building in the Fintech & DeFi industries, subscribe below.

DeFi Short Takes

PROTOCOLS: Polygon Unveils Plan To Build Network Of ZK-based Layer 2 Chains (link here)

Polygon has unveiled Polygon 2.0 — an architecture aimed at achieving scalability and unified liquidity across chains built on top of Polygon.

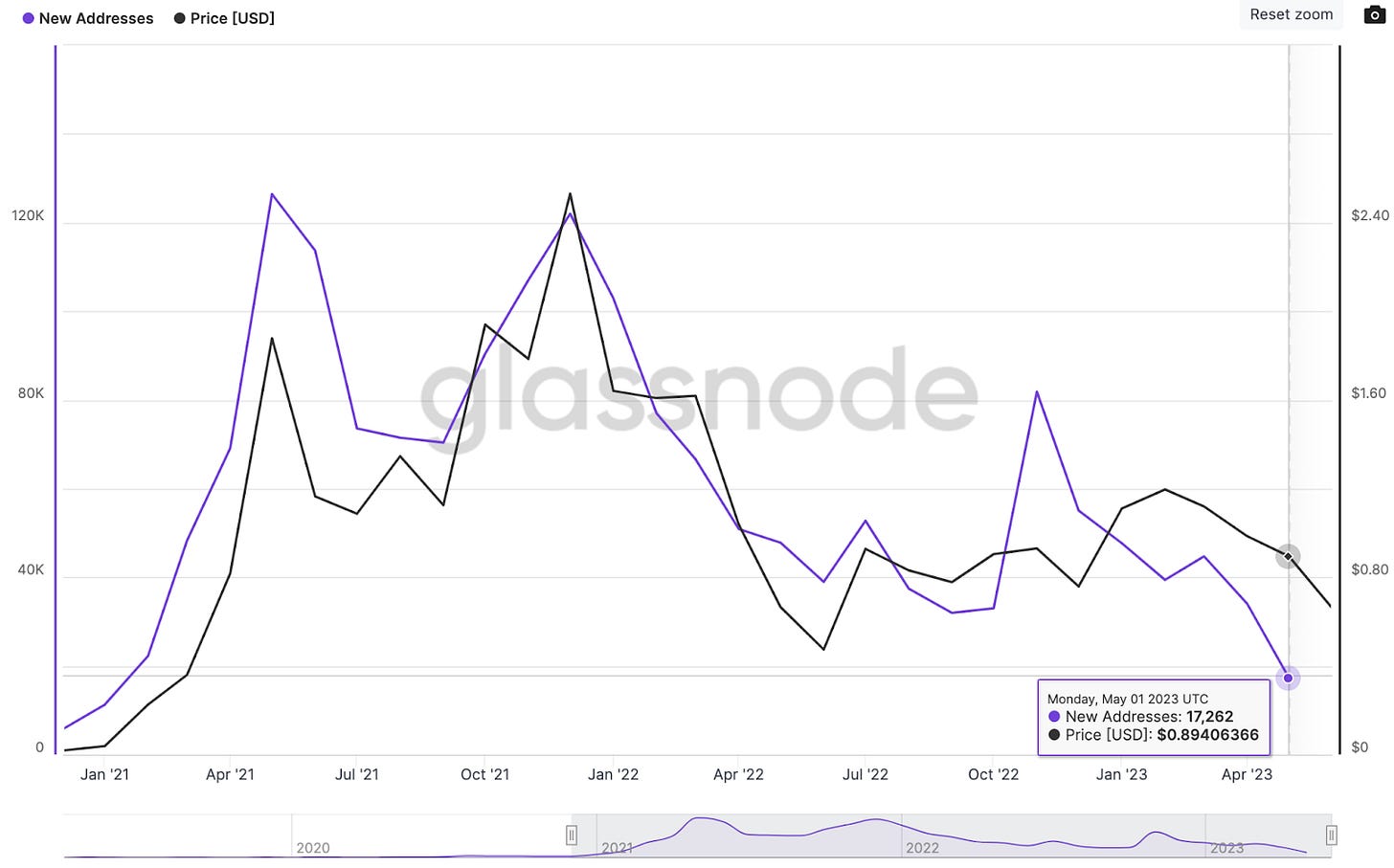

Despite recent milestones, like launching the zkEVM mainnet and partnering with Franklin Templeton to launch a money market fund, Polygon's native token has lost over 50% of its value since February. This may be in part due to the SEC labelling it a security in an effort to frame Coinbase as an exchange. There is also a decrease in new addresses on the network, which are at the lowest point since January 2021. That we think is caused by all the attention and activity sent to the L2 networks settling on Ethereum, like Arbitrum and Optimism.

The Polygon 2.0 architecture consists of four protocol layers: staking, interoperability, execution, and proving. The staking layer operates by leveraging Polygon’s $MATIC token. Validators, actors verifying transactions and adding new blocks to the chain, stake $MATIC to perform the role in return for a token reward. If they act maliciously their staked tokens are then slashed. This validator network can operate across all Polygon chains through restaking (see our write-up on EigenLayer for more details). This allows new chains to benefit from a working network of decentralised validators, removing the cost and effort associated with setting up a validator network on a chain by chain basis.

The Interoperability Layer enables cross-chain messaging within the Polygon ecosystem. This means that instead of having to utilise a cross-chain bridge, users can instantaneously move Ethereum native assets between Polygon chains. Cross-chain bridges tend to take time, be costly, have a generally poor UX, and be honeypots for hackers. The new design makes interactions between chains more seamless. The Execution Layer sequences batches of transactions in an efficient manner and helps validators agree on what is being committed to the chain. The Proving Layer generates the cryptographic ZK-proofs to ensure that these transactions are committed to the Ethereum base layer.

The advantages of scaling are evident — reduced gas fees enable the execution of computationally advanced smart contracts and allow protocols to build decentralised applications (dApps) at affordable gas fees. Polygon 2.0 caters to cost-sensitive projects, especially those dealing with high transaction volumes. More generally, it allows for individual chains to be designed to the specific needs of the dapp or dapps being built on them. MATIC’s utility and importance to the Polygon ecosystem increases in this model, although our eyes are still on how the SEC’s opinion of it shapes up.

It is also fair to note that architectures like this are closely inspired by the advances already built by the Cosmos, Polkadot, and Avalanche ecosystem, among others. The idea of a standardized internet of blockchains has been around for a while, and is now tangibly coming to fruition. It is likey that Ethereum will catch up and absorb these innovations over time.

👑 Related Coverage 👑

FINANCIAL INSTITUTIONS: Mastercard plans beta for a blockchain ‘app store’ for ‘regulated’ financial apps (link here)

Mastercard has announced the beta launch of their Multi Token Network (MTN) — a new, regulated app store designed specifically for blockchain-based applications for financial institutions. This builds on Mastercard’s previous forays into crypto, such as credit and debit cards for spending crypto on everyday purchases, enabling NFT purchases without the need to hold crypto, and Crypto Credential, a developer tool for verifying interactions between consumers and business. Visa, in comparison, has a partnership with Blockchain.com on its debit card offering and has been active in initiatives around identity and at one point had even bought a Cryptopunk.

Similar to Apple’s app store, MTN will provide developers with the tools needed to create blockchain-based applications. One example is the maintenance of its own private enterprise version of the Ethereum blockchain, which can let engineers deploy smart contracts without taking the full exposure of being on a public chain.

Developers can use Crypto Credential to have greater levels of control over user participation — from verifying that a wallet can receive specific NFTs, to ensuring that only KYCed individuals use a particular dapp. Initial test cases in the beta version will be (1) tokenising commercial bank deposits and (2) recording bank balances.

These applications are not meant to directly compete with those on Ethereum and decentralised Layer 1s. In fact, many of the applications built on the MTN could be copycats of DeFi innovators, or ports of legacy financial software. The motive here is to create a blockchain financial network that prioritizes existing laws and regulations, rather than trying build around them, as could be argued for a number of decentralized protocols. Lastly, for better or worse, enterprise chains also do not create speculative digital assets where tokens can capture innovation value — at least so far — and instead deliver technical infrastructure for existing financial processes and use cases.

Many incumbent financial leaders, such as Larry Fink, think that tokenisation will be the next generation of market infrastructure. Note how such a thesis is different from things like the Bitcoin ETF, which uses existing infrastructure for a new asset class. Mastercard, like Visa, is a financial network composed of many financial networks. To that end, they have every incentive to integrate into all venues where commerce thrives and economics are exchanged.

👑 Related Coverage 👑

Curated Updates

Here are the rest of the updates hitting our radar.

DeFi and Digital Assets

Liquid Staking Frenzy Spreads to Solana As Drift's 'Super Stake' Offers One-Click Leverage - Coindesk

Celsius To Potentially Sell More Than $170MM In ADA, MATIC, SOL And Altcoins For BTC, ETH - CoinDesk

Coinbase Offering 4% Yield On USDC Held By Customers, Rivaling Major Banks - Blockworks

DAI’s Reliance On USDC Drops Below 10% As MakerDAO Expands Bond Holdings - The Defiant

Lido Governance Greenlights Revamped Revenue Sharing Program - The Defiant

Binance Conducts 11th LUNC Burn, 2.65B Tokens Destroyed - Cointelegraph

Blockchain Protocols

Solana Co-Founder Says Ethereum Could Be Layer-2 for SOL - Decrypt

Upcoming Ethereum Update Stimulates Liquid Staking Token Growth - Blockworks

dYdX Chain To Launch Testnet Next Week - The Defiant

Phi Labs’ Archway Goes Live On Mainnet In Cosmos Ecosystem - The Block

NFTs, DAOs and the Metaverse

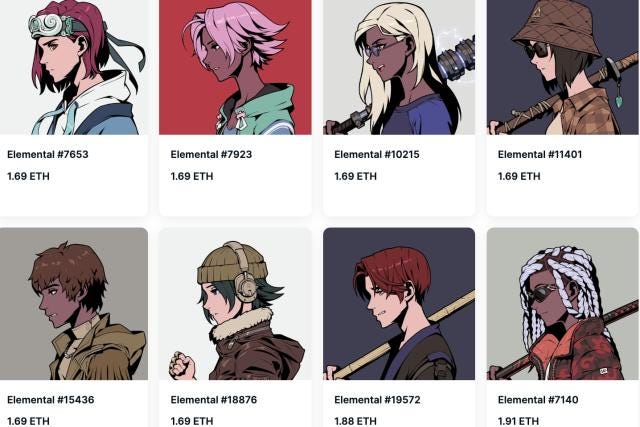

⭐Azuki DAO May Sue Over $40MM Mint That Looked Just Like The Original - Blockworks

Credit Suisse Is Launching Ethereum NFTs With The Swiss Football Association - The Block

Shape your Future

Wondering what’s shaping the future of Fintech, Digital Wealth and Web3?

At the Fintech Blueprint, we go down the rabbit hole to help you innovate and compete in Fintech.

Sign up to the Premium Fintech Blueprint newsletter and get access to:

Monday Fintech Short Takes, with weekly coverage of the latest fintech, digital investing, banking, and payments news via expert curation and in-depth analysis

Wednesday Long Takes on Fintech and Web3 topics with a deep, comprehensive, and insightful analysis without shilling or marketing narratives

Thursday DeFi Short Takes, weekly analysis of developments in the crypto space, including digital assets, DAOs, NFTs, and institutional adoption

Access to the Podcasts with industry leaders on building leading companies in Fintech and DeFi along with value-added data-driven, annotated transcripts

Full library of the weekly in-depth write-ups on 15+ topics and 50+ Fintech and DeFi brands, offering deep, comprehensive, and insightful analysis without shilling or marketing narratives

Exclusive Deep Dive reports into Fintech business models and brands that transform the Fintech and DeFi space

Access to our CEO & Founder focused 'Building Company Playbook' series, offering insider tips and advice on constructing successful fintech ventures.