DeFi: SEC charges Binance, founder Changpeng Zhao, and Coinbase for securities violations

In George Orwell's "1984," a government that feared challenges to its authority went to great lengths to eliminate any dissenting ideas

Gm Fintech Futurists —

Today we focus on the two cases brought forward by the SEC against Binance and Coinbase. A strategy is clearly at play. Our plan is to analyze that strategy more deeply in the Long Take next week, but lay down the key facts in the short takes below. Let us know your thoughts!

DEFI AND DIGITAL ASSETS: SEC Files 13 Charges Against Binance Entities and Founder Changpeng Zhao (link here)

DEFI AND DIGITAL ASSETS: SEC Charges Coinbase for Operating as an Unregistered Securities Exchange, Broker, and Clearing Agency (link here)

CURATED UPDATES. There are things to say about Apple and the metaverse, but that particular future will need to wait.

To support this writing and access our full archive of newsletters, analyses, and guides to building in the Fintech & DeFi industries, subscribe below.

DeFi Short Takes

DEFI & DIGITAL ASSETS: SEC Files 13 Charges Against Binance Entities and Founder Changpeng Zhao (link here)

The US Securities and Exchange Commission (SEC) has filed a lawsuit against Binance and its CEO, Changpeng Zhao (CZ). This follows Binance's previous legal challenges, including the SEC's lawsuit against stablecoin issuer Paxos over Binance USD (BUSD) and a money laundering investigation by the US Justice Department. Additionally, the Commodity Futures Trading Commission (CFTC) recently sued Binance for serving US customers without proper licenses and enabling the circumvention of Know Your Customer / Anti-Money Laundering (KYC/AML) procedures, where the CFTC demanded that Binance pay back the trading profits and fees sourced from US users.

According to the lawsuit, the SEC claims that starting in 2018, Binance advisors devised a complex plan to evade U.S. securities laws and avoid registration requirements. The SEC is referring to the "Tai-Chi" document, which was Binance's plan to serve U.S. customers through an entity called Binance.US. Without this so-called independent entity, Binance would operate as an unlicensed centralized exchange.

In its complaint, the SEC argues that CZ exerted control over Binance.US from abroad, as evidenced by his 81% ownership stake in the entities that control Binance.US. The SEC further alleges that the international entity, known simply as Binance, controls a significant portion of the US entity’s assets. Most damning, the SEC claims that billions of dollars in assets from Binance Platforms were blended in an account controlled by Merit Peak Limited and subsequently transferred to third parties. Merit Peak and Sigma Chain, both owned and controlled by CZ, were identified as market makers on Binance.US. Naturally, the commingling of funds between exchanges and market makers run afoul of US securities laws.

Finally, the SEC not only concluded that BNB and BUSD are securities, but SOL, ADA, MATIC, and seven other cryptocurrencies sold on the platform are securities as well, and interacting with BNB Vault, Simple Earn, and staking-as-a-service is a securities violation. By trying to define these assets as securities, the SEC is making a claim of jurisdiction — something we hope the courts recognize as a strategic maneuver to expand reach over a number of other businesses.

Zooming out, there is a clear and steady escalation in the lawsuits brought by US regulators. Remember when the CFTC sued Ooki DAO last September and swiftly shut it down? Just this year, Kraken paid $30MM for its staking service, crypto exchange Beaxy had to shut down due to an SEC lawsuit, and Sushi DAO received a subpoena which is still ongoing.

Opinions on the merits of this lawsuit vary greatly — some see the SEC moves as draconian and insincere, while others seem to be relieved that at least we now have some clear indication of how the SEC will “regulate” crypto. In our view, Binance was aware of and worked to circumvent regulatory frameworks under US law, and this has made them a target. Still, this is a far cry from the case of FTX, where customer funds were literally taken for inappropriate use — hiding in plain sight and buying their way through Washington.

👑Related Coverage👑

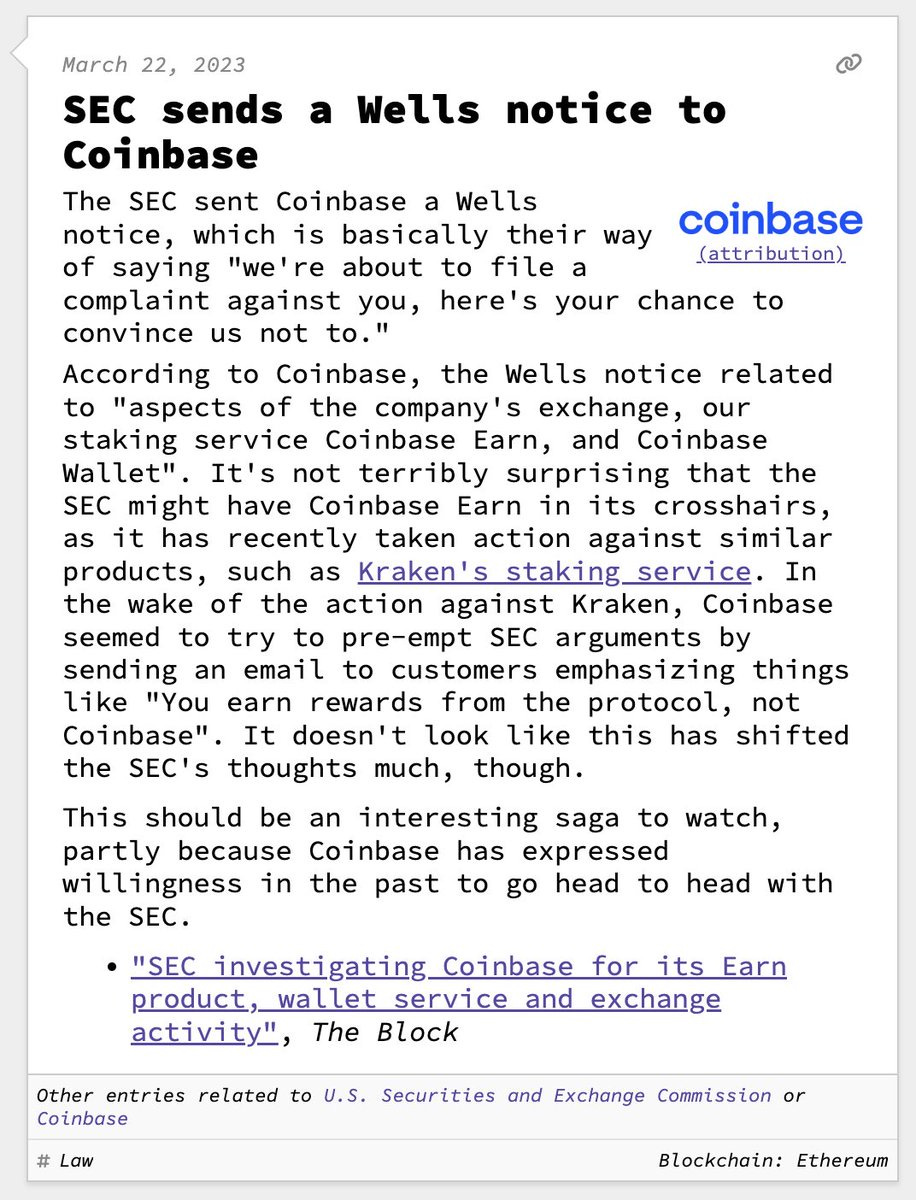

DEFI & DIGITAL ASSETS: SEC Charges Coinbase for Operating as an Unregistered Securities Exchange, Broker, and Clearing Agency (link here)

Next in the SEC’s centralized exchange crackdown is Coinbase, which is notably a public company on the US stock market. The complaint comes a day after the SEC sued Binance, with allegations that Coinbase failed to register as an exchange, broker and clearing house, and offered and sold unregistered securities through its staking-as-a-service program. The securities it is alleged to have offered and sold include the native tokens of Solana, Filecoin, Cardano, Polygon, The Sandbox, and Axie Infinity, among others. Incidentally, they also happen to be all the tokens listed on the first page of Coinbase’s trading page.

In regulated securities markets, the exchanges, brokers and clearing houses are distinct entities performing separate functions. The SEC argues that Coinbase is participating in a trading ecosystem without such separation and therefore has removed critical protections for users, such as routine inspection from the SEC. The SEC further asserts that such a system does not effectively prevent fraud or manipulation, nor protect against conflicts of interest. Overall, the entire premise of this complaint is centered around Coinbase bypassing the laws and regulatory frameworks of the US securities market.

However, until now, the SEC had never explicitly stated that the tokens on Coinbase’s website were securities — which means that the market structure for these assets does not need to look like the market structure for securities. The CFTC sees tokens and coins as commodities, for example. Still, the SEC argues that Coinbase was aware that they could be classified as securities. The stock price of Coinbase (NASDAQ:COIN) fell on the news.

Coinbase first received a Wells Notice from the SEC in January, after which Coinbase requested the SEC pass clear laws on crypto, indicating and reiterating that they are willing to comply with clearly applicable rules. The SEC rejected the request and responded that legislation may take years and that an enforcement-first approach would be taken in the meantime. Taking an enforcement-only approach may bring the SEC victories in the short-term, if they win the cases, but comes at the cost of damaging the US position in the digital assets industry.

Many other geographies have been taking a more favorable approach to crypto, such as the UK’s approach to collaborating with experts to develop regulation and the UAE creating the world’s first dedicated crypto regulator, and creating a clear rule book to boot. Also worth noting is that the SEC appears to be seeking high profile, if not slam dunk, cases with these complaints. The same approach was likely taken with Ripple’s XRP, which has not gone as planned, and XRP was not even mentioned as a security in these complaints despite being listed by Coinbase.

Perhaps unsurprising are the geographies in which crypto ownership has proliferated most. Of the top 20 countries by per capita crypto ownership, fifteen exhibit currency instability and economic inequality, four are known to be relative regulatory safe-havens. And only one — the United States — is just plain rich. See below and this spreadsheet for more detailed data.

The US, with 13.2% per capita ownership, is the fifth most crypto-penetrated country on the planet, trailing UAE (28%), Vietnam (20%), Singapore (14%) and Iran (13.5%). As cryptocurrency adoption continues to accelerate worldwide, it is perhaps only a matter of time before the US drops off the top 20 list and is relegated to the backwaters. Becoming a conservative laggard is often the case among the just-plain-rich, though we believe it is rare to see in the world of finance. Perhaps we really are living in a historic era.

👑Related Coverage👑

Curated Updates

Here are the rest of the updates hitting our radar.

Financial Institutions and Adoption

⭐ Binance Hands Rising Star Teng Key Role To Replace CEO Zhao At Largest Crypto Exchange - CoinDesk

Polygon To Onboard Deutsche Telekom As Validator - The Defiant

Privacy Concerns Dominate CBDC Discussion At Consensus 2023 - CoinDesk

DeFi and Digital Assets

⭐ Credit Suisse-Backed Taurus Integrates Polygon For Its Tokenization Offering - The Block

Cosmos Boards The DeFi Train With Native USDC Support - Blockworks

zkSync Era Welcomes Su Primer Liquid Staking Protocol - Blockworks

Coinbase To Launch 'Institutional-Sized' Bitcoin And Ether Futures Contracts Next Week - The Block

Blockchain Protocols

⭐ Ethereum All Core Developers Consensus Call #110 Writeup - Galaxy Digital

Optimism 'Bedrock' Upgrade To Speed Confirmations, Cut Gas Fees, Set Path To 'Superchain' - CoinDesk

Connext Is Connecting The Multichain With Chain Abstraction - Blockworks

NFTs, DAOs and the Metaverse

⭐ Apple's New Headset Could Change The Way We Design The Metaverse - CoinDesk

The Compelling Case for NFT Gaming - Nansen

Gamestop NFT Back In The Spotlight After Partnership With Illuvium - Cointelegraph

Nike NFTs To Make Their Way Into EA Sports Games And Its Millions Of Fans - Cointelegraph

Shape your Future

Wondering what’s shaping the future of Fintech, Digital Wealth and Web3?

At the Fintech Blueprint, we go down the rabbit hole to help you innovate and compete in Fintech.

Sign up to the Premium Fintech Blueprint newsletter and get access to:

Monday Fintech Short Takes, with weekly coverage of the latest fintech, digital investing, banking, and payments news via expert curation and in-depth analysis

Wednesday Long Takes on Fintech and Web3 topics with a deep, comprehensive, and insightful analysis without shilling or marketing narratives

Thursday DeFi Short Takes, weekly analysis of developments in the crypto space, including digital assets, DAOs, NFTs, and institutional adoption

Access to the Podcasts with industry leaders on building leading companies in Fintech and DeFi along with value-added data-driven, annotated transcripts

Full library of the weekly in-depth write-ups on 15+ topics and 50+ Fintech and DeFi brands, offering deep, comprehensive, and insightful analysis without shilling or marketing narratives

Exclusive Deep Dive reports into Fintech business models and brands that transform the Fintech and DeFi space

Access to our CEO & Founder focused 'Building Company Playbook' series, offering insider tips and advice on constructing successful fintech ventures.