DeFi: Bridging protocol Wormhole raises $225MM at a $2.5B valuation

Because trustless systems are seen as the gold standard within the Web3 economy, nearly every bridging system markets itself as trustless, even if untrue.

Gm Fintech Futurists —

Today we highlight the following:

DEFI: Wormhole Raises $225MM At A $2.5B Valuation, Finalizing Split From Jump Crypto Amid Firm’s Recent Pullback (link here)

CURATED UPDATES: Financial Institutions and Adoption; DeFi and Digital Assets; Blockchain Protocols; NFTs, DAOs and the Metaverse

To support this writing and access our full archive of newsletters, analyses, and guides to building in the Fintech & DeFi industries, subscribe below.

In Partnership

Join Fintech Meetup (March 3-6), the new BIG event with “the highest ROI” for attendees & sponsors with reasonably priced sponsorships, tickets, and rooms. Join 45,000+ double opt-in meetings, and Network with 5,000+ attendees.

👉 Get tickets Now!

DEFI: Wormhole Raises $225MM At A $2.5B Valuation, Finalizing Split From Jump Crypto Amid Firm’s Recent Pullback (link here)

Wormhole, a DeFi protocol focused on cross-chain messaging, acts as a cross-chain bridge between different blockchains, allowing users to transfer assets and information between networks.

The company raised $225MM to become an independent entity, separating from former parent Jump Trading. Jump has reduced its crypto exposure due to decreased trading volumes, a $320MM hack of Wormhole itself, and an SEC lawsuit regarding Jump’s alleged involvement in propping up TerraUSD, which had resulted in a $1.3B profit. Notably, Wormhole was developed in large part by the team behind Certus One, which was acquired by Jump in 2021.

Along with Jump Trading, investors in the carve-out included Brevan Howard, Coinbase Ventures, Multicoin Capital, and Arrington Capital. The transaction valued Wormhole at a $2.5B valuation.

Blockchains are not naturally capable of transmitting value between each other. They operate independently with their own rules, protocols, coins, and programming languages, which makes cross-chain communication challenging. For instance, there are various EVM chains like Avalanche and Arbitrum, Substrate-based chains like Polkadot, and Cosmos-SDK chains. The lack of inter-blockchain communication limits economic activity within the ecosystem.

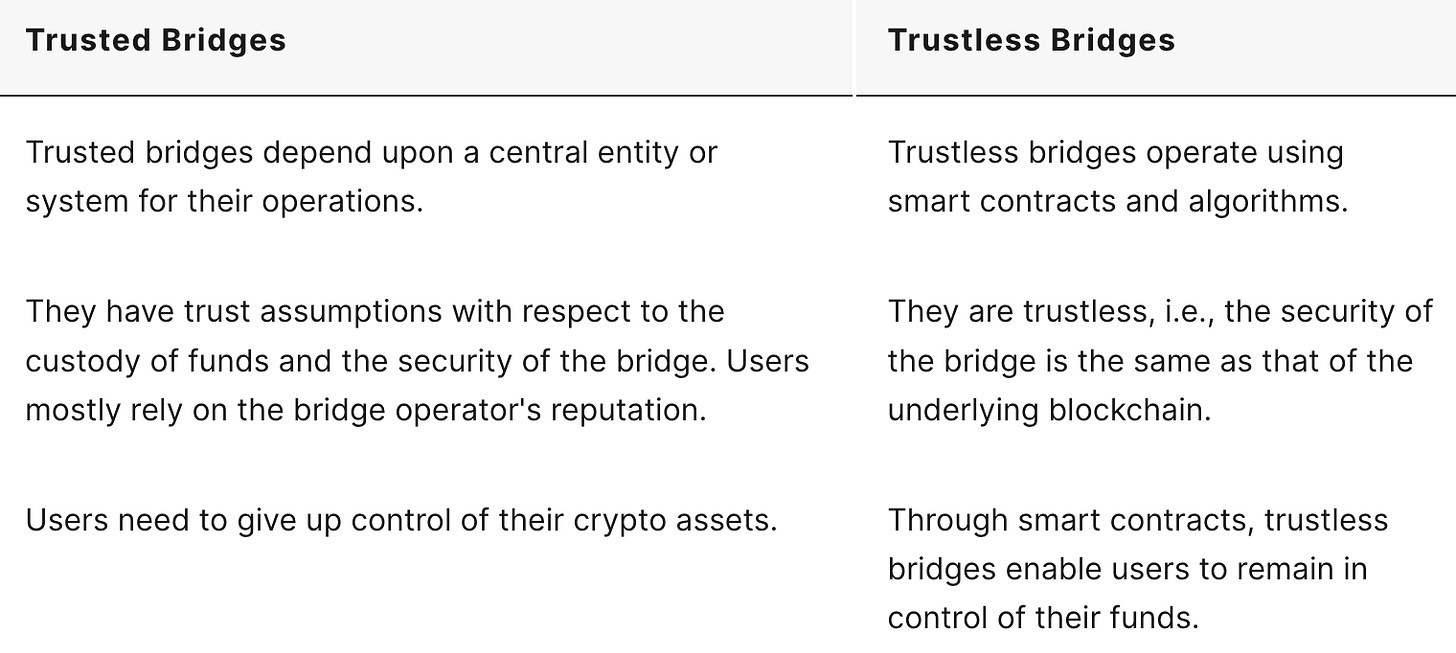

There are two types of bridges — (1) trusted (custodial) bridges and (2) trustless (non-custodial) bridges. Trusted bridges require a third party to validate movements, but users must trust the bridge operator. They give up control of their assets and rely on the operator's reputation, which adds at least some risk to every transaction. Trustless bridges, on the other hand, use smart contracts to store and release funds without new trust assumptions. Because trustless systems are seen as the gold standard within the Web3 economy, nearly every bridging system markets itself as trustless.

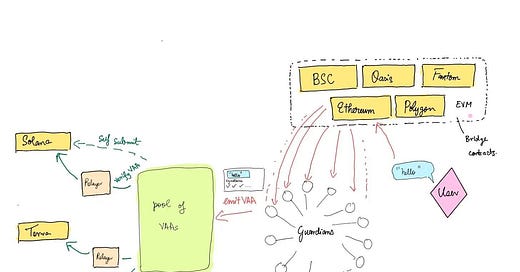

Wormhole's Portal looks like a trusted bridge. It operates using a network of nodes called guardians, which sign and verify transactions on the origin, and use relayers to relay the message to the target chain. The guardian network observes and signs messages emitted by Wormhole's core bridge contracts, and when 2/3 of them sign, Verifiable Action Approvals (VAA’s) are picked up from the Wormhole network and submitted to the target chain via relayers. The VAAs serve as a proof for Wormhole to deliver the same message on the target chain.

Identifying which bridges are trusted or trustless can be quite complex, and one can argue that theoretically at least, it is impossible to be truly trustless. Maximizing trustlessness in the context of bridges means maximizing the number and diversity of validators in the system. Remember, in comparison to L1 blockchains, cross-chain bridges (including multisig) have a lower number of validators, which reduces the amount of decentralized trust in the system. In other words, collusion can occur. Such network exposures are honeypots to hackers. Wormhole, with its 19 validators, most of which are Solana validators, is clearly prone to centralization risk.

Cross-chain interoperability is the future of DeFi, and we've seen some unique developments in the past year. Granted, there are some questionable practices, like Blast recently launching a bridging contract that allows users to deposit funds into an account that is currently in the power of a five-member ‘security council’, three out of five of whom are required to make any changes.

If there is a majority agreement from the council — if just three people agree — then the smart contract can send the deposited funds to another contract, like Maker or Lido, to earn yield. In theory, funds held in this contract cannot be withdrawn to an externally owned account (EOA), but there is nothing stopping three of the members from agreeing to send the tokens to another smart contract which enables them to withdraw to an EOA. This is another example of a trusted bridge, one that we believe is very prone to centralization.

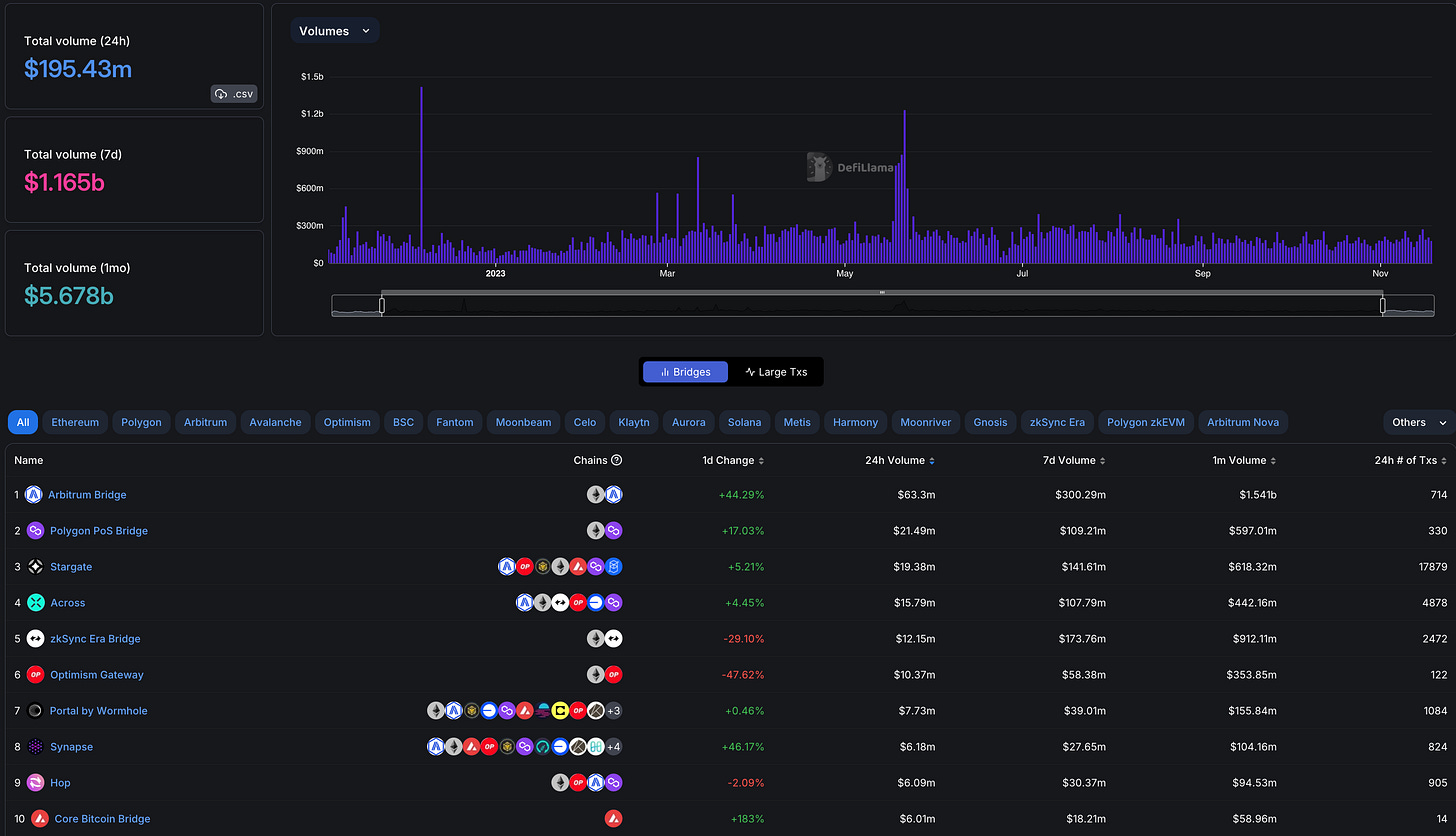

There are more novel answers emerging, like Supra's HyperNova, a bridgeless cross-chain messaging solution. Additionally, there have been advancements in intents, MetaMask snaps, Chainlink's Cross Chain Interoperability Protocol, among dozens of startup projects. Yet Wormhole’s $225MM round and cross-chain messaging protocol LayerZero’s $120MM round earlier this year showcase that cross-chain bridging is still the go-to method for users. As such, we will likely see more bridge exploits in the near future.

👑 Related Coverage 👑

🎙️ Podcast Conversation: Embedding lending and credit into the fintech value proposition, with Canopy CEO Matt Bivons (link here)

In this conversation, we chat with Matt Bivons - Founder & CEO at Canopy. Canopy’s loan management and servicing platform helps Fintechs and brands service customer accounts through automations and APIs to help improve borrower repayment rates, increase net promoter scores, and decrease the cost of servicing for lending and credit card products.

Prior to Canopy, Matt served as a VP of Growth & GM of Consumer at GreenSky (a Goldman Sachs Company), Head of Growth at fintech startup Earnest, and Director of Growth at vacation rental marketplace VaycayHero.

Curated Updates

Here are the rest of the updates hitting our radar.

Financial Institutions and Adoption

Asset Manager Abrdn, Crypto Exchange Archax Strive For Pole Position In Race To Tokenize TradFi - CoinDesk

SocGen To Introduce EURCV Stablecoin, Picks Flowdesk As Market Maker - CoinDesk

Unlimited Helium Mobile Cell Plan Goes Nationwide For $20 A Month - Blockworks

Pyth Oracle Network Brings Industry Heavyweights Into Governance Post-Airdrop - CoinDesk

DeFi and Digital Assets

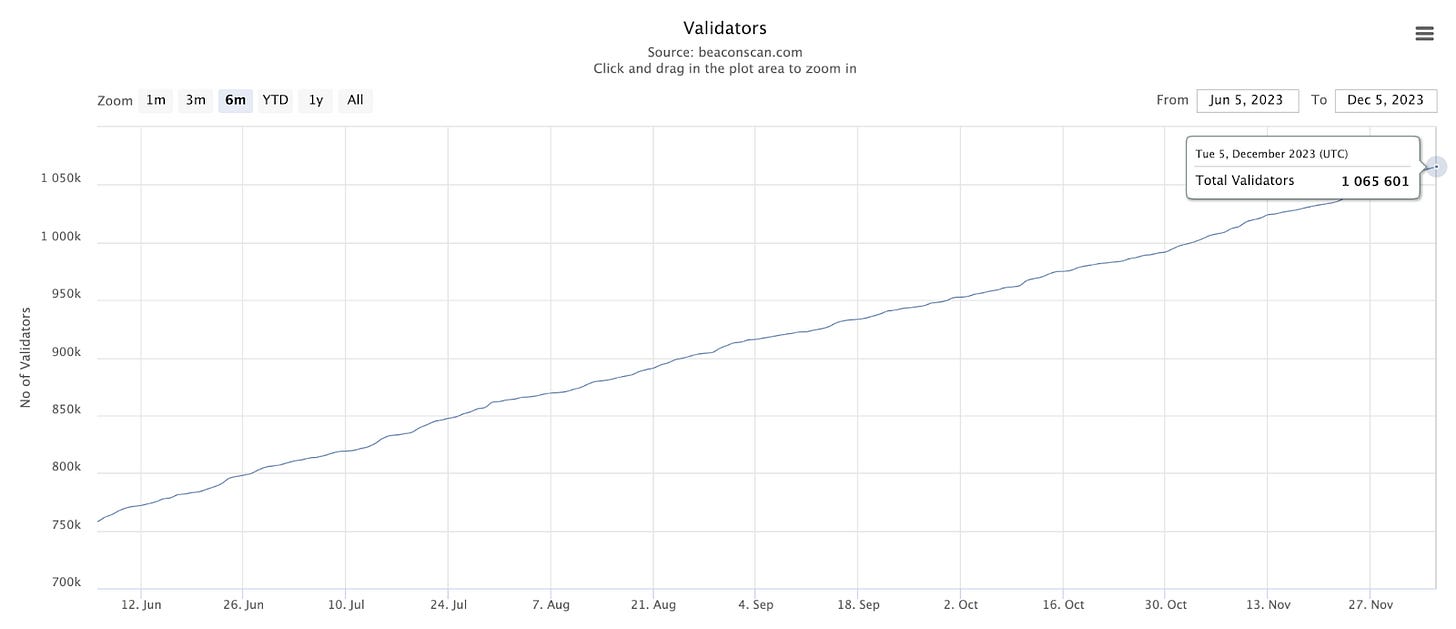

⭐ DeFi Loan Volume Climbs To Highest Since August 2022 - The Defiant

Mantle Releases Liquid Staking Protocol, Expanding Beyond Layer-2 Operator - CoinDesk

Crypto Data Company Shadow Raises $9MM In Seed Round Led By Paradigm - The Defiant

Bitcoin and the Predictability of Crypto Market Cycles - CoinDesk

Coinbase Adds Message-Based Crypto Payments To Its Decentralized Wallet - CoinDesk

Blockchain Protocols

⭐ Ethereum's 'Censorship' Problem Is Getting Worse - CoinDesk

⭐ Bitcoin Core's 'v26.0' Upgrade Aims To Impede Eavesdropping, Tampering - CoinDesk

QANplatform Raises $15MM In Funding - FINSMES

Neutron To Acquire 25% Of CosmWasm Developer Confio - Blockworks

Bitcoin Miner Backed By Jack Dorsey Confirms It Will Censor Ordinal Inscriptions - The Defiant

NFTs, DAOs and the Metaverse

Gods Unchained Launches To 200MM Amazon Prime Gaming Subscribers - The Defiant

Sotheby’s Announces Its First Bitcoin Ordinals Sale - Blockworks

LandX Closes Private Round Securing $5MM+ In Private Funding - The Defiant