DeFi: EigenLayer's TVL skyrockets to $9B - what are the rehypothecation risks?

In the past week, EigenLayer raised $100MM from a16z, and Ether.fi raised $23MM from Bullish Capital and CoinFund

Today we highlight the following:

PROTOCOLS: EigenLayer's TVL Skyrockets To $9B - What Are The Rehypothecation Risks?

CURATED UPDATES: Financial Institutions and Adoption; DeFi and Digital Assets; Blockchain Protocols; NFTs, DAOs and the Metaverse

To support this writing and access our full archive of newsletters, analyses, and guides to building in the Fintech & DeFi industries, subscribe below.

PROTOCOLS: EigenLayer's TVL skyrockets to $9B - what are the rehypothecation risks?

EigenLayer's Total Value Locked (TVL) has surged from $2B to $9B since the beginning of the month, driven by the removal of the withdrawal cap and the rise of Liquid Restaking Protocols such as Ether.Fi and Puffer.

Before delving in, let’s quickly go over EigenLayer’s restaking framework, which consists of restakers, operators, and actively validated services (AVS). Restakers pledge their staked ETH or liquid staking tokens (LSTs) and earn more yield in return. This process, which can briefly be summed up as a system of rehypothecation for staked ETH, also allows users to repurpose their staked ETH to enhance crypto-economic security for other dApps on the network. EigenLayer facilitates restaking directly through its platform or via a Liquid Restaking Protocol.

Operators in EigenLayer enable ETH stakers to delegate their staked assets, and they facilitate the restaking of ETH to actively validated services (AVSs). AVSs use the EigenLayer protocol to integrate with Ethereum's security mechanisms (i.e., decentralized validator set), enhancing validation for protocols and dApps without their own consensus mechanisms. So overall, EigenLayer's design allows staked ETH to provide validation services beyond Ethereum itself, aggregating and extending crypto-economic security through restaking and validating new dApps/protocols built on top of Ethereum.

However, restaking means your ETH is locked in nodes, limiting their accessibility. On top of that, while EigenLayer has accumulated $9B deposits, its AVSs are not yet operational (EigenDA is launching on mainnet in Q2 2024), so none of the depositors are earning any yield right now. Currently, the main reason for depositing tokens into EigenLayer revolves around acquiring restaking “points”, which will grant depositors the eligibility for a future EigenLayer airdrop (yet to be confirmed).

Liquid Restaking Tokens (LRTs) provided by Liquid Restaking Protocols address the inaccessibility issue by providing synthetic tokens for restaked ETH. And the TVL in these LRTs has skyrocketed nearly 20x, reaching $4.8B from $280MM since the start of the year, with Ether.fi and Puffer Finance holding $1.7B and $1.2B respectively. We believe this growth is primarily fueled by EigenLayer’s restaking points.

The staked ETH used by EigenLayer is mainly generated by liquid staking derivatives (LSDs) like Lido and Rocket Pool. While the TVL of staked ETH via LSDs stands at 13.7MM ETH out of 31MM ETH in total, representing 44% of the staked Ethereum supply, they account for 61% of EigenLayer’s deposits.

Departing slightly from EigenLayer for a moment, we note that Lido holds a 71.49% market share with $34B in TVL in the overall LSD market. It's interesting to compare the Market cap / TVL (or AUM) between crypto “asset management” protocols and traditional asset managers. For example, Lido's token, LDO, with a market cap of $3B, represents around 9% in terms of Market cap / TVL. In traditional finance, asset managers are typically valued at 1-2% of AUM. For instance, BlackRock, with a $120B market cap and $10T of AUM, is at 1.2%. Franklin Templeton, with a market cap of $14.26B and $1.5T of AUM, is around 1%. Similarly, Wisdom Tree, with a market cap of $1.2B and AUM of $100B, also stands at 1.2%. This discrepancy can be attributed to the different risk and return profiles of the two sectors, whereby crypto’s volatility and opportunity for higher returns can be compared to value vs glamor stocks in traditional finance.

So we can start forming a risk curve of ETH, ranging from no risk in non-staking to liquidity risk and derivative smart contract risk in staking via the Beacon chain / LSDs. And higher up, we have a system of rehypothecation for staked ETH (EigenLayer), and then LRTs, and you can go down layers of speculation and risk.

Let’s consider Ether.fi, the biggest LRT in terms of TVL, which gives depositors eETH, which represents their EigenLayer restaked position, while you also gain EigenLayer points, which aren’t tokens, but you can already trade them via initiatives like Pendle or Kelp DAO. On top of this, you can maximize returns by using the natively restaked eETH in DeFi. For example, Davos Protocol plans to use LRTs and enable users to collateralize them to mint DUSD. We forgot to mention you also get Ether.fi loyalty points, which will probably start getting traded too at this rate.

This is a bit like looking back at DeFi summer, when there were all sorts of experiments with deflationary supply, rebase tokens, and yield farming. In particular, there were hundreds of yield farms popping up, driven mainly by speculation, and many investors ended up losing money due to over-speculation. As for a TradFi analogy, consider the impact of rehypothecation on Lehman Brothers. To paint the overall picture: you earn yield on your regular staked ETH, then yield on restaking (very soon), you also earn EigenLayer and Ether.fi points (which now have value and can be traded), then perhaps more yield from another derivative layer.

“Restaking, if executed correctly, can create more efficient systems of crypto-economic security and resolve many of the challenges around fragmentation bootstrapping.” - ConsenSys

While we like the concept of making ETH more useful, the influx of liquidity gives an illusion of vast wealth generation. However, this can be a double-edged sword. If there's suddenly a loss in confidence (perhaps if investors start wondering if their 15th layer loyalty points actually have any value), the outflow could be just as dramatic, leading to a potential bank run situation. This, in turn, could trigger a cascading effect across the derivative layers, increasing the risk of system-wide insolvency.

👑 Related Coverage 👑

With a 35% open rate and 1 million post views per month, we have an engaged audience of Fintech, DeFi, and AI enthusiasts receptive to your messaging.

Contact us to learn more about our custom opportunities.

Curated Updates

Here are the rest of the updates hitting our radar.

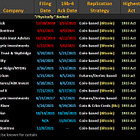

Financial Institutions and Adoption

⭐ Winklevoss Twins' Gemini Promises To Return $1.1B To Earn Customers - CoinDesk

Dune Analytics Partners With Cloud Computing Giant Snowflake - The Defiant

Validation Cloud Secures $5.8MM To Prepare Web3 For Global Enterprise Adoption - Decrypt

DeFi and Digital Assets

⭐ Uniswap Token Pumps Following Governance Fee Switch Proposal - Blockworks

⭐ Ethereum Liquid Restaking Protocol Ether.fi Closes A $27MM Investment Round - The Block

⭐ Ether.Fi Closes $23MM Series A Round As Eigenlayer TVL Surpasses $9B - The Defiant

Solana Veterans Raise $17MM for 'Backpack' Crypto Wallet, Exchange - CoinDesk

Bitcoin Restaking Protocol BounceBit Raises $6MM In Seed funding; Already Boasts Over $545MM In TVL - The Block

Pantera Capital Invests In decentralized Lending Protocol Morpho - The Block

Lens Protocol Goes Permissionless - The Defiant

Blockchain Protocols

⭐ Polygon zkEVM Prepares For Ethereum’s Dencun Upgrade, Eyes Major Fee Reductions With EIP-4844 - The Block

Blockchain Startup Initia Raises $7.5MM To Build ‘Network For Interwoven Rollups’ - Crypto.news

DePIN Sector Sees Resurgence In 2024 - The Defiant

NFTs, DAOs and the Metaverse

⭐ First Bitcoin Blockchain ICO Rockets Past $5MM Milestone - The Defiant

⭐ VanEck Starts Digital Asset Management Platform and NFT Marketplace - CoinDesk

Now Media Deploys Sovereignty® On Base To Build The Future Of Authenticated Media - nftnow

Pudgy Penguins Announces Unstoppable Domains Partnership and Walmart Expansion - The Defiant

🚀 Level Up

Sign up to the Premium Fintech Blueprint and in addition to receiving our free newsletters, get access to:

Wednesday’s Long Takes with a deep, comprehensive analysis.

‘Building Company Playbook’ series, offering insider tips and advice on constructing successful fintech ventures.

Enhanced Podcasts with industry leaders, accompanied with annotated transcripts for deeper learning.

Special Reports

Archive Access to an array of in-depth write-ups covering the hottest fintech and DeFi companies.

Join our Premium community and receive all the Fintech and Web3 intelligence you need to level up your career.