Hi Fintech Futurists —

Welcome back to our podcast series! For those that want to subscribe in your app of choice, you can now find us at Apple, Spotify, or on RSS.

In this conversation, we chat with Jeff Boortz - Chief Product Officer at Blockstream. Jeff has over two decades of experience in product management and software development. Boortz began his career as an IT Consultant at PriceWaterhouseCoopers in 1997. Jeff then moved to DoubleTwist in 1999, where he served as Technical Lead. In 2002, he joined First Data Corporation as Senior Application Architect.

Boortz joined Google in 2007 as Senior Director of Product Management. Jeff led product for the Google App and Google Discover. Boortz left Google in 2021 to join Blockstream as CPO.

Jeff attended Stanford University, where he earned a Bachelor of Science in Industrial Engineering. Jeff then went on to earn an MBA from the University of California, Berkeley, Haas School of Business.

Topics: Bitcoin, layer-2, blockchain, ethereum, crypto, cryptocurrency, Protocol, L2

Tags: Blockstream, Bitcoin, Lightning Network, Google, Liquid Network, Blockstream Green, Ethereum, Product

👑See related coverage👑

DeFi: Are Bitcoin & EVM inscriptions a valuable asset, or just spam exploiting a vulnerability?

[PREMIUM]: Long Take: What actually matters about the Bitcoin ETF

[PREMIUM]: Long Take: What Layer 1 protocols must learn from the Telecom crash

Timestamp

1’44: From web development to Google: Jeff’s journey through technology and his evolution from software developer to shaping business strategies

6’03: Integrating tech in finance vs. core technology companies: Insights on skill sets and product development

13’17: Blockstream's mission and portfolio: Rethinking trust in financial transactions with Bitcoin and layer 2 technologies

16’52: Blockstream's core business: Building protocols and tools for Bitcoin-connected networks and services

20’27: Liquid Network's scale and programmability: Exploring blinded transactions and asset representation on Blockstream's sidechain

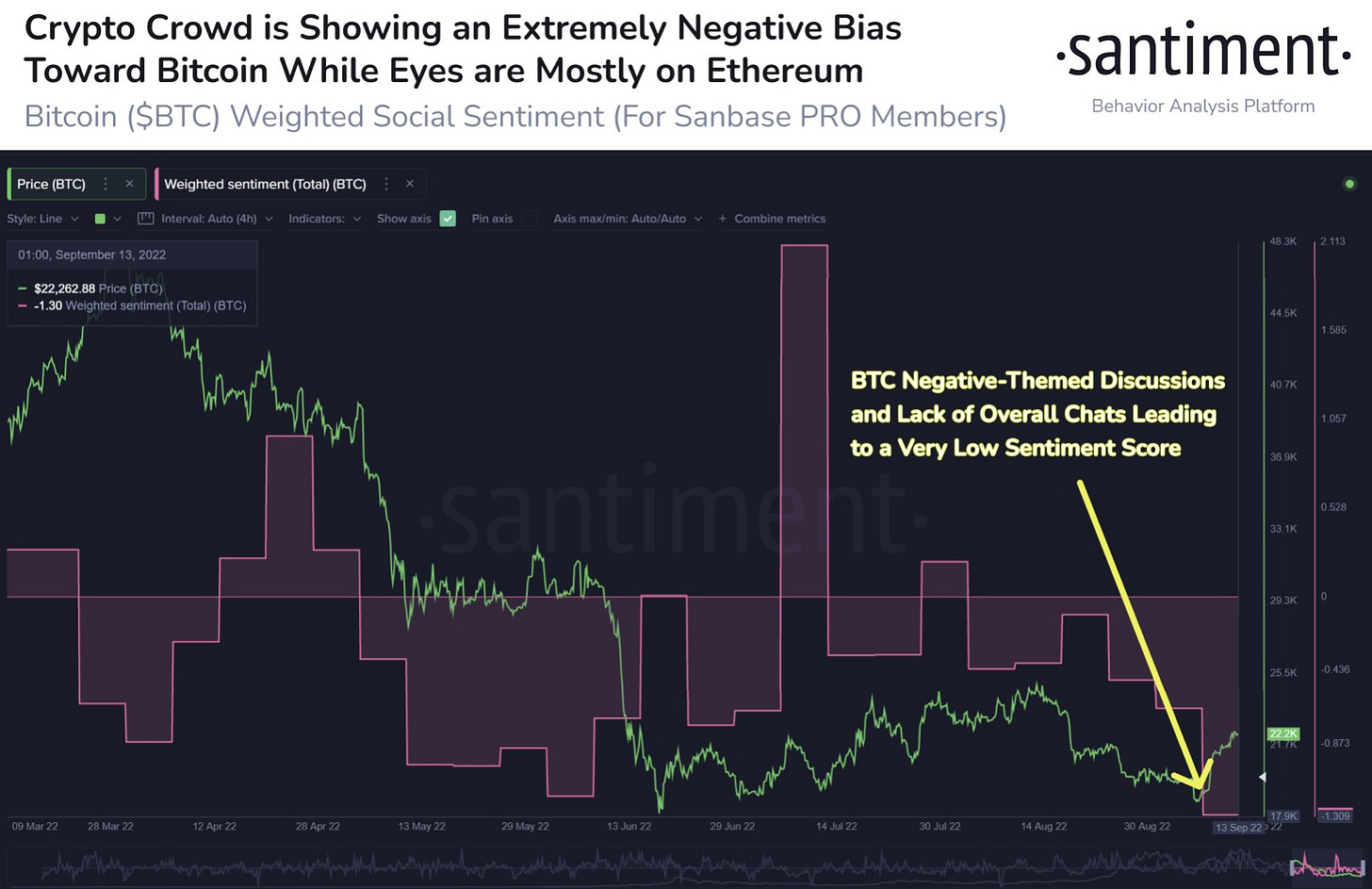

24’09: Bitcoin's evolution since 2009: Balancing decentralization with development and the institutional investment narrative

29’20: Lightning Network's progress: Enhancing Bitcoin's scalability and adoption through Layer 2 solutions

33’37: Lightning Network adoption: Balancing user convenience and enterprise applications in Bitcoin's Layer 2

37’24: Bitcoin's evolving ecosystem: Exploring Ordinals, inscriptions, and the surging interest in programmable assets

41’18: Reimagining financial markets: Blockstream's vision for trust-minimized finance and the path to equitable systems

43’45: The channels used to connect with Jeff & learn more about Blockstream

Sneak Peek:

Jeff Boortz:

…maybe if I'm jumping ahead to where things went wrong, the roots of that, I don't fully understand, but I think that does feel like a net loss for the ecosystem that things have evolved in that way. But moving back to the genesis of Bitcoin, I mean, I think it has a very unique origin story. It's probably been repeated over and over again, but the fact that it was ... to me, Bitcoin really represents the cryptocurrency that has actually moved farthest down the limb of decentralization. They have actually managed to exist without even a known creator. And the fact that Bitcoin, the distribution of Bitcoin has basically started from the point of whoever learned about the technology and started mining it, they earned the first Bitcoin. And I think it has these kinds of roots in really establishing what decentralization means, the ethos of decentralization. And obviously, I think its track record in terms of uptime and its resilience indicates that the game-theoretic conditions that were part of the design of Bitcoin really work.They are fundamentally sound, and that makes the network itself sound, which I think is really what the design of Bitcoin was aspiring to do. Obviously, Bitcoin has, I think, sacrificed quite a bit to achieve its ... or establish its decentralization position. There are things that ... famously like the blocksize wars where there were different pressures being applied that could have steered Bitcoin in different directions. The priority at that time and the priority even today is on ensuring that Bitcoin is a true peer-to-peer network that has really minimal centralization influences. There are always centralization threats and things that can creep in. And I do think a big priority for Bitcoin developers is to continue to keep those minimized.

And so, I think that's a very different design philosophy, an interesting design philosophy that Bitcoin has chosen. It's also obviously a very conservative approach, and I think you see that conservatism reflected in how Bitcoin functionality evolves as well, which is to say at a very slow pace. Obviously, things that can improve the security of the network are embraced. Things that can expand the functionality of the network are…

If you would like to access the full transcript, subscribe below.

Shape Your Future

Wondering what’s shaping the future of Fintech and DeFi?

At the Fintech Blueprint, we go down the rabbit hole in the DeFi and Fintech world to help you make better investment decisions, innovate and compete in the industry.

Sign up to the Premium Fintech Blueprint newsletter and get access to:

Blueprint Short Takes, with weekly coverage of the latest Fintech and DeFi news via expert curation and in-depth analysis

Web3 Short Takes, with weekly analysis of developments in the crypto space, including digital assets, DAOs, NFTs, and institutional adoption

Full Library of Long Takes on Fintech and Web3 topics with a deep, comprehensive, and insightful analysis without shilling or marketing narratives

Digital Wealth, a weekly aggregation of digital investing, asset management, and wealthtech news

Access to Podcasts, with industry insiders along with annotated transcripts

Full Access to the Fintech Blueprint Archive, covering consumer fintech, institutional fintech, crypto/blockchain, artificial intelligence, and AR/VR

Read our Disclaimer here — this newsletter does not provide investment advice and represents solely the views and opinions of FINTECH BLUEPRINT LTD.

Want to discuss? Stop by our Discord and reach out here with questions