DeFi: Flashbots raises at $1B valuation; Animoca invests $30MM in Web3 neobank hi

In a time when AI investments are all the rage, we are not surprised to see Flashbots bring the limelight back to crypto

The Fintech Blueprint is a newsletter authored by me, Lex Sokolin, and a small group of brilliant researchers who focus on frontier technologies impacting the future of financial services. I am glad you are here. Was this email forwarded to you? You deserve your own:

👉subscribe here.

Gm Fintech Futurists —

Today we highlight the following:

DEFI & DIGITAL ASSETS: Ethereum Software Infrastructure Provider Flashbots Raises $60MM (link here)

INVESTING: Metaverse Giant Animoca Brands Plunges $30MM Into Crypto 'Super App' hi (link here)

CURATED UPDATES

To support this writing and access our full archive of newsletters, analyses, and guides to building in the Fintech & DeFi industries, subscribe below.

DeFi Short Takes

DEFI & DIGITAL ASSETS: Ethereum Software Infrastructure Provider Flashbots Raises $60MM (link here)

Flashbots, the prominent MEV research and development firm, has raised $60MM in a Series B funding round led by Paradigm, a crypto-focussed investment firm. Investors in the round were selected based on their reverse pitches, highlighting the hype surrounding Flashbots, and its valuation is reportedly now over $1B.

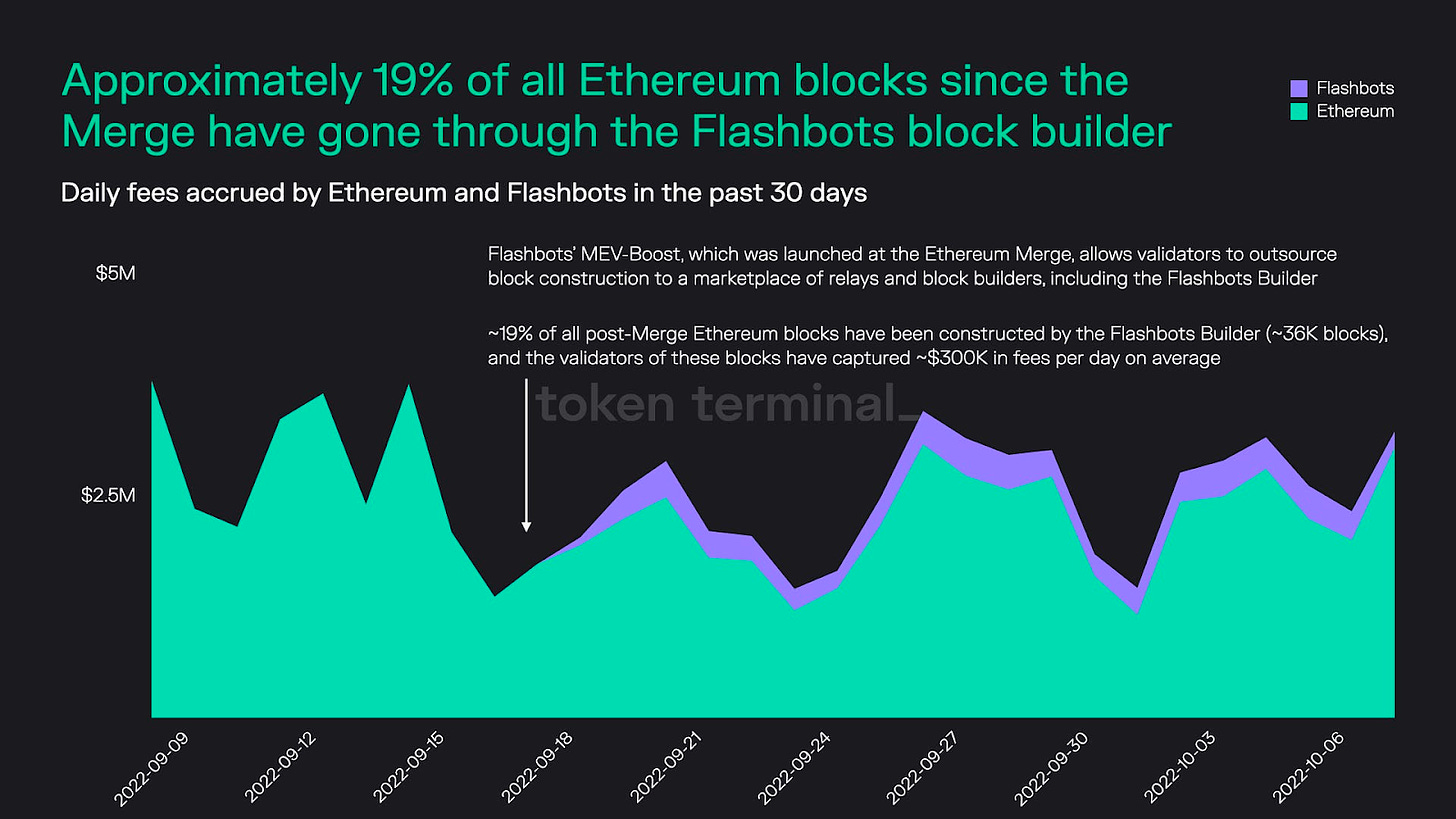

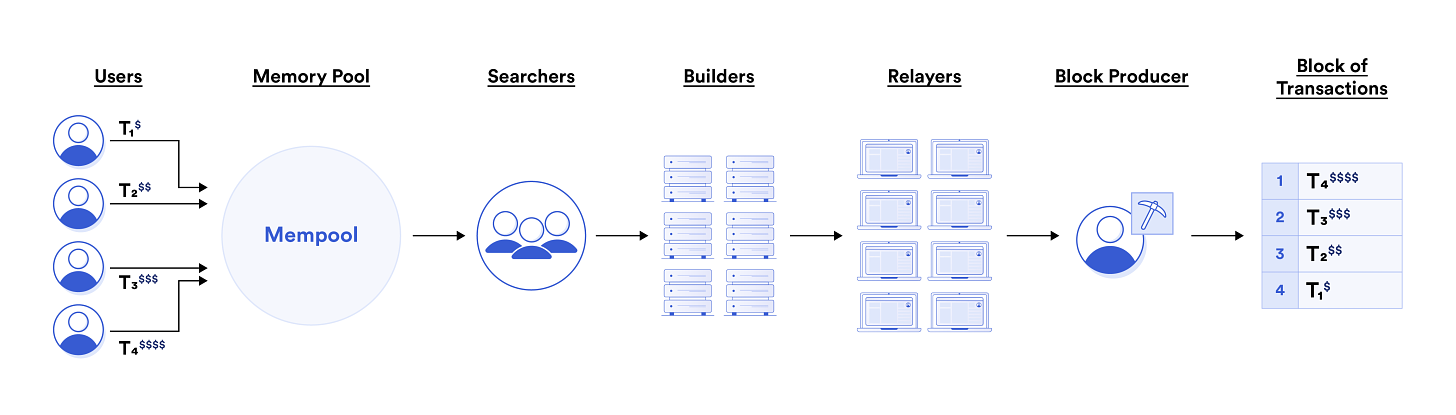

Maximal extractable value (MEV) is Flashbots’ bread and butter. MEV is the value that can be extracted by blockchain network operators by re-ordering or previewing pending blockchain transactions to realize the most cost-efficient ordering. Techniques like front-running transactions are common, whereby fees are paid to move ahead in the ordering, but it comes at the cost of deteriorating the average end-users experience.

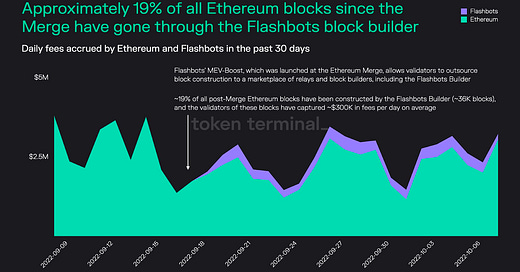

Flashbots focuses on mitigating the negative externalities posed by MEV, with a primary focus on Ethereum. Its products include Flashbots Auction, a marketplace for transaction ordering; Flashbots Data, its dashboards for MEV data; MEV-Boost, a solution for minimizing the negative impact of MEV through proposer-builder separation that is used by many validators on Ethereum; and Flashbots Protect, an RPC endpoint protecting against frontrunning and failed transactions.

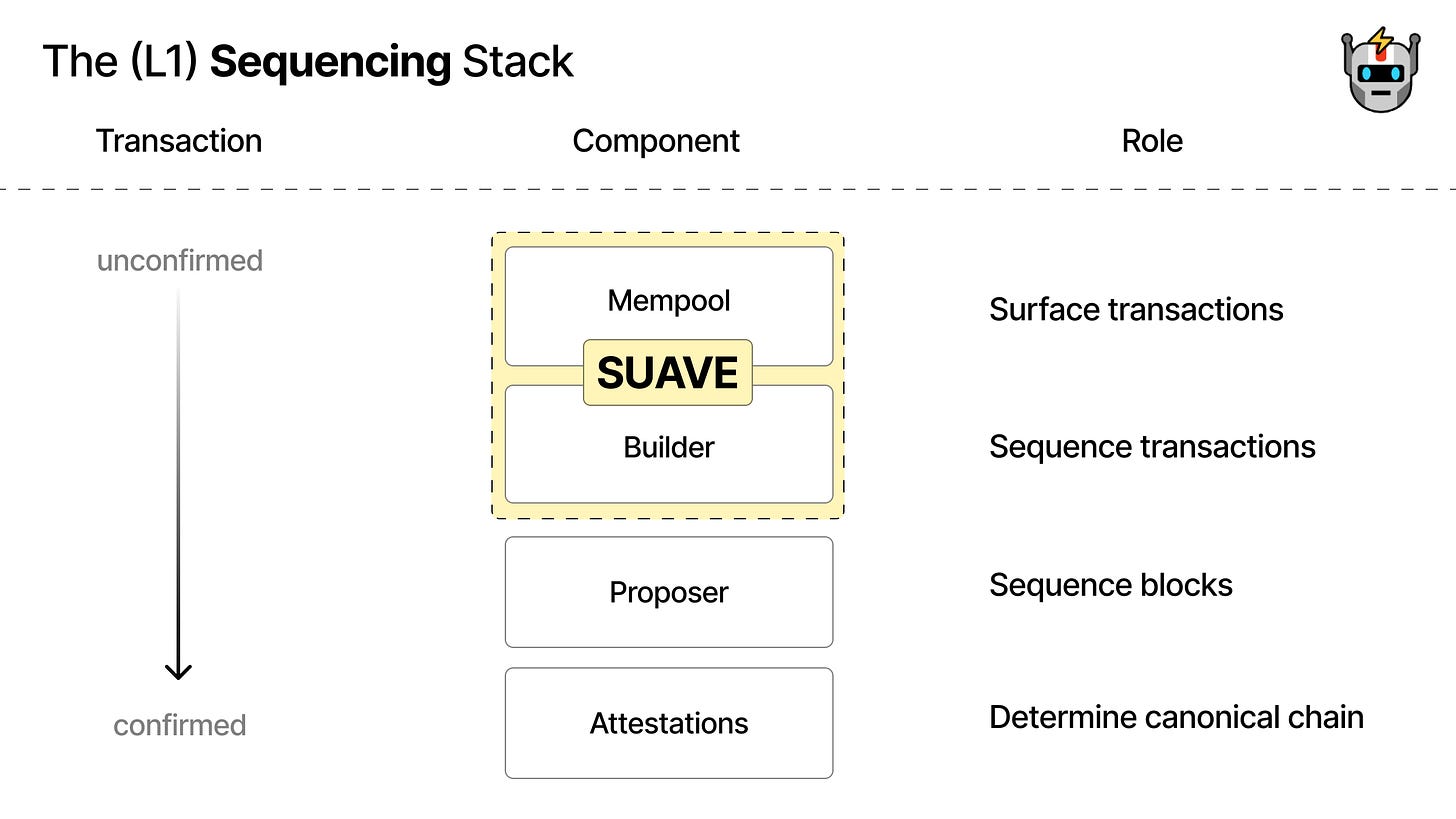

This round, in particular, will help fund its SUAVE (Single Unifying Auction for Value Expression) platform. SUAVE aims to be an independent network that can perform the roles of a decentralized block builder and act as a mempool (the list of pending transactions). At a high level, developers can use it to create intra-block applications, which can be designed in ways that provide users with custom benefits like cheaper or more private transactions than otherwise could be completed on Ethereum.

In a time when AI investments are all the rage, we’re not surprised to see Flashbots bring the limelight back to crypto. Its current offering makes it a foundational tool for Ethereum validators, which manage almost 19% of all circulating ETH via staking. Its focus for the future, SUAVE, is also attracting much attention. The solution can provide a unified sequencing layer for many layer 2s as they look to become progressively decentralized, solving a critical technical challenge for one of the most hyped areas in Web3. Both the present and future are looking rosy for Flashbots.

👑 Related Coverage 👑

INVESTING: Metaverse Giant Animoca Brands Plunges $30MM Into Crypto 'Super App' hi (link here)

Metaverse gaming company Animoca Brands has invested $30MM in Web3 neobank "hi," founded by Sean Rach, the former CMO of Crypto.com. Before the investment, "hi" had partnered with Mastercard to launch a debit card that allowed users to customize avatars using their own NFTs.

As for Animoca, the company had initially announced the development of the Animoca Capital fund with a goal of $2B in November. However, in January, they scaled down this target by 50% and have just reduced the target by an additional 20%, settling at $800MM.

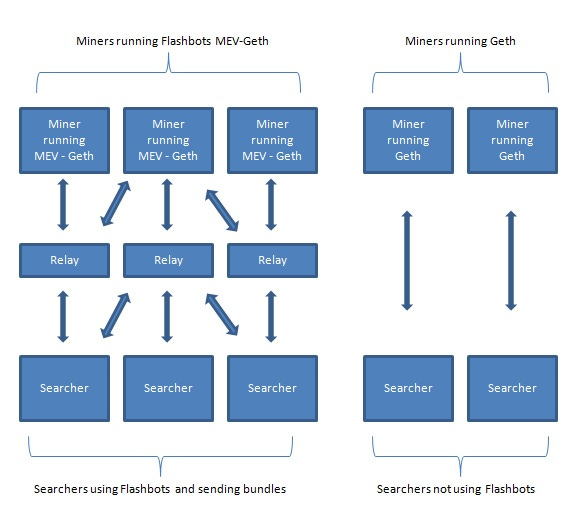

The "hi" platform offers crypto trading via credit card and bank transfers. Current listed tokens include BTC, ETH, SOL, and 100+ cryptocurrencies. The neobank offering also provides instant fiat top-ups, and fee-free money transfers. Currently, "hi" has 3.6MM members and is in phase one of its plan.

During phase one, which is slated for completion within the next 18 months, "hi" intends to introduce equity, ETF, crypto derivatives trading, and venture into Gamefi. The fintech also needs to address several highlighted challenges include KYC problems, the 40% annual yield generated on their native token, and concerns about the legitimacy of Google Play and App Store reviews.

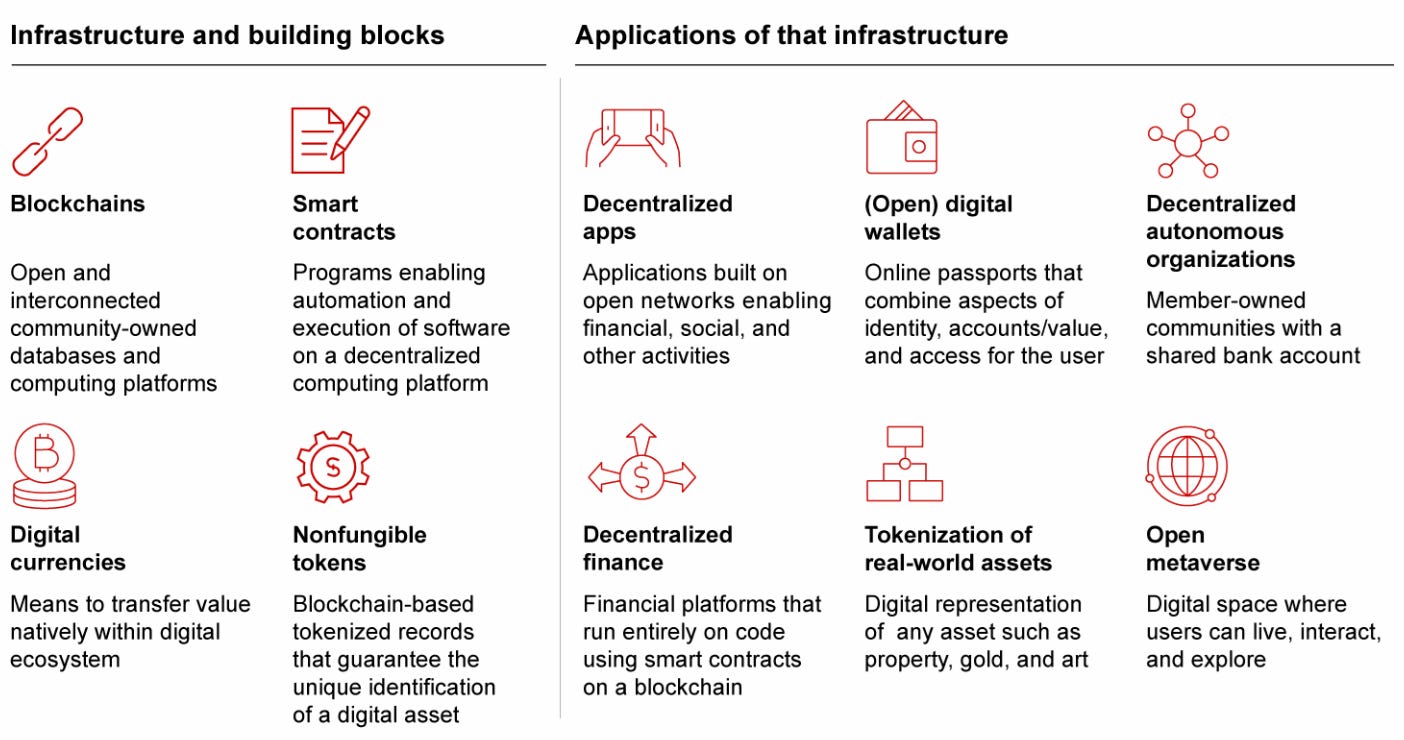

Phase two will introduce DEhi, a decentralized non-custodial wallet, for holding and accessing NFTs and dApps. "hi" also plans to unveil the “hi Protocol” (hiP), a Layer-2 Sidechain for Ethereum that boasts scalability, EVM compatibility, and a proof-of-humanity identity (PoHI) mechanism. At the core of PoHI is a Zero Knowledge Set Membership (ZKSM), which leverages ZK technologies to identify users without revealing their identities.

We see “hi”’s neobank infrastructure as the main motivation behind this investment. Animoca’s users will be able to make direct transactions with tokens from within the ecosystem, such as Sandbox’s SAND token. “hi” debit cards can be used to trade these tokens online or in real life, and the wallet can build on its Gamefi specific functionality, similar to its customizable NFT avatars feature.

For Web3 as a whole, we emphasize the need for secure banking infrastructure, which should precede ventures into gamified financial projects. The negative reviews on “hi” exemplify the importance of establishing a reliable foundation and also the nascent stage of Web3 banking. If “hi” is to establish itself as a prominent player in this area it has issues to address on its KYC processes. But if it can effectively leverage PoHI and this partnership with Animoca effectively it could become a hallmark for banking in the age of Web3 gaming.

👑 Related Coverage 👑

Curated Updates

Here are the rest of the updates hitting our radar.

Financial Institutions and Adoption

DCG Says It's Close To Reaching Agreement On Genesis Chapter 11, Appoints New CFO - The Block

WisdomTree To Leave ‘No Stone Unturned’ With New Blockchain-Native App - Blockworks

DeFi and Digital Assets

⭐ DeFi Exchange Curve Finance Confirms Various Ethereum Pools Hacked & Justin Sun, DCF God And Others Line Up To Buy Curve Finance Founder’s CRV Token - Decrypt

⭐ PancakeSwap To Share Trading-Fee Revenue With CAKE Token Stakers - The Block

dYdX Proposal To Slash Token Issuance Wins Early Support - CoinDesk

zkSync Era welcomes PancakeSwap to the ecosystem - Blockworks

Arkham Bounty Unearths $160MM In Alleged Terra Wallets - The Defiant

Blockchain Protocols

⭐ Gitcoin's Layer 2 'Public Goods Network' Goes Live On Mainnet - The Block

Celo Network Welcomes Google Cloud Validator To Its Network - Blockworks

SHIB Devs Begin Testing Shibarium To Ethereum Bridge - Decrypt

NFTs, DAOs and the Metaverse

Gucci Reveals Rewards for Vault Material NFT Holders - Decrypt

Arbitrum DAO’s First Grants Programs Take Shape - CoinDesk

Shape your Future

Wondering what’s shaping the future of Fintech, Digital Wealth and Web3?

At the Fintech Blueprint, we go down the rabbit hole to help you innovate and compete in Fintech.

Sign up to the Premium Fintech Blueprint newsletter and get access to:

Monday Fintech Short Takes, with weekly coverage of the latest fintech, digital investing, banking, and payments news via expert curation and in-depth analysis

Wednesday Long Takes on Fintech and Web3 topics with a deep, comprehensive, and insightful analysis without shilling or marketing narratives

Thursday DeFi Short Takes, weekly analysis of developments in the crypto space, including digital assets, DAOs, NFTs, and institutional adoption

Access to the Podcasts with industry leaders on building leading companies in Fintech and DeFi along with value-added data-driven, annotated transcripts

Full library of the weekly in-depth write-ups on 15+ topics and 50+ Fintech and DeFi brands, offering deep, comprehensive, and insightful analysis without shilling or marketing narratives

Exclusive Deep Dive reports into Fintech business models and brands that transform the Fintech and DeFi space

Access to our CEO & Founder focused 'Building Company Playbook' series, offering insider tips and advice on constructing successful fintech ventures.