DeFi: Jupiter airdrops $700MM to Solana users, top 10 largest of all time

And yet Solana went down again

Hi Fintech Futurists —

Today we highlight the following:

PROTOCOLS: Exploring Jupiter’s $700MM JUP Airdrop

CURATED UPDATES: Financial Institutions and Adoption; DeFi and Digital Assets; Blockchain Protocols; NFTs, DAOs and the Metaverse

To support this writing and access our full archive of newsletters, analyses, and guides to building in the Fintech & DeFi industries, subscribe below.

In Partnership

Fintech Meetup (March 3-6) is the best place to find new business, partnerships and opportunities. Attendees & sponsors say Fintech Meetup is “the highest ROI event” with reasonably priced sponsorships, tickets, and rooms. Meet everyone for any reason across every use case over 45,000+ double opt-in meetings, and network with 4,000+ attendees.

PROTOCOLS: Exploring Jupiter’s $700MM JUP Airdrop

Last week Solana witnessed the biggest airdrop in its history. Jupiter, the leading Solana decentralized exchange aggregator (i.e an application that enables users to find the best prices across all Solana DEXs), accounting for 27% of Solana DEX users, airdropped $700MM in its native JUP token to its community.

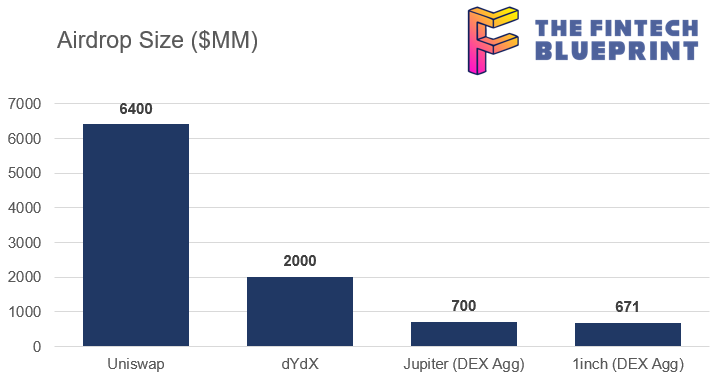

Assuming all-time high token prices, this ranks Jupiter as the tenth biggest airdrop of all time, with the only DEXs ranking ahead being Uniswap ($6.4B UNI airdropped) and dYdX ($2B DYDX airdropped). If we look specifically at DEX aggregators, Jupiter just about trumps 1inch’s $671MM airdrop to become the largest airdrop in its niche — no easy feat, given that 1inch accounted for 64% of the Ethereum DEX aggregator market in Q4 2023.

Jupiter currently accounts for 63% of all DEX volume on Solana, a particularly large amount given that Solana overtook Ethereum for the first time in 7-day DEX volume in December 202 — totaling $10.1B compared to $8.8B. This is due to the growth of Solana in the past few months, spurred by memecoins, like BONK and Dogwifhat, and more users exploring the Solana ecosystem due to its lower fees and transaction times compared to Ethereum. Despite the rise of Solana, it is worth noting that SOL’s market cap sits at $41B vs. ETH at a $285B market cap, which we largely attribute to the developer popularity of ETH and its considerably larger ecosystem of dapps. See our analysis here.

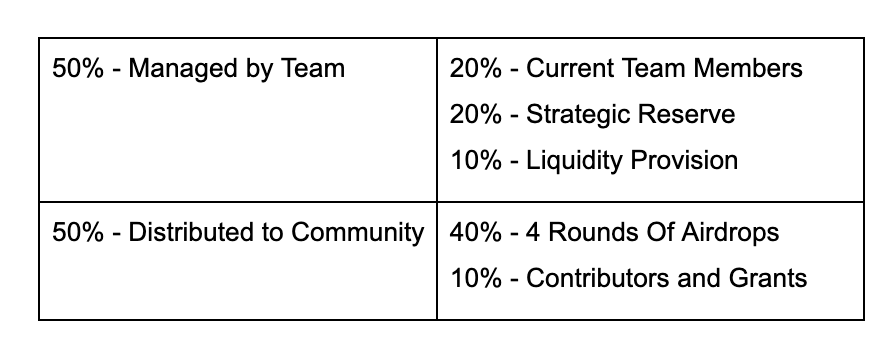

Diving into the tokenomics, Jupiter has split the token supply 50:50 between team and community. The team allocation is divided between current team members (20%), strategic reserves for new hires and investors (20%), and liquidity provisioning for the token (10%). The community allocation is split between airdrops (40%), which will be distributed across four rounds to motivate continuous growth, and grants (10%).

At first glance, the team allocation, when accounting for the strategic reserves, is high. The community allocations may also seem relatively high. However, we appreciate how they are broken into four rounds designed to incentivize future growth. This is similar to Optimism’s airdrop approach, which has undoubtedly been successful when one considers that its native token’s market cap is a third higher than Arbitrum’s despite having half the market share.

What we also like about the community allocations is that the first airdrop distributed 10% of the tokens as follows — 2% evenly distributed to all wallets, 7% distributed based on a tiered score based on adjusted volume, and 1% to community members on Discord and X. Distributing tokens evenly, while not necessarily a meritocracy, is an inclusive mechanism for all users, rather than benefiting airdrop farmers that are likely to move onto the next project after receiving and selling their tokens.

These smaller, real users now have a vested interest in Jupiter doing well and are incentivized to continue using it in the hope of future airdrops and appreciation of their JUP token holdings.

The airdrop has overall been successful, despite the token itself being limited to governance capabilities only. Tokenomics aside, key to its success has been the burgeoning interest in the Solana ecosystem, which has grown from $260MM in TVL to $1.7B in the past year, coupled with Jupiter’s dominance in the Solana DEX space.

Despite these wins for Solana, we received a reminder about its greatest pitfall this week — the blockchain went down for 5 hours, the largest outage since its two-day stoppage in February 2023, due to currently unknown causes. There is profound work to be done on decentralization if Solana is to remove such points of failure and compete with Ethereum.

👑 Related Coverage👑

Curated Updates

Here are the rest of the updates hitting our radar.

Financial Institutions and Adoption

⭐ SEC pushes back timeline for decision on the Invesco Galaxy Ethereum ETF - The Block

Ramp rolls out ID free crypto onboarding in attempt to boost adoption - The Block

DeFi and Digital Assets

⭐ Crypto Payments App Oobit Raises $25M in Series A Funding Round Led by Tether - CoinDesk

⭐ Hybrid crypto exchange Cube reaches $100 million valuation in new funding round - The Block

Crypto yield marketplace Superform, built by former BlockTower investors, raises $6.5 million - The Block

Blockchain Protocols

⭐ Solana network restarts after outage that lasted five hours - The Block

Nibiru Chain Secures $12 Million to Fuel Developer-Focused L1 Blockchain - Decrypt

NFTs, DAOs and the Metaverse

⭐ What Is Farcaster and Why Is Crypto So Excited About the Twitter Alternative? - Decrypt

Art Blocks Acquires NFT Marketplace Sansa - Decrypt

‘Heroes of Mavia’ token airdrop follows entry into crypto gaming sphere - Medium

🚀 Level Up

Sign up to the Premium Fintech Blueprint and in addition to receiving our free newsletters, get access to:

Wednesday’s Long Takes with a deep, comprehensive analysis.

‘Building Company Playbook’ series, offering insider tips and advice on constructing successful fintech ventures.

Enhanced Podcasts with industry leaders, accompanied with annotated transcripts for deeper learning.

Digital roundtable discussions.

Archive Access to an array of in-depth write-ups covering the hottest fintech and DeFi companies.

Join our Premium community and receive all the Fintech and Web3 intelligence you need to level up your career.