Long Take: J.P.Morgan's Quorum becomes part of ConsenSys, putting Ethereum at heart of commercial and financial infrastructure

Hi Fintech futurists --

This week, we look at:

Computing paradigm evolutions from mainframe, to desktop, to cloud, to blockchain

How financial infrastructure is a derivative of the computing paradigm

The current symptoms of this restructuring in DeFi

The J.P. Morgan / ConsenSys deal, and longer term convergence in digital assets

For more analysis parsing 12 frontier technology developments every week, a podcast conversation on operating fintechs, and novel food-for-thought essays, become a Blueprint member below.

Long Take

I've never been more curious! Everything seems to be getting connected -- finance, culture, art, technology, media, geopolitics. It is either a fantastic time to be working in our industry, or we are slowly going nuts from information over-exposure. Let's tug on a few strings as they relate to my personal thesis on what is happening next. I am going to focus on ConsenSys as the anchor in this write-up, so the reader is duly warned to be critical of my self-serving claims. Please also note that this my take -- not the ConsenSys take -- for which I would direct you here.

The main driver of today's entry is the news -- which has largely percolated -- that ConsenSys acquired Quorum from J.P. Morgan, as well as received an investment from the bank in the company. There is a lot of jargon in the blockchain industry, and I want to try to pull this news apart to explain why it is interesting both to incumbent financial services players, as well as meaningful to the developing decentralized finance industry.

At the core of the answer is the question about the computing paradigm. How does software operate? Where does it operate? Who secures it? And of course, in the spirit of our common interest, how does this impact financial infrastructure?

We know that financial infrastructure derives both (1) top down, from the powers of the State over moneys and the risk-taking institutions that are entrusted to safekeep such value, and (2) individual human behaviors like paying, saving, trading, investing, and insuring. Throughout time, people want to apply inter-temporal utility maximization functions to their assets, and then the various aggregations of people into super-organisms (i.e., corporations, municipalities) similarly have the same financial needs.

As a result, financial infrastructure is just our collective solution for enabling the above activities using the latest in technology -- whether that technology is language, paper, calculators, the cloud, blockchain, or some other reality-bending physical discovery. The illustration above shows the progression from main frame computers, to standalone desktops and laptops running local software, to the magnificence and efficiency of cloud computing accessed through the interface of the mobile device, to now open source programmable blockchains secured by computational mining. These gears of computational machine enable core banking, portfolio management, risk assessment, and underwriting in the guise of various companies.

Some companies, like Fiserv or FIS, still provide software that runs on a mainframe (hi there COBOL-based core banking), among other more modern activities. Some companies, like Envestnet, still support software that runs locally on your machine (see Schwab Portfolio Center acquisition), among other more modern activities.

Let's be honest. This is last century stuff.

Today, all software should at the least be written to be executed from the cloud. You can see this thesis proven out by the massive revenues Google, IBM, Amazon, and Microsoft generate in their Financial Cloud divisions. Technology firms should host technology -- they are far better at this than financial institutions. The venture capital games of embedded finance, open banking, PSD2 and API, all of these revolve around the premise that banks are behind on cloud technology and do not know how to package and deliver financial products to where they matter. And products matter where their customers live, which is in attention platforms and other brand experiences.

Nobody has proven this out as well as Ant Financial. Proximity payments and QR-code based shopping rode the mobile and cloud networks of Alibaba. You would not be able to design this user experience, nor this attention platform without a technology footprint that began with cloud computing and the Internet. It is less a banking enablement software (i.e., the narrow ambition of banking-as-a-service), and more the data, media, and e-commerce experience of Amazon and Facebook with financial product monetization.

Over 60% of Ant's revenue comes from Fintech product lead generation, with capital risks passed on to the underlying banks and insurers, which Ant also digitizes. Remember that the chassis for credit scoring comes from the tech giant and its artificial intelligence pointed at 700 million people and 80 million businesses, not the other way around from the banks. This therefore incorporates the types of enabling fintech that Refinitiv and Finastra dream about.

The 21st Century of Programmable Blockchain

So far we have abstracted, somewhat naively, all the complexities of actually standing up these operating businesses, and instead described them as financial infrastructure derivatives of the computing paradigm of the moment. This is based on the premise that people will always re-invent financial infrastructure, and use the tools of the time to make it over and over again.

As a comparison, we have always needed light, but the technology of light -- from fire, to gas lamps, to incandescent bulbs, to LEDs -- evolves progressively by ingesting new available scientific components.

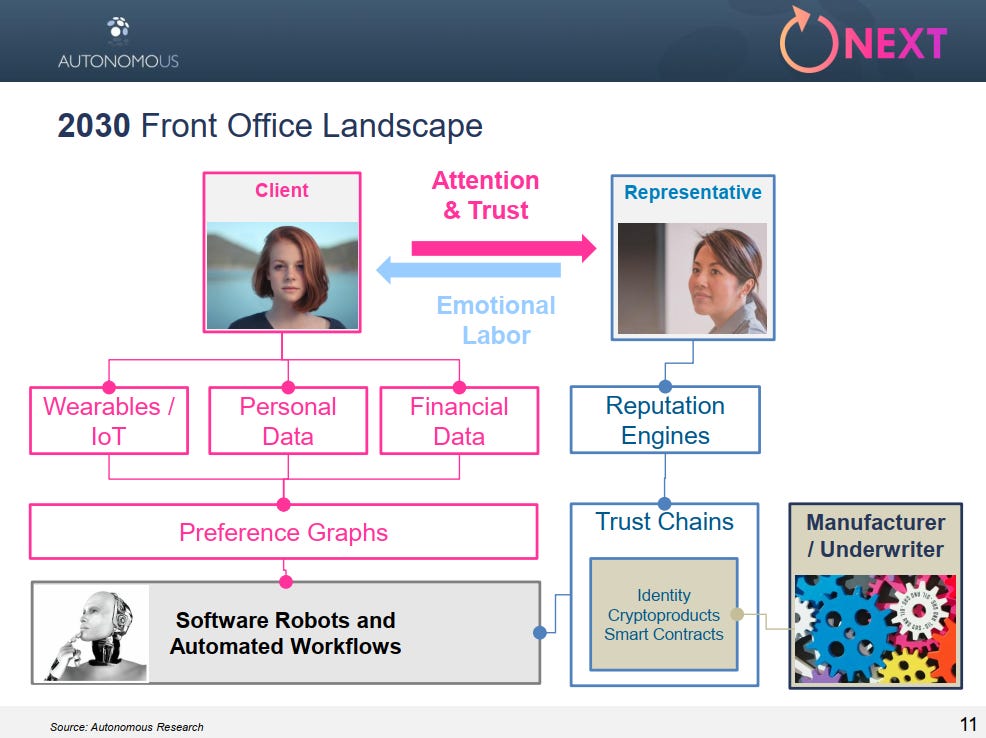

One of the next computing paradigms is running mutualized (i.e., open source, shared, communal) software on blockchain networks for digital assets. In early 2017, I articulated a version of this thesis at Autonomous Research. A human relationship remains between the client and some representative of the financial product, whether that representative is a CFA-bearing Series 7 advisor at Goldman Sachs via Zoom or a superstar developer Andre Cronje via Twitter. There is a trust link and reputational capital. But underneath that relationship is largely automated, AI-driven data gathering, which is normalized and processed into software that connects into blockchains, which is then underwritten by a financial firm. That financial firm may be BlackRock or Placeholder VC.

The examples below show you what "Software Robots and Automated Workflows" have largely become today, in this current phase of evolution. Ethereum, the leading such network, experiences over 3 million "contract" calls per day by its embedded software. Below is a chart of the machine humming along and doing ever more computational work. Certainly it is not the only programmable blockchain, with several solutions even sitting on top to create additional throughput capacity and scalability, such as Cosmos, OMG, and SKALE.

What does the android dream about? In large part, financial infrastructure.

It dreams of digital asset trading on Uniswap, which for the first time in history experienced more trading volume with its 200,000 users than fintech unicorn Coinbase with its 30 million.

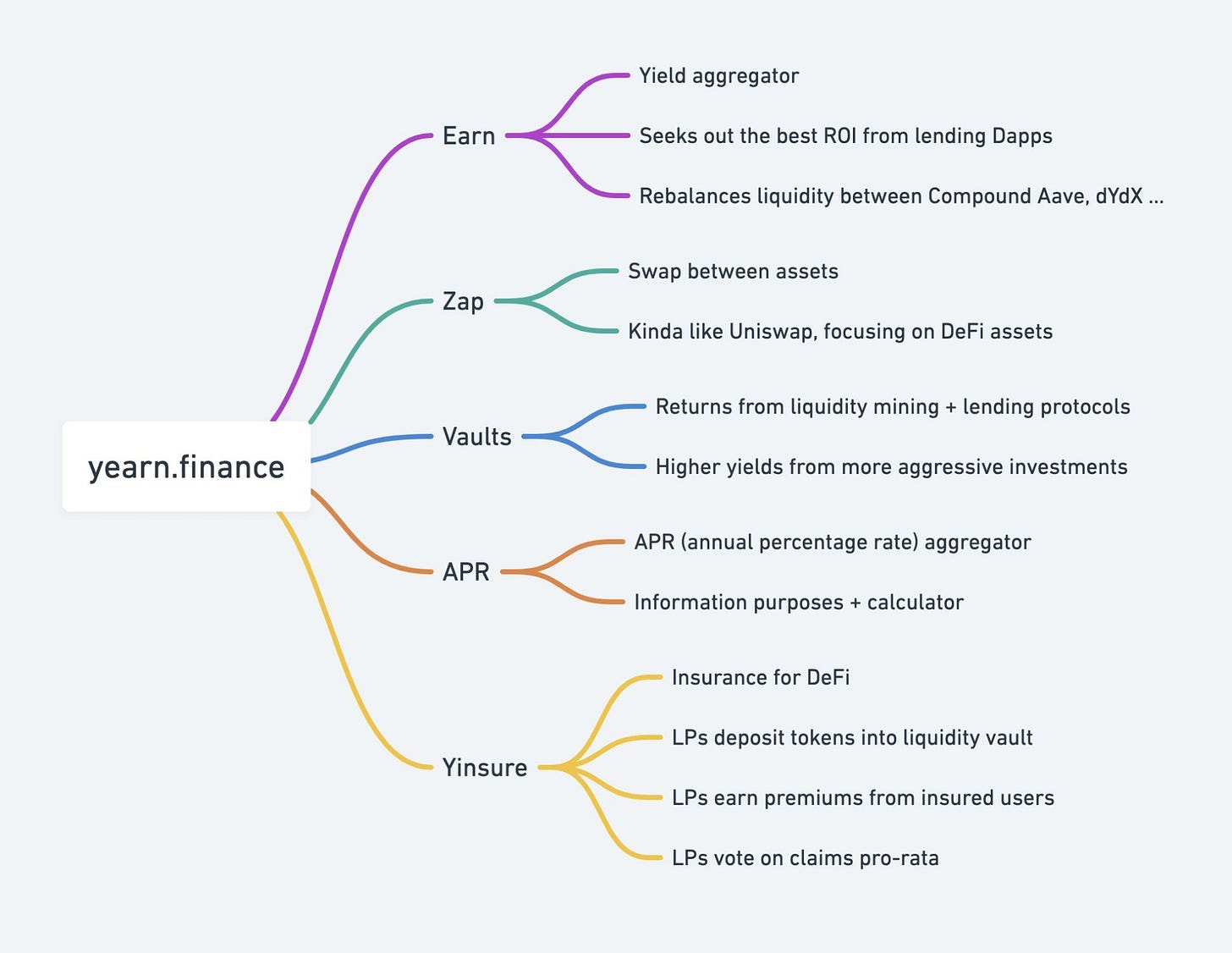

It dreams of asset management and market making, with financial robots composing automated trading and investment strategies (chart link here) on Yearn Finance. It dreams of 300,000 people creating their own investment plans on DeFi aggregator Zapper (chart link here).

Back to Quorum

J.P. Morgan, the global bank, was one of the first large financial institutions to understand and invest in the potential of this technology. With an internal team, it developed a version of Ethereum that supported the needs of the financial firm, such as privacy and scalability. For example, just because I pay you for a sandwich with digital assets, doesn't mean I want to also show you my entire banking statement. This project was called Quorum, and includes software to deploy, run, and access private networks between large financial incumbents engaged in supply chain finance, bond issuance, central bank digital currency experiments, and other wholesale payments networks.

Any fintech software that you deploy on top of a blockchain, you deploy on top of a blockchain. Someone has to orchestrate and support this infrastructure. The regular, public version of Ethereum -- often called mainnet -- is performant through decentralized mining incentives. It runs on thousands of computers and rewards participants for computational security with digital assets. The permissioned, private version of Ethereum is often deployed bespoke to industry projects and their specific context. It is coordinated and managed by network participants and their technology providers, like all regulated commodity and capital markets.

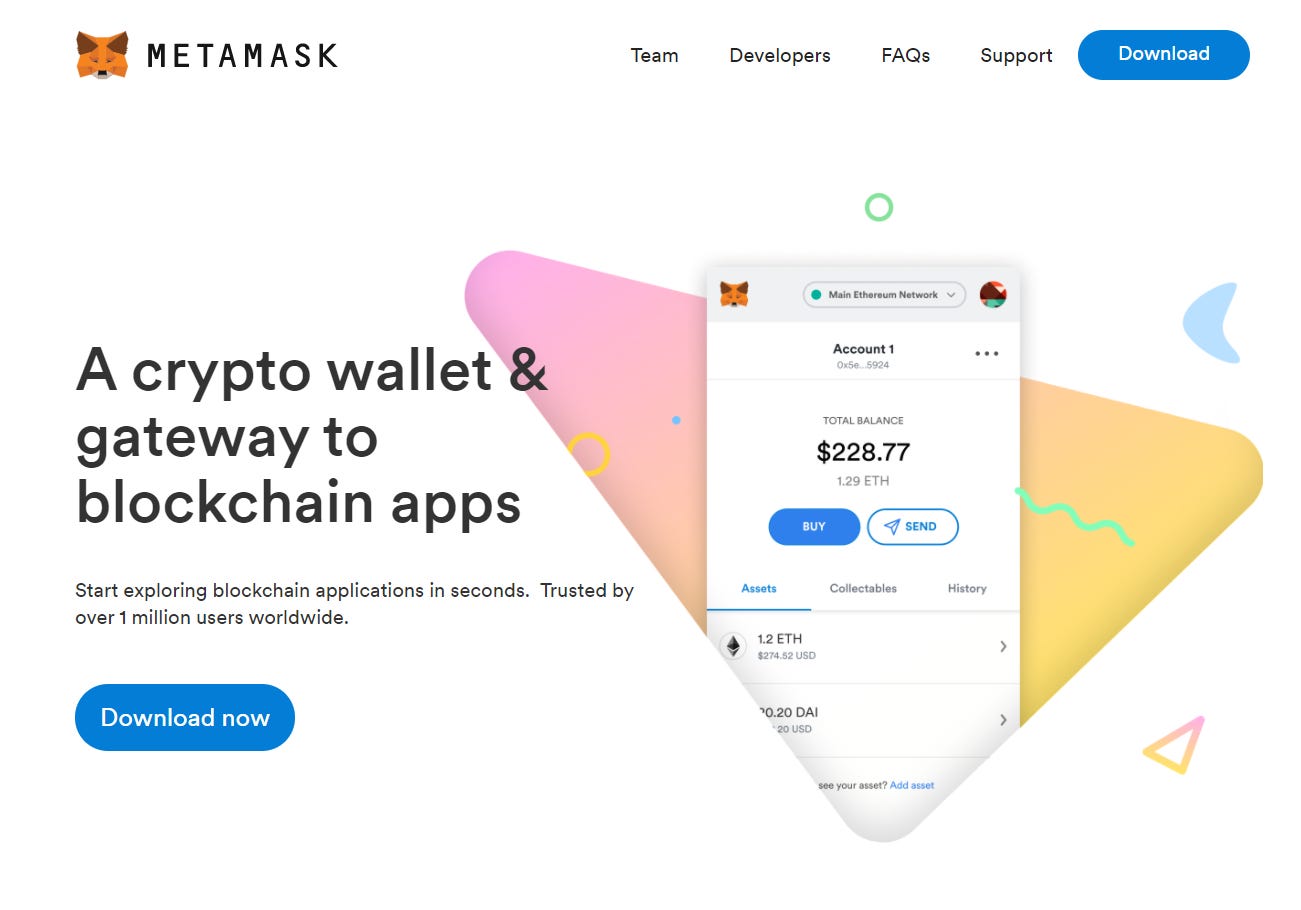

ConsenSys has historically been in the business of Ethereum infrastructure on multiple levels. First, it provides an API-based product called Infura, which allows thousands developers to outsource the grinding work of hosting their own Ethereum node. Second, it provides MetaMask, the leading wallet allowing millions of people to interact with digital assets through their web browser and a mobile app. And finally, it hosts a protocol engineering group that has built the Hyperledger Besu client -- a way for developers and enterprises to connect to both public and private Ethereum chains -- and is working on the ETH2 upgrade.

With this acquisition and funding, the ConsenSys protocol group becomes the market-leading team for Ethereum in the business world, branded as ConsenSys Quorum. It certainly still competes with R3 Corda and IBM Fabric, both backed by strong teams and balance sheets. But it is the only technology that can (1) credibly interoperate with public digital assets and tokens, adopted by millions of users and reaching into the many billions of value, while also (2) being a technology used in production by payments, supply chain, and trading consortia of the world's largest regulated incumbents. As a result, ConsenSys takes a strong position as a technology and financial infrastructure provider for the next platform shift.

ConsenSys has also further expanded the technology stack to solve fintech issues experienced by institutions when they interact with blockchains. This includes a transaction orchestration layer for plugging in third party software, a way to save and anchor data into the chain, an issuance and markets platform for regulated digital assets, and a chassis for CBDCs and other payment tools.

Will there be convergence?

I have described worlds that today are quite different: the exponential innovation of Decentralized Finance, trying to outpace regulation and automate away human involvement, and the transformative reformatting that will happen to financial incumbents over time. As DeFi assets approach $10 billion, one narrative we may see is that crypto is a completely separate, new sphere of economics and finance. It does not need to connect to the old world. It simply needs to be left alone to perform.

In some sense, this is the distinction between physical cash, credit cards, e-commerce payment processors, NFC-based proximity payments, and QR codes. Each has their own logic and sphere of influence. But in reality, one usually sits on the accomplishments of the other. Even Ant Financial today is directing its billion users to traditional capital providers, while leveraging modern user experiences.

We also know that market cycles, however long they take to complete, vacillate blockchain demand between incumbent transformation budgets and crypto-native building and investment. One year, it is all about Bitcoin. The next, about distributed ledgers. The next, about ICOs. The next, about digital assets. The next, about DeFi. It does not take long to recognize the swing of the pendulum.

To combat these demand swings, you need timeless principles. To this end, I see the ConsenSys Codefi application suite evolving towards the natural financial behaviors turned into software earlier described in this essay: paying, saving, investing, trading, insuring. Innovative DeFi protocols (like Maker, Aave, Compound, Yearn, Curve, Nexus Mutual) do even more of the work as battle-tested and capital-tested financial primitives. All that really needs to be done longer-term is connect into them in a risk-managed way to the existing economy. Folks like Centrifuge are leading the way.

That bridge can be expressed into the consumer footprint of MetaMask to help users achieve their financial goals, into the developer footprint of Infura to help financial developers maintain their financial applications, and into the institutional networks of ConsenSys Quorum for novel structures across the trillions of GDP in financial economic activity. The speed of innovation is blinding, and who knows what fortune the market will provide us. But the goal is magnificent.

If any of that resonates with you, please do not hesitate to reach out.

And as always, for weekly short takes on the industry and sharp podcast conversation, subscribe below.

This is possible.

Fun ( Fashion Music Gaming Art ) Educational Wealth Management Digital Media Banking Virtual RealWorld Crypto Stable Defi Finance Tokenization Debit Credit Yourgages in The Future A Blueprint Virtual Digital Bank - unique and very fresh - Just part of a future we all share together. Millions of people.