DeFi: Robinhood buys WonderFi for $179MM, Coinbase buys Deribit for $2B

The finance super app starts with speculation

GM Fintech Futurists,

Today we highlight the following:

DIGITAL ASSETS: Making Sense of Coinbase and Robinhood’s Crypto Expansion Moves

CURATED UPDATES: Financial Institutions and Adoption; DeFi and Digital Assets; Blockchain Protocols; NFTs, DAOs and the Metaverse

To support this writing and access our full archive of newsletters, analyses, and guides to building in Fintech & DeFi, subscribe below (if you haven’t yet). For $3 per week, you get institutional-level research delivered to your Inbox.

Call for Companies

If you are building at the intersection of AI, Fintech, and Web3 and looking for investment, share your materials with us at 👉👉👉 Generative Ventures here.

DIGITAL ASSETS: Making Sense of Coinbase and Robinhood’s Crypto Expansion Moves

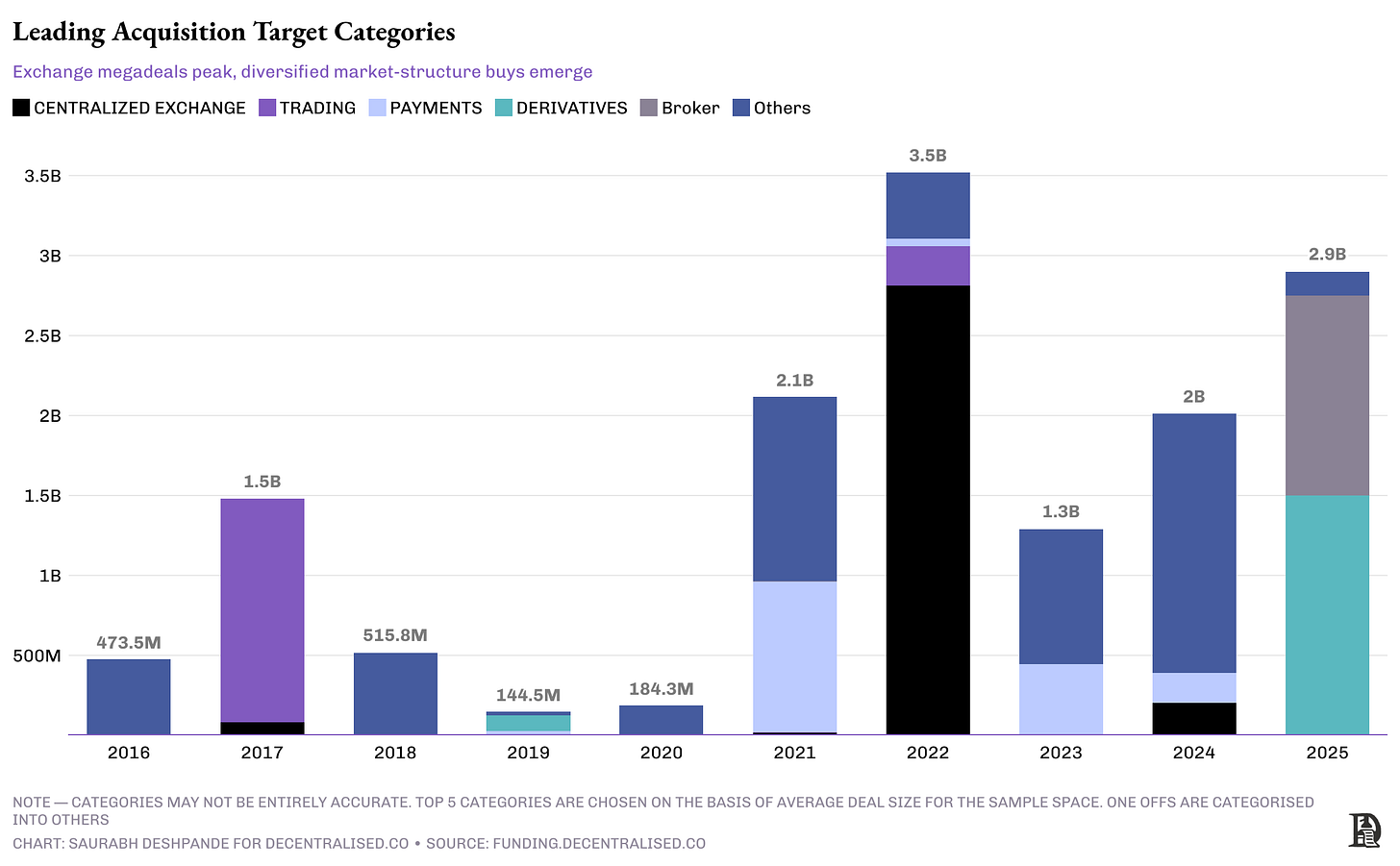

Two large crypto acquisitions in May — Robinhood’s $179 million purchase of WonderFi and Coinbase’s $2.9 billion acquisition of Deribit — showcase the shifts in crypto market structure.

These are two distinct plays — Coinbase doubling down on global market infrastructure, Robinhood expanding access through regulatory reach. Together, they illustrate how public fintechs are carving out territory in crypto by focusing on different layers of the stack: one on trading structure and institutional rails, the other on user access and jurisdictional expansion.

Deribit, headquartered in Dubai, is a market leader in crypto options. Coinbase, long a leader in spot trading, custody, and compliance, is now staking its claim in the volatility layer. Options and perpetuals are a highly commercial part of crypto trading. Derivatives accounted for approximately 79% of total crypto trading volume in 2024, surpassing spot markets by a significant margin. Last year Deribit processed $1.1 trillion in trading volume, around 85% of the crypto options market.

In contrast, the US regulatory environment restricts retail access to crypto derivatives, limiting platforms like Coinbase to spot trading and custody services. This acquisition enables Coinbase to diversify its offerings and revenue streams, positioning it to serve both compliance-focused US users and leverage-seeking international institutions.

The $2.9B deal is a mix of $700MM in cash and 11 million shares of COIN stock. For Coinbase, which generated $2B in revenue in Q1 2025 — up 24% YoY — this is a meaningful but digestible bet. More importantly, Coinbase returned to profitability in Q1, reporting $66MM in net income, up from a loss in Q1 2024. Despite this, Coinbase saw a significant decline from the previous quarter, primarily due to a $600MM paper loss on its crypto holdings.

Robinhood’s acquisition of WonderFi, by contrast, is smaller in absolute terms ($179MM all-cash) but potentially just as strategic. WonderFi is a Canadian crypto platform that owns Bitbuy and Coinsquare, two of the few federally regulated crypto trading platforms in the country. The bet here is regulatory arbitrage.

Where Coinbase is betting on product diversification and international liquidity, Robinhood is betting on geographic adjacency and licensing. WonderFi gives Robinhood a turnkey presence in Canada with regulatory approvals already in place. It also adds C$3.6B in annual trading volume and over 1 million users to Robinhood’s ecosystem.

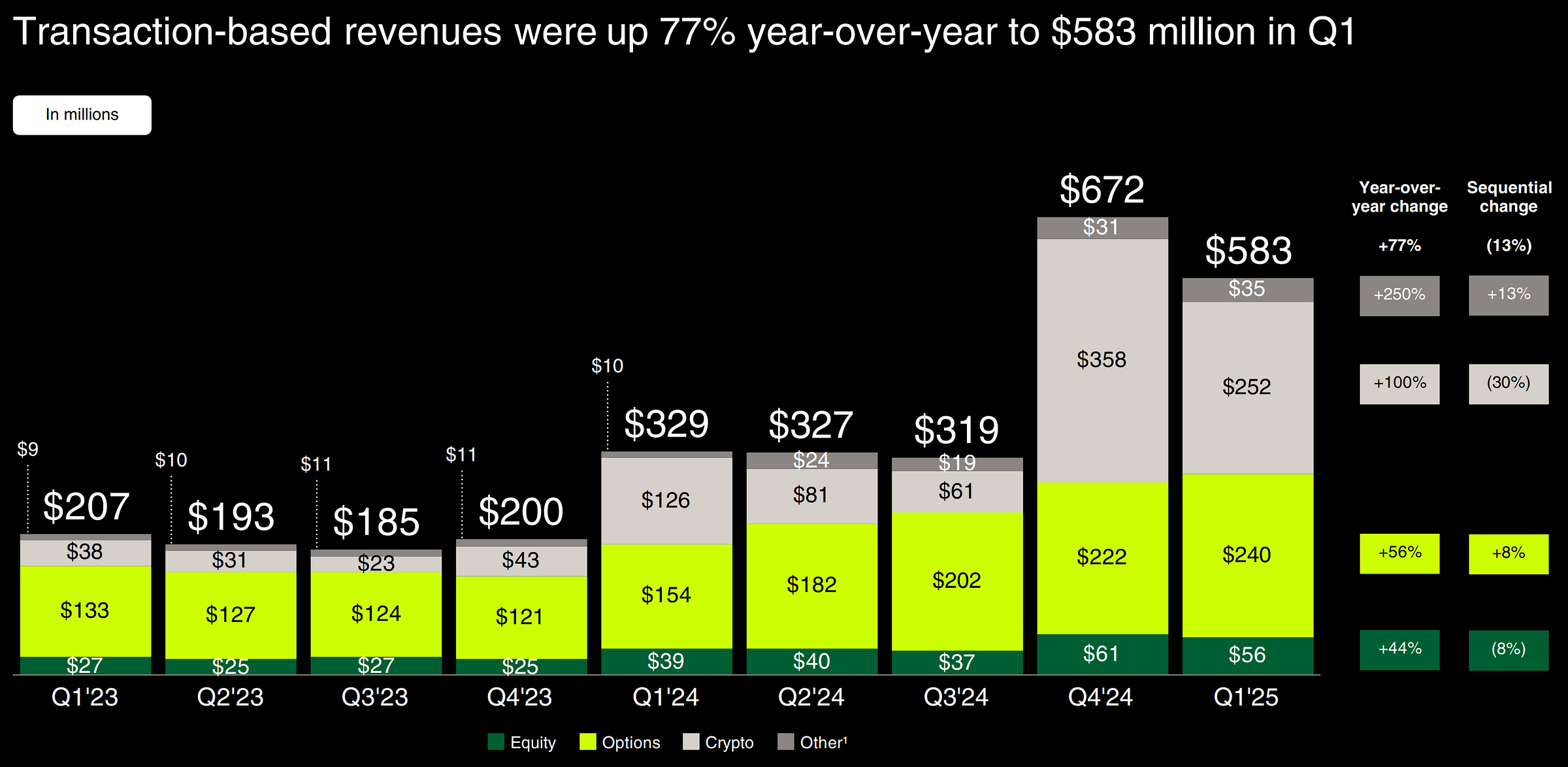

This comes at a time when Robinhood’s crypto business is growing meaningfully. In Q1 2025, the company reported $927MM in total revenue, a 50% increase year-over-year. Crypto alone generated $252MM — a full 27% of top-line revenue — and doubled from the previous year. Net income hit $336MM, with EPS at $0.37. Robinhood is firing on all cylinders, with healthy profit margins, strong growth, and increasing diversification away from core equities and options.

Robinhood is expanding its distribution footprint by getting more users, more regulated entities, and more countries. Coinbase is expanding its product infrastructure to include more asset types, and therefore more revenue per user. However, these acquisitions point to a consolidation of trading business models towards exposure to as many modern asset classes as possible.

That means offering equities, options, bonds, cash accounts, and crypto in the same super app. The prophesied future is finally here.

You can see the correlation in the economics of the two businesses below.

It is no longer enough to be a wallet or a trading app.

Coinbase and Robinhood will continue to emerge as the Schwab and Fidelity of the Millennial and Gen Z generations. They follow the market for the products consumers want, and often that means shelling out a few billion for acquisitions.

👑 Related Coverage 👑

Advertise with the Fintech Blueprint

To reach 200,000 decision makers in financial services, Fintech, and Web3, reach out to discuss sponsorship opportunities today.

🔥🔥🔥 Contact us to discuss options 🔥🔥🔥

Analysis: The 2025 Practitioner’s Guide to Stablecoins

Stablecoins have quietly become the most used product in crypto for their practical utility. They power onchain commerce, cross-border remittances, institutional settlement, and increasingly, the infrastructure layer of payments.

Yet for all their relevance, the conversation around stablecoins has often lacked detail, objectivity, and real-world insight. In partnership with Multiliquid, Rebank, and Steakhouse Financial, we are excited to release Stablecoins: The Practitioner’s Guide, a comprehensive report written by and for the people building the future of stablecoin infrastructure. This is a granular, practical, and sharply observed breakdown of what stablecoins really are and where they’re going.

Curated Updates

Here are the rest of the updates hitting our radar.

Financial Institutions and Adoption

⭐ JPMorgan to Allow Clients to Buy Bitcoin, Says Jamie Dimon - CoinDesk

JPMorgan’s Kinexys Connects With Public Blockchain on Ondo Chain Testnet Debut - CoinDesk

What are stablecoin-backed corporate cards and how do they work? - CoinTelegraph

BlackRock’s Bitcoin ETF ends 31-day inflow streak with biggest outflow ever - CoinTelegraph

DeFi and Digital Assets

⭐ Compound adopts Morpho’s tech for new Polygon vaults in controversial Gauntlet-led move - The Block

Lido Proposes a Bold Governance Model to Give stETH Holders a Say in Protocol Decisions - CoinDesk

Yearn Keeps Chugging With V3 of Vaults Aggregator - The Defiant

Blockchain Protocols

⭐ Solana Could Soon Witness Its Largest Consensus Change as Developer Proposes 'Alpenglow' - CoinDesk

Wintermute warns Pectra upgrade leaves Ethereum users at risk of automated attacks - The Block

NFTs, DAOs and the Metaverse

⭐ Creators of DeFi Firm Aave Launch Social Media Developer Network Lens Chain - CoinDesk

Arbitrum DAO proposes revamp of voting rules as token tumbles 71% and apathy rules - DLNews

Yuga Labs sells Moonbirds IP to Orange Cap Games - CoinTelegraph

🚀 Level Up

Sign up to the Premium Fintech Blueprint and in addition to receiving our free newsletters, get access to:

Long Takes with a deep, comprehensive analysis.

‘Building Company Playbook’ series, offering insider tips and advice on constructing successful fintech ventures.

Special Reports

Archive Access to an array of in-depth write-ups covering the hottest fintech and DeFi companies.

Join our Premium community and receive all the Fintech and Web3 intelligence you need to level up your career.