DeFi: Coinbase looks to the Future(s)

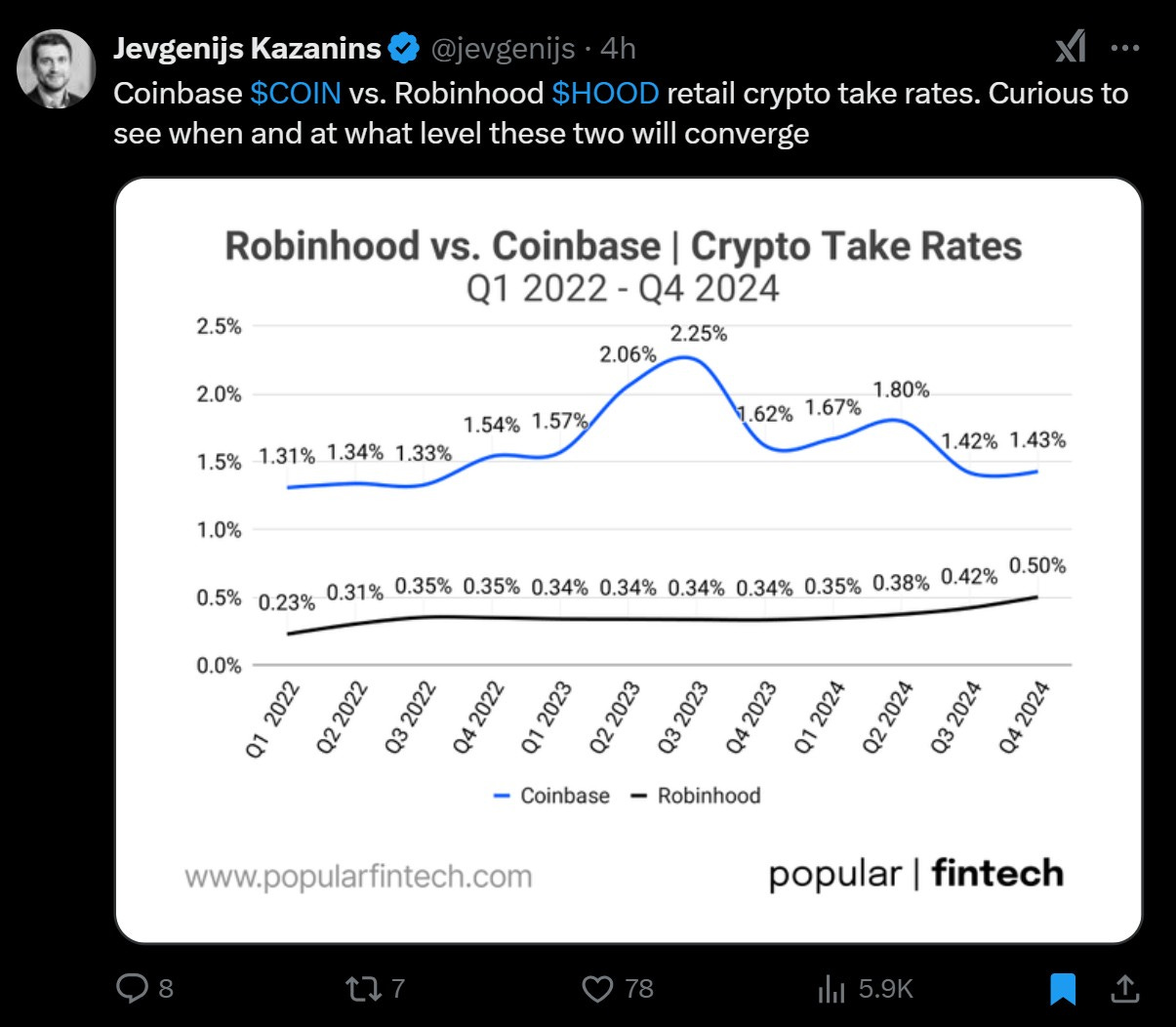

Coinbase and Robinhood converging on the same customer audience

GM Fintech Futurists,

Today we highlight the following:

DIGITAL ASSETS: Coinbase Launches Futures Trading

CURATED UPDATES: Financial Institutions and Adoption; DeFi and Digital Assets; Blockchain Protocols; NFTs, DAOs and the Metaverse

To support this writing and access our full archive of newsletters, analyses, and guides to building in Fintech & DeFi, subscribe below (if you haven’t yet).

Call for Companies

If you are building at the intersection of AI, Fintech, and Web3 and looking for investment, share your materials with us at 👉👉👉 Generative Ventures here.

DIGITAL ASSETS: Coinbase Launches Futures Trading

This week we’re covering Coinbase’s launch of 24/7 Bitcoin and Ethereum futures trading for U.S. customers through its Coinbase Derivatives Exchange.

Futures are an agreement to buy or sell a specific commodity or financial instrument at a predetermined price on a specified future date — particularly useful, and potentially profitable, for hedging risks or speculating on price movements. The exchange is also building out a perpetuals offering, a variant of futures offering continuous trading without a predefined end, utilizing mechanisms like funding rates to maintain price alignment with the underlying asset.

For Coinbase, the opportunity is enormous.

The Bitcoin Futures market consistently exceeds $1T in monthly volumes, with high-performing months exceeding $2T. Similarly impressive is the Ethereum Futures market, which typically has over $500B in monthly volumes and exceeds $1T in good months. These volumes primarily pass through Binance, OKX and Bitget — some of Coinbase’s most prominent competitors outside of the US jurisdiction.

This market has meaningful revenue pools and constantly attracts new competitors. For example, Hyperliquid is a recent successful onchain exchange launch, where futures are the bread and butter. It contributed 78.8% of total DEX futures volumes in December of 2024 and its token floats at a $14B FDV since its launch, also in December.

Outside of pure crypto competitors, Robinhood is biting on Coinbase’s heels.

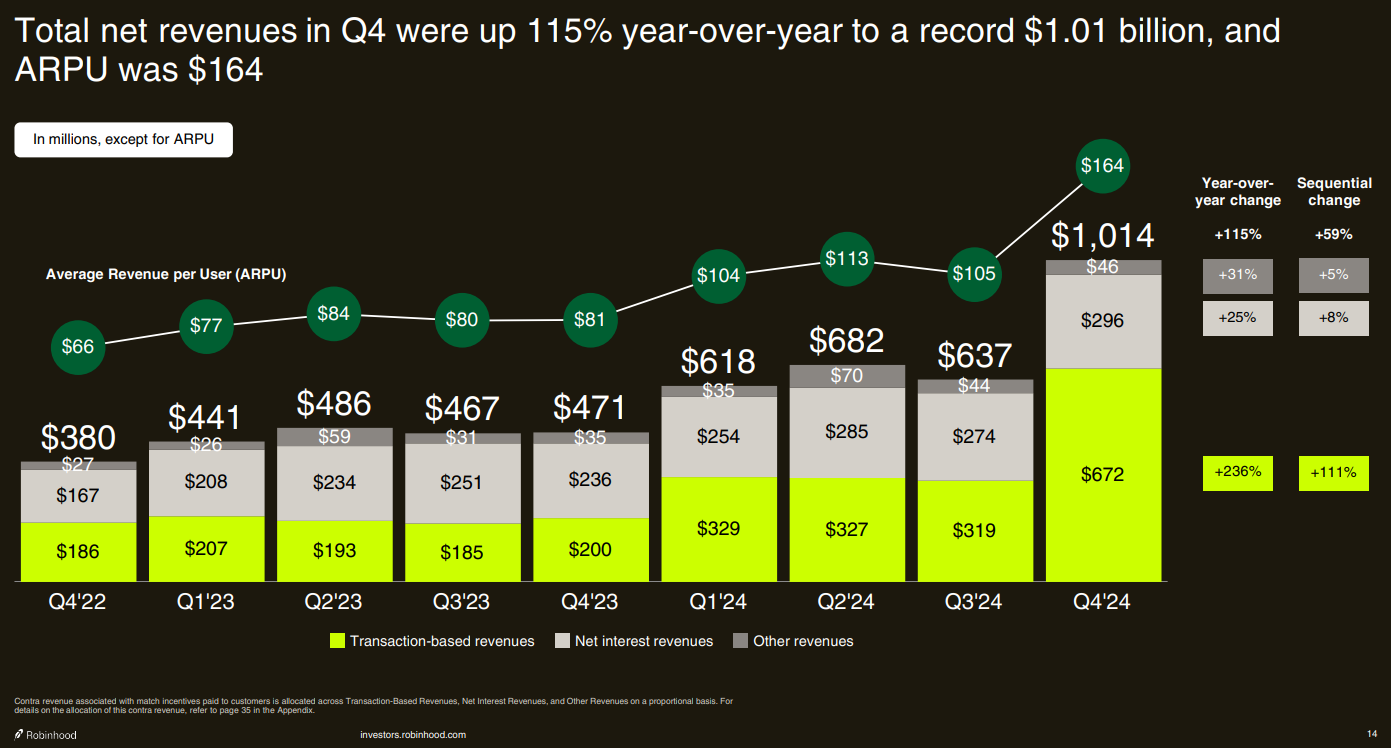

In October 2024, Robinhood introduced a desktop platform named 'Robinhood Legend' and added futures trading features to its mobile app, enabling users to trade futures on assets such as the S&P 500 index, oil, and Bitcoin. The move sets Robinhood up to compete with traditional brokers, with sights on the broader derivatives market, which has a notional value estimated at over $1 quadrillion. From Coinbase’s perspective, Robinhood is the company with the most clear overlap of customers, with both companies targeting retail users, primarily in the US. For context, here are Robinhood’s Q4 results with increasing volume from derivatives and crypto —

Robinhood famously made most of its money from Options trading.

Futures is clearly a crowded space. It reflects a broader industry trend toward providing retail investors with more sophisticated trading instruments as crypto investors become more advanced. Or, from a more skeptical perspective, fees are higher in more speculative parts of the industry.

For Robinhood and Coinbase it could also be positioning towards institutional financial infrastructure ahead of traditional asset managers entering crypto at scale, given Trump’s deregulation. Coinbase already has significant offerings in this area with its Prime and Custody solutions, underpinning most of the ETFs in the space. Robinhood has also been amping up its institutional focus with the $300MM acquisition of TradePMR, a custody solution for RIAs.

For now, both seem to have been growing the pie. Robinhood reported an eight-fold increase in transaction-based revenue from crypto trading during 2024 Q4, while Coinbase doubled its earnings in the same year. Over the past 12 months Coinbase shares have rose 112% vs 365% for Robinhood.

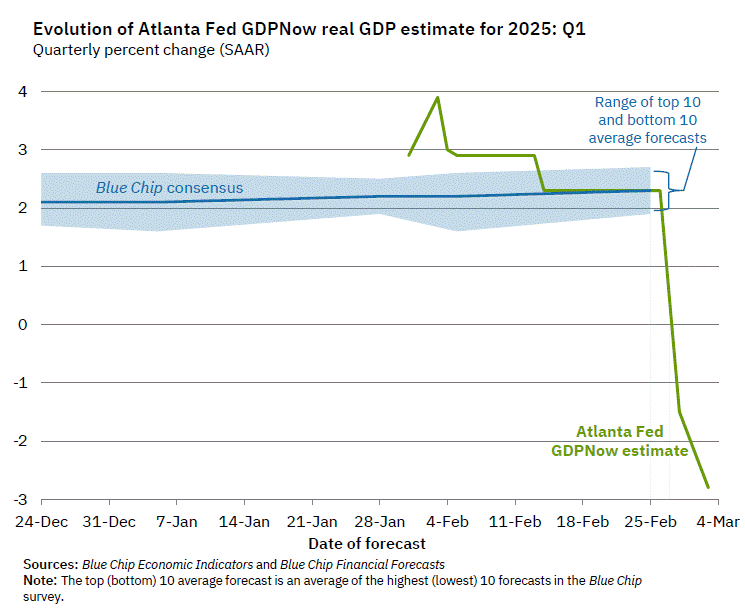

Zooming out, Coinbase also announced this week its plans to hire 1,000 US workers and that it had secured registration in India, the leading country in crypto adoption the past two years. Coinbase is growing fundamentally, despite threats from all sides and with the market onslaught in the background. As scale increases, we see a high correlation with traditional markets and extreme volatility based on global fiscal policies. Bitcoin’s 30-day correlation with the S&P 500 has often exceeding 70% over the past 5 years.

The sector might not become the apocalypse hedge, but rather an extension of risk-on speculation. Perhaps movement towards more sustainable use cases, whether it be gaming, DePIN, or AI, can counteract the speculative pressures.

👑 Related Coverage 👑

Advertise with the Fintech Blueprint

To reach 200,000 decision makers in financial services, Fintech, and Web3, reach out to discuss sponsorship opportunities today.

🔥🔥🔥 Contact us to discuss options 🔥🔥🔥

Analysis: Will Fintech Deregulation make up for a $1.5T Hit to the Economy?

We ask whether the current market chaos is a necessary short-term reset (creative destruction) or a reckless dismantling of stability that will set the U.S. back (unsustainable contraction).

The U.S. economy faces a projected $1.5T contraction due to tariffs and government downsizing, triggering a broad market sell-off across stocks, AI, fintech, and crypto. While concerns over AI overinvestment and U.S.-China competition fuel economic uncertainty, deregulation in fintech and crypto is accelerating, with the SEC dropping cases against major industry players and the White House dismantling regulatory bodies like the CFPB. The GENIUS stablecoin bill signals a pro-innovation stance, opening the door for fintechs to integrate digital assets into global financial infrastructure. However, this policy shift is time-limited, as isolationist economic strategies are historically unsustainable.

Curated Updates

Here are the rest of the updates hitting our radar.

Financial Institutions and Adoption

⭐ President Donald J. Trump Establishes the Strategic Bitcoin Reserve and U.S. Digital Asset Stockpile - The White House

Altcoin ETF Avalanche? VanEck Registers for AVAX Fund in Delaware - Decrypt

Bitwise Launches ETF Tracking Companies That Hold Bitcoin - Decrypt

Thailand Approves USDT, USDC for Trading On Crypto Exchanges - Decrypt

Michael Saylor's Strategy to raise up to $21B to purchase more Bitcoin - CoinTelegraph

South Korea Should Consider Bitcoin Reserve, Say Industry Lobbyists, Democratic Party Members - Decrypt

OCC Says Banks Can Engage in Crypto Custody and Certain Stablecoin Activities - CoinDesk

DeFi and Digital Assets

⭐ MetaMask to support BTC, SOL DeFi, eventually end gas fees in new roadmap - CoinTelegraph

Kraken’s IPO plan back on track after SEC drops unregistered broker case - DLNews

Bitwise Makes First Institutional DeFi Allocation via Maple - Maple

FBI Links North Korea to $1.4 Billion Bybit Crypto Heist - Decrypt

Infrared Raises $16M to Roll Out First Liquidity Staking Protocol on Berachain - CoinDesk

Blockchain Protocols

⭐ ChatGPT Maker OpenAI Inks $12B Deal With CoreWeave Ahead of Planned IPO - Decrypt

DoubleZero's 'New Internet' for Blockchains Nabs $400M Valuation from Top Crypto VCs - CoinDesk

Validation Cloud raises $15M Series A to bring data x AI to Web3 - CoinTelegraph

Flowdesk Raises $102M in Equity Financing - FINSMES

Crypto Trading Platform BitMEX Is Looking for a Buyer: Sources - CoinDesk

Sam Altman’s World is adding chat and payment features - Blockworks

Seismic raises $7M in round led by a16z Crypto - Blockworks

NFTs, DAOs and the Metaverse

⭐ Avalanche Shooter 'Off the Grid' Has a Thriving Black Market Ahead of On-Chain Trading - Decrypt

'Nyan Heroes' Plots Epic Games Store Return With New Hero, Map and Mode - Decrypt

🚀 Level Up

Sign up to the Premium Fintech Blueprint and in addition to receiving our free newsletters, get access to:

Long Takes with a deep, comprehensive analysis.

‘Building Company Playbook’ series, offering insider tips and advice on constructing successful fintech ventures.

Special Reports

Archive Access to an array of in-depth write-ups covering the hottest fintech and DeFi companies.

Join our Premium community and receive all the Fintech and Web3 intelligence you need to level up your career.