Fintech: Can Revolut beat Robinhood in the US and Nubank in LATAM?

The trade-off between product expansion and overseas growth

Hi Fintech Futurists —

Today’s agenda below.

FINTECH: Can Revolut beat Robinhood in the US and Nubank in LATAM?

ANALYSIS: What Circle Payment Network can learn from Facebook, Plaid, & Wise (link here)

CURATED UPDATES: Paytech, Neobanks, Lending, Regulation & Policy, Digital Investing

To support this writing and access our full archive of newsletters, analyses, and guides to building in Fintech & DeFi, subscribe below (if you haven’t yet). Prices will be going up soon, so lock it in now.

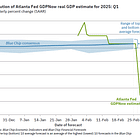

Digital Investment & Banking Short Takes

Can Revolut beat Robinhood in the US and Nubank in LATAM?

The Revolut story is well-known by now.

Back in 2015, Nik Storonsky teamed up with Vlad Yetsekno to build a better way of spending and sending money abroad. Nik was a former equity derivatives trader at Credit Suisse and Lehman Brothers in the UK, while Vlad worked as a software engineer at UBS.

Here is a slide from the initial pitch deck.

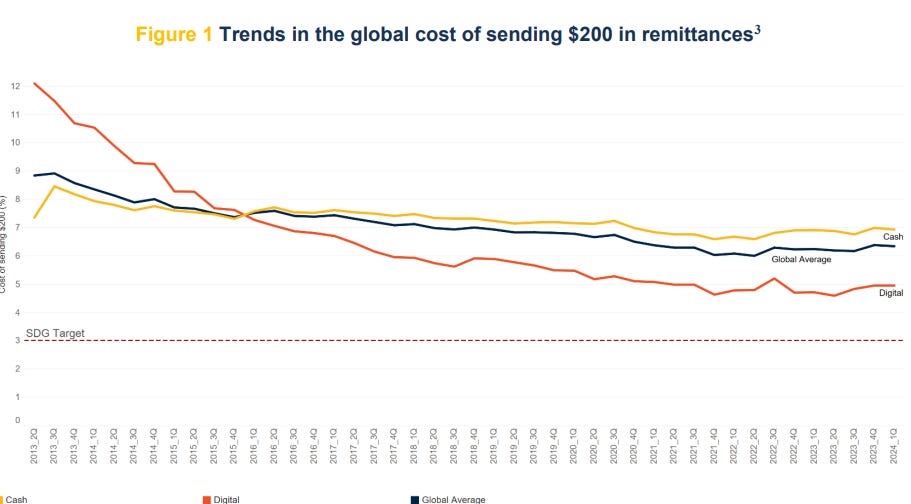

They were right — spending and sending money abroad was a bad experience. It is still awful for many less popular FX corridors, but was even worse in 2015. The global average cost of sending $200 abroad today is still 6.4%, compared to about 7.5% ten years ago (source).

Hidden exchange fees, together with an inefficient web of correspondent banks, each running their own checks and balances, make global money movement slow and expensive for retail customers. Revolut enabled users to send and exchange money at interbank rates — the ones you see on Bloomberg or Reuters — without the hidden margin. They initially offered a freemium model, charging little or no fee up to about $500, sourcing liquidity from multiple institutions at wholesale rates.

The product quickly gained traction, attracting 300,000 users by 2016. Early funding rounds helped fuel expansion: a $15 million Series A in 2016, followed by $66 million in Series B in 2017, and $250 million in Series C in 2018.

In its 2024 annual report last week, Revolut reported a whopping 52.5 million customers with $4B in total revenue and operating profit of $1.4B. The growth is impressive, with almost a 5x increase in customers and a 14x increase in revenues in the last 5 years.

Revolut’s strategy has been focused on expanding its product suite in Europe, rather than growing FX payments overseas. With a vision of becoming a financial super-app, the company has grown into adjacent verticals like banking, wealth, and subscriptions, aided by a long-standing EU banking license and, more recently, a UK one. As a result, 95% of revenues are still generated within Europe, with a relatively balanced split of income streams.

For our competitor analysis, we benchmarked Revolut against global fintechs ranging from UK neobanks to incumbents like PayPal. Here are the results.

The company has blazed ahead of Monzo, Starling, and even Klarna on most metrics (Klarna has more customers but also has a more global footprint). We think there’s still room to widen the gap in the UK. Here’s why:

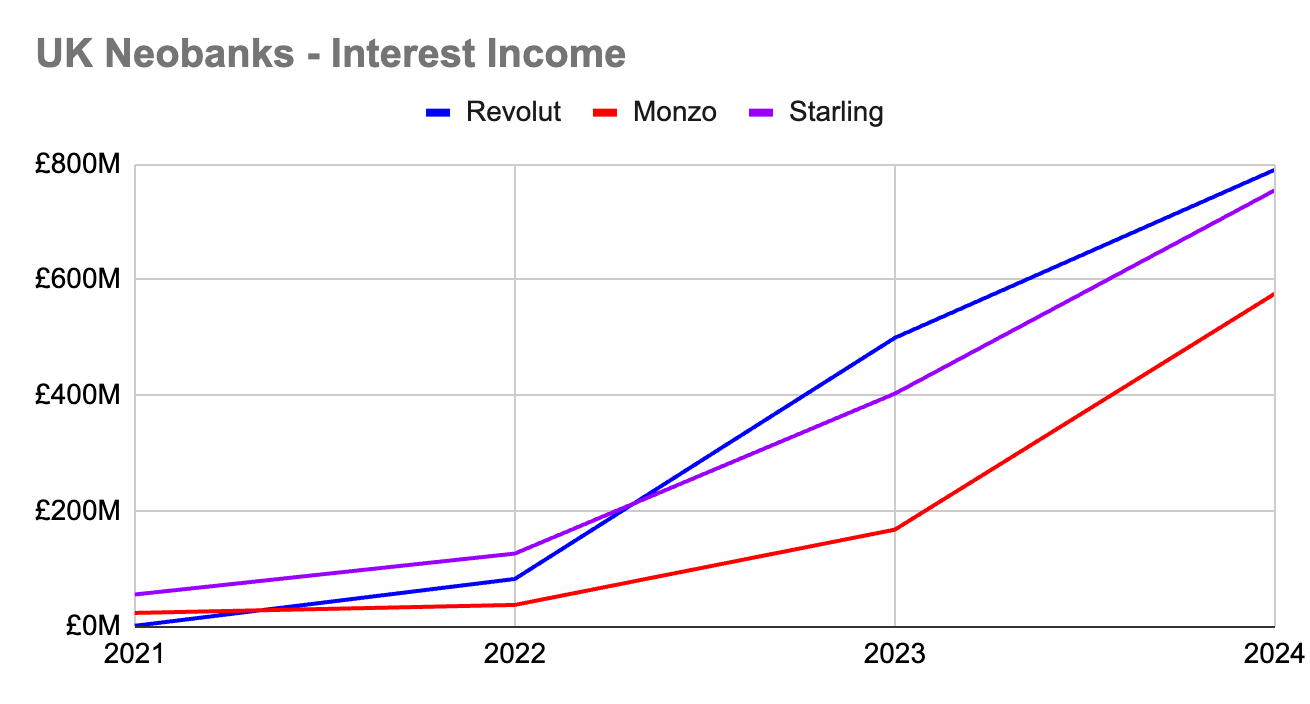

Revolut’s average revenue per customer of $75 currently trails both Starling at $206 and Monzo at $115. The difference is mainly from their UK bank status and higher average customer balances, which improves the ability to squeeze interest income on deposits. Starling reinvested deposits with a yield of nearly 7% compared to just 2.7% for Revolut. As a result, interest income made up 89% of Starling’s revenues vs. Revolut’s 25%.

With UK banking operations set to go live this year, Revolut could soon benefit from the same boost in revenues, which has thus far been limited to the EU. The company is reportedly already testing mortgage products and seeing growth in primary bank relationships. But it also suffers from a higher number of fraud complaints and concerns around previous accounting practices, which could hinder adoption.

The company is now starting to take renewed bets abroad with a focus on LATAM and the US. In the last two years, Revolut obtained licenses to operate in both Brazil and Mexico, with plans to fully launch in 2025. In the US, it has teamed up with a new sponsor bank in hopes to grow its operation. Finding success might not be as straightforward.

Revolut's US launch hasn’t gone to plan. After launching in 2020, the region still accounts for less than 3% of total revenues. Part of the challenge is structural. US financial regulations are much more fragmented than in Europe, requiring licenses and approvals from various bodies, which are often state-specific. This is not ideal for a super-app model and led Revolut to pull its application for a US banking charter in 2023.

Another issue is competition. The likes of Chime, Cash App, and SoFi have amassed around 70M users in total, by some estimates. Some of Revolut’s largest revenue drivers, like FX and card payments, might also not be as appealing as back home. US debit interchange fees are capped at just 0.05%, compared to 0.2%-0.3% in Europe, making it harder for Revolut to monetize its card business, which accounts for 23% of total revenue. Similarly, demand for FX payments is relatively lower than in Europe.

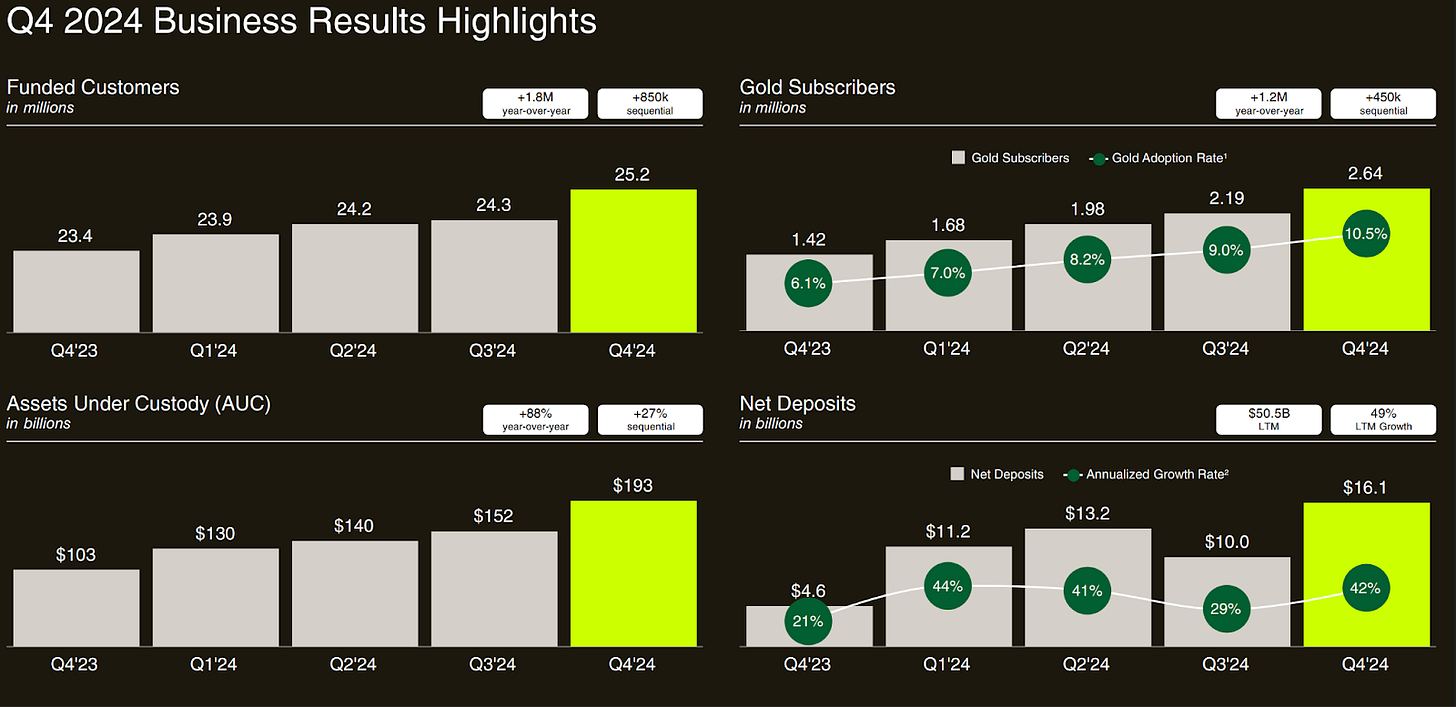

Instead, the company plans on doubling down on its wealth business, which made up 13% of total revenues (+298% YoY) driven by higher crypto trading and the launch of a new dedicated trading platform Revolut X. Acquiring customers via trading and converting them into banking and other products is not novel — it’s Robinhood’s bread and butter.

The two companies rank similarly on key metrics in terms of revenues, customers, and valuation at the time of writing. But Robinhood extracts higher ARPU at $117 on lower average deposits.

The company has seen strong uptake of its Gold subscription, reaching 10% of all funded accounts, which includes traditional banking products like a high-yield savings account (4% APY) and credit cards. It recently announced a move into wealth management and private banking to go after high-net-worth clients. Without a similarly competitive financial ecosystem, Revolut might struggle to compete. On top of that, operating via a sponsor bank likely means worse economics.

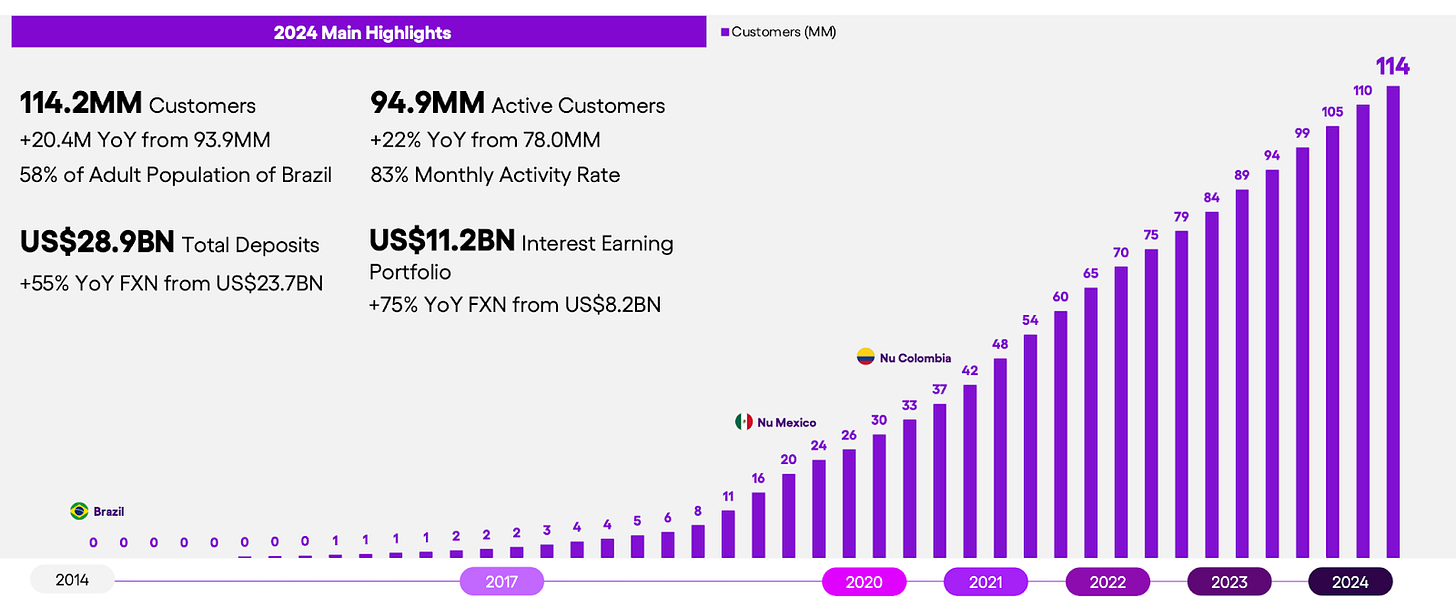

Brazil might not prove easier either, where fintech behemoth Nubank recently announced its 114M users span 58% (!) of the adult population in the region. The company’s existing ecosystem has very good traction. Customers, on average, use 4 of Nubank’s products across credit cards, payments, lending, travel booking, and shopping. Revolut will struggle to make a dent.

Mexico could be a different story, however. Revolut can replicate its European strategy, starting with FX payments and moving into the broader financial ecosystem. Mexico is the second largest recipient of remittance payments in the world after India, with $68B in 2024 volumes, mostly from the USD/MXN corridor. This could likewise make Revolut’s US presence strategically important in Mexico, with the help of a newly secured banking license in the region. It will still face competition from Nubank, who entered in 2019, and already boasts 10M customers and $4.7B in deposits.

While it fights abroad, Revolut might realise it prefers expanding domestically. It still has plenty of room to grow in Western Europe and the Nordics, where penetration remains below 10%. New products underway include CFDs, an investment platform, and loyalty programs. The winning ecosystem strategy might be a single fortress rather than an international hive mind.

👑 Related Coverage 👑

Long Take

We explore the tension between early-stage excitement and late-stage skepticism surrounding stablecoin infrastructure, using Circle’s launch of the Circle Payments Network (CPN) as a case study. While Circle positions itself as the orchestration layer connecting major fintech and crypto payment players, this "network of networks" narrative echoes past efforts by Plaid, Facebook Libra, Ripple, and Swift, all attempting to centralize fragmented financial flows.

Circle’s ambition is to evolve from a stablecoin issuer into a SWIFT–Visa hybrid, but its $10B+ valuation depends on proving this broader infrastructure play beyond mere net interest margin. However, history shows the recurring challenge of sustainable aggregation in payments, as each wave of innovation fragments and re-bundles financial networks. Ultimately, despite Circle’s progress, the long-term future likely favors decentralized, internet-scale financial protocols over centralized gatekeepers.

Curated Updates

Here are the rest of the updates hitting our radar.

Paytech

Global Payments to buy Worldpay for $22.7bn - Finextra

Citi estimates $1.6 trillion of stablecoins issued by 2030 - Citi

Fintech Plaid raises $575M at a $6.1B valuation- Techcrunch

Neobanks

⭐Circle, BitGo and other crypto firms plan to apply for bank charters or licenses- WSJ

Bunq, a neobank for ‘digital nomads,’ accelerates U.S. expansion effort as profit jumps 65% - CNBC

NatWest invests in Yonder - Finextra

Lending

eBay Expands Klarna Payment Options to US Marketplace - Fintech Magazine

Stripe Applies for US Banking License to Expand Merchant Acquiring - PYMNTS

Digital Investing

Crypto firm Ripple to buy prime broker Hidden Road for $1.25 billion - Reuters

Kraken expands beyond crypto with commission-free trading - Reuters

🚀 Level Up

Join our Premium community and receive all the Fintech and Web3 intelligence you need to level up your career. Get access to Long Takes, archives, and special reports.

Sponsor the Fintech Blueprint and reach over 200,000 professionals.

👉 Reach out here.Check out our AI newsletter, the Future Blueprint, 👉 here.

Read our Disclaimer here — this newsletter does not provide investment advice