DeFi: SEC charges Bitclout Founder with Fraud in $257MM raise

Is Decentralized Social a new movement or a new market?

GM Fintech Futurists,

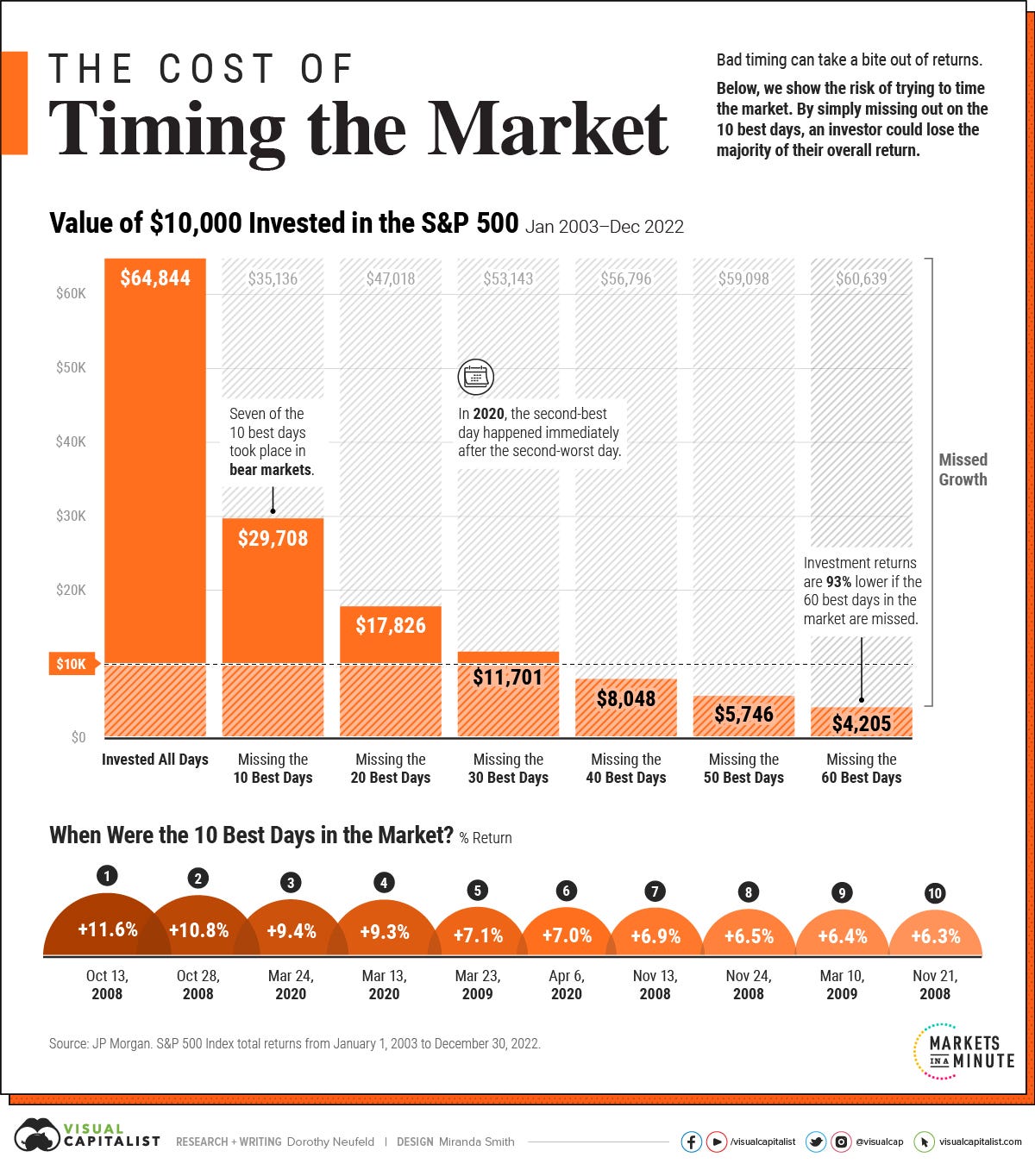

Welcome to the forever rollercoaster ride. We’ll cover the volatility of the markets in our next issue.

Today we highlight the following:

PROTOCOLS: SEC Charges Nader Al-Naji with Fraud and Unregistered Offering of Crypto Asset Securities

CURATED UPDATES: Europe cracks Apple's NFC payments and commerce monopoly

To support this writing and access our full archive of newsletters, analyses, and guides to building in Fintech & DeFi, subscribe below (if you haven’t yet).

PROTOCOLS: SEC Charges Nader Al-Naji with Fraud and Unregistered Offering of Crypto Asset Securities

The previously pseudonymous founder of BitClout, Nader Al-Naji, is in trouble with the SEC for allegedly conducting an unregistered offering of securities and fraud. His moniker, DiamondHands, is claimed to have been used to avoid regulatory scrutiny while raising $257MM in cryptocurrency for the project.

BitClout sprung to fame for its decentralized social media platform (DeSo), which garnered investments from some of the biggest VCs, including a16z, Sequoia, Coinbase Ventures, Social Capital, and Winklevoss Capital.

During fundraising, DiamondHands reportedly told investors that proceeds from BTCLT, BitClout’s native token, would not be used to pay employees or himself. Paying employees in a native token is fairly standard practice, but it was explicitly stated that these funds would not be given the token’s utility. However, the SEC says that $7MM was spent on personal expenses, including a Beverly Hills mansion and family gifts.

Even if the mansion was for business purposes, such as company-sponsored events, and even if multiple employees lived in the residence, we note that providing employees with free accommodation is similar to paying them consideration.

Originally marketed as a decentralized social media platform, BitClout gained attention after a password-locked feature was leaked and went viral. The feature allowed users to bet on famous individuals as if they were stocks. BitClout first scraped Twitter for 15,000 of the top influencers, media stars or creators, without their permission. Personality rights are clear that this is not acceptable use.

Each individual was assigned a bonding curve with implied market capitalizations based on imported followers and other social media metrics. Users could pay to mint an influencer’s tokens using the BitClout token. The more tokens minted for a particular account, the higher the price for the total market cap of the asset. Alternatively, a user could sell tokens back to the curve, resulting in a lower individual token price. You can read more about bonding curves here.

This math created a transparent, algorithmically processed supply curve for profiles on the platform, effectively turning celebrities and influencers into algorithmic meme NFTs.

Sound familiar?

While BitClout may have fallen out of popularity in the 2021 bull market, “novel” dapps with a surprisingly similar user proposition rose to fame over the past year, such as Friend.Tech and Tomo. Friend.Tech (FT) was heralded as the next great DeSo platform, yet after a few months of strong activity between August and October 2023, transaction counts became paltry. At its peak, FT daily transactions totaled 13.6K ETH (over $30MM). Now, they average 2–5 ETH a day.

Going back to BitClout, the launch and fundraising were definitely suspect and fell too far in the “growth hacking” category. More broadly, while the business model piqued the interest of Web3 users, so far there is not sufficient demand for the financialization of Internet personalities, or large markets around them. Some may argue that prediction markets around political and sports events, on Polymarket for example, are a continuation of this theme. Or, perhaps, the 500,000 tokens launched on Solana per month tap into a similar meme frenzy.

We believe it is likely for the best that we do not carry around bonding curves of our value everywhere we go. The attention economy is hellscape enough.

👑 Related Coverage 👑

Advertise with the Fintech Blueprint

If you want to reach 200,000 decision makers in financial services, Fintech, and Web3, reach out to discuss sponsorship opportunities today.

🔥🔥🔥 Contact us to discuss options 🔥🔥🔥

Analysis: Can Fifth Third be the Amazon Web Services of Banking with Stripe?

We explore the potential of vertically integrated financial institutions to become platform providers akin to Amazon Web Services (AWS).

Amazon's success with AWS serves as a model for how fintechs could leverage their core competencies to build scalable infrastructure platforms. While tech giants like Stripe partner with banks for regulatory reasons, the banking industry's fragmented approach contrasts sharply with Amazon's integrated strategy. We analyze the current landscape of banking-as-a-service providers, highlighting the dominance of larger banks like Fifth Third and the challenges faced by smaller players.

Curated Updates

Here are the rest of the updates hitting our radar.

Financial Institutions and Adoption

⭐ BlackRock's Tokenized Fund on Ethereum Pays Out $2.1 Million - Decrypt

Bybit to Exit From France’s Market as EU’s Crypto Regulation Takes Hold - Decrypt

Allium Raises $16.5 Million Series A Led by Theory Ventures to Deliver Enterprise-grade Blockchain Data Solutions - Businesswire

SEC Approves Grayscale Bitcoin Mini Trust to Trade on NYSE Arca - Decrypt

Caliza lands $8.5 million to bring real-time money transfers to Latin America using USDC - TechCrunch

Blackbird Introduces Crypto Payments at NYC’s Hottest Restaurants - R\SCENE

Hong Kong Lawmaker Latest to Push for Strategic Bitcoin Reserve - Decrypt

DeFi and Digital Assets

⭐ Crypto Lending Firm Morpho Bags $50M in Funding Round Led by Ribbit Capital - Coindesk

Zivoe Closes On $8.35M Fundraise Ahead Of July 31st Launch - Zivoe

DeFi Sector Takes a Hit as Jump Crypto Begins Shuffling Millions in Funds - Decrypt

Mt. Gox Estate Shifts $2.2 Billion to New Wallet as Bitcoin Wobbles - Decrypt

Blockchain Protocols

Solana DeFi Trading Volume Tops Ethereum for the First Time in July—Here's Why - Decrypt

Igloo, Inc. Raises $11M+ from Founders Fund to Contribute to New Consumer-Focused Blockchain Abstract - PR Newswire

Singapore-Based BitLayer Labs has Secured $11 Million in Series A Round Funding - Startup Rise Asia-Pacific

We’ve Raised $25M to Unify All Chains! - Particle Network

aPriori is building the MEV-powered liquid staking platform for Monad - X

Most Bitcoin Layer-2 Networks Won’t Survive: Galaxy Research - Decrypt

NFTs, DAOs and the Metaverse

⭐ DoodlesTV Launches With Season Pass on Base for Exclusive Content - R\SCENE

Trump Became Crypto Believer After Falling in Love With NFTs of Himself - Bloomberg

How Solana Meme Coin Billy Survived Being Abandoned by Its Dev - Decrypt

Ledger Reveals New E Ink Touchscreen Flex Wallet - Decrypt

🚀 Level Up

Sign up to the Premium Fintech Blueprint and in addition to receiving our free newsletters, get access to:

Long Takes with a deep, comprehensive analysis.

‘Building Company Playbook’ series, offering insider tips and advice on constructing successful fintech ventures.

Special Reports

Archive Access to in-depth write-ups covering the fintech and DeFi companies.

Join our Premium community and receive all the Fintech and Web3 intelligence you need to level up your career.