Analysis: Can Fifth Third be the Amazon Web Services of Banking with Stripe?

The fragmented approach of banking-as-a-service providers contrasts with Amazon's integrated strategy

Gm Fintech Architects —

Today we are diving into the following topics:

Summary: We explore the potential of vertically integrated financial institutions to become platform providers akin to Amazon Web Services (AWS). Amazon's success with AWS serves as a model for how fintechs could leverage their core competencies to build scalable infrastructure platforms. While tech giants like Stripe partner with banks for regulatory reasons, the banking industry's fragmented approach contrasts sharply with Amazon's integrated strategy. We analyze the current landscape of banking-as-a-service providers, highlighting the dominance of larger banks like Fifth Third and the challenges faced by smaller players.

To support this writing and access our full archive of newsletters, analyses, and guides to building in the Fintech & DeFi industries, see subscription options below.

Long Take

Building a Platform after Vertical Integration

Amazon is a remarkable story of building a company on the growth of the Internet.

You would think that the primary trend that the retailer rode was e-Commerce — the shift of consumer attention and shopping from physical stores to digital stores. And yes, of course, that is true. But that is not where Amazon is the most profitable.

In Q4 of 2023, AWS was responsible for 54% of Amazon's $13B in total operating income. This is not the business they were founded to build, but one they discovered along the way. In creating the largest US e-commerce company, Amazon saw the profound need for cloud infrastructure for any digitally native business.

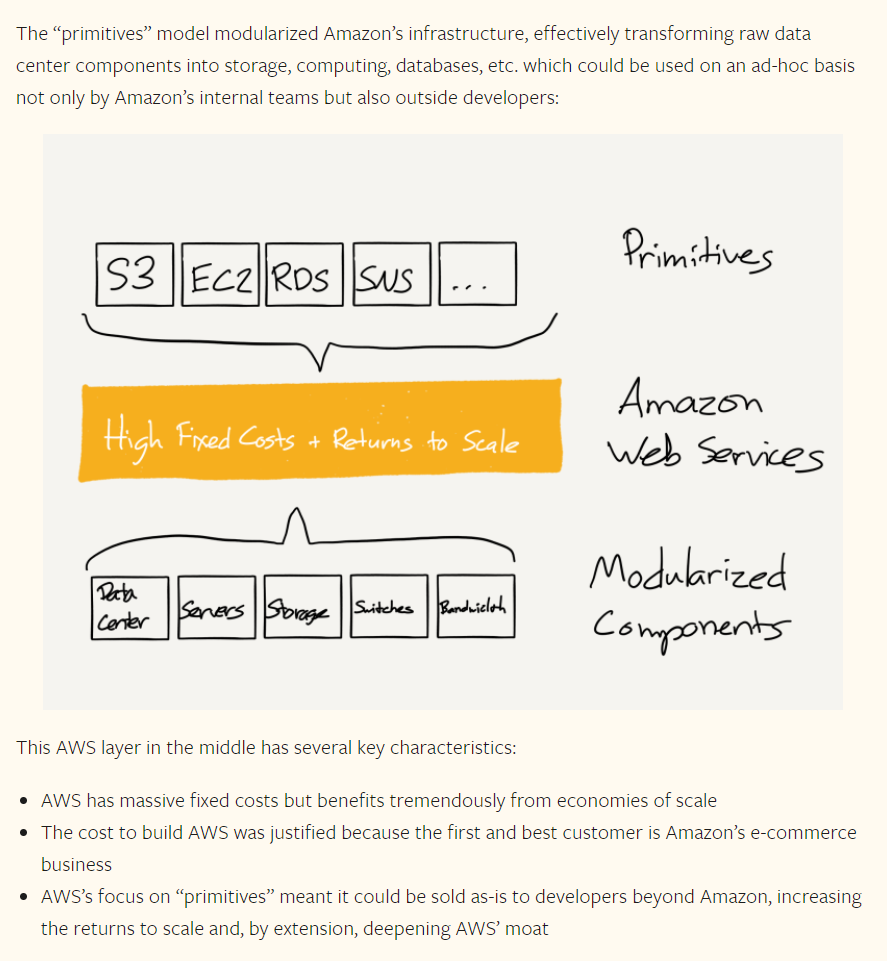

Initially, they developed this platform for themselves, as the first best customer. Ben Thompson of Stratechery has described this strategy in detail in 2017, highlighting how Amazon first developed a vertical strategy in a segment, figuring out the entire value chain. And thereafter, it opens up the infrastructure platform to third parties to scale the “cost center” into a revenue center. What would otherwise be the cost of hosting a giant e-commerce website has become a business that rivals the entire e-commerce website in profitability.

This playbook is so powerful that Amazon repeated it across cloud infrastructure and its shopping marketplace. In Fintech, the equivalent would be getting really good at B2C and owning vertically everything from the user experience, to the middleware, to the underlying regulatory entity. As an example of such execution, Betterment comes to mind. They chose to build a broker-dealer and RIA, and then master the consumer experience before broadening their platform to third parties. The same can be said of the large asset managers, like Schwab and Fidelity, who have B2C channels and B2B channels for their custody infrastructure.

But what about banking?

Can we think of any large financial institutions that are vertically integrated and have a dominant consumer presence, but have *also* become the winner in offering their core regulatory platform to other distributors of financial products? Has JP Morgan, or HSBC, or Citigroup, or Wells Fargo become the AWS of financial services?

Goldman Sachs has tried, but they have expunged all retail spirits from their sacred investment bank body in fear of unprofitability.

Scotch tape all the way down

What we have instead is a layered cake of intermediation.

Here is Stripe Treasury:

Stripe has massive distribution into commercial activity on the Internet, as well as the payment stack. They are integrated into $1 trillion of digital payments volume.

Building out other financial functions is an adjacent opportunity for which Stripe already has many customers. However, they do not want to poison their core business by becoming a bank holding company. That poison comes in many varieties — compliance and regulatory overhang, limitations on growth, much lower multiples in the capital markets, integration with the core banking systems of the world, and so on.

So they do the rational thing and partner with an intermediary platform.

Of course, we have seen chaos and fire sweep across companies that provide banking-as-a-service. Synapse aggregated Fintechs by sitting on Evolve, its ledger accounting did not agree with the underlying bank accounting, and problems were pushed to the future until nearly $100MM of funds went missing.

The largest business bank, Mercury, made these issues visible when switching from Synapse to its underlying bank Evolve, the numbers didn’t match, and now we have regulatory action shutting everything down and bankruptcy proceedings in every direction. On top of that Evolve gets hacked, and everyone from Wise to Stripe has its customer data floating around on the black markets.

In the most recent news, Stripe is switching to Fifth Third as a partner for its underlying bank to support Stripe Treasury. Fifth Third has a product called Newline, which is an API platform that allows businesses to integrate payment, card, and deposit products with the bank. Enterprises can launch and scale financial services using banking solutions and developer tools.

Let’s look at Newline.

Yep, that matches up pretty well with Stripe Treasury.

Remember that banks tend to be depository boxes first, and technology institutions a distant second. Fifth Third is one of the exceptions — they do have a reputation for being tech-forward and having a corporate venture investment practice that participates in the industry. But even Fifth Third is going to be renting core banking and payments software to run the operations of their bank. The Synapse fiasco had its roots in problems of reconciliation across multiple ledgers. How many ledgers do we see here building up to Stripe Treasury?

We can bet that Fifth Third is using either FIS, Fiserv, or Jack Henry, who control most of the core banking market in the United States. Let’s take a look at core banking provider FIS and their recent banking-as-a-service offering.

Hmm. That also fits Stripe Treasury pretty well.

We lay this out so you can see the recurring failure to build the financial Amazon Web Services, and the constant recreation of the same solution in narrow places along the value chain.

Who has mastered the integrated value chain and knows the end customer?

Who is opening up their back-end platform to support competitive businesses that also serve the same customer?