DeFi: US Treasury's ban of crypto-mixer Tornado Cash is overturned in court

Decentralized finance has reason to cheer, as does North Korea

GM Fintech Futurists,

Today we highlight the following:

DIGITAL ASSETS: Court Reverses U.S. Sanctions on Tornado Cash, Opening Door for Decentralised Crypto Innovation

CURATED UPDATES: Financial Institutions and Adoption; DeFi and Digital Assets; Blockchain Protocols; NFTs, DAOs and the Metaverse

To support this writing and access our full archive of newsletters, analyses, and guides to building in Fintech & DeFi, subscribe below (if you haven’t yet).

DIGITAL ASSETS: Court Reverses U.S. Sanctions on Tornado Cash, Opening Door for Decentralised Crypto Innovation

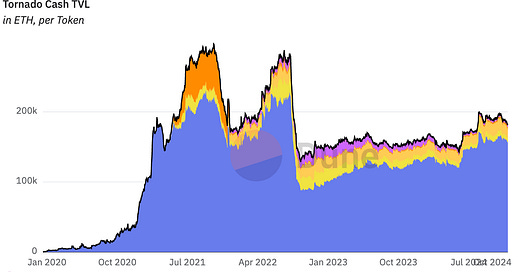

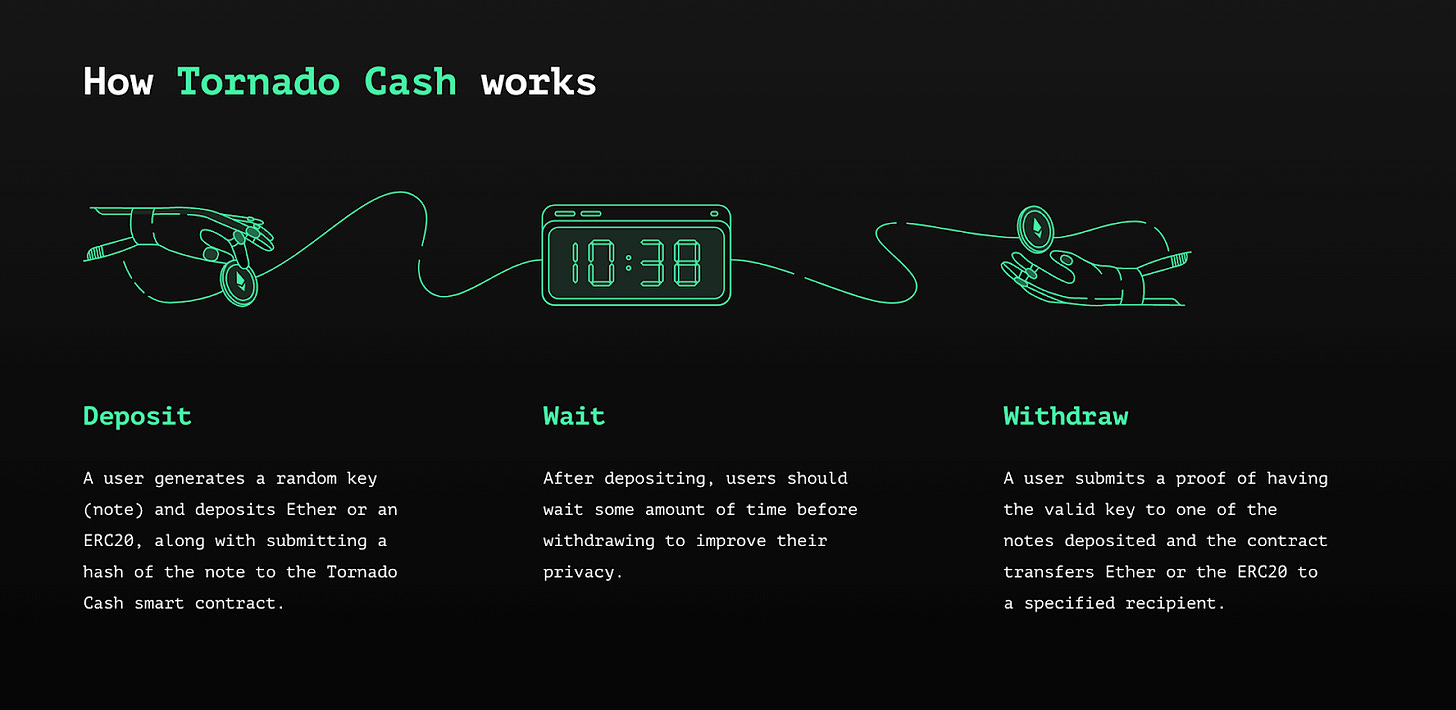

The U.S. Fifth Circuit Court of Appeals has overturned the Treasury Department’s sanctions against Tornado Cash, a decentralised cryptocurrency mixing service accused of facilitating money laundering to the tune of billions. People use mixers by adding their assets into a blind pool, from which the assets are later withdrawn while hiding their source of acquisition. OFAC attempted to outlaw the use of mixers, with Tornado Cash in particular, because the software was used for money laundering and enemy nation-state operations.

The court ruled that the Treasury’s Office of Foreign Assets Control (OFAC) overstepped its authority by sanctioning Tornado Cash’s self-executing smart contracts. These contracts, which operate autonomously without centralised control, were deemed not to constitute "property" under the International Emergency Economic Powers Act (IEEPA). This is because the underlying code cannot be owned. The court also noted that over 1,000 participants came together for a “trusted setup ceremony”, removing the ability for the code to be updated or controlled.

This development is significant as it generally enables smart contracts to be developed and released without repercussions for the creator. But there are two exceptions: (1) if fees are taken by the creator or (2) if the creator provides a service. While no fees are taken by Tornado Cash the court may still argue that Tornado Cash’s founders enabled the service in other ways through the front-end and any marketing efforts.

Co-founder Alexey Pertsev was sentenced to more than five years in prison in the Netherlands earlier this year on money laundering charges. In the U.S., other co-founders face similar charges, with trials pending and investigations ongoing.

The market reacted strongly to the news. Tornado Cash’s token, TORN, saw a surge of over 380% in value before stabilizing.

The court’s decision does not eliminate regulatory scrutiny of Tornado Cash or similar platforms but signals the need for a more nuanced approach to addressing the misuse of decentralized technologies. The judges noted that while autonomous software poses challenges, the power to regulate such innovations lies with lawmakers, not executive agencies acting under statutes that are not fit for purpose.

While rife with caveats, we see this as a big step forward for providing legal clarity and validation that an open and autonomous financial system can be built that incorporates the principles of decentralization and privacy. It is also clear that there is increased scrutiny of developer responsibilities and heightened responsibility for users — if you’re enabling illicit activity (e.g., money laundering to North Korea) or participating in it you will be liable.

The second half of 2024 has been big for crypto court cases. This month the operator of Helix, a cryptocurrency mixer, was sentenced to three years in prison for processing over $400MM in BTC transactions between 2014-17. In September the UK High Court recognised USDT as property in a case involving laundered crypto through mixers, clarifying the status of stablecoins and determining how they will be treated in future legal proceedings.

These cases establish a precedent for how regulators might address decentralised technologies going forward. It also amplifies calls for legislative clarity, with industry stakeholders urging policymakers to develop modern frameworks that foster innovation while combating illegal activity. We recently talked with Coinbase on this topic, and you can find the conversation below.

The clear direction of travel is that the US is about to get a lot more loose with its digital assets.

👑Related Coverage👑

Advertise with the Fintech Blueprint

To reach 200,000 decision makers in financial services, Fintech, and Web3, reach out to discuss sponsorship opportunities today.

🔥🔥🔥 Contact us to discuss options 🔥🔥🔥

Long Take: Why Robinhood spent $300MM on TradePMR, a $40B RIA custodian

We explore the evolution of Fintech, from its pioneering days to its current mature stage.

Robinhood’s $300 million acquisition of Trade PMR, a custodian with $40 billion in assets under custody, highlights a shift in focus from retail innovation to scaling and infrastructure dominance. This deal positions Robinhood to target a $10 trillion market in RIA custody by addressing operational complexities and leveraging proprietary software for growth. The transition from "Commandos" to "Infantry" in the Fintech lifecycle underscores the industry's maturity, as firms like Robinhood and Revolut expand into traditional services like custody, banking, and mortgages.

Curated Updates

Here are the rest of the updates hitting our radar.

Financial Institutions and Adoption

⭐ Trump Nominates Pro-Crypto Hedge Fund Manager Scott Bessent as Treasury Secretary - Decrypt

MARA Holdings Upsizes Convertible Notes Offering by $150M Amid Overwhelming Investor Demand - CoinDesk

BlackRock receives license to operate in Abu Dhabi - CoinTelegraph

Crypto "neobank": Deblock raises €16 million - The Big Whale

Alluvial Raises Total Funding to $22.5M to Meet Institutional Demand and Expand Support For Liquid Collective - Alluvial Finance

Ethereum ETFs See Record $333M Inflows, Outpacing Bitcoin Funds as Catch-Up Trade Gains Momentum - Coindesk

DeFi and Digital Assets

⭐ Kernel Secures Binance Labs Funding to Redefine Restaking on BNB Chain - CryptoSlate

New York regulator set to approve Ripple’s RLUSD stablecoin: Report - CoinTelegraph

Rise Secures $6.3M in Series A to Accelerate Hybrid Payroll and Payment Infrastructure - Medium

Zerion Raises $12.3M to Facilitate Interoperable Web3 Identity - Coindesk

Blockchain Protocols

⭐ Crypto Staking Goes Live on Starknet in First for Top Ethereum L2 Blockchains - CoinDesk

Layer 1 blockchain developer Pharos raises $8 million in seed funding - The Block

Hyperliquid token exceeds $5 billion FDV following airdrop and more - The Block

Avalanche Blockchain's Largest-Ever Upgrade Goes Live on Testnet - CoinDesk

NFTs, DAOs and the Metaverse

⭐ Monkey Tilt raises $30 million in push to make online gambling more social - Fortune

Y – The New Digital Identity Network - BNC.

NFTs hit $562M in monthly sales volumes, recording six-month high - CoinTelegraph

‘Attack on Titan’ Survival Game Launches in ‘The Sandbox’ - Decrypt

🚀 Level Up

Sign up to the Premium Fintech Blueprint and in addition to receiving our free newsletters, get access to:

Long Takes with a deep, comprehensive analysis.

‘Building Company Playbook’ series, offering insider tips and advice on constructing successful fintech ventures.

Special Reports

Archive Access to an array of in-depth write-ups covering the hottest fintech and DeFi companies.

Join our Premium community and receive all the Fintech and Web3 intelligence you need to level up your career.