Hi Fintech Architects,

Lex interviews Tom Duff Gordon, the Vice President of International Policy at Coinbase, where he drives the company’s engagement with policymakers in global markets across the UK, Europe, APAC, LatAm, and the MENA region. They discuss the following key points:

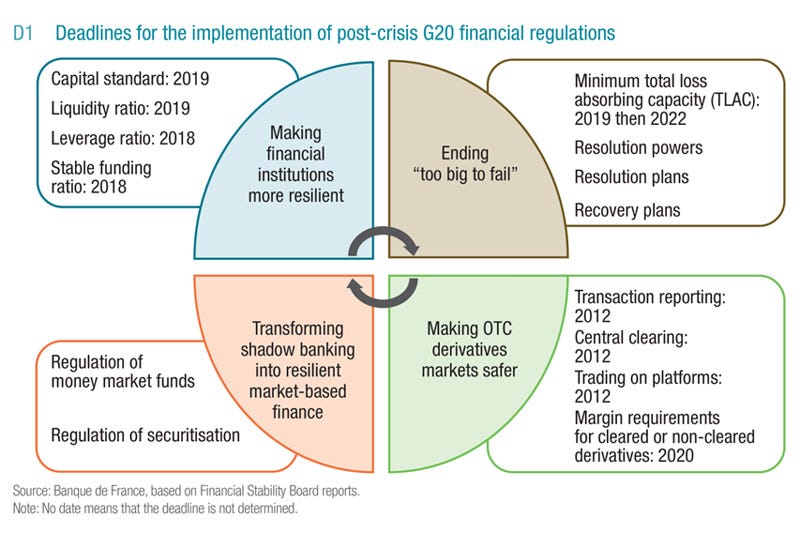

The importance of policy work in the financial services industry, especially after the 2008 financial crisis, and how policy teams collaborate with regulators to shape the regulatory environment.

Reasons why the financial services industry is heavily regulated, including the systemic and interconnected nature of the financial system and the need to protect retail consumers.

The regulatory approaches to cryptocurrency and digital assets in different jurisdictions, with Europe (MiCA), the US, and other regions like Asia. The discussion highlights the diverse and evolving nature of crypto regulation globally.

The challenges faced by the US in developing a coherent regulatory framework for crypto assets, particularly the jurisdictional tussle between the SEC and CFTC.

Coinbase's efforts to advocate for clear and balanced crypto regulation, including through grassroots initiatives like "Stand with Crypto".

Coinbase's evolving product strategy, expanding beyond its core exchange business into areas like custody, lending, and infrastructure for the broader crypto ecosystem.

For those that want to subscribe to the podcast in your app of choice, you can now find us at Apple, Spotify, or on RSS.

Background

Tom previously served as Managing Director at Credit Suisse, Head of Public Policy Europe and UK, where he had responsibility across all areas of regulatory policy and government affairs and chaired the internal global Credit Suisse policy committee, which coordinates positioning on international and cross-border issues.

Tom is on the Board of the International Regulatory Strategy Group (IRSG), the leading, cross-sectoral UK regulatory policy trade association, where he chaired one of the standing committees. For three years he co-chaired the main policy committee for the Association of Financial Markets in Europe (AFME).

Tom holds an MA degree from the University of Oxford. He began his career as a consultant at Accenture.

👑Related coverage👑

Topics: Coinbase, Credit Suisse, SEC, Circle, MiCA, Stand With Crypto, FIT21, financial regulation, financial policy, crypto, exchange, USDC

Timestamps

1’02: Shaping the Future of Finance: Tom Duff Gordon’s career involving Policy, Crypto, and Global Regulation

7’30: Preventing Financial Panic: How Regulation Mitigates Systemic Collapse

13’12: From Bank Runs to Balance Sheets: Tackling Systemic Risk and Preventing Financial Contagion

16’32: Regulating Crypto: Global Progress and Emerging Frameworks

19’42: Expanding Crypto Regulation Worldwide: Frameworks, Challenges, and the Road Ahead

28’18: Crypto and the SEC: Unpacking America’s Contradictory Approach to Regulation

34’30: Crypto Politics: Why the US is Divided While Europe Stays Unified

41’30: Scaling Crypto: Coinbase's Multi-Vertical Strategy and Ecosystem Vision

45’28: The channels used to connect with Tom & learn more about Coinbase

Illustrated Transcript

Lex Sokolin:

Hi everybody, and welcome to today's conversation. I'm absolutely thrilled to have with us Tom Duff Gordon, who is the vice president of international policy at Coinbase. We're going to talk today about the crypto industry, the regulatory environment, and the global views that Coinbase has around the world. I'm really excited to learn from Tom. And with that, welcome to the podcast.

Tom Duff Gordon:

It's great to be here. Hi, Lex.

Lex Sokolin:

Let's start off with a little bit about you and specifically what kind of career you've built in financial services. What are the kind of roles that you've been interested in and how did it come together?

Tom Duff Gordon:

Yeah, happy to start there. So, I guess I've been in financial services for quite some time. I'll go back and start around 2005, 2006 when I joined Credit Suisse. I started as a banker doing mergers and acquisitions mostly in the FIG space. So, looking at other financial institutions. I then moved into strategy. And then after, the global financial crisis began to strike mid 2007, 2008. I was getting more and more interested in the policy side of what was happening in financial services, and then transitioned into the policy team, the European policy team at Credit Suisse where I stayed as we kind of went through that journey of re-regulating finance after the global financial crash and ended up running that public policy unit within Credit Suisse from about 2017 to 2022.

Whilst I was doing that, not just working for Credit Suisse but also was very involved in some of the trade associations, both the EU ones and the UK ones, I did some work with AFME, which is the big capital markets trade association covering Europe, where I chaired the public policy committee for a number of years. And I was also on the board of the IRSG, which is a cross-sectoral financial sector trade body affiliated to the city of London.

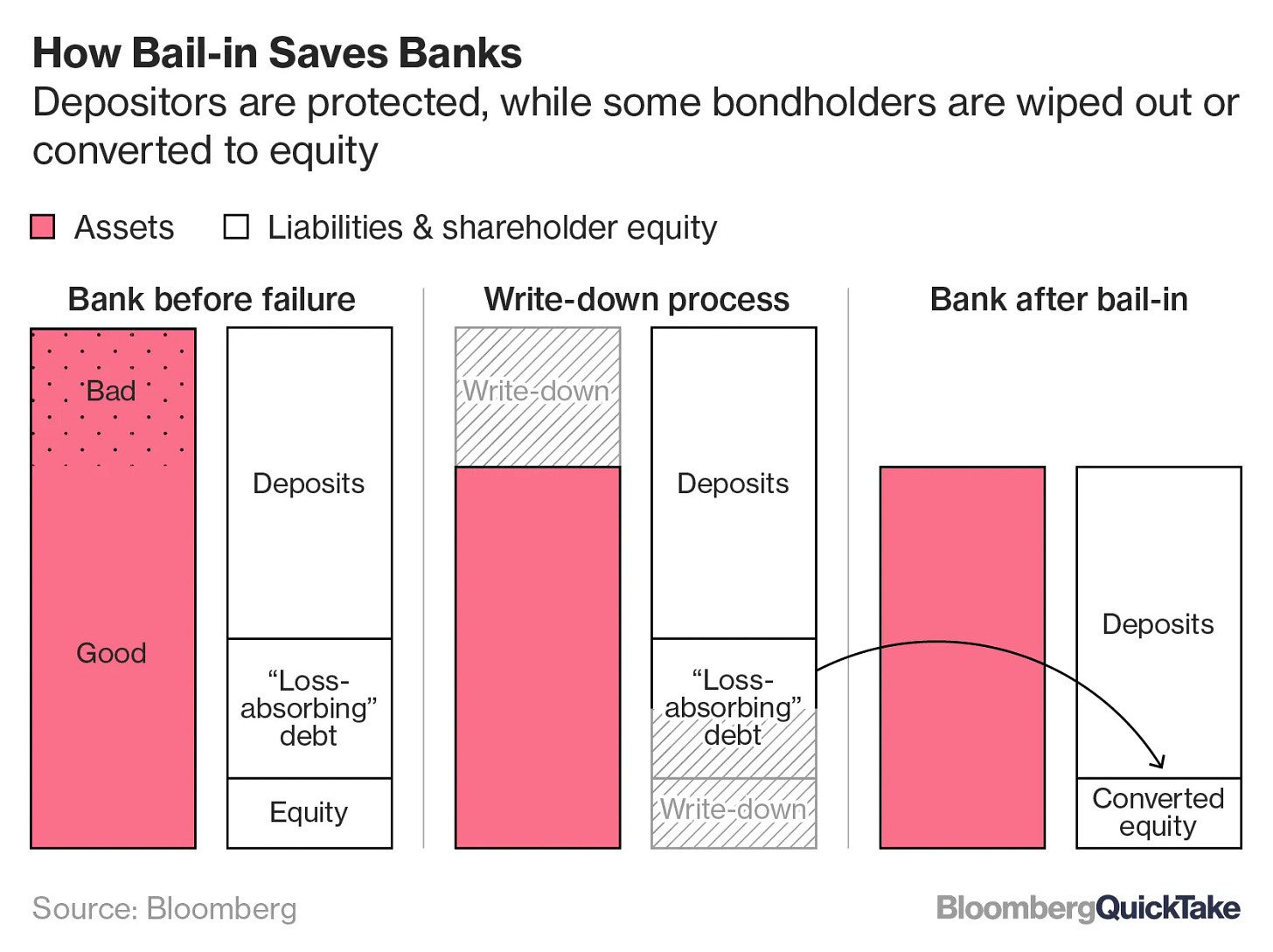

So, it was really fun to do some stuff for Credit Suisse really focused on post-financial crisis, reg reforms. We did a lot of work in the prudential space. Credit Suisse was pretty innovative when it came to thinking about things like bail-in and how to rescue banks that were getting in trouble. But towards the end of my stint at Credit Suisse, it became clear to me that the future of finance, particularly if your policy person was going to be either in the green space associated with the green transition and ESG and all that good stuff, but also digital finance. And particularly because from about 2018 when the EU brought out their FinTech action plan and then 2019, 2020 when we started to see MiCA, I was getting more focused on digital finance and super interested in it.

So, when Coinbase came knocking in late '21, early '22, I was more than delighted to join. So, I've been here at Coinbase now coming up to two and a half years running, as you said, the international policy team. So, everything focused on all of the policy work outside of the US.

Lex Sokolin:

That's an amazing speed run through a very storied career. I'm going to reel us back a bit to the very beginning and the simplest entry point. What is policy in the context of financial services? And this is in your Credit Suisse days, what did it mean to work on policy?

Tom Duff Gordon:

There was a time when policy was not interesting. So, when we think about policy, it is how do we think about what new rules and regulations need to be applied to the financial services sector. It's clearly a highly regulated sector, and so policy has to do with thinking, "In what direction should we take that regulation? Is it fit for purpose? Have we got new innovations? How do we incentivize moving activity into certain spaces? How do we disincentivize others?" And I think for a while, whilst the financial services sector was moving on a steady even keel, policy work was not moving very quickly and perhaps it was not necessarily the most interesting part of the sector. But certainly after the financial crash that we saw in late 2007 and then from 2008 accelerating onwards, it became extremely clear that there were big missing pieces of regulatory institutional infrastructure, but also big pieces of the rule book that need to be looked at again.

And so the policy work that was associated with, on the public sector side, what are those gaps and how do we fill them? And then from a private sector side, policy teams like the one that I was part of and then led at Credit Suisse were very much supposed to be the collectors of the public sector partners to talk from a practical perspective, help the policymakers on a public sector side figure out what to do and how to do it by providing those insights from the ground. So working with all of the experts from across the bank, particularly in fixed income markets and capital markets where a lot of the troubles had started and helping to provide that input, some of the empirical data and then our thoughts and perspectives from a practitioner perspective with regards to how we felt the future direction of travel should go.

So, it went from being, I think, a bit of a backwater to becoming, I think, a very highly strategic function when you think that ultimately profit and loss for some of those big financial institutions is to a large extent determined by how well they can navigate the regulatory environment. And then policy teams that have an ability to influence outcomes in that space then become central to institutional strategies. So, it was really exciting to become part of that movement. And I think we've seen now a broader recognition, particularly in fields like crypto where it's almost a blank slate and we're seeing rule books being developed over time. Getting those right is going to be absolutely vital to the way that this industry can kind of grow and scale. And if you're passionate about the transformative potential of this technology, then getting those rules right is critical. So being part of that journey from almost the ground up is something that gets me out of bed every day and is the most exciting part of the job.

Lex Sokolin:

We'll get to crypto in a bit, but the ground truth is that there are public policymakers in some sort of legislative body and they've got opinions about what people should be doing. And then the institutions that are impacted by the various policies that could come into play also develop the capability to inform those policymakers, to educate them, collaborate with them in order to influence something that might be a little more appropriate or fit for purpose.

Stepping back from that, at a very high level, why do financial services get regulated so much? Why does it, and I'm scared to say the words "need to be regulated" because that's already an assumption, but why does finance get regulated so much and is in the crosshairs of folks trying to put various guardrails around it? What's the reason for that? And as a corollary, who gets to decide what those guardrails are?

Tom Duff Gordon:

Great questions. And just to reel back a little bit into the previous conversation, I think it's worth also mentioning that when these kinds of rules get developed, it genuinely is a two-way conversation. And sometimes the perception is that people working in policy in private institutions are kind of start initiating all of these discussions. In many ways, the discussions are initiated more, in my experience, from the public sector and we respond to that.

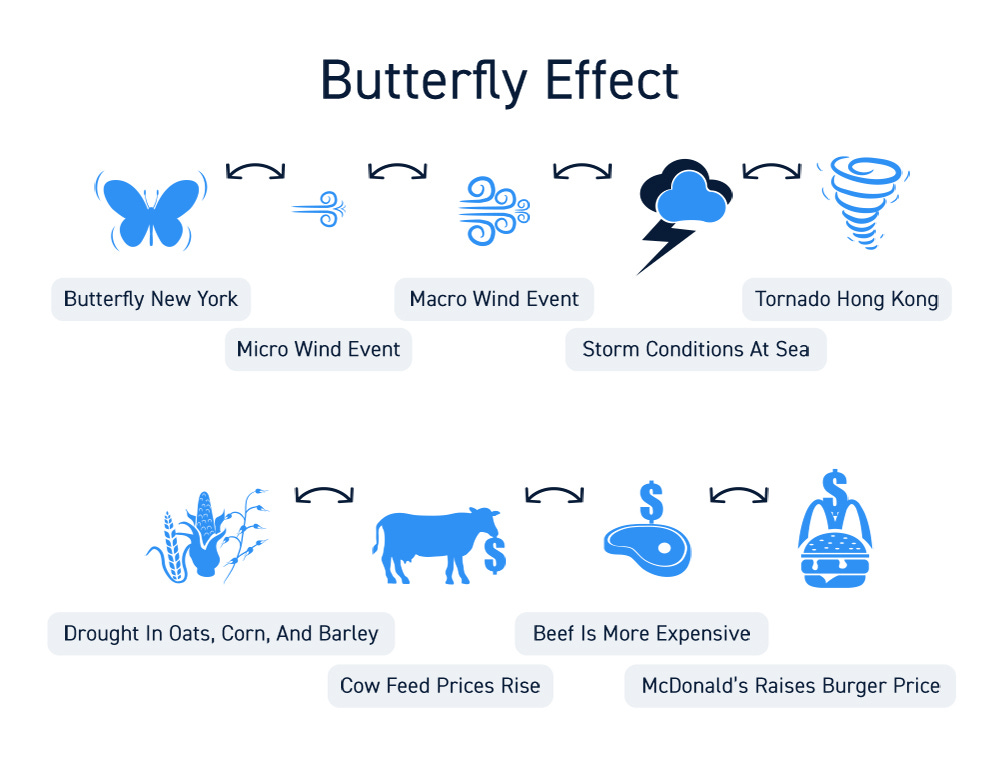

But to come to your point, I mean financial services is regulated, I think, for lots of reasons, not least because of the systemic nature of it. And that I think became readily apparent during the global financial crash. We have an interconnected system and network of banks and capital markets, and you can see issues and problems in one area spill over into other areas. And then that interconnected and systemic nature of wholesale financial services can lead to some of the problems and issues that we saw ultimately having a detrimental impact on employment and jobs and real people's lived experience.

So, we no longer live in isolated unipolar kind of worlds and systems. And the butterfly effect, I think is sometimes it's referred to, whereby a small disturbance in one part of an interconnected system can create outsize implications across the system is something that was a feature of the financial system and required some regulation in order to fix that to some extent. But we are clearly talking about the plumbing of the economies and the vital role that financial services play is just so crucial. Disruption to that service is something that everybody wants to avoid. We all know that real economic growth comes from... moves forward in productivity and innovation and it's the financial services sector that ultimately finances that. So I think a level of sensible regulation is absolutely necessary.

Also on the retail side where individuals are dealing often with complex financial products, and I think there are discrepancies between different levels of familiarity with financial products and financial literacy and things, often there's asymmetric information whereby the issuers and the structurers and developers of financial products have more or better information than the people who are purchasing it. And therefore, in order to ensure that outcomes are appropriate, we can't just live in a caveat emptor market. We do need to have some regulation to provide disclosure and some of those things such that we can ward off against consumer detriment at a broad scale. But I would also be remiss not to point out that clearly there are significant dangers from overregulating with regard to the impact that that can have on stifling innovation and growth. So as ever, it has to be a balance, but I think there are very good reasons why regulation is a necessary feature of financial services.

Lex Sokolin:

Can you give any more concrete examples? You mentioned fixed income and the infrastructure of that industry. And in a broad way, you alluded to the 2008 crisis. Can you give some kind of grounded examples of, "All right, here's the damage that we need to prevent from happening again"? Anything come to mind that this is definitely a thing that there should have been a rule in place or a principle or some law to do things differently?

Tom Duff Gordon:

Yeah, I think this is a well-trodden path in terms of analyzing the global financial system, but certainly I think there was a focus from regulators perhaps too much on micro prudential product supervision and not necessarily on the overall system in terms of where are the different pockets of leverage and risk being taken. And I think since then, and the UK is a good example of this, we've innovated by establishing new regulatory bodies at the Bank of England whose job it is is to look at more macro prudential issues and concerns and to monitor them.

So, I think there were some gaps in the institutional regulatory architecture. And then clearly there were concerns and issues from the private sector side with regard to the distribution and structuring of certain mortgage-backed securities, whereby I think through the artful development of those products, the real risk associated with them was somewhat masked. And in actual fact, when you peel them back, these were much riskier products than the credit rating agencies or the banks or the distributors or others necessarily were perhaps aware of or disclosing. So, a lot of those things have been fixed, including the way in which derivative markets are regulated. We've introduced all sorts of new rules with regard to living wills for banks. That was a big area. We've got to think of a way in which banks can exit the market without necessarily bringing a systemic crash.

And so a good example of the innovations in that space was bail-in which I touched on before, whereby rather than just the equity capital in a bank absorbing losses, the new regulatory innovation was for losses to be absorbed further up the liability stack, i.e. making not just the common equity capital but also the additional tier one capital and even some of the subordinated debt and even senior debt and perhaps even term deposits bail-unable, which basically means that there are more resources to help stabilize a bank before you have to resort to bailing out using public government money. So that is a really important innovation. It's one that we haven't necessarily seen being deployed to great effect. I think we have to be honest about that. But the innovation itself I think is important and I'm sure that that will prove to be useful as we move forward. And as respect, there will be further banking failures as we move into the future.

Lex Sokolin:

Let's figure out what the core fear is. Is it having lots of money, capital, sitting in a bank or a broker account and then some sort of pressure whether it was that moment of running for the exits with Silicon Valley Bank or marking things to market on the Lehman Brothers balance sheet, people running for the exits and as a result you've got this moment of shock that could make an institution fall apart? And of course, once you have an institution fall apart, that can create a lot of investment loss for people who are exposed to that risk inadvertently, meaning they didn't take that risk on purpose. And so, you would end up having this fallout that starts with the capital on the balance sheet, but then blows up the institutions and has lots of follow-on effects on people in society as an externality. Is that the right way to frame as what the underlying problem and what the core fear is in this case?

Tom Duff Gordon:

Yeah, I think that's right. I think we all know that we don't live in a kind of a zero-failure world, and I think regulators also are not designing rules for zero failure. So, I think there will be failures. We've seen failures in the crypto sphere that no doubt will get onto. And certainly, we see routinely, and throughout history, we've seen failures in the banking sphere. And so, as you rightly point out, the focus is around minimizing the spillover and the contagion from some of those failures such that the system itself doesn't come down and then trying to minimize losses for depositors to the extent that they're covered by insurance or their small depositors and then trying to slow down. I think now the focus is on slowing down the runs and the collapses of banks trying to stabilize them and moving some of the more healthy assets and liabilities to different and other banks rather than having a disorderly and chaotic wind down.

If you think back to Lehman Brothers, it was the chaotic unwind of the swaps and derivatives book where a huge amount of the value loss occurred. And I think a lot of the innovation that was brought in in financial services to remediate and to provide solutions to the financial crisis was associated with mechanisms and features to stabilize banks and particularly trading books where such that some of those positions can be maintained and sold off and stabilized and you don't necessarily have to sell things into a down market and creating spiral effects and creating ripples of panic. So yes, I think you're right. The regulatory reforms are there not to prevent all a failure, but to minimize the negative externalities for when those failures will occur.

Lex Sokolin:

Let's move on to crypto. This is such a broad and hard subject to enter. Maybe we can just start with your view on, how would you characterize the efforts of regulators to address risks from crypto assets?

Tom Duff Gordon:

I think this is an ongoing journey that regulators are all on. And globally, I think we're seeing a lot of progress, and we have consensus at the G20 level that this is a sector that shouldn't be banned and crypto shouldn't be prohibited. And I think that was an open question actually over the last few years, but the G20 and some of those supranational bodies have come together and said, "Crypto is an area where we can't turn it off. You can't turn off the internet. There's a lot of adoption, a lot of young people are using it. There appears to be some kind of promising use cases. We need to regulate this though because there are some kind of risks that are crystallizing. And we should start thinking about what are the principles for doing that."

And so, I think institutions like the Financial Stability Board, which is a global standard setter that reports up into the G20 IOSCO, which is the global securities regulator. I think they've done a good job over the last 24 months coming and working with the central banks and the securities regulators across those big countries and hammering out a set of very high-level principles and guidelines with regard to how you should think about managing in each of those countries the risks that may arise from crypto assets.

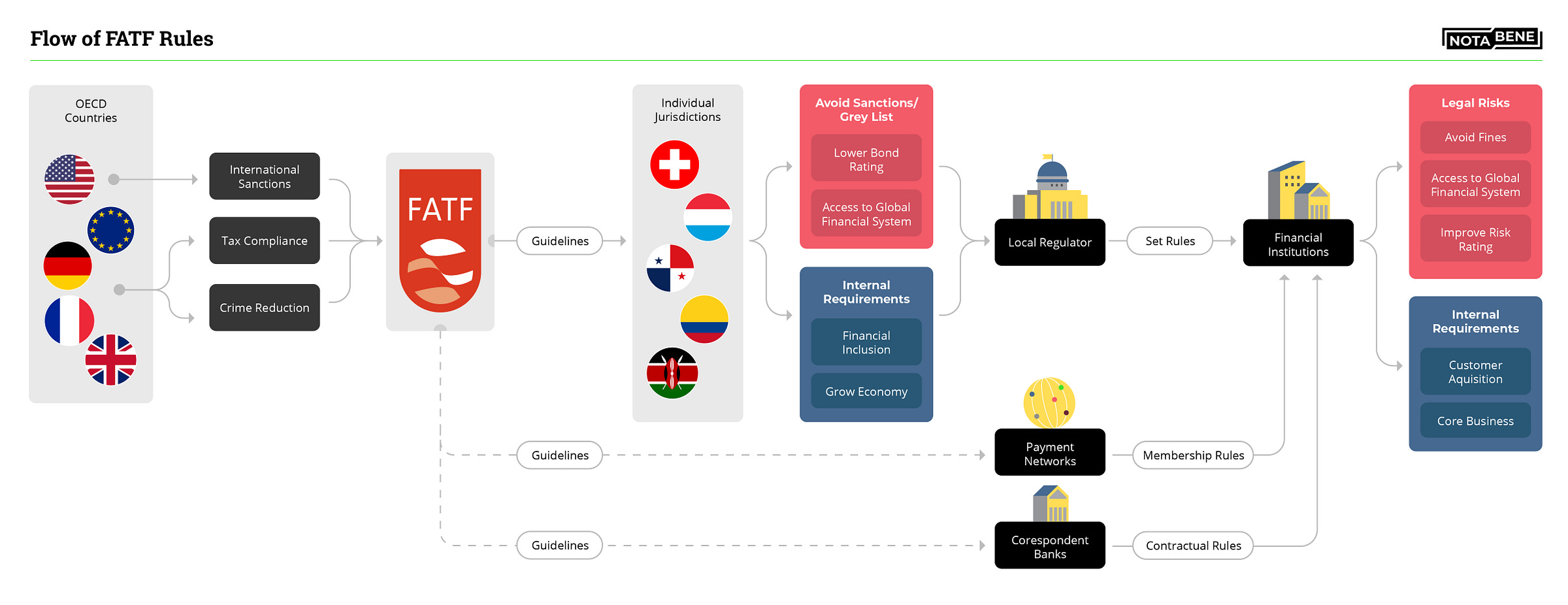

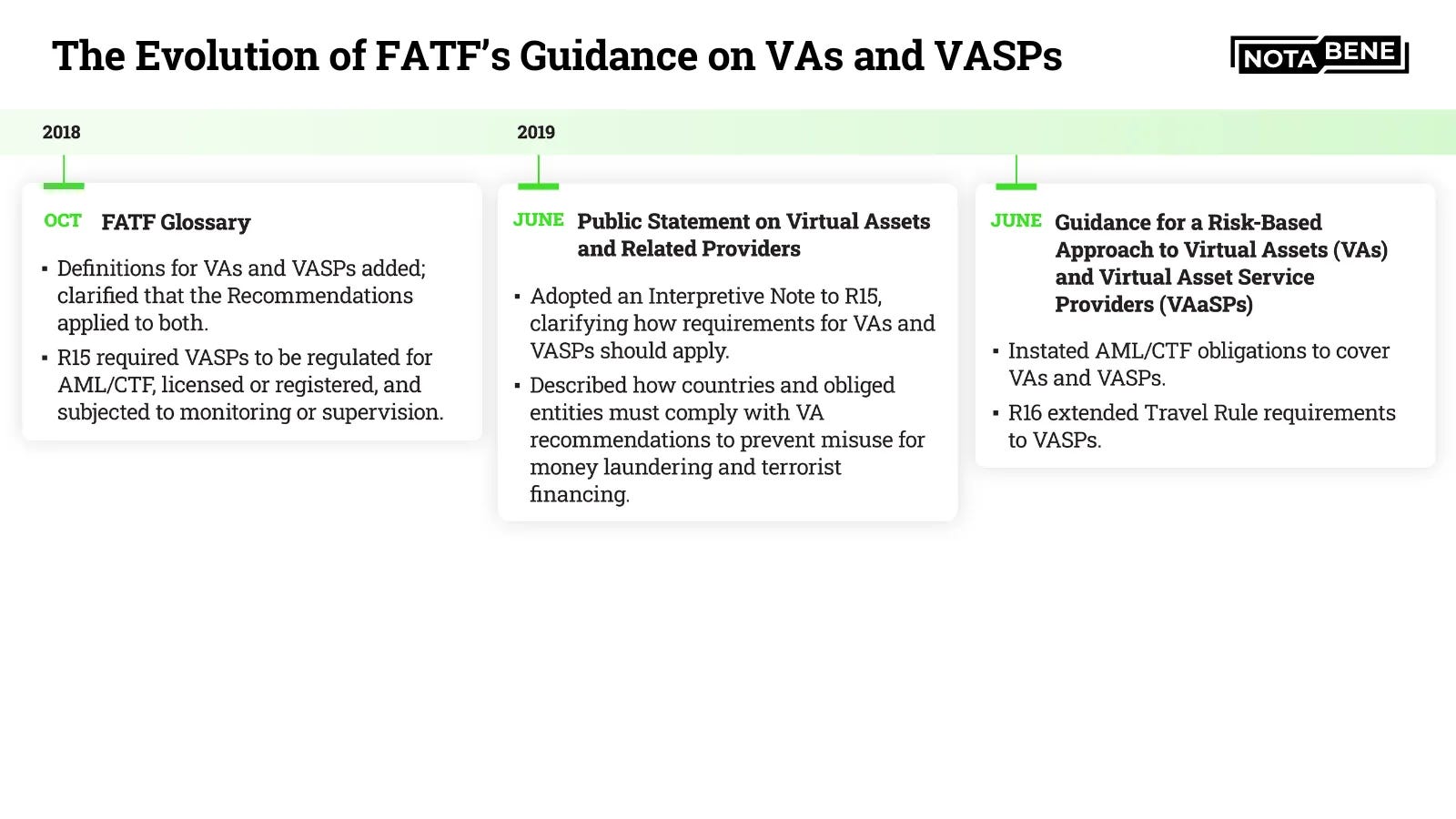

These tend to focus on the large, centralized actors like Coinbase, but also on certain products where they feel those products could scale very quickly and see high levels of adoption, so things like stable coins, which no doubt we'll talk about later. So, we can go into lots more detail, but I think we now have a kind of consensus at the global level that we should be regulating and not banning or prohibiting. We're starting to see the emergence of a framework. And then different jurisdictions around the world are further down the line in terms of actually implementing that. Some have done phase one or on phase two and others are still going through the early motions of getting that. So, it starts normally with some form of AML, which is anti-money laundering regulation. And we've seen actually some global rules on that from the Financial Action Task Force or FATF. So, AML tends to be a place where countries start.

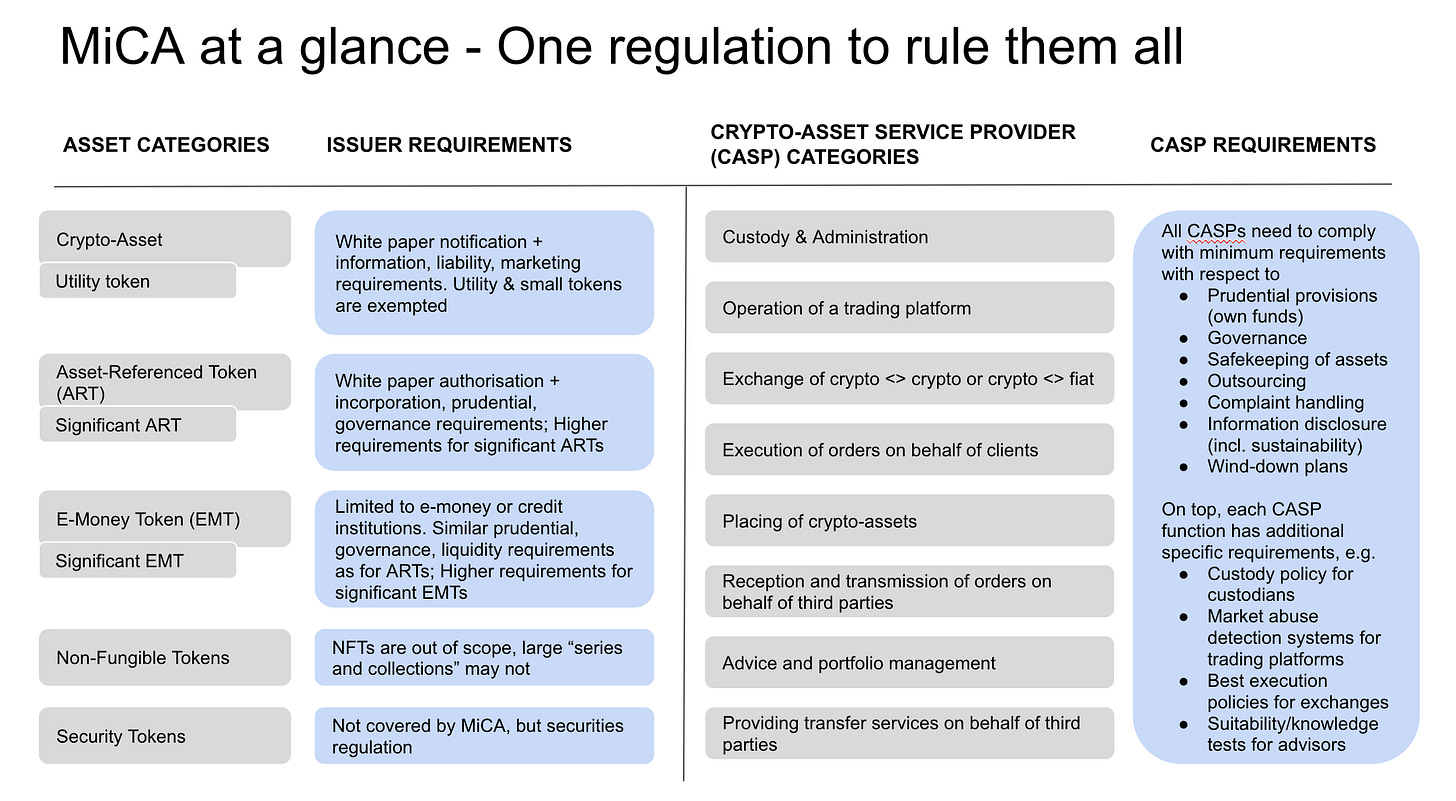

Taxation is obviously where countries are self-interested to make sure that crypto assets are included. And then the next steps tend to include things like a licensing framework for kind of CASPs, as we call them, crypto-asset service providers, and then some rules around stable coins. And then we're now thinking in some countries that are further ahead around what we should do and how we should regulate things like decentralized finance, NFTs and other things. So, I would say the general picture is a good picture and we're moving in the right direction, but there is a lot of variety and heterogeneity within that when you start looking at individual countries.

Lex Sokolin:

There was so much effort in the beginning, probably the first two or three years spent by the various regulatory bodies to just assign labels to different crypto assets, whether something's a security token or a protocol token or a coin or a stable coin and so on. It almost felt like it was a distraction to create all these labels because the activity on the ground just continued to move really quickly. And it sounds like that maybe we're out of this phase of trying to put labels and align the labels to prior existing law. Maybe we're in a phase where there are frameworks being developed that are more productive and fit for purpose in the sense that they actually understand how the technology works and what it's trying to accomplish and its differentiation.

How would you characterize globally the different frameworks and maybe the different areas in terms of how advanced they've gotten with their policies as well as how contextual they've gotten to be close to things that are useful and what's actually happening on chain? You mentioned there is a diversity. Can you open up a bit about what the diversity is and some of the substance in terms of what is being put into action?

Tom Duff Gordon:

Yeah, maybe I can start with Europe but also bring the US into this comparison and maybe some of the markets across Asia. So, Europe started in 2018 to think about crypto assets and then they started to develop a couple of years later something which is now known as MiCA, the Markets in Crypto-Assets regulation. And they are kind of like everybody who starts out on this journey face the question around, "Do we create a brand-new framework for crypto assets? Do we try and adapt what already exists somewhat for securities and other financial instruments that are adjacent? Or do we just drag all of the crypto world that we currently see into without any amendment into a kind of a body, a corpus of existing financial regulation?"

And in actual fact, what MiCA did I think is a bit in the middle whereby they said in Europe this kind of feels like financial instruments that we're familiar with regulating through MiFID, which is that you EU's Markets in Financial Instruments Directive, but clearly there are some kind of differences and we can't treat crypto assets exactly the same way as we would treat fixed income instruments or equities.

And so what they did in Europe, which I think was prescient, was to take a lot of the relevant things in MiFID, things around having fit and proper people running exchanges, ensuring that you've got market surveillance, ensuring that you've got various kind of rules and regulations to prevent market abuse, that you've got sensible rules around what assets you can put on an exchange, what kind of disclosures should be made, what kind of prudential requirements you need. They took a lot of those sensible things that they were familiar with from some of the other financial services regulations like MiFID and they adapted them somewhat to make them fit for purpose for crypto assets. And they created a new set of rules known as MiCA, which has now gone live for stable coins as of the end of June of this year, 2023. 2024, sorry, and will go live at the end of this year for crypto asset service providers more generally.

So, Europe is pretty advanced, which is a kind of impressive, I think, development given Europe requires 27 different countries to come and agree. And it's also an impressive and comprehensive piece of regulation that I think by and large the industry supports. Now there are kind of concerns, and no regulation is kind of perfect, but it's a decent place to start.

But as a segue to the US, I would say that in Europe the precise question about where to draw the line between an existing financial instrument which is covered under MiFID or MiFIR in the EU and what is a new crypto asset of one form or another, which would be under MiCA, is a kind of, it's a slightly hazy line and I think there will be further work over the next 12 months, 24, 36 months to try and create a bit more understanding on that perspective.

But I think to your question, some of the real nuances of the taxonomy associated with what's decentralized, what's centralized, what could be an issued security versus a decentralized commodity type crypto asset have not been addressed in this round of MiCA but will be punted for a further elaboration as we move forward.

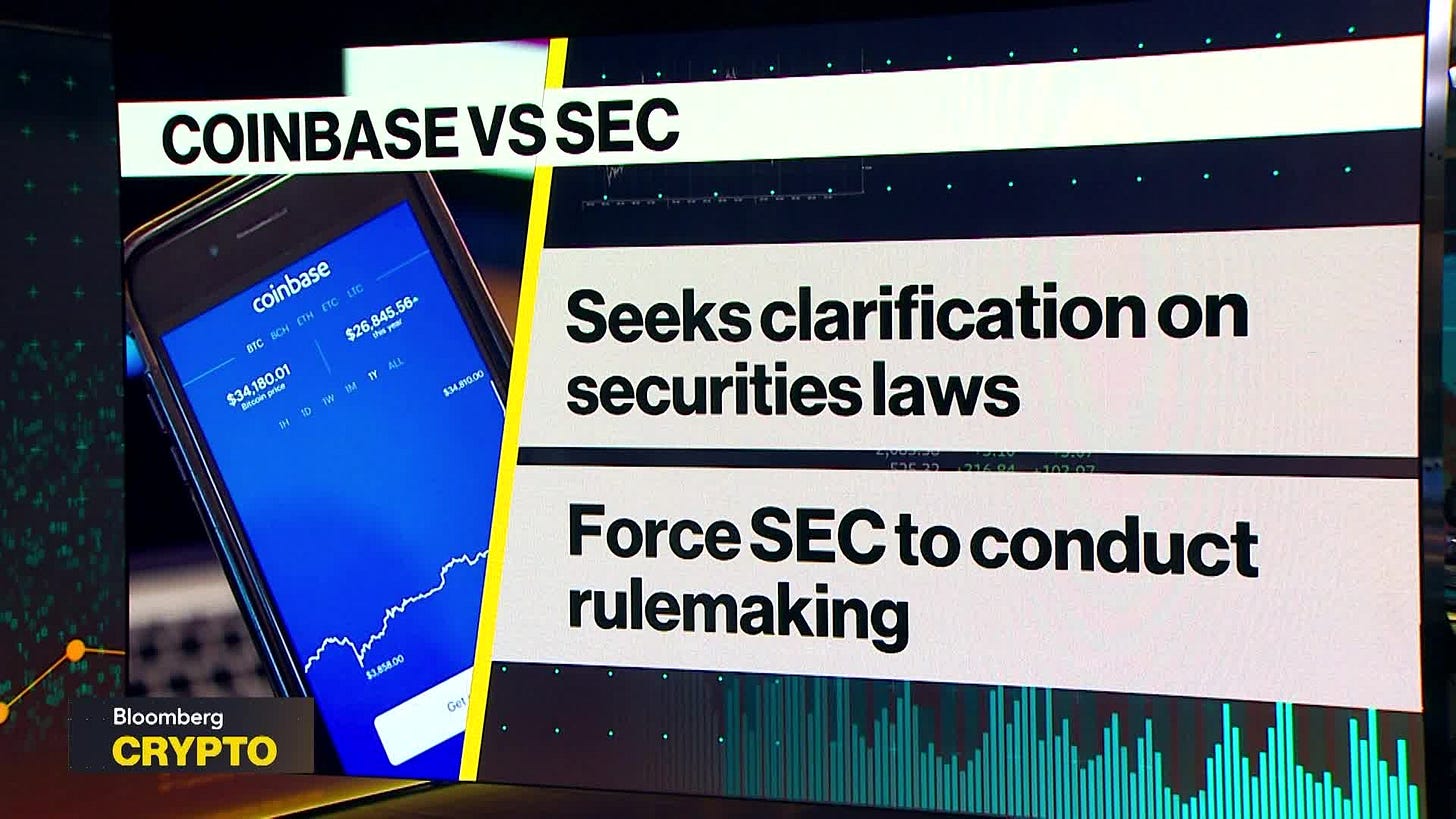

If we think about the US, it's actually the other way round in that the question that has been the vexing one has been, are crypto assets, are they commodities or are they securities? And that has been particularly troublesome as a question and an issue to address in the US because there are different supervisory authorities that are responsible for those different financial instruments. So, we have the CFTC, which is of course responsible for supervising commodities in futures markets. And then we've got the SEC that has the responsibility for equity markets, securities markets. And so, there's been a tussle I think as everybody knows between those two bodies with regard to whether crypto should be securities or whether they're commodities. And also, some quite extensive thinking with regard to this question on decentralization whereby can something start as a security but then become a commodity in a crypto asset and what does that journey look like?

So, as a result of those questions, the US is further behind. I think your listeners will all know that. So, we don't have yet the prospect of an agreed... Well, we have the prospect, but we do not have in our hands yet an agreed legislative text.

And actually what we've seen more on the US side is regulation by enforcement whereby the SEC in particular has I think tried to demonstrate what the guardrails are for this industry, not through notice and comment and the usual thing that you would expect to see, i.e., a consultation paper and getting the views of the industry proposing rules, moving to draft final rules and then finally publishing the standard. They have not done that. They have sought to assume or to say that crypto assets are already covered without any amendment necessarily to the existing rules that were in some ways date back to the Howey test in the 1930s, and therefore the new industry needs to adapt itself to this old regulatory framework, which from a Coinbase perspective doesn't work. Our conviction is that the tokens that we have on our exchange are commodities and they're not securities and therefore not under the purview of the SEC and that the rules do require significant amendment before they would be fit for purpose.

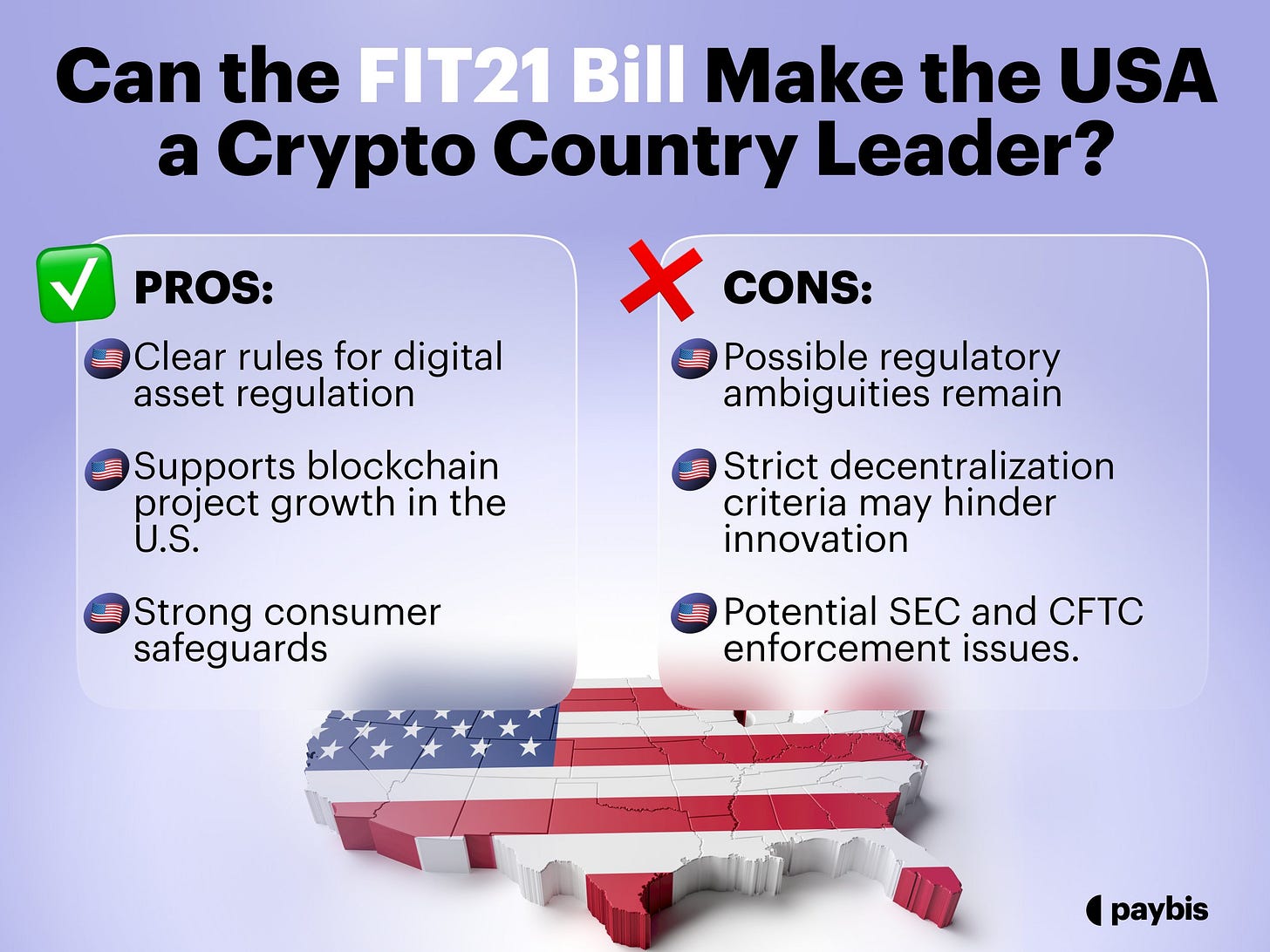

And we have been, I think as you know, working really hard with the industry and on behalf of the industry to try and promote and advocate in favor of just legislative and regulatory clarity in the US. We think it's so important that the US is a leader in this space. They tend to lead on technology, and this is a strange happenstance that they've advocated. They've abdicated their responsibility in this area. So, we will fight for clarity on these issues and issues. We've seen some really good progress through Congress. Recently, bipartisan agreement, the FIT21 bill, and we'll see what the Senate says with that. But either through the courts or through the legislative apparatus, all our other means, I'm sure we'll see some clarity forthcoming in the US in due course.

And then as far as Asia goes, just to wind up because we can go into more details, there are markets like Japan and Singapore that are I think quite far ahead and that they've had frameworks for crypto for a number of different years now and they're moving almost into the next phase. Hong Kong, I think is a hot spot that people are following very closely. The Middle East has been extremely impressive with their kind of foresight, again whether in Abu Dhabi or in Dubai. There are up and running frameworks in place and a lot of investment and activity is happening there. And then in Canada, there's been a bit of progress. We'd like to see a bit more in certain areas, not least stable coins. But also, further south in places like Brazil and Argentina, you're seeing kind of developments. So, there's lots happening and I think we are on that journey that I described before, which I think will lead to broadly I think a harmonized basic framework over the next couple of years.

Lex Sokolin:

That's a fantastic overview and I think very generous as you have to be to our friends who are in the difficult position of trying to create rules for the space.

I can call it out probably a bit more plainly, which is, I think the American treatment has been incredible at undermining the ability of this industry to grow in a way that benefits the American economy, especially given that most of crypto is actually denominated in the US dollar. We've seen the SEC go after literally all the good actors, including my former employer, ConsenSys, the wallet MetaMask, after Uniswap, one of the cleanest and best projects in the space that provides real use to millions of people. Of course, after Coinbase, one of the most compliant and well-regulated crypto exchanges with actual separation between its business units and its functions that has gone public and is completely transparent about its business relative to others. The SEC has gone after OpenSea, a place where you can buy digital art.

So it's aggressively gone into places in which there is uncertainty. And many of those cases, the SEC now has lost in court for overreaching. And of course, there's been huge political blowback across the election and the different bodies of government, and yet the SEC failed to actually do the thing that we talked about, which is to prevent the collapse of a very traditionally structured financial entity in FTX where there were no questions of crypto. There were only questions of broker dealer and exchange holding assets on other people's behalf. I can't ask you to speculate, but I can point out this completely strange contradiction and ask, "Why is this happening? Why did it happen in the US?" Whereas the rest of the world seems to be, well at least the rest of the developed economies, are fairly measured or are starting to have a more clear opinion with MiCA in Europe with there's visibility around Singapore and in Hong Kong. Of course, China and India are both very closed off, but there are jurisdictions that do have a more coherent point of view.

Are there things in policy circles that you could share that would help people make sense of what from the outside looks like just really irrational behavior?

Tom Duff Gordon:

I think you gave a really good overview of the SEC's approach. It is difficult. It is difficult for us to understand I think the totality of all of the reasons for why they've decided to take that approach. I think one of the aspects or drivers of that I think is a leadership and a personal one. I think we have got a leadership team and we've got leaders at the SEC who are taking very active interest in crypto and have very strong, very negative views on the sector, and that has led to the institutional position and posture towards crypto that's been adopted. And it's possible, I think that if the leadership changes over the coming weeks and months, I think it's possible with new leadership that comes in, you have a slightly different posture, and I think you would have more constructive collaboration and then we can move forward.

Zooming out, look, I think it is strange that the US that normally takes the leadership role on technology and also post-FTX, this would seem two things to provide the perfect platform to say we need to kind of regulate this space and we need to be influential in the global discussions on this, and we want crypto and digital assets to have the rules to have the imprimatur of the US on it.

So, I'm not sure I can shine a specific light on a single thing, but it obviously has to do again with the FTC versus SEC in some of the jurisdictional complexity that that brings, which is not a feature of a lot of other markets where both commodities and securities are covered by the same regulator. So, you think of the UK for example, so the financial conduct authority. Or if you think of the EU for example, you've got ESMA. And then throughout the member states, you can just have one singular FTC equivalent entity that covers both commodities and securities. And so therefore, having to kind of grapple between the precise taxonomy and distinction of these tokens as the [inaudible] of commodities has not been a feature of those discussions, which has allowed them to move much further and much faster forward.

So I think it's a number of different things, but we're hopeful at Coinbase that this will unlock, and not least because we can't have a separate conversation about AI and blockchain. And so, when you do think about technologies as the future and when all policymakers are concerned with the right framework for AI, it's just even more pressing that these adjacent technologies and supporting technologies should also be part of that broader conversation to unlock the investment, the innovation, the productivity gains that we know are possible.

Lex Sokolin:

The other point that's confusing to me is, how much more apolitical crypto is in Europe and the UK than it is in the US? So, we recorded this before the American election. Trump came out with some very bold statements about Bitcoin being in the treasury and in the reserve. And also, he's in the process of launching a coin and token and that's being covered by the major news outlets and they're talking about, "Here's the allocation and the tokenomics of this Trump coin and so on." Meanwhile, the Harris side had tried to, in some ways, moderate its position on crypto, though I'd say largely the details are missing from the war against camp.

There's this really strong political split in the US for better or worse, and for many people, it's a single issue that they vote on. Whereas I feel like if you look at the UK and maybe Europe more broadly, although I'm not aware for sure, it doesn't seem like you have this conversation between, for example, the Tories and Labor, and it just has not risen to that level of popular discourse. What's the reason for that?

Tom Duff Gordon:

Well, of course, it won't surprise you to hear. We want crypto to be a bipartisan issue, right? I mean, we think that this is a transformative technology that should really disrupt payments, that should disrupt capital markets and financial services. And we're hopeful the technology and blockchains will provide the fundamental infrastructure layer for new version of the internet, the Web3 story.

So, we think that there's something for everybody within that and it should be a bipartisan issue. We were, by the way, very pleased to see that I think around 70 Democrats voted for FIT21, which was the recent crypto bill in the house, which I think demonstrated that it is and should be a bipartisan issue in the US. But I think you're also right to point out that it is becoming a bit more politicized and we're seeing perhaps greater emphasis on it from the Republican side of the presidential campaign that is ongoing.

I think we want to keep it bipartisan. We have Stand With Crypto in the US. And the focus of that grassroots body that we're associated with is very much just to talk about the benefits of crypto and this innovation and to support legislators on either side of the aisle who've expressed support for this industry.

When it comes to the UK and when it comes to Europe, you're right, we haven't seen a politicized debate on crypto and we're super grateful for that. I mean, again, the technology, if you're a libertarian and you care about individual rights and freedoms and you don't want the state to interfere with your property and other things like that, there are big parts of this domain and sector that would be appealing, the self-custody aspects of it, controlling our own data. But equally, if you care about financial inclusion and the democratization of finance or young people who see very clearly that the use case for this technology and gaming and e-commerce, they traffic and they spend their lives in online and in virtual reality and they just see this just necessarily as a kind of corollary of that future.

There's also a lot to be said and there's a lot of excitement around this kind of technology. So people like me, I think our job is to continue to talk about the transformative nature of this technology and to have that open conversation with policymakers from all different sides and aisles and try and bring different perspectives together to create a regulatory framework that will foster the innovation in this space that we think will lead to some of those exciting developments we touched on.

Lex Sokolin:

How do you do that? Who would you be talking to? How do you talk to them and what are you hearing back right now?

Tom Duff Gordon:

Sometimes I think the best advocates for this space are not necessarily policy professionals like myself and others. It's actually the real people who are either using the products or developing the entrepreneurs, the SMEs, developing and using these products.

And so, one of the things that we're really excited about is this movement Stand With Crypto, which has been a big movement in the US where I think they've just brought national level awareness of the fact that 52 million Americans have crypto and I think have helped elevate crypto into the political conversation as we mentioned.

But we're launching that broad and internationally. We've done so in the UK and in Canada, and we've got some exciting plans for doing that in other jurisdictions. And the purpose of that movement is really to try and galvanize the community, bring them together and galvanize the community, the developers, the builders, the entrepreneurs, the SMEs, the innovators, and get them to talk a bit about what it's that they're doing. Let's just show policymakers that there are really important clusters of innovation and activity and entrepreneurs in sometimes not the main cities, but actually the second or the third cities or out in the countryside or wherever, doing interesting things, using blockchain, solving real world problems, creating [inaudible] paying jobs. It's that kind of shining a light on that type of activity and getting those folks to talk about why they're using blockchains and why they're excited for the future, they can be often the most powerful advocates for our sector, particularly when they can articulate why a lack of regulation or an existing piece of legacy regulation that doesn't work for them is hindering their ability to grow their small company and employ more people.

So that is something that we want to do more of, which is finding those use cases, finding those exciting companies, and trying to amplify their message, their experience, because I think doing that is one of the most powerful things we can do as a lobbyist.

Lex Sokolin:

I think now is a moment where the overall system has so much fragility built into it that applying maximum leverage could actually have a real effect. You look at everything starting with the FTX collapse to the Silicon Valley Bank situation with VCs and the tech industry falling apart around that. And then more recently, embedded finance and the issues around Synapse and intermediated banking and of course the current powder keg of politics.

I think the more leverage you can apply into the situation, the more give we're going to get out of the system, at least in my view. And this incrementalism, it's like you're boiling the frog and we're at the point where the frog is getting pretty boiled.

I want to end on a question, jumping off your point of builders being the ones who tell this story. So let me ask you about the Coinbase product footprint. And in particular, Coinbase started out as a Bitcoin exchange around the idea of trading coins, and now it's a company where the core engine is still the exchange, but you have over a hundred billion of custody and over 90% of the assets for the Bitcoin ETF and the Ethereum ETF. So, there is this asset management custodian arm. And then you've got the base roll up, the layer-2 that connects to Ethereum, which is mirroring the Binance chain strategy where you've got this attached chain that you're sending your own customers to, like a captive app store that bridges out to the rest of Ethereum. And you've got the venture arm. And you've still got Coinbase commerce, which is sort of a Stripe Shopify payments checkout thing. And I see parts of the business also starting to move into artificial intelligence.

So it feels like we're seeing Coinbase in a lot of verticals, either exploring or competing with a lot more people than in the past. What is the organizing principle behind the product strategy and how do you balance empowering the ecosystem through the exchange and at the same time giving enough space for other companies to build their own stuff?

Tom Duff Gordon:

That was a great list of everything Coinbase does, so thank you for that. Maybe before answering the question, a couple of other areas, which I think we've, from a product perspective, that we've grown out recently that we're proud of, and one would be the international exchange that we launched in May of last year, but Coinbase has historically been mainly focused on spot with crypto, but we are now increasingly bringing derivatives and perpetual futures offerings to that.

So, we launched that exchange in Stock Exchange in May of last year, and we actually announced recently that we've acquired a MiFID license in the EU, so we'll be able to bring the derivative products and those perpetual futures to the EU market quite soon too. So that's really exciting because obviously derivatives actually make up 75% of the trading volume. So, to be able to be a big player in that market as well is something that we're super excited about.

And then the other is USDC, so the stable coin. You mentioned before that most of crypto is US-denominated. And obviously there are a few big stable coins, and we have a partnership as you know with the issuer of USDC, which is Circle and seeing that scale and seeing the use cases around stable coins, not least on base, which you also mentioned, which is our layer-2 on Ethereum where you can now send and receive USDC. So digital dollars can be sent via your Coinbase wallet or your app on base around the world almost instantaneously and for free. And it's that kind of functionality which you can demonstrate it works, it's there today. It's something that most banks cannot do and may never be able to do. And if we want to solve some of the world's big challenges and problems, whether that's remittances or bringing the unbanked further into the financial system, then it's tools like that kind of almost instantaneous and free value transfer from a smartphone that is really safe from a trusted player, I think, are going to be transformative and super interesting.

So, with that, just to answer the question more directly, I think our role is we want to bring a billion people into the crypto economy. A key part of that is making sure that people can have access to Bitcoin, they can buy it. They've got to be able to store it as well, so we have the custodian that you mentioned. And then we want people to start building Web3. And so, we are providing the infrastructure for that through the blockchain that I described base, but also through providing developer tools for people and cloud services and Coinbase commerce to try and accelerate that development. So, we are not in and of ourselves innovating particular use cases in particular sectors, but we're trying to facilitate that innovation and scale it up by making the infrastructure as good as it possibly can be.

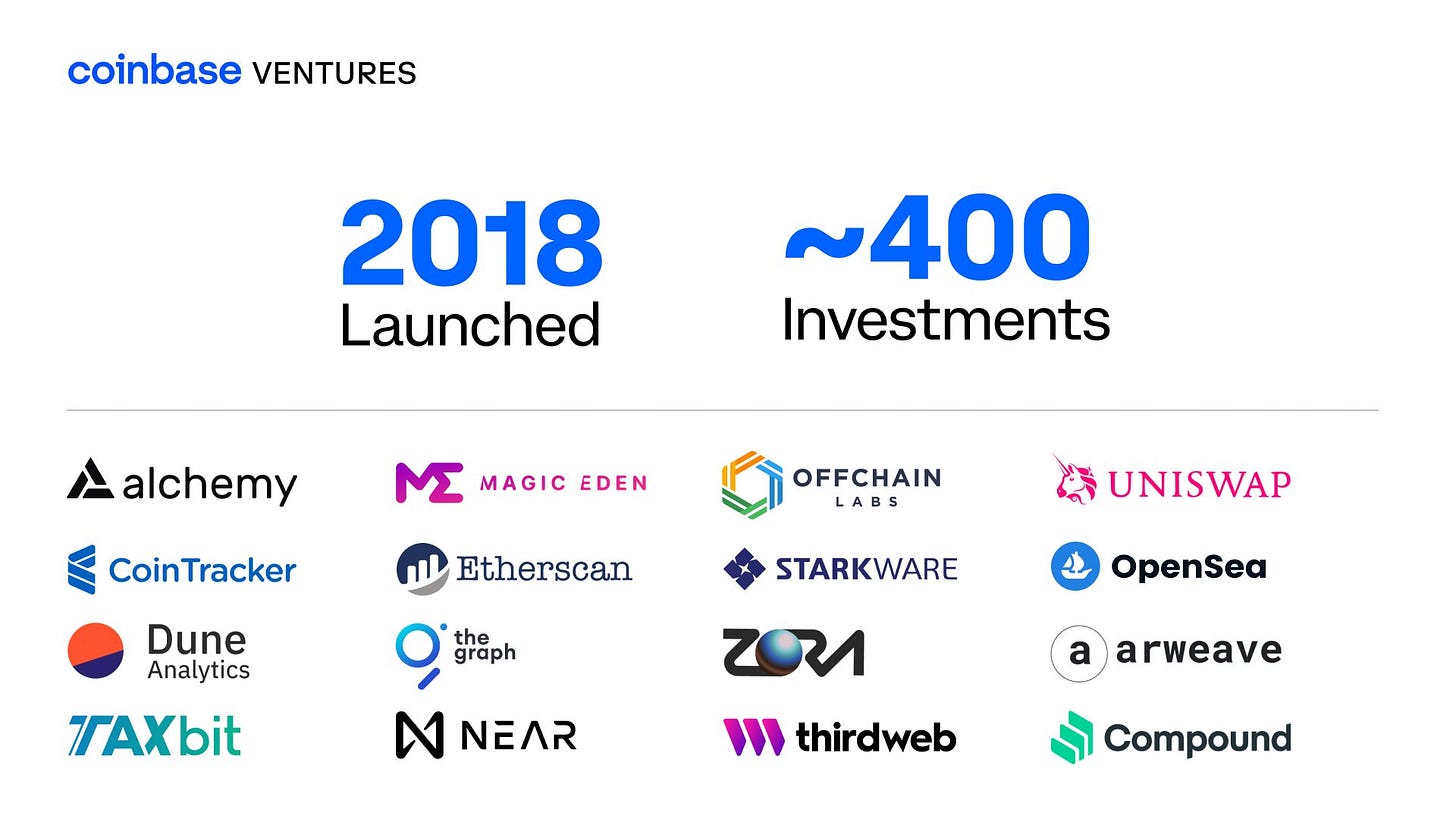

So, we also, as you know, we're very connected obviously across the ecosystem. We have a ventures arm, and we make a number of bets. I think we're a prolific venture investor in the Web3 and crypto space. It's very exciting what we're doing in that space and the portfolio is growing.

So, I think our role is to try and bring people into the crypto economy and facilitate people who want to build and develop and scale once they're there. And increasingly, I think we're going to be doing much going to the institutional side as we see Bitcoin and Ethereum and some of the major layer-1 tokens become more readily accepted as a financial asset and asset class in and of themselves via the ETFs that you mentioned.

So we're very excited. There's more to come. We've announced smart wallets this year. There's a lot of other innovations in the pipeline. But we don't want to limit ourselves at this moment to one particular vertical. We're very excited to play a role in scaling the entire ecosystem.

Lex Sokolin:

Fantastic. Tom, thank you for joining me today. If our listeners want to learn more about you or about Coinbase, where should they go?

Tom Duff Gordon:

Coinbase.com. We also have blogs up there. We have the Coinbase Institute where we publish some more of our policy thinking on these different topics, whether that's AI and crypto, it's the energy intensity of crypto, which is a big topic or some of these other political questions that you hear. Head to the Coinbase Institute and you can see some of the materials we have. Or if you want to follow some of the things that me and my team are doing, check me out on LinkedIn or on Twitter.

Lex Sokolin:

Awesome. Thanks again.

Tom Duff Gordon:

Thank you.

Postscript

Sponsor the Fintech Blueprint and reach over 200,000 professionals.

👉 Reach out here.Read our Disclaimer here — this newsletter does not provide investment advice

For access to all our premium content and archives, consider supporting us with a subscription.

Share this post