DeFi: Usual cuts redemption price on depegged stablecoin, keeps $1.6B TVL

Usual’s sudden move secures $60 million revenue but sparks backlash

GM Fintech Futurists,

Today we highlight the following:

DIGITAL ASSETS: Usual’s USD0++ Change Sparks DeFi Backlash

CURATED UPDATES: Financial Institutions and Adoption; DeFi and Digital Assets; Blockchain Protocols; NFTs, DAOs and the Metaverse

To support this writing and access our full archive of newsletters, analyses, and guides to building in Fintech & DeFi, subscribe below (if you haven’t yet).

And make sure to check out our sponsor — your engagement helps us immensely.

Fintech Meetup

It’s time to get ready for a huge 2025: join thousands Fintechs and FIs for the ecosystem event of the year on March 10-13 at the Venetian, Las Vegas.

You’ll be part of the industry's largest, most productive, and highest-rated meetings program. Don’t miss your chance to connect in over 60,000 meetings with banks, credit unions, fintechs, investors, and professional services firms. The event will feature a carefully-curated agenda packed with insights into the future of fintech. You’ll hear from industry visionaries like Kathleen Peters, Chief Innovation Officer at Experian, Eric Sager, COO at Plaid, and Kate Walton, MD & CCO at Merchant Payments, JPMorgan Chase & Co.

Whether you’re a start-up pitching for investment, an exhibitor unveiling cutting-edge AI solutions, or a financial institution developing the next-gen digital platform, Fintech Meetup 2025 is THE place to be this Q1.

DIGITAL ASSETS: Usual’s USD0++ Change Sparks DeFi Backlash

Usual Labs, the developer of a $1.6 billion stablecoin protocol, has faced significant criticism after implementing a surprise adjustment to the redemption price of its staking token, USD0++. The change, which reduced the fixed redemption price from $0.995 to $0.87, came as a surprise and impacted various DeFi trading strategies. Usual’s docs did state that parameters changes were possible, but the lack of transparency and communication has sparked market backlash.

Here’s what happened.

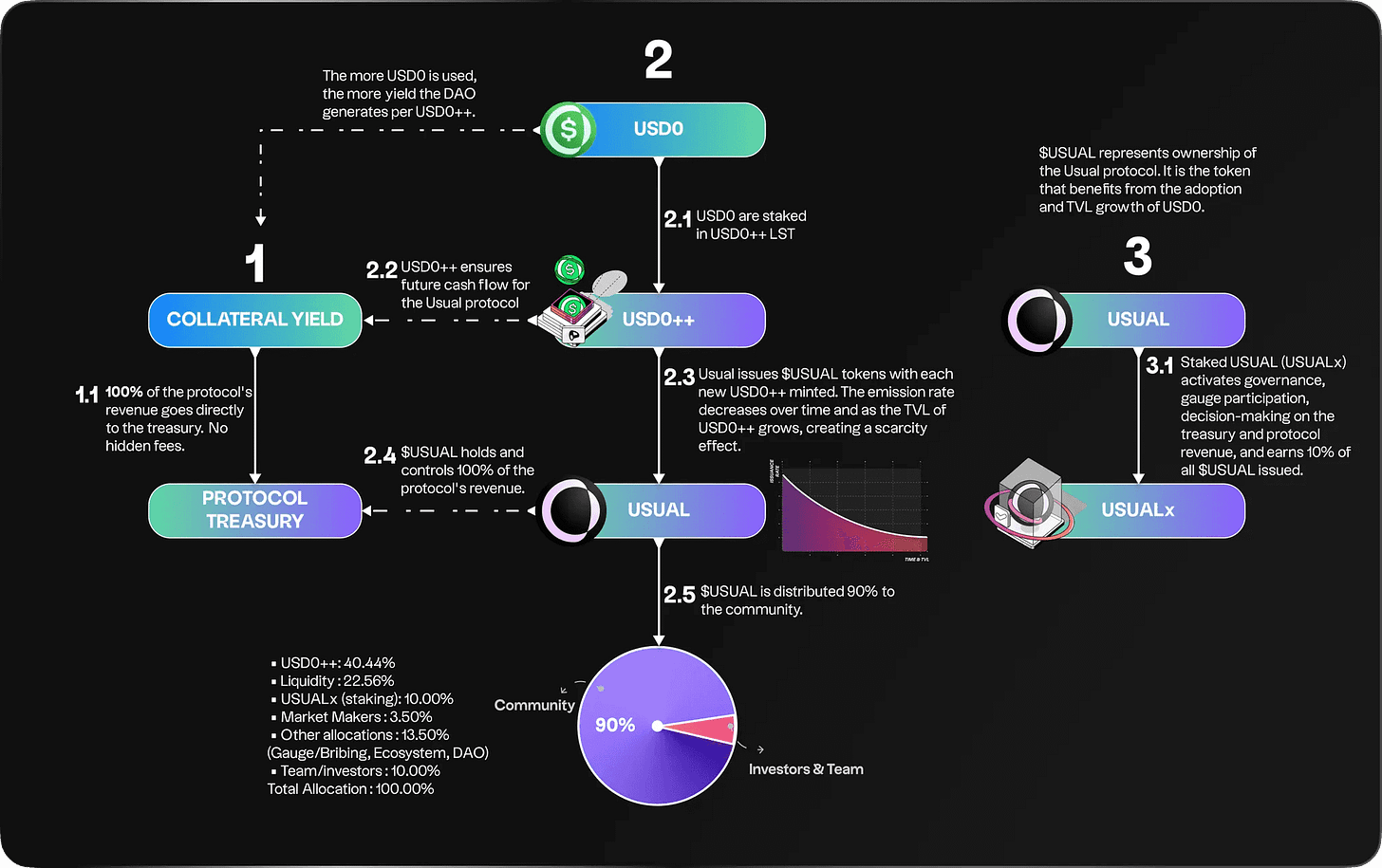

Usual is the issuer of USD0, a collateralized stablecoin, which it manufactures by ingesting various treasury-backed tokenized products. This sets a returns “floor” that looks like the risk free interest rate. However, you can also stake USD0 in return for USD0++, a yield-bearing locked version that is illiquid for … 4 years. Yields are paid out in the governance token, USUAL, and had reached as high as 55% APY. Thus, holders can choose between the risk-free rate from the fixed income markets, or an equity-like return from the USUAL token.

We have looked at Usual mechanics in detail in prior analysis, like this one:

However, the USUAL token suffered a significant decline, losing up to 50% of its value since its peak. These things happen, especially when a token is being emitted, but there is not sufficient utility for it beyond governance — so stakers sold their distributions.

Yield on USD0++ fell from 40% to approximately 22% annualized. The falling returns rendered leveraged strategies unprofitable, prompting outflows of liquidity and a subsequent decline in total value locked (TVL). With less TVL, the protocol generated lower revenues, amplifying dissatisfaction among $USUAL holders and exacerbating selling pressure. Further, the USD0++ product de-pegged from $1.00 to $0.91 — looking a lot like a 4-year no coupon bond trading at a discount.

To address this downward spiral, Usual Labs implemented the redemption rule change abruptly, halting the ability of investors to redeem USD0++ at its prior fixed value. This move stabilized the protocol’s TVL at around $1.6 billion, effectively locking in approximately $60 million in annual revenues for $USUAL stakers, provided the underlying bonds continue yielding 4%. Great for Usual, bad for people that thought they could exit.

Additionally, to patch the hole left by the lacklustre tokenomics Usual introduced a new redemption mechanism that requires users to burn $USUAL tokens to redeem USD0++. This adjustment is intended to create buying pressure for $USUAL, discourage selling, and maintain high APRs for the stablecoin.

Of the DeFi strategies disrupted, most were Pendle users waiting for their USD0++ principle token to mature or leverage traders. To rectify the situation Usual Labs plans to introduce a conditional exit option, allowing USD0++ holders to redeem their tokens for USD0 at a one-to-one ratio, contingent upon forfeiting a portion of accrued yields. Opportunity cost is the price to pay.

Some have accused Usual Labs of exploiting early liquidity providers. By halting redemptions and locking their funds, the protocol has effectively secured long-term revenues while preparing to target new, less speculative markets with lower, but still sizeable (by traditional finance standards) yields. For the future, Usual also has plans to integrate USD0++ into consumer-facing applications, marketing it as a reliable bond-like asset with an attractive yield.

On paper, Usual managed to offer very attractive yields. But with a one-way source of USUAL being emitted and no real token sinks the yields were destined to fall. Whether the burning of USUAL will be enough to combat its selling pressure is yet to be seen.

This is a good time to remind everyone that perpetual money machines don’t work, and eventually all derivatives and structured products show the risks that are embedded within them. Always mark to market.

👑Related Coverage

Advertise with the Fintech Blueprint

To reach 200,000 decision makers in financial services, Fintech, and Web3, reach out to discuss sponsorship opportunities today.

🔥🔥🔥 Contact us to discuss options 🔥🔥🔥

Long Take: Who pays the $60B for LA’s Wildfire Devastation?

*Revision — this number is over $250B*

Recent wildfires driven by Santa Ana winds have burned 30,000 acres in Los Angeles, destroying over 1,000 structures and causing an estimated $50–60 billion in financial damage, largely due to the high-value properties affected.

Private insurers are expected to cover $10 billion, with additional support from reinsurance and California’s FAIR Plan, which holds $25 billion in exposure for these areas. However, insurers have been scaling back coverage in high-risk zones after historical losses, leaving many homeowners with limited options. We explore the financial impact and related insurance industry.

Curated Updates

Here are the rest of the updates hitting our radar.

Financial Institutions and Adoption

⭐ Standard Chartered Launches Crypto Custody Services in Europe - Decrypt

More Countries to Establish Bitcoin Reserves in 2025, Fidelity Says - Decrypt

Global Crypto Funds Shatter Inflow Records with $44.2 Billion in 2024 - The Defiant

Four Solana ETFs are about to hit their approval deadlines. Here’s what analysts say will happen - DLNews

Coinbase acquires BUX’s Cyprus unit in MiCA-friendly European expansion - DLNews

DeFi and Digital Assets

⭐ Stablecoins seen more than doubling to $500bn this year. Here’s what will drive the boom - DLNews

Synthetix to Pivot V3 Perps From Arbitrum to Base - The Defiant

Aave poised to leave Polygon blockchain after $1bn proposal triggers clash - DLNews

Yield-hungry investors push Ethena’s $5.8bn USDe over rival Dai stablecoin - DLNews

It’s Hard to Fund Midsize Green Assets. This Tokenization Startup Wants to Change That - CoinDesk

MANTRA Blockchain to Tokenize $1B of Real-World Assets for UAE-Based Property Firm DAMAC - CoinDesk

Blockchain Protocols

⭐ Singapore labels Polymarket illegal gambling, restricts site access - DLNews

StarkNet Rolls Out SN Stack For Custom Blockchain Deployment - The Defiant

NFTs, DAOs and the Metaverse

⭐ Sophon launches mainnet blockchain with $500M in locked value - VentureBeat

Telegram Game 'Seed' Reveals Sui Airdrop Details Ahead of Mining Phase End - Decrypt

Mad Lads Solana NFTs Gain After Parent Firm Backpack Hints at Acquiring FTX Europe - Decrypt

Solana Layer-2 Sonic SVM Launching Token Tuesday With Airdrop for TikTok Gamers - Decrypt

AI Agent NFTs Outperform Broader Market - The Defiant

🚀 Level Up

Sign up to the Premium Fintech Blueprint and in addition to receiving our free newsletters, get access to:

Long Takes with a deep, comprehensive analysis.

‘Building Company Playbook’ series, offering insider tips and advice on constructing successful fintech ventures.

Special Reports

Archive Access to an array of in-depth write-ups covering the hottest fintech and DeFi companies.

Join our Premium community and receive all the Fintech and Web3 intelligence you need to level up your career.