Digital Wealth: Canoe Intelligence gets $25MM for AI approach to Alternatives data

Alternative products represented more than 40% of total asset management revenue in 2021, despite comprising less than 20% of global AUM

Hi Fintech Futurists —

Happy Thursday! Today we highlight the following —

NORTH AMERICA: Canoe Intelligence Raises $25MM Series B Funding To Transform The Alternative Investment Data Ecosystem

EMEA: Landytech Secures $12MM Series B Funding From Aquiline Technology Growth

ASIA PACIFIC: Interactive Brokers Launches Crypto Trading Powered By OSL In Hong Kong

Geographic news curation

Reports and Events

We are going to slightly change around with the format today to improve readability, and mirror the experience of the short takes. Let us know what you think of this layout!

Digital Wealth Short Takes

⭐🇺🇸 Canoe Intelligence Raises $25MM Series B Funding To Transform The Alternative Investment Data Ecosystem - Globe Newswire, February 8, New York

Alternative investment intelligence company Canoe Intelligence, which works with clients that support over $5T in assets, has raised $25MM in a Series B funding round. The investment is led by F-Prime Capital with participation from Eight Roads Ventures and other strategic investors. Canoe's client base grew over 200% in 2021 and has continued that pace into 2022, highlighting the appeal of the Alts asset class.

Canoe's platform provides a database of 20,000+ funds, supporting improvements in the workflow of fund processing. The company sources investment documents (e.g., K-1s, capital calls, account statements, HF fact sheets, quarterly reports) from fund administrator portals, scans the documents, and categorizes them into a database for extraction and validation through machine learning, and delivers extracted data throuh APIs to downstream accounting and reporting systems.

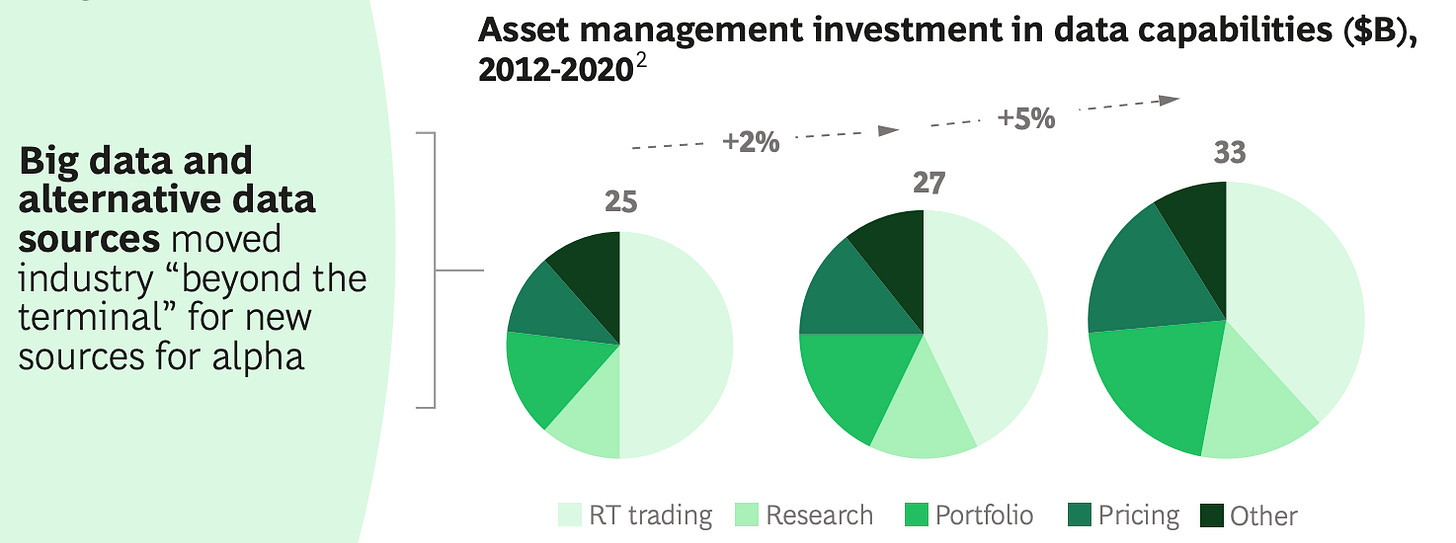

By 2026, BCG expects the revenue from Alternatives to grow to more than half of all global asset management revenues, in part because traditional assets are also getting less expensive. As the asset class grows, there is an emergence of tech companies that manage related documents and data. Longer term, blockchain anchoring and tokenization will affect both the asset management and investment reporting tech industries. Companies like Allfunds are already working on related initiatives.

👑Related Coverage👑

⭐🇬🇧 Landytech Secures $12MM Series B Funding From Aquiline Technology Growth - Fintech Global, February 14, London

Investment reporting technology company Landytech has raised $12MM in a Series B funding round led by Aquiline Technology Growth with participation from Adelie Capital. Landytech's last raise was a $6MM Series A in March 2021.

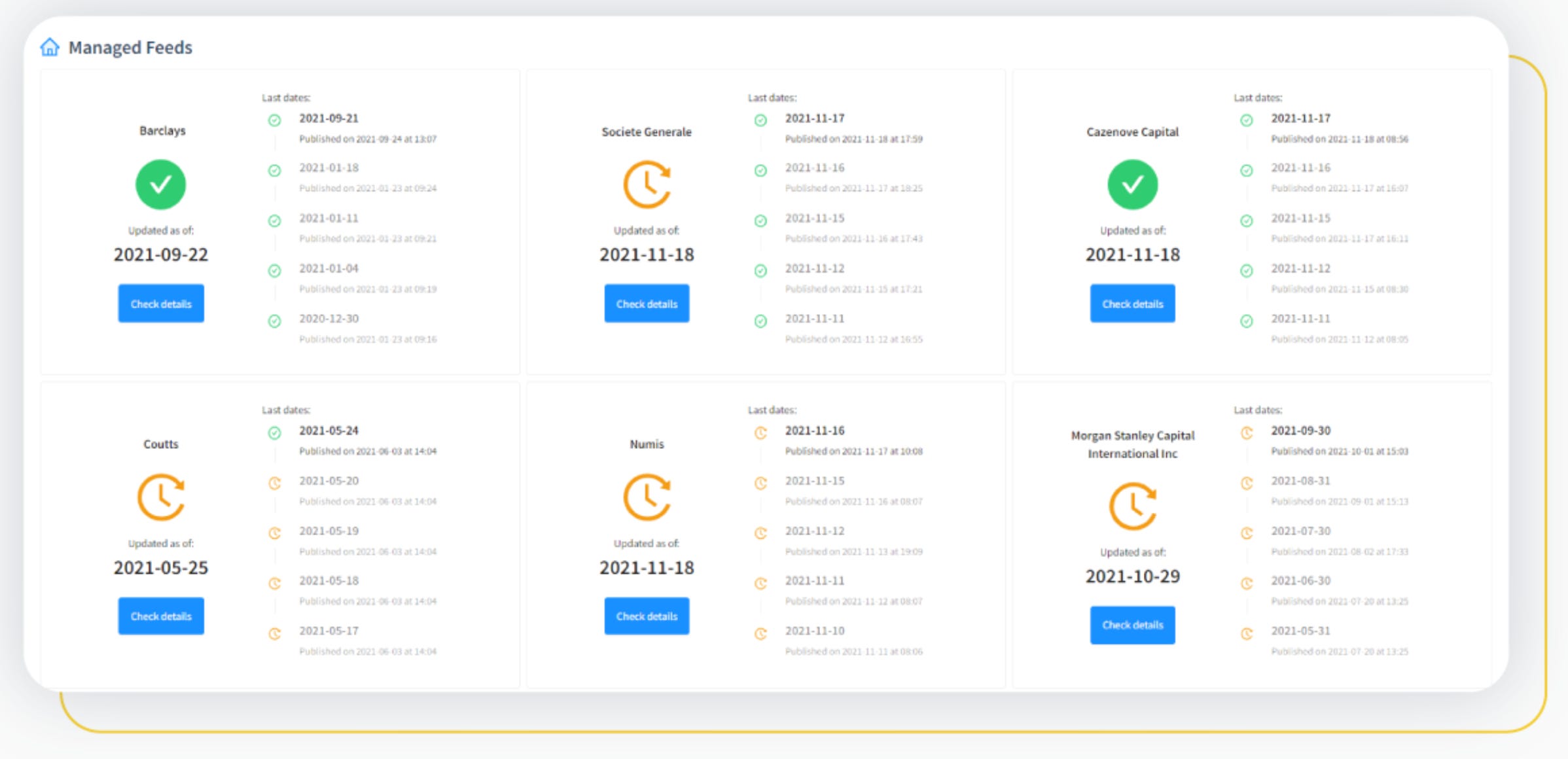

Sesame, Landytech's core software, is used by 170 custodians across 15 countries and reports on $30B+ assets.

The platform provides (1) automated and standardised bookkeeping with the latest market data; (2) analytics powered by MSCI BarraOne and RiskMetrics such as VaR, portfolio sensitivities, risk contributions, customisable scenario analyses, stress tests, what-if simulations, liquidity analysis, performance attribution, and pre-trade compliance; (3) simplified regulatory reporting via resourcing support and templated reports; and (4) for family offices, consolidated reporting across public and private assets and breakdowns of management fees.

Many asset managers are still in a manual workflow world in their backoffice. In a prior analysis, we showed that family offices waste 20-40% of working hours on manual processes, using a combination of spreadsheets, accounting software packages, and tax systems. Meanwhile, according to Bain returns to scale are 35% higher with a digitally designed model. Yet finance firms often downplay the importance of modern investment tech and remain complacent. There are plenty of solutions — Eton, Adeppar, Envesnet, Orion — and many others. Just automate your performance reporting already!

👑Related Coverage👑

⭐🇭🇰 Interactive Brokers Launches Crypto Trading Powered By OSL In Hong Kong - Fintech News, February 15, Hong Kong

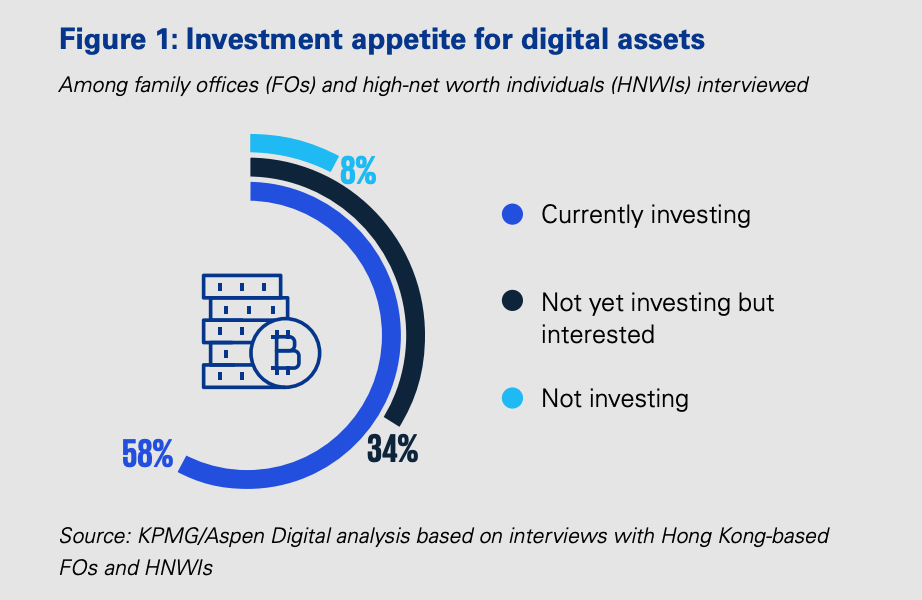

Interactive Brokers has partnered with crypto exchange OSL Digital Securities to offer its existing client base in Hong Kong the ability to trade crypto products like Bitcoin and Ethereum. Despite the volatility, there is increasing demand for exposure to digital assets among HNWIs in the region.

A KPMG study of HNWIs and FOs found that 92% of respondents (based in Hong Kong/Singapore) said they were interested in investing in the asset class. The main reasons were its high upside potential (64%) and mainstream institutional adoption (35%).

The trend of Mastercard integrating crypto trading for bank partners attests that adoption is becoming mainstream. And this week, Singapore's DBS Bank also plans to launch cryptocurrency services in Hong Kong. Asian regulatory authorities have also recently softened their stance on the asset class, with regulations passed in Hong Kong subjecting crypto exchanges to the same laws governing TradFi products.

Interactive Brokers is charging commissions relative to trading volume — 0.12% on >$1MM, 0.15% on >$100k - $1MM, and 0.18% on <$100K, with a $1.75 minimum per order, and no added spreads or markups. Clients must either be native residents with HKD 8MM (~$10MM) in investable assets or institutions with more than HKD 40MM (~$51MM).

Industry players that integrate traditional and crypto assets on a unified platform are merely reflecting back consumer demand. We would advocate the wealth management industry think about asset allocation and risk-adjusted returns in figuring out the right balance, which would be an improvement on straight brokerage.

👑Related Coverage👑

Curated News

North America News

🇺🇸 SYSTM Launches As A Comprehensive Wealth Ecosystem For Financial Advisors And Asset Managers - PR Newswire, February 9, Colorado

🇺🇸 AdvizorStack Adds Zephyr To Their Financial Advisor Tech Stack - PR Newswire, February 15, Massachusetts

🇺🇸 SMC Signs Letter Of Intent To Acquire AI-enabled Wealth Management Technology Platform - Accesswire, February 15, Florida

🇺🇸 Interactive Brokers Cuts Some Roboadvisor Fees - Barron’s, February 10, Connecticut

🇺🇸 Merrill Readies Advisors For Their Close Ups With New Virtual Video Studio - Financial Planning, February 15, New York

🇺🇸 FusionIQ, DriveWealth To Form Digital Investing Platform Alliance At BISA 2023 Annual Convention - PR Newswire, February 15, Massachusetts

EMEA News

🇬🇧 Wealthtech Firm Aiviq Signs Multi-Year Deal With AllianceBernstein - Fintech Global, February 14, London

🇸🇦 SNB Capital Launches “Idikhari Program” Digital Robo Advisory - Fintech Global, February 14, Riyadh

🇬🇧 Ad Infinitum Capital Seeks To Change The Game For Retail Investors With A Smart Portfolio Program - EIN Presswire, February 15, London

Asia Pacific News

🇨🇳 Hamilton Lane Expands Presence In Asia, Opening An Office In Shanghai - PR Newswire, February 15, Shanghai

🇸🇬 Eton Solutions Selects Singapore For Its International Headquarters And Launches New Administrative Family Office Solution To Support Clients In The Middle East - PR Newswire, February 14, Singapore

Blogs, Webinars, Podcasts

🇺🇸 Digital Wealth Management Is A Golden Opportunity For Growth - BankDirector.com, February 15, Tennessee

🇬🇧 Reinventing Wealth Management - Is Your Technology Future-Ready? - The Wealth Mosaic, February 15, London

🇺🇸 As RIA Industry Matures, M&A Is Here To Stay - Private Wealth, February 13, New Jersey

🇬🇧 Reinventing Wealth Management - Is Your Technology Future-Ready? - The Wealth Mosaic, February 15, London

Events & Reports

🇬🇧 Digital Integration In Wealth Management 2023 - Arena International, February 21-22, London

🇺🇸 Wealth Management Edge - Informa Connect, May 21 - 24, Florida

🇬🇧Private Banking & Wealth Management London Conference & Awards 2023 - Arena International, June 14, London

Shape your Future

Wondering what’s shaping the future of wealthtech, Fintech, and DeFi?

At the Fintech Blueprint, we go down the rabbit hole in the DeFi and Fintech industries to help you make better investment decisions, innovate, and compete in the industry. Subscribe now to level up your knowledge and get access to our weekly Long Takes!

Read our Disclaimer here — this newsletter does not provide investment advice and represents solely the views and opinions of FINTECH BLUEPRINT LTD.

Want to discuss? Stop by our Discord and or reach out here anytime. Leave a comment below on what you think and what we should cover next.