Digital Wealth: Mastercard integrating crypto trading for bank partners, using Paxos Trust

Visa has also bolstered its efforts to expand its crypto offerings by partnering with FTX and 50 other crypto platforms, and launching a crypto advisory program

Hi Fintech Futurists —

Welcome back to Digital Wealth, the weekly news aggregator for digital investing, asset management, and wealthtech.

Today we highlight the following news —

NORTH AMERICA: Mastercard To Bring Crypto Trading Capabilities To Banks

EMEA: Mintus Announced Partnership With Amicorp To Expand Global Reach

ASIA PACIFIC: Singapore Digital Wealth Startup Endowus Buys Carret Private

Our premium subscribers get deeper analysis on news like this. Check it out!

North America News

⭐🇺🇸 Mastercard To Bring Crypto Trading Capabilities To Banks - Mastercard, October 17, New York

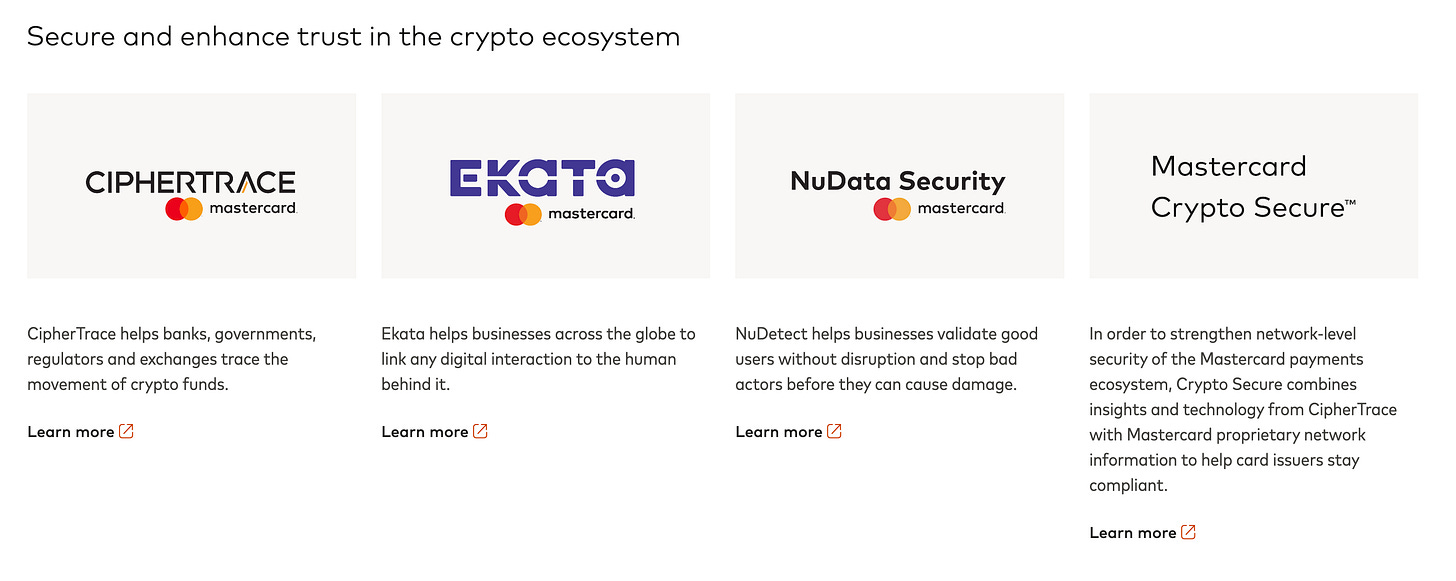

Mastercard has unveiled Crypto SourceTM, a program that offers crypto trading to financial institutions via Paxos Trust. This is part of an offering that includes a crypto card (e.g. Gemini card), offering Crypto & Digital Currencies consulting services to banks and governments, and acquiring blockchain analytics company CipherTrace.

By partnering with custody providers and infrastructure platforms like Paxos Trust, Mastercard offers institutions (1) crypto trading (buy, hold, sell); (2) Mastercard Crypto SecureTM, which uses CipherTrace tech to measure transaction approvals and declines, assess crypto risk exposure, and identify exchanges; (3) security management, which includes AML, 'Know Your Business' and lifecycle stages, cybersecurity, and biometrics; and (4) Crypto program management, which includes program design and development, technology implementation and marketing consultancy services.

Visa has also invested in its crypto offerings — our last Web3 analysis mentioned that crypto exchange FTX partnered with Visa to offer crypto debit cards. There are also Visa Nexo, Binance, and Crypto.com cards. In July 2021, Visa partnered with 50 crypto platforms and launched a crypto advisory practice to onboard new clients. Mastercard's crypto trading initiative, as well as its focus on security (e.g., acquired identity verification and fraud prevention firm Ekata) is keeping pressure on Visa in terms of this new race.

As it relates to wealth management, we find it notable that a payment rail provider is extending out of money movement into digital asset trading, and partnering with a custodian, acting as a tech platform and bank aggregator on top. Mastercard has distribution into banks, and is happy to be the venue where things happen.

👑 See related coverage 👑

🇺🇸 MDOTM Launches Sphere: The AI-Powered Platform For Institutional Investors - PR Newswire, October 17, New York

🇺🇸 Crypto Asset Manager Valkyrie Lost The Biggest Investor In Its $11MM Funding Round - Decrypt, October 19, California

🇺🇸 Beyond Bitcoin™ Launches Diversified, Equal-Weight Core Web3 SMA Model For Financial Advisors - PR Newswire, October 17, New York

🇺🇸 Fidelity’s Crypto Platform To Add Ether Trading For Institutional Clients - CoinDesk, October 19, Massachusetts

🇺🇸 Mazuma Credit Union Moves Wealth Management Program To Ameriprise Financial For Enhanced Technology And Solutions - Businesswire, October 19, Minnesota

🇺🇸 Bronte Capital Selects Clearwater Analytics To Power Its Digital Operating Platform - PR Newswire, October 19, Idaho

EMEA News

⭐🇬🇧 Mintus Announced Partnership With Amicorp To Expand Global Reach - PR Newswire, October 18, London

Fractional art investment platform Mintus partnered with Amicorp Group's wealth management arm, Amergeris. The partnership offers Amergeris clients access to fractional shares of high-value art pieces. According to a Bank of America Private Bank study published last week, demand for portfolio diversification away from traditional stocks and bonds, and more towards alternative assets, appeals to younger investors with at least $3MM in investable assets. The interest comes as no surprise as blue-chip art has outperformed the S&P 500 since 2000.

Mintus, launched during Q2 of this year, is a new player in a crowded arena that includes other fractional art investing platforms such as Yieldstreet ($3B in art purchased to date since 2014) and Masterworks ($150MM in art purchased to date since 2017). However, in its short history, Mintus has become the first FCA-authorised company to launch and scale art fractionalization in the UK, with a $150MM pipeline of investment quality paintings, including Andy Warhol, Pablo Picasso, Jean-Michel Basquiat, and others.

Artory/Winston, a joint venture between Artory and Winston Art Group, recently unveiled its $25MM tokenized art fund - another way of owning fractional shares of high-value art pieces. The offering is available on Securitize, a digital asset platform that uses blockchain tech for private companies to tokenize assets and raise capital. This thematic also connect with the development of NFTs and the groundbreaking work that company like Lobus, having digitized massive traditional art collections, are pushing forward.

🇬🇧 Impact Investing App To Launch Its Own ETFs With Direct Voting Rights - ETF Stream, October 17, London

🇬🇧 Global Asset Management Firm VIAE Capital Launches - PR Newswire, October 19, London

🇫🇷 France's 3rd Largest Bank Societe Generale's Subsidiary Obtains Registration As Digital Asset Service Provider - Bitcoin.com, October 19, Paris

Asia Pacific News

⭐🇸🇬 Singapore Digital Wealth Startup Endowus Buys Carret Private - Bloomberg, October 16, Singapore

Digital wealth platform Endowus has acquired a 60% stake in Carret Private Investments Asia, a Hong Kong-based wealth manager. So far, Endowus has raised $48MM in funding from firms such as UBS, SoftBank Ventures Asia and Samsung Ventures, and the firm recently surpassed $2B in AUM. This July, Endowus announced that it plans to launch its wealth management and advisory service in Hong Kong by Q4 2022, and the majority stake in Carret is likely a move towards the new service.

Besides Endowus’s investment offering of cash savings, pension and retirement plans, the firm provides wealth management solutions to investors with S$1MM+ to invest. Using Carret Private’s UHNWIs customers across Asia, Endowus will serve clients with total assets of $4B+. The private wealth management service includes a “relationship manager” and a team of investors who help create a customized portfolio alongside access to 200+ institutional share-class funds and alternatives. Portfolios can be denominated/hedged in currencies such as SGD, USD, AUD, EUR, GBP, and Endowus offers Singapore-based investors estate and dividend-withholding tax-efficient holdings.

For overall context, in the first half of 2022, $77B was invested across 3,400 fintech deals, 15% of which were wealthtech-related. This deal is an example of a fintech startup acquiring a traditional player — a rare occasion, and once that has gotten more expensive as tech multiples collapsed and interest rates rose. Traditional players tend to have more cash and be less tech-savvy, thereby funding demand for acquisitions. The reverse happens when a new company has a strong tech platform, and wants to accelerate commercial adoption.

👑 See related coverage 👑

🇭🇰 Brinc Announces Partnership With Fusang, Asia's First Fully Regulated Digital Asset Exchange - PR Newswire, October 17, Hong Kong

🇦🇺 VentureCrowd Teams Up With MakerX To Build Vest, A World-First Blockchain Wealth-Tech Platform - Business News Australia, October 20, Sydney

🇮🇳 Moneyfy And Raise Financial Services Collaborate To Deliver Financial Products - IBS Intelligence, October 19, Lucknow

🇮🇳 Coinswitch Kuber Plans To Go Live With Its Wealth Tech Platform By Year End - Financial Express, October 18, Bangalore

Blogs, Webinars, Podcasts

🇨🇦 Why Wealth Tech Adoption Is 'A Journey, Not A Destination' - Wealth Professional, October 14, Ontario

🇺🇸 The Wealth Management Firm Of The Future: Wealthtech To Watch - Next | Wealth 2.0, October 13, New York

🇺🇸 Opening Alts To A Wider Client Base - RIA Intel, October 18, New York

🇺🇸 Robo-Advisors Don't Want To Be Judged On Their Crypto Advice - Axios, October 18, Virginia

🇺🇸 How Advisors Can Give Clients Amazon-Like Service - Think Advisor, October 19, Virginia

Events & Reports

🇬🇧 Global WealthTech Summit - Fintech Global, November 2, London

🇸🇬 Singapore FinTech Festival 2022 - Singapore FinTech Festival, November 2-4, Singapore

🇿🇦 Africa Fintech Summit 2022 - Africa Fintech Festival, November 3-4, Virtual

🇺🇸 2022 Forbes Wealth Summit - Forbes, December 6, Virtual

Shape your Future

Wondering what’s shaping the future of Fintech and Digital Wealth? At the Fintech Blueprint, we go down the rabbit hole to help you make better investment decisions and innovate and compete in the industry. A premium subscription opens access to:

Weekly Long Takes on Fintech and DeFi operating and investment topics

Unlocks access to the full archives of all Long Takes (see index here)

Weekly Podcast Conversation transcript, illustrated with analysis and charts

Read our Disclaimer here — this newsletter does not provide investment advice and represents solely the views and opinions of FINTECH BLUEPRINT LTD.

Want to discuss? Stop by our Discord and or reach out here anytime.