Digital Wealth: Allfunds grows in Brazil, Amber Group raises $300MM, Eton Solutions $425B of family office assets

Also Green Dot and Wealthfront

Hi Fintech Futurists —

Welcome back to Digital Wealth. Today we highlight the following news —

NORTH AMERICA: Eton Solutions Highlights 2022 Momentum And Milestones Toward Modernizing Family Office Technology And Process Automation Globally

EMEA: Allfunds Signs Service Agreement With Brazil’s BB Asset

ASIA PACIFIC: Crypto Firm Amber Raises $300MM To Tackle Damage From FTX

Thanks as always for your time and attention. To dive deeper into our covered topics, check out the premium options below.

North America News

⭐🇺🇸 Eton Solutions Highlights 2022 Momentum And Milestones Toward Modernizing Family Office Technology And Process Automation Globally - PR Newswire, December 20, North Carolina

Eton Solutions, a SaaS family office software platform, has raised $38MM from Navis Capital Partners, launched an updated client experience and transaction processing platform (AtlasFive 2.0), as well as a mobile app for family offices.

Eton's platform has $425B in assets under administration, powers over 4.3MM annual transactions, and manages the wealth of about 400 families globally. It offers data aggregation, consolidation, normalisation, fund accounting, and tax support services for single and multi-family offices. The transaction processing workflow initiates family office operations and records these transactions on an investment ledger, general ledger, and tax ledger. On the user side, there is a mobile app and client portal.

As we mentioned in our previous coverage of Eton, family offices waste 20-40% of working hours on manual processes because of generic software — many use a combination of spreadsheets, accounting software packages, and tax systems. Further, family offices are facing pressures from multiple directions: (1) gathering and reporting on data across increasingly different asset classes; (2) cybersecurity threats; and (3) the need to find operational efficiencies at a time of economic turmoil. That's why see growth in family office software platforms and wealth management software companies in general. For more, see the "Events & Reports" section below to read a new BNY Mellon report on the disconnect between next-gen clients and family offices.

⭐🇺🇸 Green Dot And Wealthfront Extend Relationship - Finovate, December 15, California

🇺🇸 Docupace Launches New Productivity Toolkit For Financial Advisors And RIA Firms - PR Newswire, December 15, California

🇺🇸 Surge Ventures Launches An Innovative Venture Studio Starting With A Focus In The Financial Services And Wealth Management Industry - PR Newswire, December 15, California

🇬🇧 Bento Engine Surpasses 7,000 Advice Opportunities - Businesswire, December 19, New York

EMEA News

⭐🇪🇸 Allfunds Signs Service Agreement With Brazil’s BB Asset - IBS Intelligence, December 8, Madrid

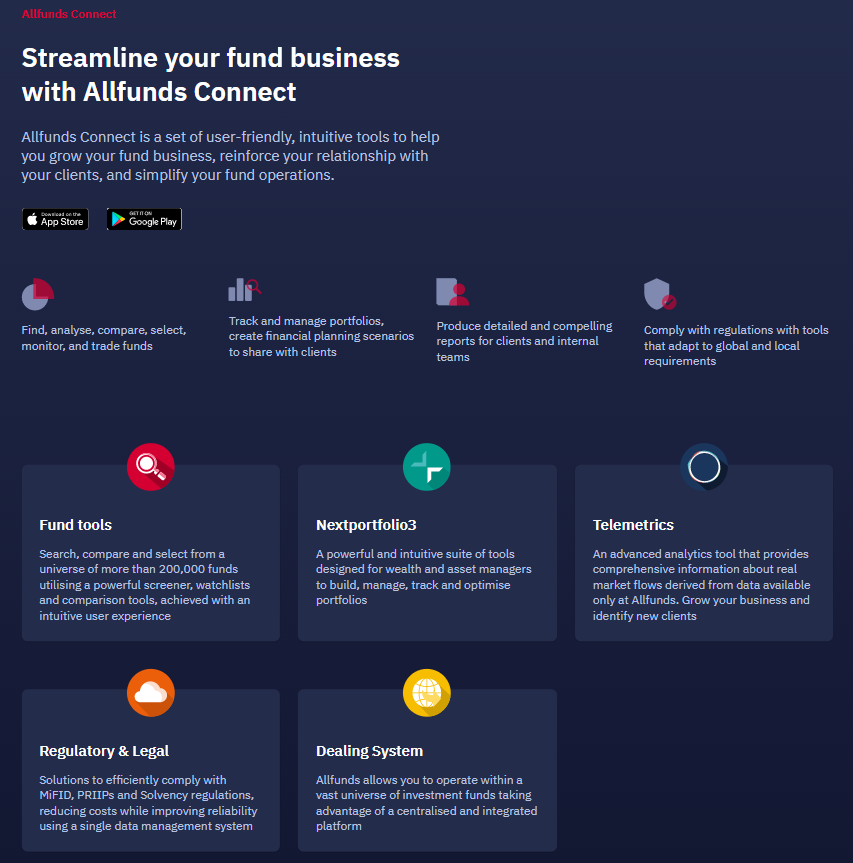

Allfunds, a B2B wealthtech platform for the fund industry, is partnering with BB Asset, the asset management arm of one of Brazil’s largest fund managers, Banco de Brasil. BB Asset will have access to the Allfunds Connect platform, which offers portfolio reporting and digital tools for data & analytics, reporting, research, and regulatory services.

Earlier this year, we covered Allfunds’ partnership with iCapital to expand Carlyle’s wealth management offerings, the acquisition of Web Financial Group, which saw them establish a more substantial presence in Europe, and most recently, through its blockchain arm, to help AllianceBernstein bring its asset services to the blockchain.

Unfortunately, this year’s activity has not translated into positive stock performance, but this is likely due to category valuation collapse. AUM has declined from €1.4T in Q1FY2022 to €1.3T as of Q3FY2022 — global macro has spared no one this year.

The move to expand and capture a larger volume of AUM, specifically within Latin America’s largest market, makes sense given only a small percentage of Brazil’s 214MM people actually invest. Less than 2% of adults in Brazil invest in the stock market compared to 58% in the US. And, of those that do, allocation to equities has been as low as 10%. There is no choice but focus on long term growth.

👑 See related coverage 👑

🇳🇱 Bitvavo To Prefund Locked DCG Assets Worth $296.7MM Amid Liquidity Crisis - Cointelegraph, December 17, Amsterdam

🇬🇧 UBS Asset Management And J.P. Morgan Execute First Electronic Bilateral Trade Via FlexTrade's FlexFI - Businesswire, December 20, London

🇬🇧 New Fintech Start-Up Step Fourth Launches In The UK - Fintech Futures, December 19, Birmingham

Asia Pacific News

⭐🇸🇬 Crypto Firm Amber Raises $300MM To Tackle Damage From FTX - Bloomberg, December 15, Singapore

4) As previously disclosed, less than 10% of our total trading capital was with FTX at the time of its collapse, but we did have to rebalance some positions. None of this impacted our daily operations or our business continuity.Sequoia and Temasek-backed crypto trading firm Amber Group, which has $5B+ in AUM, has raised $300MM in a Series C funding round led by Fenbushi Capital US. Amber was last valued at $3B in its $200MM Series B+ round in February, and Fenbushi Capital also backed Amber's $100MM Series B round in June 2021. The recent round's funding is primarily to protect Amber users from its FTX exposure, prompting a restructuring and a halt to Europe and US expansion plans. Further, Amber also had to terminate its sponsorship deal with Chelsea FC and slash its workforce to less than 400 from about 700 currently. Staff numbers earlier peaked at 1,100.

Digital asset companies are narrowing their focus on core value propositions. Given the economic contraction, this is happening everywhere from investment banks (e.g., Goldman Sachs laying off up to 4,000 employees) to tech firms (e.g., Meta’s 11,000 employees). With that, we expect Amber to focus more WhaleFin, its flagship digital asset platform for retail investors. The platform (1) allows users to trade in over 100 assets; (2) provides automated transaction cost analysis reports; (3) instrument and portfolio data; and (4) a cross-collateralized account system to manage risk.

The collapse of FTX has rippled through the holdings of many institutional investors and hedge funds, with mark-downs in Genesis, DCG, Grayscale, and BlockFi, as well as adversely impacted the Solana ecosystem, creating further contagion for venture firms SoftBank and Andreessen Horowitz. We expect more down-rounds to come in the industry, which needs to shore up capital to plug in hole, and also last through a bear market.

👑 See related coverage 👑

🇮🇳 CoinSwitch Announces CoinSwitch Pro League For Crypto Traders - PR Newswire, December 21, Bangalore

🇹🇼 HSBC Opens New Wealth Management Centre In Taiwan - Private Banker International, December 21, Taipei

Blogs, Webinars, Podcasts

🇬🇧 Was 2022 A Good Year For Wealthtech? - Fintech Global, December 20, London

🇺🇸 WealthStack Research Reveals Big Gaps In How Advisory Firms Use Tech - Wealth Management, December 20, New Jersey

🇬🇧 The Challenges Of Digital Transformation In Wealth Management - IBS Intelligence, December 20, London

🇬🇧 Fund Administration: Tech’s Role In Democratising Private Markets - Funds Europe, December 16, London

Events & Reports

⭐🇺🇸 BNY Mellon Wealth Management And Campden Wealth Study Reveals Succession Disconnect Between Next Gen Individuals And Family Offices - PR Newswire, December 20, California

🇺🇸 Wealth Management Edge - Informa Connect, May 21 - 24, Florida

🇬🇧 Private Banking & Wealth Management London Conference & Awards 2023 - Arena International, June 14, London

🇬🇧Digital Integration In Wealth Management 2023 - Arena International, February 21-22, London

Shape your Future

Wondering what’s shaping the future of wealthtech, Fintech, and DeFi?

At the Fintech Blueprint, we go down the rabbit hole in the DeFi and Fintech industries to help you make better investment decisions, innovate, and compete in the industry. Subscribe now to level up your knowledge and get access to our weekly Long Takes!

Read our Disclaimer here — this newsletter does not provide investment advice and represents solely the views and opinions of FINTECH BLUEPRINT LTD.

Want to discuss? Stop by our Discord and or reach out here anytime.