Digital Wealth: NerdWallet to acquire consumer debt roboadvisor in $120MM deal

The deal consists of $70 million in cash and $50 million in NerdWallet Class A common stock, with On the Barrelhead integrating into NerdWallet’s existing teams, brand, products and technology

Dear Fintech Futurists,

Welcome to another Digital Wealth issue, the weekly news aggregator regarding digital investing, asset management, and wealthtech. For deep, comprehensive, and insightful analysis on the Fintech and Web3 world, upgrade your subscription below.

North America News

⭐🇺🇸 NerdWallet To Acquire On The Barrelhead - Businesswire, June 23, California

Financial guidance fintech NerdWallet, which is public now with about $400MM in annual revenue and 20MM MAUs, is acquiring consumer debt roboadvisor platform *On the Barrelhead* for approximately $120MM, with $70MM in cash and $50MM in NerdWallet common stock. On the Barrelhead has $38MM in revenue, growing 90% year-on-year, thus the deal is priced at 4x. The company provides consumers and small and medium-sized businesses (SMBs) with credit-driven product recommendations by matching customer credit information with financial partner data.

On the Barrelhead’s tech stack consists of (1) Plinko, a proprietary lead routing engine that is currently deployed in lending and insurance, (2) Maestro, which controls data flow across all OTB products and services, (3) Recast, a product recommendation engine that leverages details from the consumer’s credit file and identifies alternative loan and insurance products (i.e. alternatives may offer lower interest rate or improved monthly savings) and (4) Squid, which recommends multiple debt reducing and money-saving products to users. Financial lead generation will always be a good business — see Lending Tree, Credit Karma, and Mint.com.

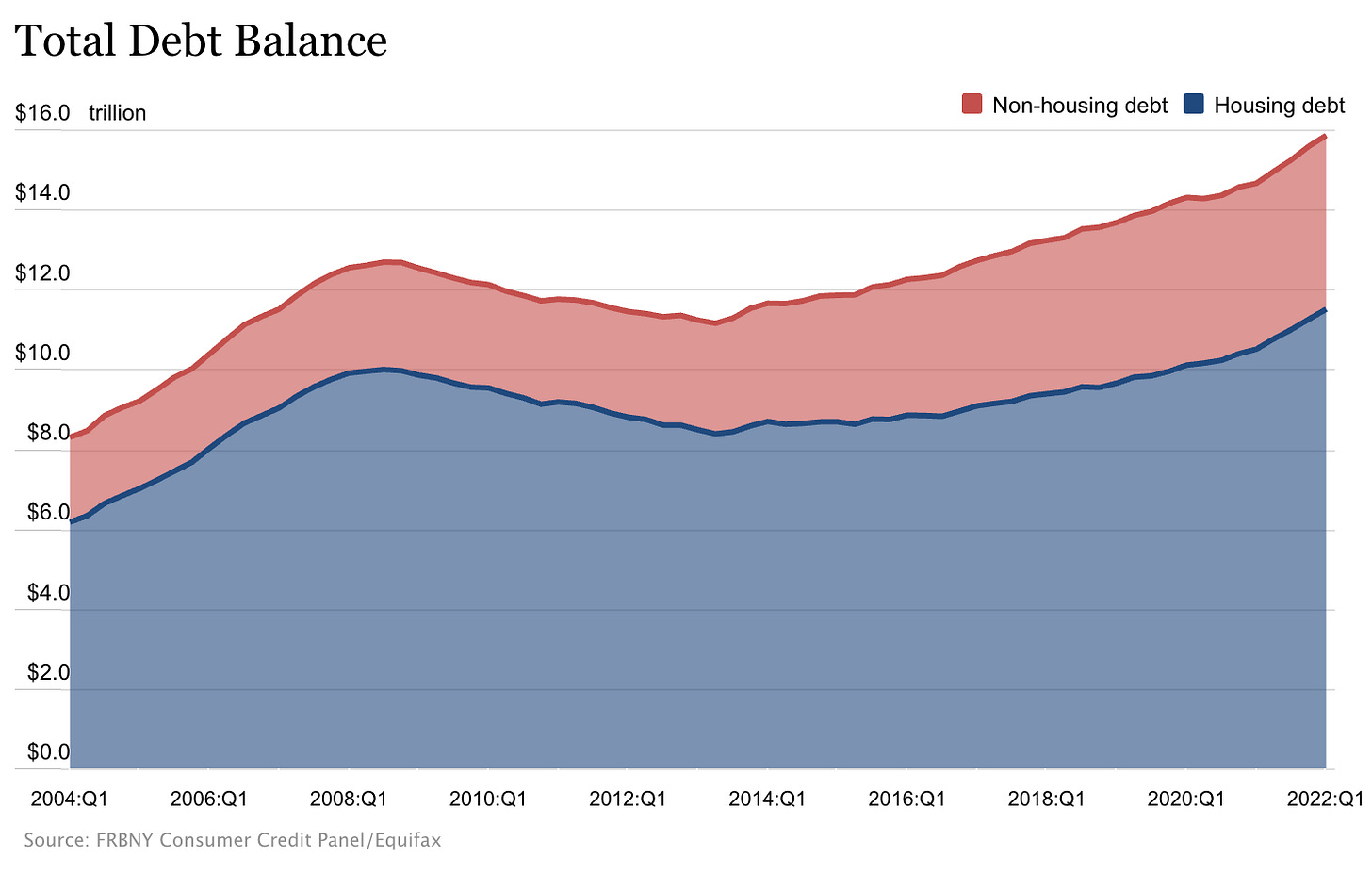

NerdWallet had their IPO debut last November, valuing the firm at $1.2 billion. With Fintech multiples down 90%, it’s a good time for larger fintechs to eat up the smaller ones, like we’re seeing with FTX’s recent potential M&A activity. Another note is that in the first quarter of 2022, total US household debt increased by $266 billion, putting the total at $15.8T, $1.7T higher than at the end of 2019. This suggests that connecting consumers to credit products will continue to be a growing market.

🇺🇸 American Century Investments® Selects Marstone To Provide Digital Wealth Management Platform For New And Existing End Clients - Businesswire, June 29, New York

🇺🇸 TELEO Capital Portfolio Company, Univeris, Acquires TechRules - Yahoo Finance, June 29, Idaho

🇺🇸 Bento Engine Announces Seed Funding From Wealth Management Industry Leaders - Businesswire, June 22, New York

🇺🇸 Access Softek Adds Cryptocurrency Investment With Launch Of EasyCoin - Yahoo Finance, June 23, California

🇺🇸 BNY Mellon Pershing's Subscription Custody Plan Was Scuttled By Crashing Covid Interest Rates, But May Get A Second Wind As Rates Rise, Reviving Its Play For Schwab/TD Ameritrade RIAs - RIABiz, June 25, New York

🇺🇸 Puzzle Wealth Solutions Celebrates One Year Anniversary With Expected Growth To $2B In Assets Under Management By Year End - PR Newswire, June 28, Illinois

🇺🇸 Elevate.Money Debuts IOS App: Bringing Fractional Commercial Real Estate Investing To Mobile And Desktop - PR Newswire, June 28, California

EMEA News

⭐🇨🇭 Credit Suisse Outlines Plans To Bolster Wealth Unit In Revamp - Private Banker International, June 29, Zurich

Credit Suisse outlined a plan to focus more on its wealth management unit and cut costs through a tech revamp. This is primarily spurred by the $5.5 billion loss brought on by the collapse of Archegos Capital Management, as well as recent the scandal of $80 billion being held in the bank by criminals and corrupt politicians.

Moving forward, Credit Suisse plans to save $840MM by centralising technology, with the key changes being: (1) becoming cloud-native to solve duplication and data fragmentation, (2) implementing intelligent automation to reduce the time spent on manual tasks, and (3) running applications on the same data platform to remove siloed infrastructure. Additionally, Credit Suisse plans to shrink their investment banking unit and transfer $3 billion of capital to the wealth management unit in order to double the client AUM within the wealth unit. We are skeptical about a bank being able to pull this off, but welcome the attempt.

Wealth management units are currently bright spots in an otherwise dark place (i.e. the financial market with the S&P 500 down about 20% YTD), and according to 1Q reports, wealth management units did better than banks’ other divisions. For example, Wells Fargo was down over 5%, but wealth and investment management was up 6% year-over-year. At Goldman Sachs, wealth management revenues were 19% higher than the first quarter of 2021, whereas overall net revenue dropped by 27%.

One key point to note is that wealth management gains are due to fees tied to growing assets, but the tigtening from the Fed (Powell says another 75 or 50 is likely in July + the Fed's $2.7 trillion mortgage problem) is likely to keep shrinking the value of those assets and therefore revenue. However, AUM fees are far less cyclical than brokerage or banking or lending, and thus a requirement for a diversified financial player to get through a bear market.

🇬🇧 Velexa Launches Embedded Investing As A Service Platform - GlobeNewswire, June 28, London

🇬🇧 Neptune Networks Upgrades Platform To Provide More Data - MarketsMedia, June 28, London

🇬🇧 Wealth Dynamix Launches First Simplified Client Lifecycle Management Benefit Calculator For Wealth Managers - Altfi, June 23, London

🇨🇭 Compass Financial Technologies And Marex To Collaborate On Digital Asset Investment Solutions - Yahoo Finance, June 28, Lausanne

🇬🇧 Bitpanda Custody Joins The Bosonic Network™ - Yahoo Finance, June 30, London

Curated sponsorships

We work with select companies to deliver brand awareness to our 100,000+ digital finance audience. See our prior partners here, and reach out here with interest.

Asia Pacific News

⭐🇹🇭 Maybank Securities (Thailand) Transforms To Democratise Investment Opportunities - Bangkok Post, June 23, Bangkok

Maybank Securities (Thailand), Maybank’s investment business, has partnered with BNY Mellon Investment Management (IM), an investment manager with $2.3T in AUM. The partnership will allow Maybank to expand its asset management offering via BNY Mellon IM model portfolio services, which consists of five portfolios of different risk levels and another five with different volatility targets.

Maybank is set to release new investing services this year, one of which is is the Maybank Invest (MBI) application, a tool that will enable customers to invest in stocks, funds and debentures via a single application. It is also leveraging AI to analyse customer data to provide investors with personalised products.

Maybank’s increased offering comes at a time when Thailand’s stock market has never been busier — more and more people have been opening new trading accounts, and over 150,000 new retail investors started trading stocks for the first time during the first four months of 2021. That’s more than the total number in 2020. To us this suggests that the digital investing model, including roboadvice, neobanking, and crypto assets, is a global phenomenon.

🇸🇬 BNP Paribas Wealth Management Launches Private Asset Platform - Finews Asia, June 30, Singapore

🇭🇰 Franklin Templeton Selects First Startup To Join Inaugural Franklin Templeton Singapore Fintech Incubator - Yahoo Finance, June 28, Hong Kong

🇨🇳 China’s ICBC And Merchants Bank To Stop Digital Investment Service After June - Nexth, June 29, Beijing

🇸🇬 Credit Suisse Taps Asia’s Mass Millionaire Segment - Finews Asia, June 28, Singapore

Blogs, Webinars, Podcasts

🇬🇧 Jonathan Wauton: Robo-Advice - The Great Under The Radar Comeback - ProfessionalAdviser, June 23, London

🇬🇧 Do Nutmeg's Losses Mean The Digital Wealth Model Can Ever Be Profitable? - FT Adviser, June 24, London

🇺🇸 Can Envestnet Lure Wealth Managers To The 401(K) Market? - Wealth Management, June 27, Pennsylvania

🇬🇧 Moneyfarm Eases Investment Risks With Efficient Compliance - Cryptocoin, June 25, London

🇲🇾 Paperweight: Wealth Management Is Still Among The Least Tech-Literate Sectors Of The Financial Services Industry - TechWire Asia, June 29, Kuala Lumpur

Events & Reports

🇺🇸 Citi Global Wealth Investments Issues Mid-Year Outlook 2022 Investing In The Afterglow Of A Boom - Hubbis, June 30, New York

🌐 Digital Wealth Management Market Evolving Technology, Trends 2022 – Hewlett Packard Enterprise Development LP, SimCorp Inc, ProTrak International, Broadridge Investment Management Solutions, FundCount, Etc - High Timber Times, June 28, Global

🇺🇸 Fintech Week London - Fintech Week London, July 11-15, London

🇬🇧 What It Takes To Become A Leader In Fintech – Q&A With Paysafe’s CIO - Paysafe Group, June 30, Virtual

🇬🇧 FinTech Europe: 2021 Vs 2022 - Storm2, July 6, Virtual

Shape your Future

Wondering what’s shaping the future of Fintech and Digital Wealth? At the Fintech Blueprint, we go down the rabbit hole to help you make better investment decisions and innovate and compete in the industry. A premium subscription opens access to:

Weekly Long Takes on Fintech and DeFi operating and investment topics

Unlocks access to the full archives of all Long Takes (see index here)

Weekly Podcast Conversation transcript, illustrated with analysis and charts