Digital Wealth: Penfold roboadvisor crowdfunds from 700 investors to aggregate UK pensions

The company caters to both businesses and freelancers, with 150+ businesses signed up, adding up to 7,000+ employees.

Dear Fintech Futurists,

Welcome to our Digital Wealth issue, the weekly news aggregator for digital investing, asset management, and wealthtech.

Is there someting in the investing world you would like us to cover in more detail? Share your ideas below:

North America News

⭐🇺🇸 SoftBank Sells 12MM SoFi Shares. SoFi Stock Tumbles - Barron’s, August 9, California

Our favorite tech investing conglomerate, SoftBank, sold 12MM in SoFi shares — 6.7MM @$8.17 and then 5.4MM @$7.99 each. SoftBank is still a large shareholder, owning 83.2MM shares, but the company’s growing market mark downs may force it to continue divesting.

We’ve covered SoFi quite a bit before, including a conversation with Mike Cagney, but to refresh — SoFi’s main offerings include: (1) lending, across student loans, personal loans, and home loans, and (2) money management, such as cash management and investment services across SoFi Money, SoFi Invest, SoFi Credit Card, and SoFi Relay. As with most fintech firms, SoFi is down over 50% YTD. In addition to market forces, student loan volume in Q2 FY2022 was down to 25% of the average pre-pandemic volume because of the student loan payment moratorium. Federal student debt repayments have been paused for more than two years, meaning interest hasn't accumulated and collections on defaulted debts have been put on hold. On the bright side, the company posted record $360MM Q2 FY2022 revenue.

SoftBank, on the other hand, reported a loss of $23B+ past quarter, which was partially due to losses in its Vision Fund, which invests in high-risk, hyper-growth tech firms. The company is forced to take a “defensive” stance to review costs across all its investments. The tech sell off similarly impacted investment firm Tiger Global, which recently lost $17B and nearly depleted its latest VC fund.

🇺🇸 Integrity Expands Comprehensive Life, Health And Wealth Platform With Monumental Agreement To Acquire Gladstone Wealth Partners - PR Newswire, August 3, Texas

🇺🇸 The Schwab Crypto Thematic ETF (STCE) Begins Trading On NYSE Arca - Businesswire, August 4, Texas

🇨🇦 Growth Capital Firm Clearco Cuts 125 Jobs Citing “Significant” Economic Headwinds - Fintech Futures, August 4, Toronto

EMEA News

⭐🇬🇧 Penfold Closes £7MM Series A Led By Bridford Group - Altfi, August 5, London

Digital pensions platform Penfold raised £7MM in a Series A funding round. The round comprises £5MM from Bridford Group, a £1MM personal investment from Jeremy Coller, the chair and CIO of Coller Capital, and a further £1MM from Penfold’s recent Crowdcube crowdfunding round that attracted 700 retail investors. This is the second time Penfold has raised money via crowdfunding; last May, it closed an £8.5MM funding round, $4MM of which came from crowdfunding.

This retail participation continues to be an important trend for user ownership of their financial providers — see Finary’s €2.17MM as part of its Series A, Qonto, an online bank valued at $5B+ raised €4.7MM. Similarly think about investment DAOs as another symptom of this trend. For example, Global Coin Research (GCR), a tokenised DAO of researchers and investors that aims to “disrupt the VC world”, deployed over $25MM into projects such as blockchain protocol Aurora and Web3 management platform Coinvise. See our DAO Greatest Hits publication for more.

Back to Penfold. Penfold says that traditional pension providers are built up from “100s of consolidated schemes” and are often still paper-based and require an army of people to administer. The company caters to both businesses and freelancers, with 150+ businesses signed up, adding up to 7,000+ employees. Some features of the platform include combining all your pensions, choosing an investment plan based on age/risk appetite, and tracking your investments in real time. The "Find My Pension" tool is a particularly clever way to generate leads.

According to insights by PwC, pensions technology is evolving across this legacy value chain. Big data and analytics tools are enabling greater personalisation, and robo-advisors are offering pension planning. We mentioned investment DAOs earlier, and one can imagine how such DAOs infrastructure can change traditional collections and payments, eventually leading to decentralised pension funds attempts like ROSA Finance. Oh perchance to dream!

🇬🇧 Old Street Digital Raises $2.8MM In Seed Funding - Fintech & Finance News, August 8, London

🇬🇧 Appital Secures An Additional £1.7MM Investment Led By Frontline Ventures - IBS Intelligence, August 9, London

🇲🇹 MeDirect Continued Its Transformation Towards Becoming A Pan-European Wealthtech Leader - Malta Independent, August 10, Malta

🇿🇦 Passive Micro-Investing App Upnup Launches In South Africa - Fintech Futures, August 9, Cape Town

Curated sponsorships

We work with select companies to deliver brand awareness to our 100,000+ digital finance audience. See our prior partners here, and reach out here with interest.

Asia Pacific News

⭐🇮🇳 Scripbox Acquires Investment Startup Wealth Managers To Grow Cumulative Consumer Base - Inc42, August 8, Bengalur

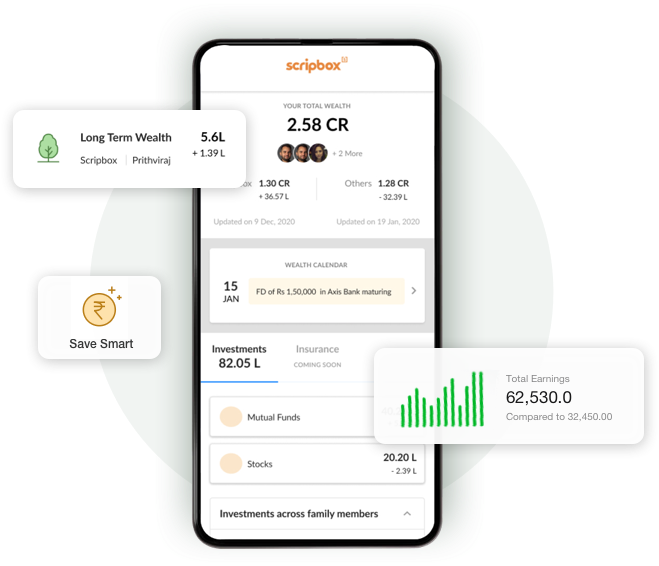

Wealthtech firm Scripbox has acquired Wealth Managers, a startup that specialises in portfolio management, mutual fund distribution, and investment advisory services. The cost of the acquisition is undisclosed, but Scripbox has been on an M&A spree over the past two years — this is Scripbox’s 10th acquisition. The deals have led to a 7x surge in Scripbox’s AUM, from $215MM to $1.5B.

Scripbox is similar to most roboadvisor startups, helping people invest with less behavioral bias algorithmically (e.g., see here for more). After Scripbox helps determine an asset allocation, the algorithm “chooses the best products” within each asset class. Before any fund is recommended, it must pass the following criteria: (1) growth options only, with tax-efficiency in mind, (2) no small funds as they are susceptible to redemption pressure, and (3) no funds without a 4-year track record. There are annual reviews to ensure the recommended funds’ health. Note that the platform derives 90% of its revenue from commissions. Three times a year, the algorithm runs a rebalancing scan to identify if clients need to exit any underperforming funds.

The acquisition is another example of horizontal integration that wealth management firms have been pursuing to inorganically grow AUM and capabilities. A recent wealth management report by Bain & Co highlighted that scale is increasingly important and the top players are pulling ahead of the rest. Two firms you should be familiar with by now, FNZ and TIFIN, are testament to this.

🇭🇰 Virtual Firm ZA Bank Launches Investment Fund Service - Private Banker International, August 10, Hong Kong

🇸🇬 Syfe Officially Launches In Australia, Introducing A Holistic Platform To Invest In US Stocks, ETFs And Crypto - Fintech & Finance News, August 10, Singapore

Blogs, Webinars, Podcasts

🇺🇸 The Best Robo-Advisor For You: Barron’s Annual Ranking - Barron’s, August 5, New York

🇺🇸 Envestnet Revenue Flattens Amid Modernization Push - Seeking Alpha, August 10, Pennsylvania

🇨🇦 Crossing The Digital Divide In Wealth Management - Investment Executive, August 8, Toronto

🇬🇧 UK Wealth Managers Have Enormous Potential To Offer Crypto Services Following Recent Market Turmoil, Says Avaloq - Wealth Adviser, August 9, United Kingdom

Events & Reports

⭐🇮🇳 $1T India FinTech Opportunity - Ernst & Young, August 8

🇺🇸 Banks Seize Competitive Edge Using Digital Platforms - Businesswire, August 9, Connecticut

🇺🇸 VenCent Fintech Summit - The Venture Center, August 15-18, Virtual

🇲🇽 Fintech Summit LATAM - MobiFin, August 24-25, Atlatlahucan

🇺🇸 Fintech_Devcon 22 - Fintech_Devcon, August 23-25, Colorado

🇺🇸 Fintech Growth Summit - MGA, August 25-26, Florida

🇺🇸 Crypto Wealth Summit - Eaglebrook Advisors, October 10-12, Florida

Shape your Future

Wondering what’s shaping the future of Fintech and Digital Wealth? At the Fintech Blueprint, we go down the rabbit hole to help you make better investment decisions and innovate and compete in the industry. A premium subscription opens access to:

Weekly Long Takes on Fintech and DeFi operating and investment topics

Unlocks access to the full archives of all Long Takes (see index here)

Weekly Podcast Conversation transcript, illustrated with analysis and charts

Read our Disclaimer here — this newsletter does not provide investment advice and represents solely the views and opinions of FINTECH BLUEPRINT LTD.

Want to discuss? Stop by our Discord and or reach out here anytime.