Digital Wealth: UBS launches Chinese digital wealth platform WE.UBS

In contrast, UBS recently sold its proprietary US alternative investment manager to iCapital, and then terminated its $1.4B acquisition of Wealthfront

Hi Fintech Futurists —

Welcome back to Digital Wealth, the weekly news aggregator for digital investing, asset management, and wealthtech.

Today we highlight the following news —

NORTH AMERICA: Manzil Launches Manzil Invest, Canada's First Actively Managed Halal Digital Investment Platform

EMEA: UK's Most Exclusive Wealthtech, Privat 3 Money, Launches Bespoke Mobile Trading Platform To HNW Clients

ASIA PACIFIC: UBS launches digital wealth management platform, WE.UBS, in Shenzhen, China

Our premium subscribers get deeper analysis on news like this. Check it out!

North America News

⭐🇨🇦 Manzil Launches Manzil Invest, Canada's First Actively Managed Halal Digital Investment Platform - GlobeNewswire, October 26, Toronto

Manzil, a Halal-certified wealthtech, has launched Manzil Invest, Canada's first Halal roboadvisor. Halal investment products must have no ties to tobacco, alcohol, firearms, or adult entertainment. A Shariah supervisory board, internal and external auditors, and a third-party Shariah advisory firm have reviewed Manzil's products.

Manzil raised $3.5MM in sao far, and started by offering Halal fixed-rate and variable-rate mortgages, using capital sourced from the Halal Manzil Mortgage Fund, which trades on the Neo Exchange and acts like a fixed-income fund. Manzil now launched its roboadvisor using OneVest, a wealth management startup and registered portfolio manager in Canada. OneVest also recently powered Neo Financial in launching its investment product.

Manzil Invest gives users access to custom investment portfolios, which range from fixed income (85% is allocated to Manzil's Mortgage Fund and the SP Funds Dow Jones Global Sukuk) to higher risk equities (90% is allocated to Shariah-compliant equities such as Wahed Dow Jones Islamic World ETF and Wahed FTSE USA Shariah ETF). That said, we don’t think mortgage funds are particularly low risk as far as fixed income goes.

Offering Halal investment products comes with regulation, compliance, and cultural roadblocks. Take Wahed, for example, a Shariah-compliant roboadvisor with 10,500 clients and $280MM in AUM, which was charged $300K by the SEC for making misleading statements related to its Shariah advisory business. At the moment, few independent fintechs have delved into Halal investing and most banks claim that the demand for Islamic banking is too low to justify necessary investments. Wealthsimple has begun to move into this space with its Shariah-compliant ETF and Halal investment portfolio, and Aghaz, a Halal roboadvisor that uses DriveWealth's portfolio management technology, Autopilot, offers very similar offerings to those of Manzil.

🇺🇸 Unicorn Strategic Partners And iCapital Partner To Provide LATAM Wealth Managers With Access To Institutional-Quality Alternative Investment Opportunities - Businesswire, October 26, New York

🇺🇸 Hamilton Lane Partners With Figure To Launch First Private Markets-Focused, Blockchain-Native Registered Investment Fund - PR Newswire, October 26, California

🇺🇸 Social Investment App AleFi Nabs $600K To Bring Transparency To Investments - LatamList, October 24, Florida

🇺🇸 Fidelity Expands Direct Indexing Product Lineup With Rollout Of Fidelity Institutional Custom SMAs - Businesswire, October 24, Massachusetts ← this is important

EMEA News

⭐🇬🇧 UK's Most Exclusive Wealthtech, Privat 3 Money, Launches Bespoke Mobile Trading Platform To HNW Clients - Finance Feeds, October 24, London

Privat 3 Money (P3M) — we hope that reads as “private money” — targets HNW individuals and offers deposits, multi-currency exchange, and payments in a private banking approach. The company is now launching a mobile trading platform as well. Via P3M, clients can conduct their banking activities and trade equities across the NYSE and NASDAQ.

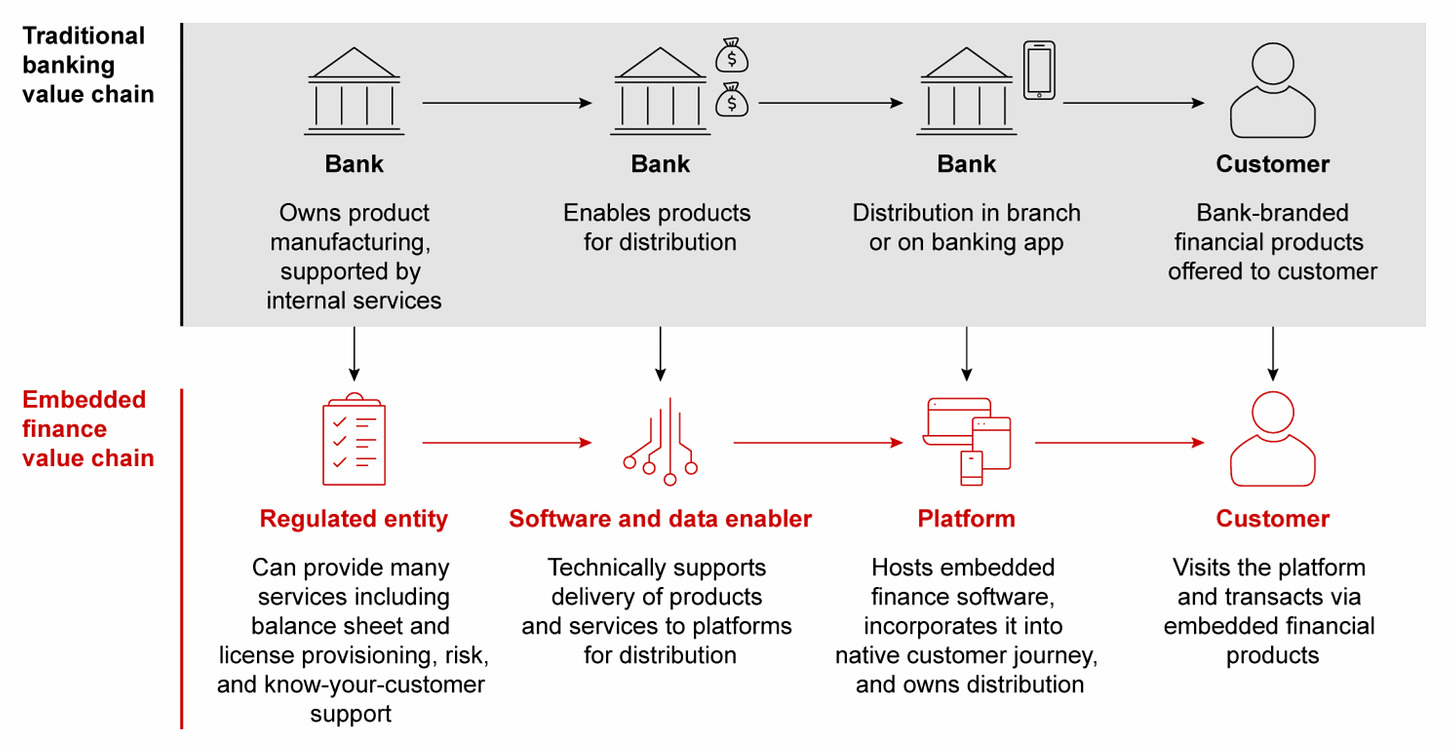

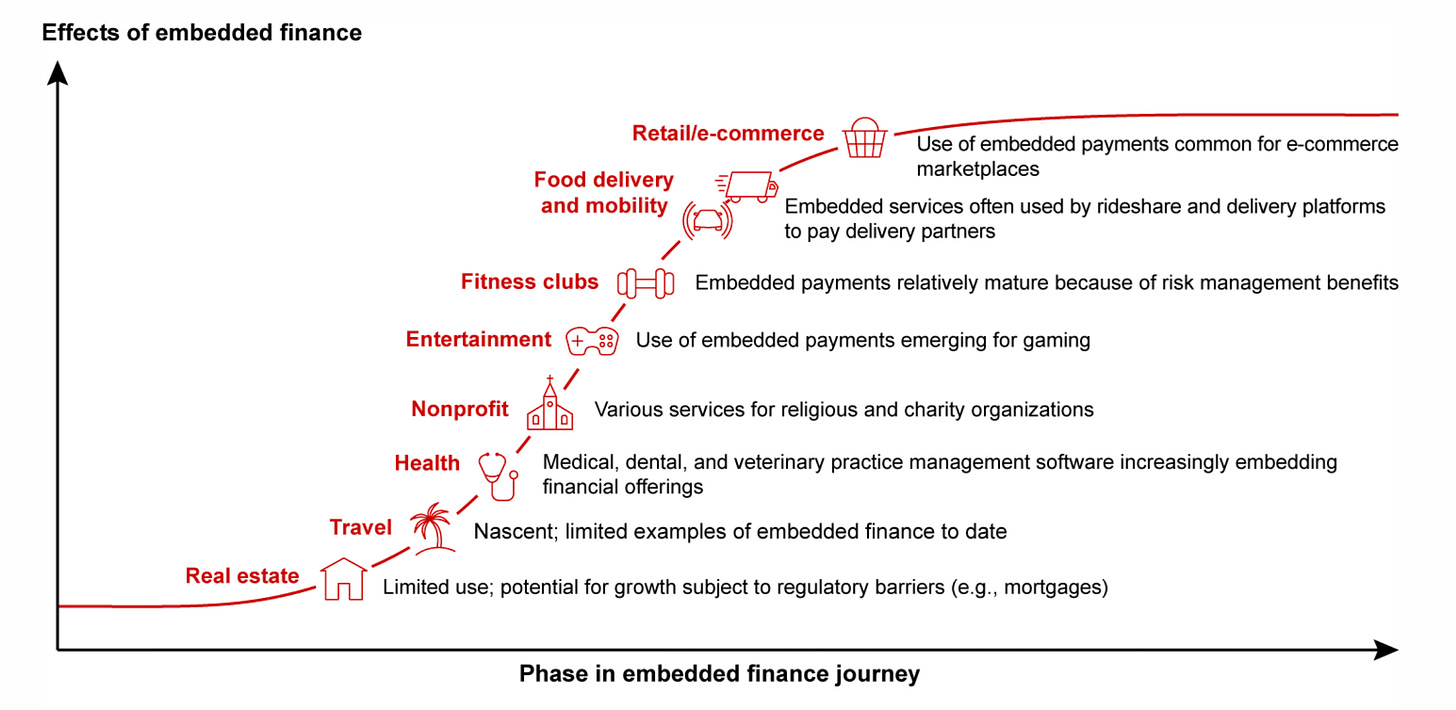

This trading platform was built on top of DriveWealth, which is the embedded finance leader for brokerage. DriveWealth's tech stack includes Fracker, which offers fractionalised stock investing, and an Autopilot Portfolio Management Tool, which manages and rebalances customer portfolios based on drift parameters and rebalancing frequency. Thus far, DriveWealth has integrated its tech stack into 100+ fintechs and neobanks in a winner-take-all dynamic (👑 link here).

In the UK, Revolut has similar offerings to P3M, having launched a commission-free stock trading platform. B2C Fintechs have been bundling features to manage every aspect of a customer's finances, but, as with Revolut, most have not yet found a very profitable business model. For reference, it took Revolut 5 years (2015-2020) to reach 15MM customers.

We find the focus on private banking type customers interesting here too, as the idea of mobile apps taking away financial advisor work at the high end of wealth used to be something of a controversy. No more.

🇬🇧 Gamified Crypto Asset Management Platform Klink Finance Raises $500K Led By Blockchain Founders Fund - PR Newswire, October 25, London

🇬🇧 Moneybox Taps DriveWealth To Add Fractional Shares On Wealth Manager App - Finance Feeds, October 24, London

Seems like everyone is using DriveWealth this week

🇦🇪 AlHuda CIBE Introduced Shariah Advisory For Fintech, Blockchain, NFT, Crypto And Metaverse - Zawya, October 24, Dubai

🇸🇦 Valuable Capital Financial Company Secures Initial Licenses From Saudi Arabia’s Capital Market Authority (CMA) - Macau Business, October 23, Riyadh

Asia Pacific News

⭐🇨🇳 UBS Launches Digital Wealth Management Platform, WE.UBS, In Shenzhen, China - UBS Media, October 26, Shenzhen

UBS Fund Distribution (Shenzhen) has launched WE.UBS, a digital wealth platform for HNWIs in China. WE.UBS is not only UBS's first digital wealth platform in APAC, but also the first one by an international wealth manager in China. For context, in the past few months UBS sold its UBS Fund Advisor LLC, the UBS proprietary US alternative investment manager, to iCapital, and then terminated its $1.4B acquisition of Wealthfront.

UBS is also planning to set up a mutual fund business in China, launched an exchange rate and swap derivatives business, and in August, the bank introduced a new private clients team for Chinese HNWIs. WE.UBS appears to be an extension of UBS's efforts to attract HNWIs in the region.

Not a great deal is known about WE.UBS yet, but the platform claims to be a one-stop service for financial planning by offering local and global investment solutions, investor education such as "How to tell if a new fund is worth buying," and 24-hour tracking based on market developments. WE.UBS is collaborating with fund houses such as Invesco Great Wall Fund Management and HSBC Jintrust Fund Management, and leveraging local tech firms like Tencent for cloud computing.

In other UBS-related news, the bank has just published its financial statements. It will engage in share buybacks next year, buoyed by higher interest rates and robust wealth management inflows. Industry growth appears to be a trend across large banks — e.g., UBS, Deutsche Bank, and Credit Suisse are shrinking their IBD divisions and expanding wealth management activity. In a market with no IPOs, investment banking is poison, as the $4B Credit Suisse losses demonstrate, while wealth management continues to siphon off management fees.

🇮🇩 Indonesia’s BCA Taps Avaloq To Bolster Wealth Management Business - The Asset, October 27, Jakarta

🇭🇰 Fidelity launches Bitcoin ETF for Hong Kong investors - Fund Selector Asia, October 27, Hong Kong

Blogs, Webinars, Podcasts

🇸🇬 Digital Wealth Management: Q&A With Co-Founder And CEO Of Endowus, Gregory Van - KrAsia, October 25, Singapore

🇺🇸 Echelon: Investment Adviser M&A Bucks Downward Trend In Dealmaking - PlanAdviser, October 25, New York

🇨🇦 AI In Wealth Management: A Win-Win For Clients And Advisors - Wealth Professional, October 21, Toronto

🇦🇺 Changing The Wealth Management Game With APIs - ITWire, October 21, Victoria

🇨🇭 Wealth Managers Reluctant To Invest In Crypto - Fintech News, October 24, Zurich

Events & Reports

⭐ 🇨🇳 Investing In Digital Assets Family Office And High-Net Worth Investor Perspectives On Digital Asset Allocation - KPMG China, October 24, Beijing

🇭🇰 The Evolution Of Wealth Management In Indonesia - Hubbis, October 24, Hong Kong

🇬🇧 Global WealthTech Summit - Fintech Global, November 2, London

🇸🇬 Singapore FinTech Festival 2022 - Singapore FinTech Festival, November 2-4, Singapore

🇿🇦 Africa Fintech Summit 2022 - Africa Fintech Festival, November 3-4, Virtual

🇺🇸 2022 Forbes Wealth Summit - Forbes, December 6, Virtual

Shape your Future

Wondering what’s shaping the future of Fintech and Digital Wealth? At the Fintech Blueprint, we go down the rabbit hole to help you make better investment decisions and innovate and compete in the industry. A premium subscription opens access to:

Weekly Long Takes on Fintech and DeFi operating and investment topics

Unlocks access to the full archives of all Long Takes (see index here)

Weekly Podcast Conversation transcript, illustrated with analysis and charts

Read our Disclaimer here — this newsletter does not provide investment advice and represents solely the views and opinions of FINTECH BLUEPRINT LTD.

Want to discuss? Stop by our Discord and or reach out here anytime.