Fintech: Brazilian embedded finance champion QI Tech raises $200MM in growing market

Easier to grow in a growth market

Hi Fintech Futurists —

You’re the best, today’s agenda below.

NEOBANK: QI Tech becomes the first-ever BaaS to receive an SCD license from the Brazilian Central Bank (link here)

LONG TAKE: Can we be optimistic about 2Q2023 Equities, Crypto and Venture markets? (link here)

PODCAST CONVERSATION: Using AI to digitize financial documents at scale, with Ocrolus CEO Sam Bobley (link here)

CURATED UPDATES

To support this writing and access our full archive of newsletters, analyses, and guides to building in the Fintech & DeFi industries, subscribe below.

In Partnership

Fintech Meetup Ticket Prices Increase Friday, 11/10! Join Fintech Meetup (March 3-6), the new BIG event with “the highest ROI” for attendees & sponsors with reasonably priced sponsorships, tickets, and rooms. Join 45,000+ double opt-in meetings, and Network with 5,000+ attendees. Ticket Prices go UP at midnight on Friday, Nov. 10.

Digital Investment & Banking Short Takes

NEOBANK: QI Tech becomes the first-ever BaaS to receive an SCD license from the Brazilian Central Bank (link here)

QI Tech enables virtually any company to offer financial products through its infrastructure platform, which provides a modular API for developing payment, credit, and banking solutions. This offering, known as Banking-as-a-Service (BaaS), has become a worldwide trend in recent years as more and more distribution channels and applications find monetization in offering financial products.

The company now also has a Direct Credit Society (SCD) license, which effectively acts as a national bank charter in Brazil, albeit with limitations. An SCD enables a business to carry out credit operations on an electronic platform, but must be funded from its own operating balance sheet — the lending institution cannot raise funds from the public — and customers must be selected based on verifiable, transparent and consistent criteria. This marks the first SCD that the Brazilian Central Bank has approved.

The company’s BaaS offering is applicable to companies across any vertical, whether it be a retailer or a telecom, looking to bolster their own financial products offerings including digital registration tools, credit scoring, wire transfers, Pix (Brazil’s digital payment network), digital account opening, credit underwriting, bank slips, data validation and wire transfer services.

QI Tech can offer its technology in modular components via API — something that technolofy-first firms require. QI also differentiates by providing a suite of offerings, rather than focusing on a specific niche. A customer can therefore begin with a point solution and continue to build out a full suite of services over time. We are impressed and surprised by the breadth of the offering — from eCommerce, to payments and anti-fraud, to banking and BNPL, as well as capital markets.

QI Tech’s raised the largest VC round in Brazil this year — a $200MM Series B. This brings total funds raised to $262MM since founding in 2018. The company has reportedly been profitable since year one, and in the first half of 2023 reported $21.2MM in net revenues, an increase of 89% compared to the same period the year before. It operates on a pay-as-you-go model, with customers paying a fixed fee for every transaction that utilizes QI Tech APIs. Its 300+ Customers include Shopee, which has annual revenue of $2.1B, and Vivo Telefonica, a subsidiary of Telefonica Group.

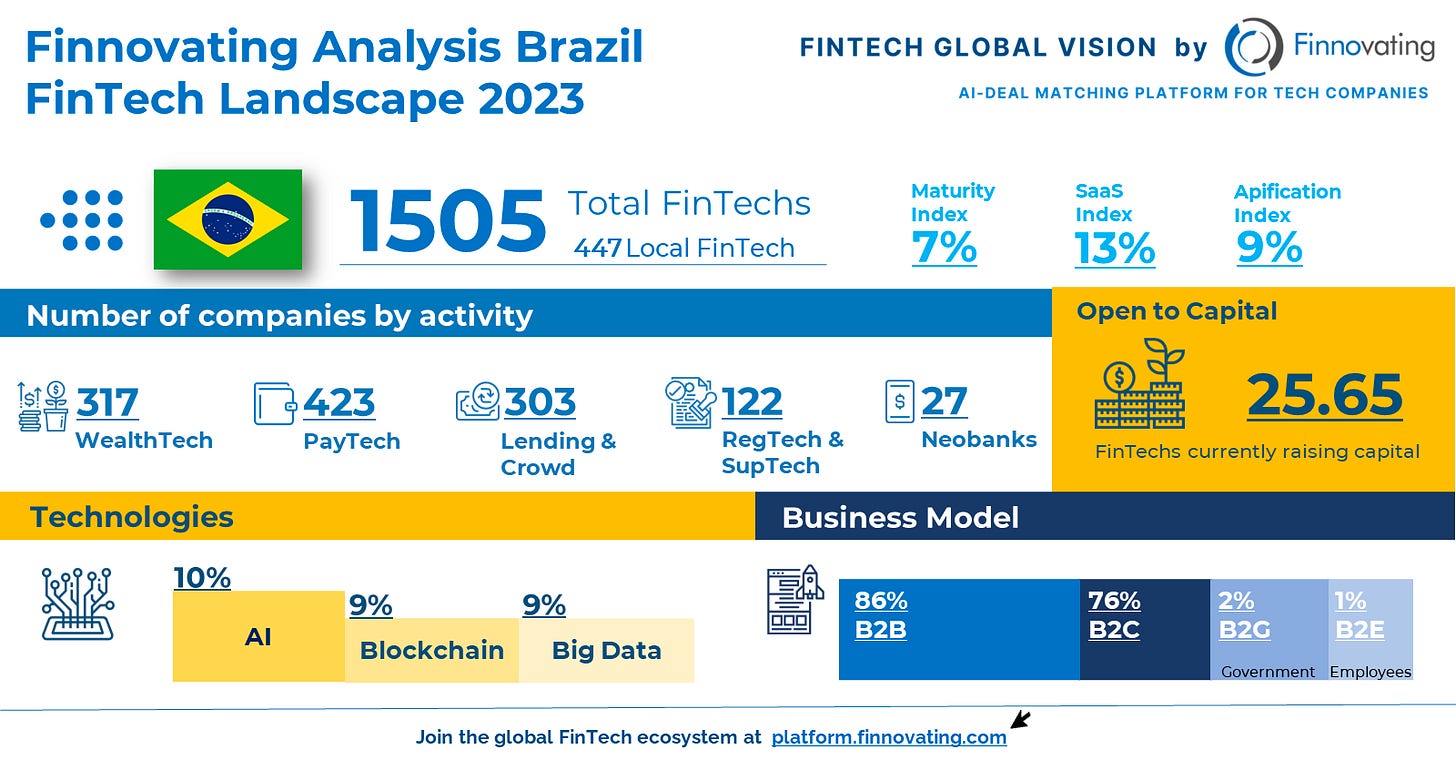

Brazil’s fintech scene has been burgeoning this year. It is home to Nubank, which is valued at $35B, and Pismo, which Visa acquired for $1B in one of the biggest fintech M&A deals this year.

Nubank is a particularly interesting comparison as it offers many of the same services but directly to consumers and SMEs. The neobank has c. 84MM customers globally with $1.9B in revenue, making up 14% of the $128B Brazilian retail banking market. We show its economics below — while not a direct comparison, the pace of growth and its dominance in the Brazillian market is instructive for other similarly positioned companies. In contrast, QI Tech allows users to bypass the bank experience, instead allowing consumers to get financial products directly from the businesses where they shop.

Brazil’s BaaS market size is currently only 15% of the total retail banking market ($19B vs $128B), but this figure is expected to double by 2029. Nubank commands a 20x revenue multiple and $40B valuation, with room for expansion. QI’s $200MM round might imply a $500MM-$1B valuation, which would suggest somewhere around a 10-25x multiple — on the edge of reasonable given the market where it operates and the pace of growth.

👑 Related Coverage 👑

In Partnership

With a growing number of consumers being online and using apps to manage their financial lives, adapting to the rapidly evolving digital and mobile landscapes is a must for FinTechs. Download the whitepaper “A Guide to Identity Verification for FinTechs” to learn how FinTechs can leverage a comprehensive identity proofing solution to overcome onboarding challenges.

Blueprint Deep Dives

Long Take: Can we be optimistic about 2Q2023 Equities, Crypto and Venture markets? (link here)

We look for key indicators suggesting a risk-seeking environment, potentially favorable for growth and innovation.

Despite recent volatility, equities show resilience over a five-year span. Crypto and AI, represented by Bitcoin and NVIDIA, are enjoying substantial gains, hinting at deep tech's growing appeal. Venture capital, although subdued compared to its 2021 zenith, maintains a steady pulse in fintech, with banking and lending drawing the lion's share of investment. Our analysis points towards a cautious optimism as we navigate through the economic fluctuations, keeping an eye on the horizon for emerging opportunities in fintech and beyond.

🎙️ Podcast Conversation: Using AI to digitize financial documents at scale, with Ocrolus CEO Sam Bobley (link here)

In this conversation, we chat with Sam Bobley, founder and CEO of Ocrolus, a fintech infrastructure company that powers underwriting processes for lenders like SoFi, Lending Club, and Enova.

He started building Ocrolus in his parent’s kitchen when he was 22-years-old. Six years later, the company has more than 900 employees globally, across four offices. Along the way, Sam authored a patent application, helped raise over $50 million in venture capital, and surrounded himself with a world-class team of coworkers, investors, and advisors. Inc. Magazine recognized Ocrolus as the #1 fastest-growing fintech company nationwide, and the #1 fastest-growing software company in NY.

Curated Updates

Here are the rest of the updates hitting our radar.

Banking

⭐ Israel’s One Zero digital bank seeks to raise up to $100m led by Deutsche Bank - Fintech Futures

NEU CREDIT CARD FEATURING NO INTEREST OR LATE FEES LAUNCHES FOR U.S. COLLEGE STUDENTS - PR Newswire

Thai bank buys stake in crypto exchange - Fintextra

Insurtech

Lending

⭐ British Klarna rival valued at £1.65bn as it wins backing of eBay - Telegraph

Buy now, pay later platform Tabby nabs $200M in Series D funding at $1.5B valuation - TechCrunch

Wealthtech

EarlyBird raises $4.5M, partially from its users, to scale its investment gifting platform for families - TechCrunch

Financial Operations

⭐ Nasdaq Completes $10.5 Billion Adenza Deal in Fintech Bet - Bloomberg

IRS will pilot free, direct tax filing in 2024 - TechCrunch

Arteria AI announces $30m Series B led by GGV Capital U.S. - Fintech Global

Shape your Future

Curious about what is shaping the future of Fintech and DeFi?

At the Fintech Blueprint, we go down the rabbit hole to help you innovate and compete.

Sign up to the Premium Fintech Blueprint newsletter and get access to:

Wednesday’s Long Takes on Fintech and Web3 topics with a deep, comprehensive analysis

Office Hours, monthly digital roundtable discussions with industry insiders

‘Building Company Playbook’ series, offering insider tips and advice on constructing successful fintech ventures

Enhanced Podcasts with industry leaders, accompanied by annotated transcripts

Archive Access to an array of in-depth write-ups, spanning across 15+ topics and encompassing over 50 Fintech and DeFi brands